Press release

The 4% Rule Is Broken? New Safe Withdrawal Rates for Early Retirees in 2025

The Financial Independence, Retire Early (FIRE) movement has long relied on the 4% rule as its North Star: Withdraw 4% of your portfolio in year one, adjust for inflation annually, and your savings should last 30 years. Born from Bill Bengen's 1994 Trinity Study, it promised a simple path to freedom-$1 million nest egg equals $40,000 annual spending. But in 2025, with markets volatile from tariffs, persistent inflation at 2.9%, and longer lifespans pushing retirements to 40-50 years, the rule feels increasingly fragile. Is it broken? Experts like Morningstar say yes, pegging a safer starting rate at 3.7% for new retirees. Yet Bengen himself just updated it to 4.7% in his August 2025 book, A Richer Retirement. For early retirees eyeing mid-30s exits, the debate rages on Reddit's r/FIRE: 3.3% for 50-year horizons or stick with 4% and side-hustle if needed? This article dives into why the rule's cracking, updated rates for 2025, and flexible strategies to make FIRE viable without starving-or panicking.Why the 4% Rule Feels Broken in 2025

The Trinity Study assumed a 60/40 stock-bond portfolio, 30-year horizon, and historical U.S. data from 1926-1994. It worked 95% of the time, failing only in worst-case sequences like the Great Depression. Fast-forward to 2025: Bonds yield ~4% post-cuts but inflation lingers at 2.9%, eroding real returns. Lifespans hit 80-85, stretching horizons to 50 years-dropping safe rates to 3.3% for 100% equities, per updated Trinity analyses.

Market shifts compound issues: The 2022 bear (S&P down 25%) tested sequences, with early retirees facing "sequence of returns risk"-big drops upfront force selling low, depleting principal faster. Low bond yields (0-2% in 2010s) skewed historical backtests; today's 4-5% environment helps, but tariffs could spike CPI to 3.5%. Morningstar's 2025 research warns: Rigid 4% risks depletion in 20% of scenarios for 30-year plans, worse for FIRE's longer timelines. r/FIRE threads echo this: "4% has as much chance to triple as zero-CAPE's normal, so it's safe enough," but many hedge with 3-3.5%.

Enter Bengen's twist: His 2025 update, incorporating small-caps, international stocks, and REITs, boosts SAFEMAX to 4.7%-$47,000 on $1M-succeeding 100% historically. Critics like Wade Pfau call it optimistic, favoring dynamic models over static rules.

Updated Safe Withdrawal Rates for Early Retirees

For 2025 FIRE aspirants (retiring 30s-40s, 40-50 year horizons), blend historical simulations with modern tweaks. Morningstar's baseline: 3.7% for 30 years (up from 3.3% in 2024, thanks to higher yields). For longer FIRE spans:

● 3.0-3.5% (Ultra-Safe): 95% success over 50 years, per updated Trinity (1871-2024 data). Suits conservative FIRE (e.g., FatFIRE with buffers). On $1M: $30-35k/year.

● 3.5-4.0% (Balanced FIRE): 90% success, assuming 60/40 portfolio and flexible spending. Bengen's 4% holds if diversified; Morningstar eyes 3.7% baseline. Ideal for LeanFIRE: $35-40k on $1M.

● 4.0-4.7% (Aggressive/Barista FIRE): Bengen's 4.7% with global tilt succeeds 100% historically, but risks 10-15% failure in prolonged bears. For ChubbyFIRE with side gigs: $40-47k on $1M.

Schwab's 2025 projections: 5.4-6.0% initial for 20-year horizons (not FIRE), but early retirees should cap at 4% max without guards. Kitces' CAPE-based model ties rates to valuations: At 2025's ~36 Shiller CAPE, aim 3.5%-up from 3% at peaks.

Flexible Strategies to Make FIRE Sustainable

Ditch rigidity-2025's tools enable dynamic plans. Morningstar advocates "variable strategies": Higher initial rates (4.5%) with cuts in down years.

1. Guardrails Approach: Withdraw 4-5% but cap at portfolio floor (e.g., reduce 10% if down 20%). Kitces' model: Success jumps to 98%.

2. Bond Tent: Heavy bonds early (50% year 1), tapering to 40%-buffers sequence risk, allowing 4.2% starts.

3. Cash Bucket: 2-3 years' expenses in HYSA (4.5% yields), invest rest aggressively. Refill annually-skips inflation bumps in bears.

4. Part-Time Flexibility: BaristaFIRE at 3.5%, scaling to 4% with gigs. r/FIRE: "Uber a few hours/week covers shortfalls."

5. TIPS Ladder: 20% in inflation-protected bonds for real yields, per Pfau-boosts safe rates 0.5%.

Simulate with cFIREsim or Big ERN's Google Sheet-2025 updates factor tariffs. Track via https://www.tradebb.ai/ - it logs withdrawals, benchmarks vs. CPI, and flags adjustments for real-time FIRE tweaks.

The Bottom Line for 2025 FIRE

The 4% rule isn't dead-it's evolving. For early retirees, 3.5-4.0% with flexibility trumps rigidity, balancing Bengen's optimism (4.7%) against Morningstar's caution (3.7%). In 2025's choppy waters, success hinges on adaptability: Model scenarios, build buffers, and monitor. Platforms like https://www.tradebb.ai/ automate this, turning debates into data-driven decisions. FIRE isn't about rules-it's about freedom. Stress-test your plan today; your future self (and wallet) will thank you.

Media Details:

Azitfirm

7 Westferry Circus,E14 4HD,

London,United Kingdom

----------------------------

About Us:

AZitfirm is a dynamic digital marketing development company committed to helping businesses thrive in the digital world.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release The 4% Rule Is Broken? New Safe Withdrawal Rates for Early Retirees in 2025 here

News-ID: 4294984 • Views: …

More Releases from IQnewswire

The Future of Influencer Content: How Creators Scale Production with AI

The Creator Production Crisis

Every content creator faces the same constraint: more ideas than production capacity.

A successful YouTube content creator has 100 video ideas. They can produce 4 per month. A TikTok creator could post 10 times daily but manages 3-4. An Instagram creator wants themed content series but settles for inconsistent posts.

Production bottleneck equals missed opportunity, until now.

The emergence of AI video generation tools like Seedance 2.0 is reshaping what's…

Bathroom Decoration and Paint for Bathroom Ceiling: Transforming Your Space with …

When it comes to bathroom decoration, every detail matters-from the tiles and fixtures to the paint for bathroom ceiling. The right combination of elements can turn an ordinary bathroom into a relaxing sanctuary or a stylish, functional space that complements your home's overall aesthetic. In this article, we'll explore trending ideas and practical tips for bathroom decoration, with a special focus on choosing the perfect paint for your bathroom ceiling.…

Track Followers and Engagement Trends with PV Story

Understanding how an Instagram account grows is important for users, brands, and marketers. Instagram itself limits how much data users can see, especially when it comes to follower changes and engagement trends. PV Story solves this problem by offering advanced viewing features while keeping everything anonymous.

PV Story allows users to track followers, following activity, and engagement patterns without logging into Instagram or revealing their identity.

What Makes PV Story Different for…

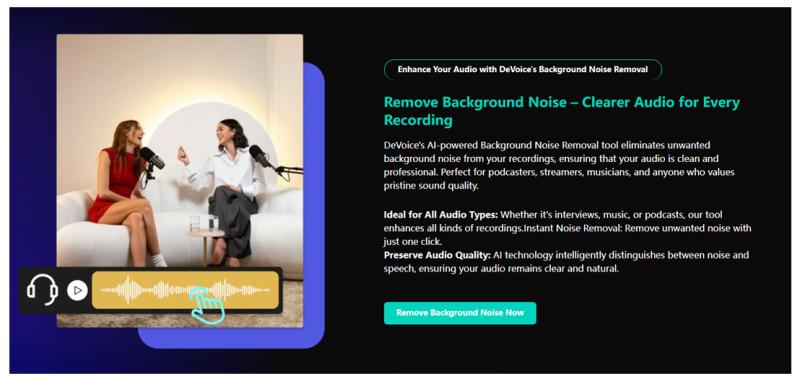

Best Way to Remove Background Noise from Audio in 2026

One of such issues is background noise which never completely disappears. Regardless of the quality of your microphone, there is always hums, wind, sound of keyboards, or passing traffic. Several years later, I have tried numerous applications to identify the most appropriate approach to remove background noise from audio: https://devoice.io/remove-background-noise, starting with manual editing and proceeding through AI-based applications.

I will compare the most common methods of noise removal, describe their…

More Releases for Withdraw

Chicago Divorce Lawyer Russell Knight Explains What Happens When Your Divorce At …

CHICAGO, IL - Divorce proceedings are often fraught with unexpected turns, but one situation that can catch people off guard is when their own divorce lawyer withdraws from the case. Chicago divorce lawyer Russell Knight of The Law Office of Russell D. Knight (https://rdklegal.com/my-divorce-lawyer-filed-a-motion-to-withdraw-in-chicago-illinois-now-what/) breaks down this confusing situation in his updated November 2025 article, "My Illinois Divorce Lawyer Filed A Motion To Withdraw. Now What Do I Do?"

For individuals…

No More Waiting: Withdraw Anytime, Anywhere - GoldNX Proves Why Speed Matters

Brighton, United Kingdom - In an industry where access and efficiency define the user experience, GoldNX has implemented instant withdrawals across its crypto trading platform, eliminating wait times that often hinder transactional fluidity. This update marks a significant milestone for the company, reinforcing its dedication to infrastructure performance, platform reliability, and the growing demand for user-centric solutions in the digital asset ecosystem.

As the digital finance landscape continues to evolve, the…

No More Waiting: Withdraw Anytime, Anywhere - Goldmanpeak Proves Why Speed Matte …

Brighton, United Kingdom - In a fast-moving digital asset landscape, time has become a critical currency. Goldmanpeak, an advanced crypto trading platform, has implemented instant withdrawal functionality, signaling a decisive move toward redefining expectations around transaction speed, user control, and financial responsiveness. As access to liquidity becomes a central metric for evaluating trading platforms, Goldmanpeak's approach reflects both technological maturity and a strong commitment to the evolving needs of modern…

All about Astra Horizon - How to Deposit and Withdraw

We designed a platform that suits all traders regardless of their level of knowledge. This platform is suitable for both beginners and experienced traders who have been in this market for a long time. It is for everyone who likes trading and investing money. Our trading model is transparent and unique.

Account options

Here are three account choices to pick from. They involve gold, silver, and platinum.

You can start with our silver…

Caution! This is a Reliable Review of Astra Horizon withdrawal and Astra Horizon …

The popularity of cryptocurrencies expanding exponentially at present moment. Depending on its current stage people are likely of creating profit but, witnessed loss also.

Let's Accept it, We all hate losing money. With regards to trading, I will offer you a platform that permits you to trade with minimal risk of losing your money, isn't it interesting?

Introducing Astra Horizon, a trustworthy crypto trading platform. The Astra Horizon withdrawal and Astra Horizon…

Low Voltage Switchgear Market Report 2018: Segmentation by Protection (Circuit B …

Global Low Voltage Switchgear market research report provides company profile for Eaton Corporation Plc. (Ireland), General Electric (U.S.), Mitsubishi Motors Corporation (Japan), Hitachi, Ltd. (Japan), Schneider Electric SE (France), Siemens AG (Germany), Fuji Electric Co., Ltd. and Others.

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2018 to 2025 in terms of volume, revenue,…