Press release

India Energy Storage Market: Emerging Trends & Industry Forecast by 2034

MARKET OVERVIEWThe India energy storage market reached a size of 233.78 MWh in 2024. The market is forecasted to grow at a CAGR of 41.70% during the 2025-2033 period, reaching 6,637.31 MWh by 2033. Growth is driven by major investments in cutting-edge storage technology advancements and government policies supporting renewable energy integration. The market benefits from the improved stability and efficiency provided by smart grids and increasing adoption of electric vehicles, signaling a robust outlook.

STUDY ASSUMPTION YEARS

❥ Base Year: 2024

❥ Historical Year/Period: 2019-2024

❥ Forecast Year/Period: 2025-2033

INDIA ENERGY STORAGE MARKET KEY TAKEAWAYS

❥ The India energy storage market size was 233.78 MWh in 2024 with a forecast to reach 6,637.31 MWh by 2033 at a CAGR of 41.70% (2025-2033).

❥ The market growth is propelled by increasing energy demand and integration of renewable energy sources.

❥ Favorable government policies like the National Electric Mobility Mission Plan and Atmanirbhar Bharat Abhiyan support market expansion.

❥ Battery Energy Storage System (BESS) holds the largest market share of 63.8% in 2024.

❥ Utility scale end users dominate with 54.3% market share in 2024, stabilizing grid operations.

❥ South India leads regionally due to high renewable capacity and energy demand.

Sample Request Link: https://www.imarcgroup.com/india-energy-storage-market/requestsample

MARKET TRENDS

India is witnessing a strong upsurge in energy storage innovation with significant investment facilitating rapid advances in storage technology. Efforts target enhancing long-term storage capacity, lithium-ion battery manufacturing, and battery recycling facilities to support sustainable transport and renewable power integration. Standalone energy storage tenders accounted for 6.1 GW in Q1 2025, comprising 64% of the 9.5 GW total utility-scale tenders, illustrating growing investor and regulatory engagement.

Government policies and incentives play a pivotal role in catalyzing market growth. Initiatives such as the National Mission on Electric Mobility and Atmanirbhar Bharat Abhiyan incentivize energy storage deployment, especially for solar and wind projects. Moreover, mandatory storage regulations for grid infrastructure reinforce adoption. In July 2024, INR 2,000 crore investment pledges in energy storage, EVs, and green hydrogen sectors underscore the optimistic climate.

Battery storage technology enhancement is critical to grid resilience and renewable integration. The Union power ministry's Rs.5,400 crore viability gap funding facilitates 30 GWh of battery storage capacity, with Rs.18 lakh per MWh subsidy. Projects like Delhi's first standalone commercial BESS (20 MW/40 MWh) launched in May 2024 set affordability benchmarks by reducing tariffs by about 55%, highlighting cost efficiency and accessibility.

MARKET GROWTH FACTORS

Escalating energy demand and the shift towards renewable energy are fundamental drivers for the India energy storage market. With India's ambitious solar and wind energy goals, energy storage technologies such as lithium-ion batteries become essential to smooth intermittent renewable supply, ensuring reliable power. This underpins the market's rapid expansion and stability enhancement.

Government interventions by financing, subsidies, and tax incentives further bolster market growth. Policies targeting renewable integration and electric mobility increase demand for storage infrastructure. Regulatory frameworks stimulate investment, exemplified by substantial funding commitments during the India Energy Storage Week 2024, facilitating advanced energy solutions and localization efforts.

The increasing need for grid stability emphasizes storage's role in stabilizing supply-demand mismatches. Utility-scale storage balances loads by buffering excess off-peak energy and delivering it during peaks, minimizing outages and dependence on inefficient fossil fuel peaking plants. This capability, combined with financial benefits and environmental consciousness, fuels adoption across commercial, residential, and utility sectors.

Speak To an Analyst For a Customized Report: https://www.imarcgroup.com/request?type=report&id=29556&flag=C

MARKET SEGMENTATION

By Type:

❥ Battery Energy Storage System (BESS)

❥ Pumped-Storage Hydroelectricity (PSH)

❥ Others

The largest segment in 2024 with 63.8% market share. BESS improves grid stability by storing excess energy during low demand and providing backup during high demand or disruptions. It reduces voltage and frequency fluctuations and efficiently stores renewable energy from wind and solar, supporting a cleaner energy grid.

By End User:

❥ Residential

❥ Commercial and Industrial

❥ Utility Scale

Utility-Scale leading with 54.3% share in 2024, these large-scale systems stabilise grid operations by balancing supply and demand, buffering excess energy off-peak and releasing during peak demand. They facilitate renewable energy integration while reducing fossil fuel reliance.

By Region:

❥ North India

❥ South India

❥ East India

❥ West India

South India is the dominant region driven by rising energy demand and a strong push for renewable energy projects, especially solar and wind, necessitating robust energy storage to maintain grid stability and optimize power usage.

REGIONAL INSIGHTS

South India accounts for the largest share of the India energy storage market due to elevated energy demands and ambitious renewable energy initiatives in states like Tamil Nadu, Karnataka, and Andhra Pradesh. These states focus on expanding solar and wind capacity, requiring energy storage systems to mitigate supply intermittency, stabilize the grid, and promote efficient energy utilization.

RECENT DEVELOPMENTS & NEWS

❥ May 2025: NTPC Green Energy Ltd tendered a 250 MW/1,000 MWh battery energy storage system at its Kayamkulam plant in Kerala with 15-year O&M and containerized 125 MW/500 MWh blocks.

❥ May 2025: AmpereHour Energy and Indigrid's Kirlokari BESS Pvt Ltd commissioned India's first regulator-approved urban BESS (20 MW/40 MWh) at BSES Rajdhani, Delhi, providing four-hour peak support and significant diesel reduction.

❥ April 2025: Cygni Energy launched a 4.8 GWh BESS assembly plant in Hyderabad with plans to expand to 10.8 GWh.

❥ March 2025: PUR Energy introduced PuREPower, an AI-powered energy storage product line for scales from home to grid in Hyderabad, addressing grid stability challenges.

❥ March 2025: Hindustan Power announced INR 620 Crore investment for solar and battery storage projects in Assam enhancing renewable capacity and grid reliability.

KEY PLAYERS

❥ NTPC Green Energy Ltd

❥ AmpereHour Energy

❥ Indigrid's Kirlokari BESS Pvt Ltd

❥ Cygni Energy

❥ PUR Energy

❥ Hindustan Power

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

Get Your Customized Market Report: https://www.imarcgroup.com/request?type=report&id=29556&flag=E

ABOUT US

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

CONTACT US

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: sales@imarcgroup.com,

Tel No: (D) +91-120-433-0800,

United States: +1-201971-6302

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release India Energy Storage Market: Emerging Trends & Industry Forecast by 2034 here

News-ID: 4292351 • Views: …

More Releases from IMARC Group

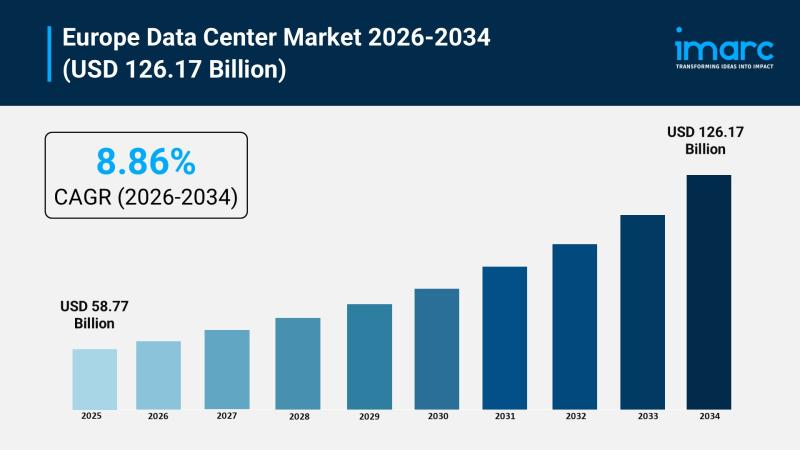

IMARC Group Forecasts 8.86% CAGR for Europe Data Center Market Amidst AI and Clo …

The Europe data center market is experiencing a critical phase of infrastructure evolution, having reached a valuation of USD 58.77 Billion in 2025. Propelled by the accelerating digitalization of the region's economy and sovereign cloud ambitions, the market is projected to reach USD 126.17 Billion by 2034. This growth trajectory represents a solid Compound Annual Growth Rate (CAGR) of 8.86% during the forecast period of 2026-2034.

Key Market Trends &…

Hot Sauce Manufacturing Plant DPR & Unit Setup - 2026: Demand Analysis and Proje …

Setting up a hot sauce manufacturing plant positions investors within one of the fastest-growing and flavor-driven segments of the global condiment industry, fueled by rising consumer appetite for spicy, bold, and ethnic flavors, increasing demand for clean-label and premium condiment products, and expanding utilization of hot sauce across food service, retail, and food processing applications. Made primarily from chili peppers, vinegar, salt, and complementary flavoring ingredients, hot sauce is recognized…

Glyoxylic Acid Prices Q4 2025: US Stable While Europe Remains High Price Trend

The Glyoxylic Acid Price Trend Analysis indicates dynamic shifts in global supply-demand balance, feedstock volatility, and regional trade flows. In 2026, Glyoxylic Acid Prices are reflecting fluctuations in raw material costs and downstream demand from pharmaceuticals, cosmetics, and agrochemicals. Market participants closely track the Glyoxylic Acid price index and forecast data to understand pricing momentum, risk exposure, and procurement strategies across key global regions.

Glyoxylic Acid Current Glyoxylic Acid Price Movements:

Recent…

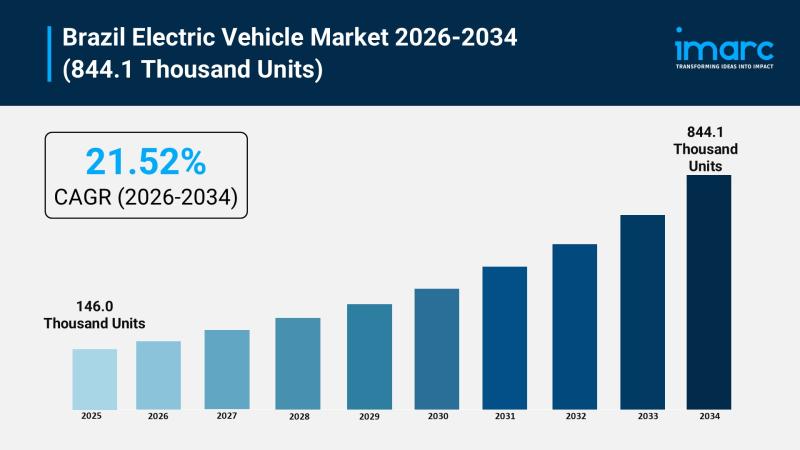

IMARC Group Forecasts 21.52% CAGR for Brazil EV Market as BYD and GWM Ramp Up Lo …

The Brazil electric vehicle (EV) market is currently witnessing an unprecedented surge, having reached a volume of 146.0 Thousand Units in 2025. Fueled by a combination of stringent environmental policies and a strategic shift toward domestic production by global automakers, the market is projected to reach 844.1 Thousand Units by 2034. This rapid expansion represents a robust Compound Annual Growth Rate (CAGR) of 21.52% during the forecast period of 2026-2034.

Key…

More Releases for India

India Smart Air Purifier Market Set to Witness Significant Growth by 2035 | Phil …

India smart air purifier market was valued at $125.8 million in 2024 and is projected to reach $298.7 million by 2035, growing at a CAGR of 8.3% during the forecast period (2025-2035).

India Smart Air Purifier Market Overview

The Indian smart air purifier market is experiencing significant growth, driven by increasing concerns over air pollution and its impact on health. Consumers are increasingly adopting smart air purifiers equipped with advanced features…

Ayurvedic Service Market is Flourishing Like Never Before | Patanjali Ayurved Li …

RnM newly added a research report on the Ayurvedic Service market, which represents a study for the period from 2020 to 2026.

The research study provides a near look at the market scenario and dynamics impacting its growth. This report highlights the crucial developments along with other events happening in the market which are marking on the growth and opening doors for future growth in the coming years. Additionally, the…

Pasta Market Report 2018 Companies included Bambino (India), Nestle (USA), Field …

We have recently published this report and it is available for immediate purchase. For inquiry Email us on: jasonsmith@marketreportscompany.com

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2018 to 2025 in terms of volume, revenue, YOY growth rate, and CAGR for the year 2018 to 2025, etc. The report also provides detailed segmentation on the…

Interior Designers India, Designers and Architects India, Interior Design Consul …

Synergy Corporate Interiors Pvt. Ltd. are offer Designers and Architects India Our architects, designers are working an national and international client base. The final design output is then integrated with the various technical and engineering aspects and taken into production. The expression is also individualistic, based on the communication of the correct corporate identity. Our designers, engineers and architects perform any plan successfully combine handy knowledge with creative ideas into…

Domain Registration India, Web Hosting India, VPS Hosting India , SSL Certificat …

All the Domain Registration services are at affordable price and assure you for the 100% quality.

India Internet offers cheap domain name registration for many domain extensions available. We are a full-service web site solutions provider. We offer a full range of web services including domain registration India, Web Hosting India, Web design, SEO marketing and etc.

We offer different standard and different Windows .NET low-cost, full-featured, all-inclusive web hosting and domain…

Domain Registration India, Web Hosting India, Payment Gateway India

Indiainternet.in is a Quality Web Hosting Company India, provide all web related support and Web hosting services like linux web hosting, windows web hosting, web hosting packages, domain registration in india, Corporate email solution, business email hosting, payment gateway integration, SSL with supports like free php, cgi, asp, free msaccess, free cdonts, free webmail, web based control panel, unlimited ftp access, unlimited data transfer.

During the domain registration process, you will…