Press release

Digital Banking Market Signals a $13.8B Recode | AI, Cloud, and Open Finance Are Rewriting the Next Decade of Banking

Digital Banking Market Signals a $13.8B Recode | AI, Cloud, and Open Finance Are Rewriting the Next Decade of Banking

(Is Digital Banking a Convenience-or the New Operating System of the World's Financial Economy?)

For years, the world celebrated digital payments, mobile wallets, UPI booms, and contactless commerce.

Yet an equally critical transformation unfolded quietly in the background-the global Digital Banking Market, once dismissed as a supplementary channel, is now the core engine of banking modernization.

In 2025, the Digital Banking Market reached USD 7.3 billion.

By 2035, it is set to hit USD 13.8 billion, expanding at a steady 6.6% CAGR.

For an industry historically known for conservative adoption cycles, this shift is seismic-and irreversible.

Get the full Digital Banking Market analysis (TOC, tables, figures):

https://marketgenics.co/reports/digital-banking-market-55560

The acceleration comes from three unstoppable forces:

customer expectations shifting toward real-time, mobile-first experiences,

regulatory pressure redefining identity, security, and transparency,

and AI-driven automation reengineering financial operations end to end.

The digital banking platforms market and the Internet Banking Market have evolved from utility tools to strategic battlegrounds for banks and fintechs.

So what exactly is driving this momentum?

Let's decode the architecture-the technologies, the players, the regulations, and the global power shifts-that are shaping banking's next decade.

Why the Digital Banking Market Has Shifted From Optional Channel to Operational Imperative

Think of the Digital Banking Market as the operational nervous system of modern finance.

When customer expectations rise-digital banking responds.

When fraud risk increases-AI detection steps in.

When compliance tightens-digital identity and audit systems scale up.

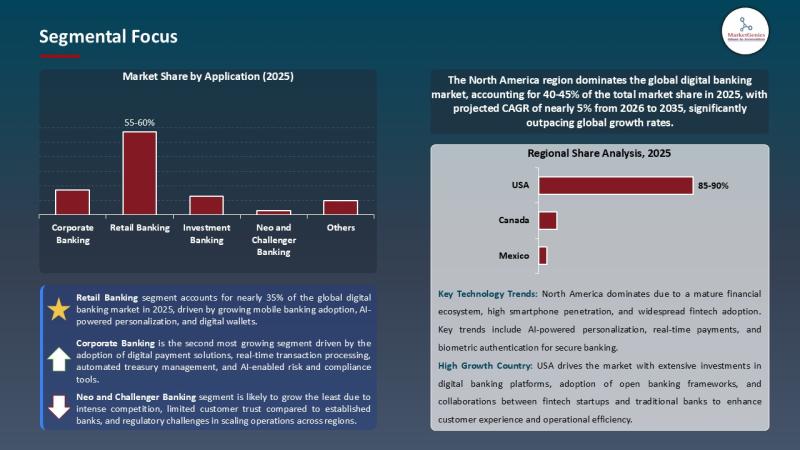

In 2025, retail banking alone accounted for ~57% of the entire Digital Banking Market-driven by:

mobile-first consumers,

instant payments,

personalized financial services,

and frictionless onboarding.

Meanwhile, corporate and investment banking platforms are modernizing through embedded finance, API-driven models, and automated risk engines.

Technological breakthroughs validate this momentum:

Fiserv's FraudNet 2.0 (2025) introduced real-time AI fraud monitoring across digital channels.

Temenos' Quantum Banking Cloud Suite (2025) integrated generative AI, blockchain audit trails, and cloud-native microservices-raising efficiency by 30%.

The narrative is clear:

The digital banking platforms market is no longer a patchwork of tools-it is the centralized command hub of the modern financial institution.

👉 Download the sample report:

https://marketgenics.co/download-report-sample/digital-banking-market-55560

Acceleration or Oversaturation? Why Global Digital Banking Investment Keeps Rising

The rise of the Digital Banking Market is not hype-it is infrastructure.

Governments and regulators are reshaping the banking landscape:

Open banking mandates in Europe and Asia are forcing standardized, secure digital access.

Stricter digital authentication norms are driving demand for biometric verification and AI-based fraud detection.

AI governance frameworks in the U.S., U.K., India, and Singapore are defining the boundaries for responsible financial automation.

Regulation is no longer a constraint; it's a catalyst.

Digital banking is becoming mandatory, not optional:

Banks must offer mobile-first access.

They must maintain 24/7 operational resilience.

They must detect fraud in milliseconds.

They must verify identities in real time.

The Internet Banking Market, once considered merely a web interface, is now a regulatory compliance engine.

This is not digital convenience.

This is digital survival.

Emerging Markets Step Up | The Next Digital Banking Power Regions

To see the future of the Digital Banking Market, look to Asia Pacific, the Middle East, and Latin America.

These regions are not experimenting-they are leapfrogging:

India's digital public infrastructure (UPI, Aadhaar-enabled onboarding)

China's super-app banking ecosystems

UAE and Saudi Arabia's open finance frameworks

Brazil's PIX real-time payments revolution

Each initiative fuels adoption across the digital banking platforms market and accelerates mobile-first penetration.

These regions are not merely catching up-they're building world-class digital finance blueprints.

And they will shape the next decade of global growth.

Buy Now: https://marketgenics.co/buy/digital-banking-market-55560

The AI Tipping Point | How Intelligence Is Rebuilding Banking's Core Systems

Here's where the Digital Banking Market transitions from digital interfaces to intelligent architectures.

AI is not an add-on-it is the central transformer:

Fraud detection models cut false positives by 25-60%.

AI chatbots resolve 70%+ customer queries instantly.

Predictive analytics drive lending, risk scoring, and investment guidance.

Generative AI engines interpret customer intent and deliver autonomous financial services.

HSBC's deployment of AI-driven fraud detection reduced false alarms by 60% and doubled genuine threat detection.

This is digital banking reinterpreted through intelligence-faster, safer, more predictive, and more efficient.

AI is the multiplier turning digital banking from billions into tens of billions.

Segmental Shift | Where the Digital Banking Market Is Growing the Fastest

Under the hood of the Global Digital Banking Market, the structure is transforming:

1. Platforms dominate

Core, mobile, and Internet banking platforms remain the industry's backbone.

2. AI and cloud surge

AI, cloud-native systems, APIs, RPA, and big data drive automation and compliance.

3. Verification and security explode

Fraud detection, identity verification, and threat analytics become mandatory in all regions.

4. Services scale up

Banks rely on consulting, integration, and managed IT operations to modernize legacy systems.

5. Retail banking remains the battleground

It accounts for 57% of market share-and its growth is accelerating.

Banks that win retail will win the digital decade.

North America's Digital Banking Advantage | Where Policy Leads Innovation

North America holds the most advanced digital infrastructure in the Digital Banking Market due to:

powerful AI research ecosystems

rigorous cybersecurity frameworks

open banking and interoperability initiatives

cloud-native adoption across major banks

The U.S. Artificial Intelligence Safety Institute (AISI) is shaping the world's financial AI standards-ensuring banking models stay safe, explainable, and auditable.

In North America, policy does not chase digital banking.

Policy builds digital banking.

The Geopolitics of Digital Banking | Data, Identity & AI as Financial Power

Three structural shifts are underway:

1. From banking products to banking platforms

Nations with sophisticated digital infrastructures gain dominance in cross-border financial services.

2. From branch networks to identity networks

Secure digital ID systems are becoming the backbone of financial inclusion.

3. From financial services to financial ecosystems

Open finance + embedded banking = new competitive frontiers.

Banks that control identity, data, and AI will define the next era of global banking competition.

Explore the full breakdown:

https://marketgenics.co/press-releases/digital-banking-market-55560

So, Is the Digital Banking Market Overhyped or Underestimated?

A bit of both-and neither entirely.

Demand is rising but remains controlled.

Costs are falling but require deep modernization.

Regulations are tightening but create new opportunities.

AI is expanding but demands oversight.

Cloud adoption is accelerating but widening the skills gap.

The truth is simple:

The Digital Banking Market is no longer a digital upgrade.

It is the foundational operating system of a modern financial ecosystem.

Any serious discussion about the future of banking, security, payments, financial inclusion, or economic competitiveness starts-and ends-with digital banking.

Contact:

Mr. Debashish Roy

MarketGenics India Pvt. Ltd.

800 N King Street, Suite 304 #4208, Wilmington, DE 19801, United States

USA: +1 (302) 303-2617

Email: sales@marketgenics.co

Website: https://marketgenics.co

About Us

MarketGenics is a global market research and management consulting company empowering decision makers across healthcare, technology, and policy domains. Our mission is to deliver granular market intelligence combined with strategic foresight to accelerate sustainable growth.

We support clients across strategy development, product innovation, healthcare infrastructure, and digital transformation.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Digital Banking Market Signals a $13.8B Recode | AI, Cloud, and Open Finance Are Rewriting the Next Decade of Banking here

News-ID: 4289621 • Views: …

More Releases from MarketGenics India Pvt. Ltd.

APAC Deepfake Detection Market Accelerates as Governments Tighten Digital Trust …

A Market Transforming How the World Verifies Reality

The global deepfake detection technology market, valued at USD 0.6 billion in 2025, is positioned to accelerate at a powerful 37.2% CAGR, reaching USD 15.1 billion by 2035.

This growth is driven by one undeniable truth:

Synthetic media is reshaping the threat landscape faster than humans can recognize it.

Deepfake detection technologies now determine:

How newsrooms verify breaking content

How financial institutions prevent identity-spoofing

How governments protect election integrity

How…

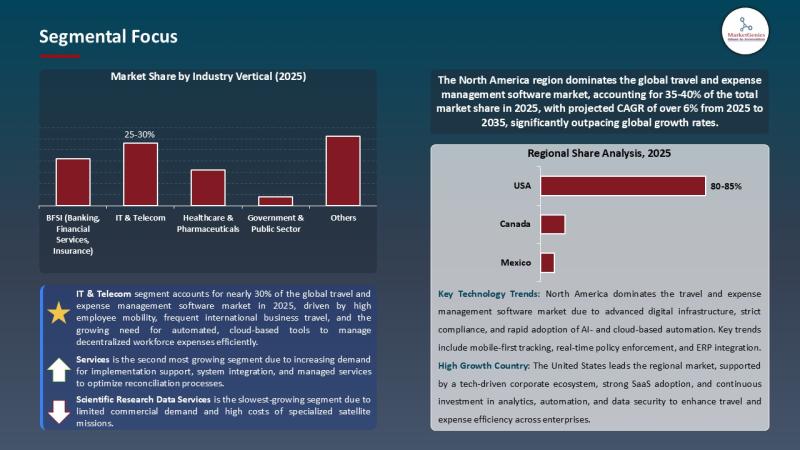

Travel & Expense Management Software Market Signals a Digital Pivot | AI, Cloud …

The Travel and Expense Management (TEM) Market Crossroads | A Sector Accelerating, Repricing Efficiency, and Redrawing the Corporate Spend Map

(Is TEM a Back-Office Tool-or the Operating System of the Next Enterprise Economy?)

For years, the travel and expense management software market lived in the administrative shadows-handed off to finance teams, constrained by spreadsheets, and dismissed as a routine cost-control tool. But the numbers now tell a radically different story.

In 2025, the…

Oilfield Equipment Market hits USD 116.2B in 2025 and grows to USD 156.5B by 203 …

Oilfield Equipment Market | The $156.5B Hardware Backbone of the Global Energy System

Every headline loves clean energy. Yet the global energy mix still demands a brutal truth: oil and gas remain the world's primary supply of heat, mobility, and petrochemicals - and the machines that drill, lift, complete, and produce hydrocarbons continue to define industrial capability.

That's why the Oilfield Equipment Market remains a strategic industry - not a relic.

In 2025,…

Machine Tools Market 2025-2035 | USD 109.9B Growth, CNC & Automation Trends

Machine Tools Market | The $109.9B Intelligence Engine of Global Manufacturing

Factories don't work without machine tools. They shape, cut, drill, grind, and define the physical world around us. Yet most end-products - cars, aircraft parts, electronics housings, surgical devices - never reveal the precision machinery behind them.

The Machine Tools Market is the invisible infrastructure that turns digital models into physical reality.

In 2025, the global Machine Tools Market stands at USD…

More Releases for Banking

Banking ERP Software Market: A Catalyst for Banking Excellence

The Banking ERP Software Market is at the forefront of a financial revolution, poised to redefine the way banking institutions operate in the digital age. As the industry grapples with evolving customer expectations, regulatory demands, and technological advancements, ERP software solutions have emerged as indispensable tools for financial institutions. These systems streamline operations, enhance data management, and empower banks to deliver more efficient and customer-centric services. In an era where…

Digital Banking Market Report, Worth, Size, Share, Trends, Segmented by Applicat …

Digital Banking Market Size:

In 2018, the global Digital Banking market size was 5.180 Billion USD and it is expected to reach 16.200 Billion US$ by the end of 2025, with a CAGR of 15.3% during 2019-2025.

Get Free Sample: https://reports.valuates.com/request/sample/QYRE-Auto-4N473/Global_Digital_Banking

Digital Banking Market Share:

• In 2017, North America's economy accounted for about 48.73% of the global Digital Banking market share, while Europe and Asia-Pacific accounted for about 30.22%, 16.54%, respectively.

• European countries such…

Online Banking Market by Banking Type - Retail Banking, Corporate Banking, and I …

The Online Banking Market size is expected to reach $29,976 million in 2023 from $7,305 million in 2016, growing at a CAGR of 22.6% from 2017 to 2023. Digital banking includes all kinds of online/internet transactions done for various purposes. It is the incorporation of new technologies, to deliver enhanced customer services.

Customer convenience, higher interest rates, and technologically advanced interface majorly drive the market. High security risk of customer’s data…

Explore Mobile Banking Market with Top Players like Barclays, BOC, SBI, HSBC Mob …

Mobile Banking allow various users to avail banking and financial services through any telecommunication devices. Different kind of services include both information and monetary transaction. Increase in the use of number of smart phones and mobile phones mobile Banking Market has gained its popularity. It is preferable and comfortable by the users than any other means of transaction.

Global Mobile Banking Market anticipated to grow at a CAGR of +35% over…

Mobile Banking Market Is Booming Worldwide | HSBC Mobile Banking, ICICI Bank Mob …

HTF MI recently introduced Global Mobile Banking Market study with in-depth overview, describing about the Product / Industry Scope and elaborates market outlook and status to 2023. The market Study is segmented by key regions which is accelerating the marketization. At present, the market is developing its presence and some of the key players from the complete study are HSBC Mobile Banking, ICICI Bank Mobile Banking, U.S. Bank, Santander Mobile…

Online Banking Market Report 2018: Segmentation by Banking Type (Retail Banking, …

Global Online Banking market research report provides company profile for ACI Worldwide (U.S.), Microsoft Corporation (U.S.), Fiserv, Inc. (U.S.), Tata Consultancy Services (India), Cor Financial Solutions Ltd. (UK), Oracle Corporation (U.S.) and Others.

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2018 to 2025 in terms of volume, revenue, YOY growth rate, and CAGR for…