Press release

Mortgage Brokers Streamline the Loan Journey for First-Time Buyers

Image: https://www.abnewswire.com/upload/2025/11/d6fe63898d88ecacd4f6f98ec7704596.jpgKey Takeaways

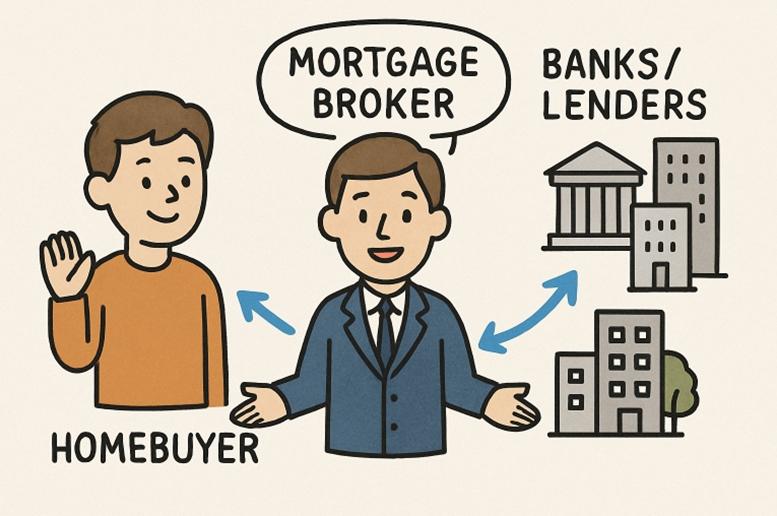

* Mortgage brokers serve as intermediaries between borrowers and lenders, providing access to a diverse range of loan products.

* They provide personalized advice tailored to individual financial situations, enhancing the likelihood of loan approval.

* Utilizing a mortgage broker can save time and potentially reduce costs by securing competitive interest rates.

Table of Contents

* The Role of Mortgage Brokers

* Benefits of Using a Mortgage Broker

* Technological Advancements in Mortgage Brokering

* Regulatory Changes Impacting Mortgage Brokers

* Choosing the Right Mortgage Broker

* Conclusion

Embarking on the journey to homeownership can be both exhilarating and daunting. With a web of mortgage options, complex interest rates, and unique lender requirements, it's easy for prospective buyers to feel confused or overwhelmed. Many turn to professionals to streamline their experience and improve their odds of success. That's why many first-time and experienced buyers alike find a mortgage broker [https://www.invis.ca/en/] to gain expert guidance at every step and access an expanded range of loan solutions that can be difficult to navigate otherwise.

Mortgage brokers act as trusted guides, serving as liaisons between borrowers and a wide array of lenders. This role enables them to advocate on behalf of clients, provide personalized financial recommendations, and assist users in avoiding many common pitfalls in the mortgage application process. Their deep understanding of the ever-changing market ensures that borrowers receive mortgage products best suited to their unique circumstances.

In today's increasingly digital landscape, mortgage brokers also leverage powerful technology to quicken loan approvals and enhance transparency. Coupled with recent regulatory shifts bringing more clarity to compensation and lending standards, the result is a more secure and client-focused journey to homeownership-one where buyers have an informed advocate at every stage.

This comprehensive guide explores how mortgage brokers simplify the home-buying process, from the tangible benefits they offer borrowers to the innovative tech tools transforming the industry, and what to look for when choosing the right broker for your needs. For a broader view of the mortgage industry and tips for navigating your first home purchase, see these resources from CNBC Select and similar finance authorities.

The Role of Mortgage Brokers

Mortgage brokers [https://www.bankrate.com/mortgages/mortgage-broker/] play a crucial role in the home-buying process, serving as expert intermediaries between borrowers and lenders. Their responsibilities extend far beyond mere introductions. A broker takes time to review each client's financial profile, discuss goals in detail, and map out clear strategies that realistically fit the borrower's needs and circumstances. Using their broad lender networks, they match borrowers to the most suitable products-often saving applicants from fruitless applications or costly mistakes.

Beyond matchmaking, brokers handle negotiations, paperwork, and many of the time-consuming administrative steps that are part of mortgage acquisition. Their market knowledge enables them to quickly recognize competitive deals or spot unfavorable terms, providing clients with a more confident and hassle-free journey.

Benefits of Using a Mortgage Broker

Turning to a mortgage broker brings numerous concrete advantages:

* Access to Multiple Lenders: Mortgage brokers work with a broad panel of banks, credit unions, and independent lenders, enabling borrowers to consider multiple options instead of being limited to a single bank's offerings.

* Expert Guidance: Brokers break down complex mortgage jargon, ensuring borrowers understand every aspect of the process, from varying rates and fees to repayment options and fine print.

* Time and Cost Efficiency: By presenting tailored loan matches and leveraging industry relationships, brokers can help clients secure competitive rates and favorable terms. This often translates into both upfront and long-term savings, as highlighted by authorities such as Forbes.

Additionally, brokers can advise on improving credit profiles, preparing documentation, and navigating issues such as self-employment or unique income situations, making mortgage approval more accessible to a diverse range of buyers.

Technological Advancements in Mortgage Brokering

The mortgage industry is adapting swiftly to embrace technological innovations. Today's brokers leverage automation and artificial intelligence to create smoother, faster, and more secure experiences for both themselves and their clients. Here are some of the pivotal changes:

* Accelerated Loan Approvals: Advanced AI and digital underwriting platforms reduce the time it takes for approvals, cutting wait times from weeks to just minutes or hours.

* Improved Credit Assessments: Modern algorithms analyze a broader range of financial data, including recurring rent payments and spending habits, to paint a more comprehensive picture of borrower eligibility.

* Enhanced Fraud Detection: AI-powered systems identify inconsistencies and potential fraudulent activity, safeguarding both buyers and lenders from common scams.

These digital tools not only create a more user-friendly mortgage process but also enable borrowers to track their application progress in real-time and communicate seamlessly with their brokers and lenders.

Regulatory Changes Impacting Mortgage Brokers

Legislative updates continue to shape the mortgage sector, directly impacting how brokers and their clients interact. For example, new requirements may include written agreements before home viewings, clarifying agent compensation to foster open communication and transparency. Lenders and brokers are also increasingly accepting alternative credit scoring models and even digital currencies within the mortgage application process, helping to expand access and modernize the criteria used in assessing potential buyers.

Staying informed about these changes ensures that both brokers and borrowers remain compliant and benefit from new pathways to homeownership. This is especially true as digital platforms and fintech tools become increasingly integrated into everyday transactions.

Choosing the Right Mortgage Broker

Finding the right mortgage broker [https://www.nerdwallet.com/mortgages/learn/how-to-find-a-mortgage-broker] is crucial for a smooth and successful home-buying experience. To select a suitable partner, begin by verifying their professional credentials and industry experience. Established brokers should be transparent in explaining their fee structures, sourcing options from a diverse range of lenders, and clearly outlining the full range of services provided. Open communication and a willingness to answer questions are hallmarks of reliable brokers who prioritize client outcomes over commissions.

Borrowers should interview multiple brokers, ask for references or reviews, and be wary of anyone who is not forthcoming about total costs or restricts access to only a handful of lenders.

Conclusion

Mortgage brokers are invaluable allies in demystifying the often complicated process of buying a home. They guide borrowers through every step, finding optimal mortgage solutions tailored to individual financial situations, thereby improving the chances of approval and saving money over the life of a loan. Layered with cutting-edge technology and guided by evolving regulatory standards, mortgage brokering has become more efficient and accessible than ever. Selecting an experienced and transparent broker can make all the difference in turning your path to homeownership into a streamlined and rewarding experience.

Media Contact

Company Name: Bankrate, LLC

Contact Person: Bruce J. Zanca

Email:Send Email [https://www.abnewswire.com/email_contact_us.php?pr=mortgage-brokers-streamline-the-loan-journey-for-firsttime-buyers]

Country: United States

Website: https://www.bankrate.com

Legal Disclaimer: Information contained on this page is provided by an independent third-party content provider. ABNewswire makes no warranties or responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you are affiliated with this article or have any complaints or copyright issues related to this article and would like it to be removed, please contact retract@swscontact.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Mortgage Brokers Streamline the Loan Journey for First-Time Buyers here

News-ID: 4288383 • Views: …

More Releases from ABNewswire

Price Moving Strengthens Long Distance Mover Operations Across Southwest Florida …

Price Moving expands long-distance moving services across Southwest Florida, offering professional relocation solutions from four regional offices with transparent pricing and trained crews.

Long distance mover services have expanded throughout Southwest Florida as Price Moving [https://www.google.com/maps/place/Price+Moving/@26.3283752,-81.7829893,1082m/data=!3m2!1e3!4b1!4m6!3m5!1s0x88db197000ff2647:0xa1898c6c1e368016!8m2!3d26.3283752!4d-81.7829893!16s%2Fg%2F11hy9p596x!5m1!1e3?entry=ttu&g_ep=EgoyMDI2MDEyNS4wIKXMDSoKLDEwMDc5MjA3MUgBUAM%3D] rolls out enhanced capabilities for handling relocations across state lines and beyond. The Bonita Springs-based company has built a strong reputation across Naples, Fort Myers, Marco Island, and surrounding communities through consistent service quality and…

AQUA VAULT PureX Redefines Hygiene Standards: Six-Month Success of India's Leadi …

Image: https://www.abnewswire.com/upload/2026/01/58a074575e8b6f0ee00b7a611288e95f.jpg

Chatra, India - AQUA VAULT is proud to celebrate the six-month milestone of its flagship innovation, the PureX Self-Cleaning Smart Water Bottle [https://www.aquavault.co/products/aqua-vault-purex-bottle-750ml-self-cleaning-smart-water-bottle], which has rapidly emerged as India's premier solution for health-conscious professionals and global travelers. Since its market entry, the PureX Bottle has proved that the demand for lab-verified hydration hygiene is at an all-time high, filling a critical gap in the portable wellness market.

As public awareness…

'The Wilde Girls' Lands Rave Review from Screenage Wasteland as Indie Comedy Str …

Following a successful theatrical rollout, the absurdist period comedy The Wilde Girls is now streaming on Plex, buoyed by rave critical reviews with a standout critical response from Screenage Wasteland that praises the film's inventive humor, committed performances, and surprising emotional core.

Video: https://www.youtube.com/embed/zpFB3bRPCf8

Video Link: https://www.youtube.com/embed/zpFB3bRPCf8

Los Angeles, CA - Following a successful theatrical rollout, the absurdist period comedy The Wilde Girls is now streaming on Plex, buoyed by rave critical reviews…

Why Delaying Pet Grooming Can Lead To Serious Health Issues In Dogs

Brooklyn Pet Spa highlights how delayed grooming can contribute to skin infections, matting, nail overgrowth, and ear issues in dogs, emphasizing preventive care and hygiene from a professional groomer's perspective.

Brooklyn, NY, USA - Regular grooming plays a critical role in maintaining a dog's overall health, yet many pet owners underestimate the risks associated with delaying routine grooming appointments [https://brooklynpetspa.com/appointment-request/]. According to professional groomers and pet wellness experts, postponing basic grooming…

More Releases for Mortgage

Relocation Mortgage Market 2023: Sales and Industry Revenue Forecasts- Wells Far …

The Relocation Mortgage market has witnessed growth from USD XX million to USD XX million from 2017 to 2023. With the CAGR of X.X%, this market is estimated to reach USD XX million in 2029.

The report focuses on the Relocation Mortgage market size, segment size (mainly covering product type, application, and geography), competitor landscape, recent status, and development trends. Furthermore, the report provides detailed cost analysis, supply chain.

Technological innovation and…

Residential Mortgage Service Market to Witness Huge Growth by 2029 - Residential …

The Global Residential Mortgage Service Market: 2022 has been recently published by the Mr Accuracy Reports. The report offers a cutting edge about the Residential Mortgage Service market, which helps the business strategists to make the best investment evaluation.

"The recession is going to come very badly . Please get to know your market RIGHT NOW with an extremely important information."

The Residential Mortgage Service market industry report includes details about…

Mortgage Broker Market Set for Explosive Growth : Associated Mortgage Group, Mor …

Advance Market Analytics published a new research publication on "Mortgage Broker Market Insights, to 2027" with 232 pages and enriched with self-explained Tables and charts in presentable format. In the Study you will find new evolving Trends, Drivers, Restraints, Opportunities generated by targeting market associated stakeholders. The growth of the Mortgage Broker market was mainly driven by the increasing R&D spending across the world.

Get Free Exclusive PDF Sample Copy of…

Reverse Mortgage Providers Market Is Booming Worldwide | Live Well Financial, Op …

Reverse Mortgage Providers Market: The extensive research on Reverse Mortgage Providers Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Reverse Mortgage Providers Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the market, such as…

Mortgage Broker Market Size [2022-2029] will reach at $ 565.3 bn by 2032 100% -T …

A recent market research report added to repository of MR Accuracy Reports is an in-depth analysis of global Mortgage Broker. On the basis of historic growth analysis and current scenario of Mortgage Broker place, the report intends to offer actionable insights on global market growth projections. Authenticated data presented in report is based on findings of extensive primary and secondary research. Insights drawn from data serve as excellent tools that…

Reverse Mortgage Providers Market 2021 Is Booming Worldwide | Live Well Financia …

Reverse Mortgage Providers Market describes an in-depth evaluation and Covid19 Outbreak study on the present and future state of the Reverse Mortgage Providers market across the globe, including valuable facts and figures. Reverse Mortgage Providers Market provides information regarding the emerging opportunities in the market & the market drivers, trends & upcoming technologies that will boost these growth trends. The report provides a comprehensive overview including Definitions, Scope, Application, Production…