Press release

Wealthtech Solutions Market - Key Players, Capability Assessment & M&A Indicators

The wealthtech solutions market has become one of the most transformative forces in global financial services, reshaping how wealth is built, managed, and transferred. Powered by digitization, automation, and increasingly personalized portfolio tools, wealthtech solutions are enabling retail investors, advisory firms, and high-net-worth clients to access sophisticated financial insights that were previously exclusive to institutional investors. As competition accelerates, companies operating in this market differentiate themselves through advanced analytics, integrated advisory platforms, seamless digital experiences, and regulatory compliance capabilities.➤ Request Free Sample PDF Report @ https://www.researchnester.com/sample-request-6065

Top Companies & Their Strategies

BlackRock (Aladdin Wealth)

BlackRock has established one of the most influential technology platforms in the wealthtech solutions market through Aladdin Wealth, its risk analytics and portfolio management system. The company's primary strength is its ability to integrate institutional-grade risk engineering with advisor-ready tools, enabling wealth managers to deliver more accurate portfolio insights. Its global footprint and deep relationships with financial institutions give it unmatched distribution advantages.

Fidelity Investments (Wealthscape)

Fidelity's Wealthscape platform provides wealth advisors with consolidated account management, trading solutions, and compliance support. Fidelity's market strength lies in its broad product ecosystem-retirement services, brokerage, clearing, and custody-which feeds into a fully integrated wealthtech infrastructure. Its ability to scale solutions for both small advisory firms and large institutions makes it a versatile competitor with strong brand credibility.

Charles Schwab (Schwab Advisor Center)

Schwab Advisor Center operates as a powerful digital platform for registered investment advisors (RIAs), offering streamlined onboarding, portfolio management, and custodial tools. Schwab's competitive positioning rests on its low-cost advantage, expansive client base, and leading role in the fee-free investment movement. Its strong regional presence in North America and extensive advisory network enhance its distribution and service capabilities.

Envestnet

Envestnet is one of the most comprehensive players in the wealthtech solutions market, offering unified managed accounts (UMA), data aggregation, financial planning, and analytics tools. Its strengths include diversified revenue streams, deep penetration within advisor networks, and a focus on open-architecture capabilities. Envestnet's acquisition-driven strategy has expanded its reach into data intelligence, compliance, and embedded finance solutions.

➤ Explore detailed profiles of top players and new entrants in this space - access your free sample report → https://www.researchnester.com/sample-request-6065

Robinhood

Robinhood has transformed wealthtech accessibility by democratizing investing through commission-free trading, simple digital interfaces, and automated investing tools. Although primarily known as a retail trading platform, Robinhood's entry into advisory tools and cash management positions it as an emerging market disruptor. Its cost advantages and strong appeal among younger investors give it an edge in customer acquisition.

Betterment

Betterment is a pioneer in automated portfolio advisory, offering robo-advisory services, retirement planning tools, and cash-management products. Its strength lies in algorithm-driven portfolio construction, low fees, and an intuitive user experience. Betterment continues to differentiate itself with hybrid advisory models and socially responsible investment portfolios that appeal to ESG-focused investors.

Temenos

Temenos provides robust wealth management software for banks, private wealth firms, and digital challenger institutions. Its modular platform allows clients to build customized wealthtech stacks covering portfolio management, client onboarding, compliance, and AI-based analytics. Temenos' global reach and institution-grade capabilities make it one of the most important infrastructure providers in the wealthtech solutions market.

➤ View our Wealthtech Solutions Market Report Overview here: https://www.researchnester.com/reports/wealthtech-solutions-market/6065

SWOT Analysis

Strengths

Leading companies in the wealthtech solutions market benefit from strong digital capabilities, sophisticated analytics engines, and high customer trust built over years of financial sector operations. Their broad product ecosystems-spanning portfolio management, robo-advisory, compliance automation, and client reporting-allow them to scale efficiently across multiple investor segments. Further, their ability to integrate AI-driven insights enhances personalization and portfolio performance, positioning them strongly within competitive advisory ecosystems. Global distribution networks and partnerships with financial institutions significantly strengthen market reach.

Weaknesses

A significant weakness across the sector is the dependency on data security, regulatory compliance, and cybersecurity frameworks that require continuous investment. Many companies face challenges balancing rapid technology innovation with stringent financial regulations, raising operational complexity. Some platforms also struggle with feature overcrowding, creating steep learning curves for advisors or clients. Additionally, smaller or newer players often face branding disadvantages compared to long-established financial giants, limiting their ability to attract institutional customers.

Opportunities

The wealthtech solutions market presents substantial opportunities through expansion into emerging markets, where rapid digital adoption is transforming financial behaviors. Strong growth potential exists in hybrid advisory models that fuse human expertise with AI-driven insights, appealing to both new and established investors. New technologies such as generative AI, real-time risk scoring, embedded finance, and blockchain-based advisory frameworks offer major avenues for innovation. There is also rising demand for ESG-focused investment tools and customizable thematic portfolios, creating new market niches for differentiated offerings.

Threats

Intense competition from fintech disruptors, major banks, and global asset managers creates constant pricing and innovation pressure. Regulatory changes-especially related to investor protection, fiduciary standards, and data privacy-can alter business models or limit product expansion. Market volatility poses operational risks for platforms heavily integrated with retail trading behavior. Cyberthreats, fraud, and system outages remain critical risks that can undermine customer trust. Additionally, consolidation among large financial institutions could limit market entry opportunities for smaller wealthtech innovators.

➤ Access a complete SWOT breakdown with company-specific scorecards: Claim your sample report → https://www.researchnester.com/sample-request-6065

Investment Opportunities & Trends

Key Investment Themes

Investment in the wealthtech solutions market is being shaped by major themes including AI integration, personalization engines, digital-first advisory platforms, and next-generation portfolio analytics. Investors are increasingly backing startups focused on robo-advisory automation, tax-optimized investment engines, and "financial wellness" tools that blend wealth planning with behavioral finance insights. Venture funding is also flowing into infrastructure-level wealthtech solutions such as digital identity verification, compliance automation, and cloud-native portfolio systems.

M&A activity remains strong as large players acquire niche fintechs to expand capabilities in areas like ESG scoring, risk analytics, and direct indexing. Wealth management institutions are also investing in embedded wealth technologies that integrate advisory tools directly into banking apps, credit platforms, and payment systems.

Segments & Regions Attracting Capital

The most capital-attractive segments today include automated advisory, digital onboarding platforms, AI-powered analytics, and wealth planning tools for mass-affluent clients. North America continues to attract the largest share of investments due to its mature wealth management ecosystem and technology-driven advisory models. Europe is experiencing rising investment momentum due to open-banking initiatives and increased digital adoption among traditional banks. Asia-Pacific is emerging as a high-growth investment zone, boosted by rapid wealth creation, mobile-first investing behavior, and supportive financial digitization policies.

Notable M&A, Product Launches & Policy Changes (Last 12 Months)

Several major financial institutions acquired fintech firms specializing in AI-based portfolio analytics and tax-loss harvesting tools.

Wealthtech leaders launched enhanced financial planning engines powered by generative AI to improve client engagement and scenario modeling.

Regulatory updates across the U.S., U.K., and Singapore introduced stricter digital advisory guidelines, prompting wealthtech companies to strengthen compliance and risk-management frameworks.

Multiple companies unveiled new ESG scoring tools, thematic investing models, and digital onboarding suites designed to improve advisor productivity and customer experience.

These developments underscore the transition toward fully digital, compliant, and highly personalized wealthtech ecosystems.

➤ Request Free Sample PDF Report @ https://www.researchnester.com/sample-request-6065

Related News -

https://www.linkedin.com/pulse/how-cryptocurrency-hardware-wallet-market-transforming-dhaqf

https://www.linkedin.com/pulse/how-specialty-pacs-market-transforming-diagnostic-workflows-6cnrf

Contact Data

AJ Daniel

Corporate Sales, USA

Research Nester

77 Water Street 8th Floor, New York, 10005

Email: info@researchnester.com

USA Phone: +1 646 586 9123

Europe Phone: +44 203 608 5919

About Research Nester

Research Nester is a one-stop service provider with a client base in more than 50 countries, leading in strategic market research and consulting with an unbiased and unparalleled approach towards helping global industrial players, conglomerates and executives for their future investment while avoiding forthcoming uncertainties. With an out-of-the-box mindset to produce statistical and analytical market research reports, we provide strategic consulting so that our clients can make wise business decisions with clarity while strategizing and planning for their forthcoming needs and succeed in achieving their future endeavors. We believe every business can expand to its new horizon, provided a right guidance at a right time is available through strategic minds.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Wealthtech Solutions Market - Key Players, Capability Assessment & M&A Indicators here

News-ID: 4287436 • Views: …

More Releases from Research Nester Pvt Ltd

Key Players in the Returnable Packaging Market: Share Positioning & Investor Per …

The returnable packaging market is gaining strategic importance as companies across logistics, food & beverage, automotive, and retail industries seek cost efficiency, sustainability, and supply chain resilience. Returnable packaging solutions-such as reusable pallets, crates, containers, drums, and intermediate bulk containers (IBCs)-are increasingly favored over single-use packaging due to regulatory pressure, circular economy goals, and operational efficiency.

➤ Request Free Sample PDF Report @ https://www.researchnester.com/sample-request-8352

Top Companies

1. Brambles (CHEP)

Brambles, through its…

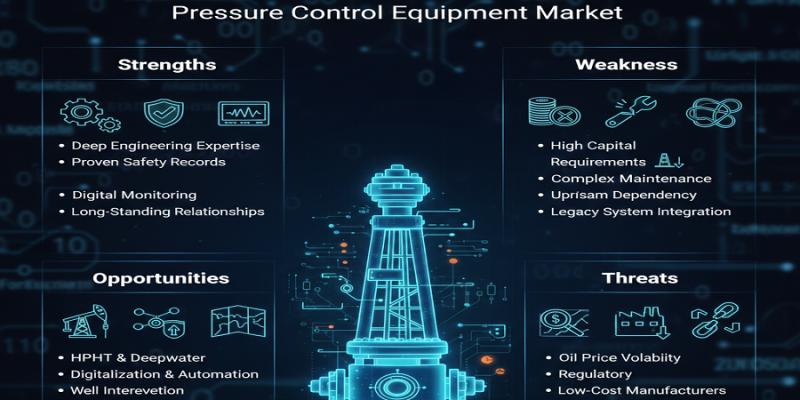

Pressure Control Equipment Market Dominance: Top Companies Strengthening Share & …

Pressure control equipment plays a mission-critical role in ensuring safety, operational integrity, and regulatory compliance across oil & gas exploration, well intervention, drilling, and production activities. From blowout preventers (BOPs) and control heads to manifolds and pressure valves, these systems are essential for managing high-pressure environments in both onshore and offshore operations.

As upstream operators focus on deeper wells, high-pressure high-temperature (HPHT) environments, and complex well architectures, demand for advanced pressure…

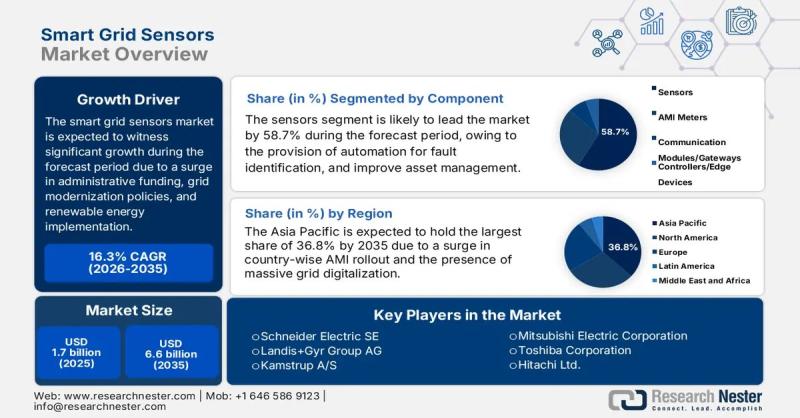

Smart Grid Sensors Market size to exceed $6.6 Billion by 2035 | General Electric …

Market Outlook and Forecast

The smart grid sensors market is emerging as a critical enabler of next-generation power infrastructure, supporting utilities and grid operators in transitioning from conventional, centralized electricity networks to intelligent, data-driven energy systems. Smart grid sensors provide real-time visibility into grid performance, enabling advanced monitoring, predictive maintenance, fault detection, and efficient energy distribution across transmission and distribution networks.

In 2025, the global smart grid sensors market is valued at…

Top Companies in Architectural Lighting Market - Benchmarking Performance & Futu …

The architectural lighting market has evolved into a design-driven, technology-intensive segment of the global lighting industry. Beyond illumination, architectural lighting now plays a critical role in enhancing aesthetics, supporting energy efficiency goals, and enabling smart building environments. Demand is increasingly shaped by urban development, commercial real estate upgrades, hospitality projects, and public infrastructure modernization.

➤ Request Free Sample PDF Report @ https://www.researchnester.com/sample-request-8342

Top Companies & Their Strategies

1. Signify (Philips Lighting)

Signify…

More Releases for Wealth

Wealth Wave Script Review | Attract Wealth Fast

Today, we're diving into the Wealth Wave Script - a digital manifestation program that's been generating buzz in the personal development space. But here's the real question:

Is it just another batch of fluffy affirmations, or is there actual science and structure behind it?

Let's break down the truth behind the Wealth Wave Script and see how it stacks up against typical manifestation tools.

Visit the official Wealth Wave Script : https://rebrand.ly/WealthWaveScriptDiscount

What Is…

Wealth Geometric Code - Top Wealth Manifestation Program: A Comprehensive Review

The Wealth Geometric Cell is a revolutionary solution to unlock its potential as a manifestation of wealth. Imagine owning a tool that not only facilitates the effortless attraction of financial abundance, but also aligns with ancient wisdom and modern science. The Wealth Geometry Cell is designed to activate what is called the "geometric cell", a unique aspect of your being that has been inactive for too long. This innovative approach…

Wealth Brain Code: Breakthrough System for Wealth Building

Combining principles from psychology, neuroscience, and spirituality, programs like 'Wealth Brain Code' offer a holistic approach to personal and financial transformation. By leveraging psychological insights to challenge limiting beliefs, employing neuroscience techniques to rewire the brain for abundance, and integrating spiritual principles to foster purpose and growth, these programs aim to empower individuals to cultivate a mindset of prosperity and attract wealth effortlessly.

The program represents a holistic approach to personal…

Wealth DNA Code Wealth Manifestation Offer (Wealth DNA Code Audio Frequency) How …

Wealth DNA Code - Wealth Manifestation Offer: How To Make Money By Manifesting Your Desires

Did you know about Wealth Manifestation? It's a thrilling new method to generate income by manifestation of your goals! Wealth Manifestation is an effective tool to help discover the power of Manifestation which allows you to utilize the laws of attraction to manifest an abundant life as well as financial independence. In this article we'll look…

Wealth Management Market is Gaining Momentum with key players Bajaj Capital, Cen …

The "Wealth Management - Market Analysis, Trends, and Forecasts 2014-2025 " Study has been added to HTF MI offering. The study focus on both qualitative as well as quantitative side and follows Industry benchmark and NAICS standards to built coverage of players for final compilation of study. Some of the major and emerging players profiled are Alpha Capital, Anand Rathi Wealth Services Limited, Bajaj Capital Limited, Centrum Wealth Management Limited,…

Wealth Management Market in India 2020: Bajaj Capital Limited, IIFL Wealth Manag …

A new research document is added in HTF MI database of 54 pages, titled as 'Wealth Management Market in India 2020’ with detailed analysis, Competitive landscape, forecast and strategies. The study covers geographic analysis that includes regions like North America, Europe or Asia and important players/vendors such as Alpha Capital, Anand Rathi Wealth Services Limited, Bajaj Capital Limited, Centrum Wealth Management Limited, Edelweiss Asset Management Limited, IIFL Wealth Management Limited,…