Press release

Trade Finance Market size to surpass $14.06 Billion by 2035 | Top players include HSBC, Citigroup, Standard Chartered, BNP Paribas, JPMorgan Chase

The Trade Finance Market plays an indispensable role in global commerce by reducing payment risks, enabling smooth cross-border transactions, and ensuring liquidity for businesses of all sizes. As international trade continues to expand, the need for efficient financial instruments such as letters of credit, export credit, invoice financing, supply chain financing, and guarantees has grown significantly. In 2025, the trade finance market size reached USD 9.97 trillion, reflecting deep global reliance on these mechanisms to enable import and export operations. By 2035, the market is projected to reach USD 14.06 trillion, supported by a stable 3.5% CAGR between 2025 and 2035.This expansion showcases the strengthening link between global trade flows, financial institutions, and corporate borrowers. Market growth is also being influenced by technological modernization, rising digital adoption, and ongoing structural reforms in international banking regulations. Demand for modern trade finance solutions is surging as businesses aim to mitigate risks stemming from currency fluctuations, payment uncertainties, political instability, and supply chain disruptions. Additionally, the widespread adoption of digital platforms is helping reduce paperwork, streamline compliance checks, and accelerate transaction cycles, positioning digital trade finance as an essential enabler of economic resilience.

➤ Request Free Sample PDF Report @ https://www.researchnester.com/sample-request-6024

Regional Performance Highlights

Regional trends reveal how different economies are shaping the overall momentum of the trade finance market.

North America - 35% Market Share by the End of 2035

North America is poised to account for 35% of the global market by 2035, supported by advanced banking infrastructure, high adoption of digital trade platforms, and strong international trade interactions with Asia and Europe. The region benefits from robust supply chain networks, growing export demand for technological equipment, and increasing reliance on structured trade credits and guarantees. U.S.-based banks and fintech providers continue to invest heavily in blockchain-enabled trade finance products, boosting efficiency and transparency.

Europe - A Mature Market with Strong Banking Networks

Europe remains a mature and critical market for trade finance due to its extensive network of global banks, export-oriented industries, and supportive regulatory frameworks. European companies exhibit high demand for export credit insurance, receivables financing, and structured trade instruments that help in mitigating risks associated with geopolitical uncertainty and shifting trade policies. Moreover, Europe's focus on sustainability has accelerated the development of green trade finance solutions that prioritize climate-aligned investments.

Asia Pacific - Positioned for Substantial Growth (2026-2035)

The Asia Pacific region is set to grow substantially between 2026 and 2035, driven by booming export markets, rapid industrialization, and rising intra-regional trade. Countries such as China, India, Vietnam, and Indonesia are experiencing strong demand for letters of credit, import financing, and pre-shipment financing as manufacturing footprints expand. The rise of digital trade ecosystems across the region, combined with government-led initiatives for supply chain strengthening, is expected to accelerate financial inclusion for small and medium-sized enterprises (SMEs).

➤ Gain access to expanded insights on competitive strategies, market size, and regional analysis. View our Trade Finance Report Overview here: https://www.researchnester.com/reports/trade-finance-market/6024

Market Segmentation

The trade finance market is structured around various end-use sectors, financial providers, and transaction instruments. Each segment plays a critical role in supporting global trade efficiency.

Construction Segment - Holding 30% Market Share

The construction sector accounts for 30% of the trade finance market, supported by large-scale procurement, import of machinery, raw material supply chains, and high-value project financing. Infrastructure development, particularly in Asia and the Middle East, has created rising demand for bank guarantees, performance bonds, and import financing. Global construction companies rely on trade finance to mitigate risks associated with lengthy project cycles, international vendor contracts, and fluctuating commodity prices.

Banks Segment - 40% Share Through 2035

Banks dominate the market with a 40% share, serving as the primary facilitators of letters of credit, documentary collections, supply chain financing, and export credits. Large commercial banks hold strong positions due to their global reach, compliance expertise, and established relationships with international traders. Increasingly, banks are partnering with fintech companies to digitize trade documentation, automate compliance processes, and improve transaction transparency.

Other High-Demand Use Cases

Manufacturing: Heavy reliance on import-export documentation and supply chain financing.

Automotive: Strong need for component financing and vendor credit assurance.

Agriculture & Food Trade: Frequent use of letters of credit to secure cross-border shipments.

➤ Discover how the Trade Finance Market is evolving globally - access your free sample report → https://www.researchnester.com/sample-request-6024

Top Market Trends

Below are three key trends shaping the future of the trade finance market:

1. Rise of Digital and Blockchain-Enabled Trade Finance

Digitization is revolutionizing trade finance, eliminating paper processes, and minimizing fraud risk. Technologies such as blockchain, AI-powered compliance tools, and automated KYC/AML systems are improving transaction transparency and speeding up approval cycles.

2. Growing Focus on Supply Chain Resilience

Global disruptions-ranging from geopolitical tensions to pandemic-induced logistics challenges-have pushed companies to strengthen supply chain resilience using advanced trade financing instruments.

3. Increasing Role of Sustainable and Green Trade Finance

Financial institutions are offering sustainability-linked trade finance products designed to support environmentally responsible trade practices. These solutions incentivize companies to meet emissions, waste reduction, or ethical sourcing standards.

➤ Stay ahead of the curve with the latest Trade Finance Market trends. Claim your sample report → https://www.researchnester.com/sample-request-6024

Recent Company Developments

Below are five key developments from major companies shaping the global trade finance market over the past year:

1. HSBC

HSBC expanded its digital trade finance capabilities with new blockchain-based documentation systems and increased automation for cross-border settlements. The bank also invested in sustainability-linked trade finance offerings to support green supply chains.

2. Citigroup

Citi introduced advanced AI-powered compliance tools designed to streamline document verification and reduce transaction processing times. The institution also strengthened partnerships with trade finance fintech firms across Asia.

3. Standard Chartered

Standard Chartered launched enhanced supply chain financing programs tailored for SMEs in emerging markets. Recent digital upgrades include integration with global e-trade platforms to accelerate cross-border workflows.

4. BNP Paribas

BNP Paribas expanded its ESG-linked trade finance portfolio and adopted smart contract technology for high-value trade transactions. The bank has also increased investments in digital onboarding platforms to support exporters.

5. JPMorgan Chase

JPMorgan made strategic investments in trade digitization, including the expansion of its blockchain network for secure, verifiable trade documentation. The company also introduced new receivables financing solutions aimed at strengthening corporate liquidity.

➤ Request Free Sample PDF Report @ https://www.researchnester.com/sample-request-6024

Related News -

https://www.linkedin.com/pulse/what-driving-growth-xerostomia-therapeutics-market-today-f3btf/

https://www.linkedin.com/pulse/can-disposable-camera-market-survive-smartphone-dominated-t6pef

Contact Data

AJ Daniel

Corporate Sales, USA

Research Nester

77 Water Street 8th Floor, New York, 10005

Email: info@researchnester.com

USA Phone: +1 646 586 9123

Europe Phone: +44 203 608 5919

About Research Nester

Research Nester is a one-stop service provider with a client base in more than 50 countries, leading in strategic market research and consulting with an unbiased and unparalleled approach towards helping global industrial players, conglomerates and executives for their future investment while avoiding forthcoming uncertainties. With an out-of-the-box mindset to produce statistical and analytical market research reports, we provide strategic consulting so that our clients can make wise business decisions with clarity while strategizing and planning for their forthcoming needs and succeed in achieving their future endeavors. We believe every business can expand to its new horizon, provided a right guidance at a right time is available through strategic minds.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Trade Finance Market size to surpass $14.06 Billion by 2035 | Top players include HSBC, Citigroup, Standard Chartered, BNP Paribas, JPMorgan Chase here

News-ID: 4287394 • Views: …

More Releases from Research Nester Pvt Ltd

Lutein and Zeaxanthin Market - Key Players, Capability Assessment & M&A Indicato …

The lutein and zeaxanthin market has expanded steadily as demand for eye-health supplements, functional foods, and preventive nutrition increases across global consumer segments. Lutein and zeaxanthin, two essential carotenoids concentrated in the retina, are widely recognized for their protective roles against oxidative stress, age-related macular degeneration (AMD), blue-light exposure, and general visual fatigue. Their adoption has accelerated with the rise of digital lifestyles, an aging population, and growing clinical evidence…

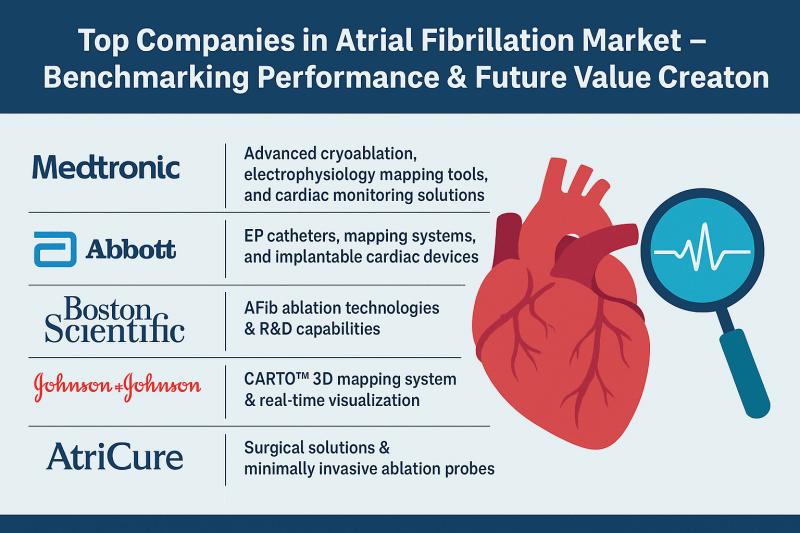

Top Companies in Atrial Fibrillation Market - Benchmarking Performance & Future …

The atrial fibrillation market is undergoing a period of rapid transformation as diagnostic technologies, catheter-based therapies, and antiarrhythmic solutions continue to advance. Atrial fibrillation (AFib) is one of the most prevalent cardiac arrhythmias globally, prompting significant demand for improved detection, early intervention, and minimally invasive treatment. The shift toward advanced ablation systems, AI-enabled diagnostics, wearable monitoring, and next-generation electro-mapping tools has strengthened competition across the market. Companies are expanding their…

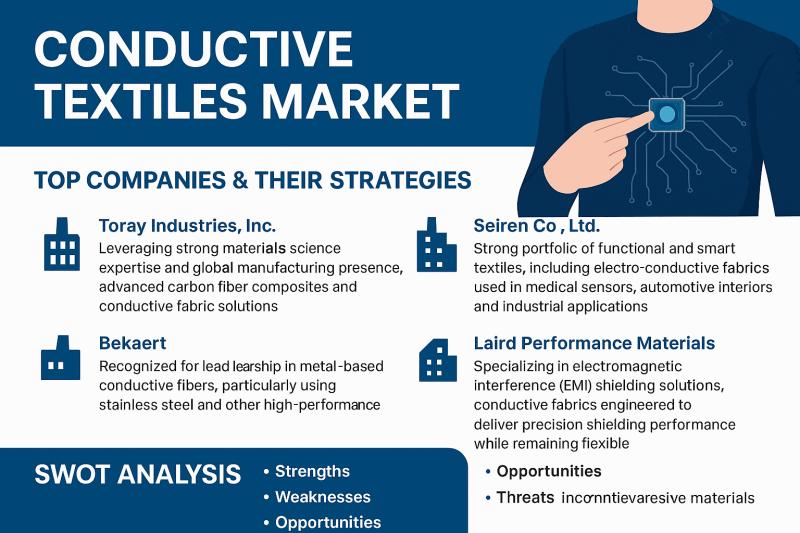

Conductive Textiles Market - Top Companies, SWOT Deep Dive & Capital Flow Trends

The conductive textiles market is undergoing a rapid transformation as wearable electronics, smart apparel, and advanced sensor-integrated fabrics move from niche applications to mainstream adoption. Conductive textiles-engineered using conductive polymers, metal-coated fibers, or intrinsically conductive yarns-have become integral to next-generation healthcare wearables, military gear, automotive interiors, and consumer smart devices. As industries push for lighter, flexible, and more energy-efficient electronic systems, conductive materials embedded within fabrics are emerging as a…

Global Osteosynthesis Devices Market: Top Companies, Market Share Rankings & Inv …

The osteosynthesis devices market continues to evolve as orthopedic care moves toward minimally invasive procedures, biologically compatible materials, and technology-enabled implants. These devices-ranging from plates and screws to intramedullary nails and fixation systems-are essential for treating fractures, deformities, and complex bone injuries. Companies operating in this space are adopting strategies centered around product innovation, clinical efficacy, and expansion into fast-growing regions. As trauma care volumes rise in both developed and…

More Releases for Trade

Trade Intelligence for Global Trade: Benchmarking Competitors with Verified Trad …

In the modern supply chain battlefield, knowledge is not just power-it's leverage. Understanding how your competitors move in the global trade space can make the difference between a strategic win and a costly misstep. Yet, many companies still rely on fragmented or outdated information, missing out on key shifts that trade intelligence platforms can now uncover easily.

The Blind Spot in Traditional Competitive Research

Traditional competitor analysis typically relies on market reports,…

Decoding Chongqing's Cross-Border Trade through the Yumaotong Smart Trade Platfo …

Since its launch on May 13, the New Western International Land - Sea Corridor - Yumaotong Smart Trade Platform (hereinafter referred to as the 'Yumaotong Smart Trade Platform') has welcomed 420 enterprises, including over 100 foreign companies. At the 7th Western China International Fair held in Chongqing on May 22, Deng Ai, head of the platform, said that it offered global businesses a one-stop, full-chain, professional service from capturing trade…

Trade Show Displays: Maximizing Your Trade Show Booth Design

Trade shows are a critical aspect of any business that wants to showcase its products, services, and brand to potential customers, partners, and investors. Trade show displays are one of the most crucial elements in trade show marketing, and they play a significant role in determining the success of a company's presence at a trade show. In this article, we'll explore the different types of displays for trade shows and…

The future of international trade and worldwide network: Global Trade Plaza

The future of international trade and worldwide network: Global Trade Plaza

A radical change to support continuous growth in supply traffic.

Connecting all manufacturers, suppliers, traders, exporters, and importers.

Open the door to the future of safe international trade.

B2B marketplace Global Trade Plaza wants to redefine the supply chain. The growth due to digitalization has touched multiple fields, but couldn't do much for the intercountry supply. We are here with…

US-China trade war shifting cement seaborne trade flows

In 2018, the total number of active cement carriers surpassed 360 units, with the total dead weight tonnage topping 2.7 million, the highest figure recorded since 2010.

According to CW Research’s 2019 update of the World Cement, Clinker & Slag Sea-Based Trade Report, the upward trend was underpinned by a growing demand for cement carriers in key domestic trade markets.

Specialized cement carriers move about 25 million tons of cement per…

Suisse Trade – Holding Trade Seminar in Tokyo in December 2016

Suisse Trade is a full-fledged Forex trading firm that is renowned worldwide for rendering clients with the best assistance in commodity and Forex based trading. The company has been consistently successful in presenting clients with the most formidable instruments to trade in currency and commodities markets. The tasks undertaken by the company also involve spot and cash trades, limited risk options on futures as well as contracts. It has always…