Press release

Anti-money Laundering (AML) Solution Market size to hit $14.05 Billion by 2035 | Top companies include FICO, NICE Actimize, ACI Worldwide, Oracle Corporation, SAS Institute

Market Outlook and ForecastAnti-money Laundering (AML) Solution Market is on a strong upward growth path as organizations strengthen their compliance frameworks and invest in automated technology to detect suspicious activity. The market size is projected to rise from USD 2.85 billion in 2025 to USD 14.05 billion by 2035, supported by wider adoption of AI-driven analytics, automated identity verification, and cloud-based transaction monitoring. With an expected 17.3% CAGR between 2026 and 2035, AML platforms will continue to evolve into intelligent, predictive systems that help businesses prevent financial risks before they escalate.

➤ Request Free Sample PDF Report @ https://www.researchnester.com/sample-request-6064

Regional Performance Highlights

The need for reliable AML systems is accelerating worldwide due to rising digital financial activity, but geographic adoption differs based on risk exposure and regulatory pressure.

North America stands as the most technologically advanced market for AML solutions, with banks and fintech companies expanding investments in cloud-native compliance frameworks. Increasing cryptocurrency adoption and digital transaction volume have further fueled the demand for real-time risk analytics and regulatory reporting tools.

Europe remains a compliance-driven landscape, where financial institutions are required to demonstrate enhanced due diligence and customer risk profiling. The introduction of pan-European AML authorities and unified compliance standards is stimulating market demand.

Asia Pacific is projected to witness rapid uptake in AML tools as digital payments surge and financial institutions expand across rural and semi-urban regions. Government-led regulatory reform and large-scale financial inclusion initiatives are reinforcing the need for AML automation to detect evolving fraud schemes.

➤ Gain access to expanded insights on competitive strategies, market size, and regional analysis. View our Anti-money Laundering (AML) Solution Market Report Overview here: https://www.researchnester.com/reports/anti-money-laundering-solution-market/6064

Segmental Insights

The software segment is expected to dominate the AML Solution Market by 2035, driven by demand for scalable digital platforms that integrate AI and machine learning to detect unusual patterns in real time. Software providers are enhancing their offerings with predictive threat intelligence, automated case management, sanctions screening, and centralized compliance dashboards.

On the demand side, the BFSI segment is forecasted to secure the largest share by 2035, as banks, insurance companies, and fintech enterprises continue to adopt AML tools to combat identity fraud, suspicious money movement, and regulatory non-compliance. The growth of online lending, digital wallets, and neobanking is making AML technology indispensable to secure end-to-end financial workflows.

➤ Discover how the Anti-money Laundering (AML) Solution Market is evolving globally - access your free sample report → https://www.researchnester.com/sample-request-6064

Top Market Trends

The AML Solution Market is undergoing a digital revolution as businesses adopt proactive and automated approaches to financial security.

AI-Driven Predictive Analytics and Automation

Financial institutions are integrating AI and machine learning into AML systems to detect anomalies and enhance decision-making accuracy. Predictive algorithms enable early identification of high-risk transactions and reduce manual workloads. Many fintechs have invested in automation to accelerate compliance checks and streamline alert investigation.

Cloud-Based AML Platforms and API Integration

Cloud deployment is rapidly gaining popularity due to scalability, cost advantages, and centralized threat visibility across multiple business units. Open-API-based platforms are enabling frictionless integration with core banking systems, KYC portals, and fraud detection engines, optimizing compliance workflows.

Growing Focus on Cryptocurrency AML and Blockchain Monitoring

The surge in digital assets has forced regulators to mandate enhanced monitoring of crypto transactions. AML systems are being upgraded to track wallet ownership, verify exchange activity, and detect cross-asset money movement. Many financial institutions are now deploying blockchain forensics tools to identify potential fraud patterns.

➤ Stay ahead of the curve with the latest Anti-money Laundering (AML) Solution Market trends. Claim your sample report → https://www.researchnester.com/sample-request-6064

Recent Company Developments

Rising regulatory pressures and digital transformation have encouraged prominent market players to expand through innovation, acquisitions, and strategic partnerships.

FICO introduced advanced machine learning-based fraud detection enhancements designed to reduce false positives and support automated compliance escalation.

NICE Actimize launched a modular cloud-native financial crime platform to support end-to-end AML case management and regulatory reporting across regional markets.

ACI Worldwide announced strategic collaboration with a global digital banking security provider to expand AML capabilities for real-time payments.

Oracle Corporation upgraded its AML suite with generative-AI-powered investigation analytics and multi-jurisdiction regulatory support.

SAS Institute invested in new AI labs to accelerate R&D for scalable AML and fraud prevention technologies tailored for banks and fintech enterprises.

➤ Request Free Sample PDF Report @ https://www.researchnester.com/sample-request-6064

➤ Related News -

https://www.linkedin.com/pulse/what-future-digital-transformation-consulting-services-ehsyf

https://www.linkedin.com/pulse/what-factors-driving-global-growth-beta-testing-tools-xqxyf

Contact Data

AJ Daniel

Corporate Sales, USA

Research Nester

77 Water Street 8th Floor, New York, 10005

Email: info@researchnester.com

USA Phone: +1 646 586 9123

Europe Phone: +44 203 608 5919

About Research Nester

Research Nester is a one-stop service provider with a client base in more than 50 countries, leading in strategic market research and consulting with an unbiased and unparalleled approach towards helping global industrial players, conglomerates and executives for their future investment while avoiding forthcoming uncertainties. With an out-of-the-box mindset to produce statistical and analytical market research reports, we provide strategic consulting so that our clients can make wise business decisions with clarity while strategizing and planning for their forthcoming needs and succeed in achieving their future endeavors. We believe every business can expand to its new horizon, provided a right guidance at a right time is available through strategic minds.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Anti-money Laundering (AML) Solution Market size to hit $14.05 Billion by 2035 | Top companies include FICO, NICE Actimize, ACI Worldwide, Oracle Corporation, SAS Institute here

News-ID: 4287152 • Views: …

More Releases from Research Nester Pvt Ltd

Key Players in the Returnable Packaging Market: Share Positioning & Investor Per …

The returnable packaging market is gaining strategic importance as companies across logistics, food & beverage, automotive, and retail industries seek cost efficiency, sustainability, and supply chain resilience. Returnable packaging solutions-such as reusable pallets, crates, containers, drums, and intermediate bulk containers (IBCs)-are increasingly favored over single-use packaging due to regulatory pressure, circular economy goals, and operational efficiency.

➤ Request Free Sample PDF Report @ https://www.researchnester.com/sample-request-8352

Top Companies

1. Brambles (CHEP)

Brambles, through its…

Pressure Control Equipment Market Dominance: Top Companies Strengthening Share & …

Pressure control equipment plays a mission-critical role in ensuring safety, operational integrity, and regulatory compliance across oil & gas exploration, well intervention, drilling, and production activities. From blowout preventers (BOPs) and control heads to manifolds and pressure valves, these systems are essential for managing high-pressure environments in both onshore and offshore operations.

As upstream operators focus on deeper wells, high-pressure high-temperature (HPHT) environments, and complex well architectures, demand for advanced pressure…

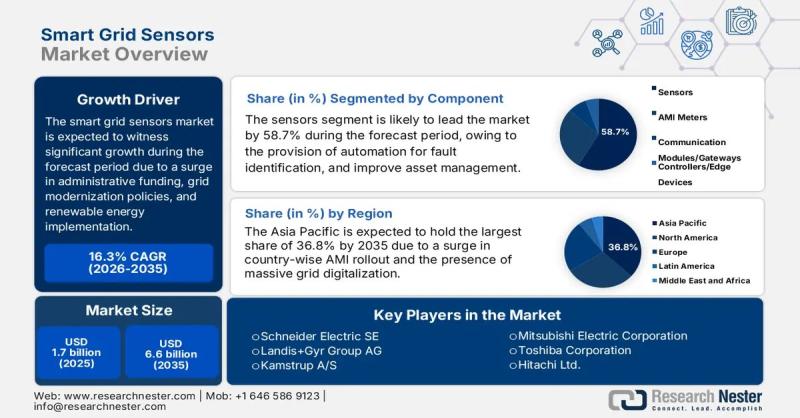

Smart Grid Sensors Market size to exceed $6.6 Billion by 2035 | General Electric …

Market Outlook and Forecast

The smart grid sensors market is emerging as a critical enabler of next-generation power infrastructure, supporting utilities and grid operators in transitioning from conventional, centralized electricity networks to intelligent, data-driven energy systems. Smart grid sensors provide real-time visibility into grid performance, enabling advanced monitoring, predictive maintenance, fault detection, and efficient energy distribution across transmission and distribution networks.

In 2025, the global smart grid sensors market is valued at…

Top Companies in Architectural Lighting Market - Benchmarking Performance & Futu …

The architectural lighting market has evolved into a design-driven, technology-intensive segment of the global lighting industry. Beyond illumination, architectural lighting now plays a critical role in enhancing aesthetics, supporting energy efficiency goals, and enabling smart building environments. Demand is increasingly shaped by urban development, commercial real estate upgrades, hospitality projects, and public infrastructure modernization.

➤ Request Free Sample PDF Report @ https://www.researchnester.com/sample-request-8342

Top Companies & Their Strategies

1. Signify (Philips Lighting)

Signify…

More Releases for AML

Xepeng Emphasizes AML Screening in Platform Security

Platform details AML measures, including counterparty checks, to support secure conversions for merchants.

Denpasar, Bali, Indonesia, 30th Dec 2025 -- As digital value conversion systems evolve, enterprises like Xepeng recognize that robust anti-money laundering (AML) practices are essential to maintaining trust, safeguarding merchants, and aligning with regulatory expectations. AML encompasses a set of policies and practices intended to prevent, detect, and respond to financial activity that may be linked to illicit…

Top Trends Transforming the Hemato Oncology Testing Market Landscape in 2025: Ne …

Use code ONLINE30 to get 30% off on global market reports and stay ahead of tariff changes, macro trends, and global economic shifts.

What Will the Hemato Oncology Testing Industry Market Size Be by 2025?

There has been a swift expansion in the hemato oncology testing market in the past few years. The market, which was valued at $3.5 billion in 2024, is predicted to surge to $3.96 billion in 2025, reflecting…

AML BitCoin Founder Asks President Trump to release their AML BITCOIN Classified …

The DOJ and the FBI should practice tough love while also providing financial incentives for government employees that uphold the constitution and obey the law. AG Bondi and Director Patel should ask President Trump for access to some of the billions of dollars that DOGE has saved us and utilize it for pay raises. Their employees need to be taken care of financially, or their hardships will make them the…

Anti-Money Laundering (AML) Software Market Is Booming So Rapidly with Thomson R …

The Latest published market study on Global Anti-Money Laundering (AML) Software Market provides an overview of the current market dynamics in the Anti-Money Laundering (AML) Software space, as well as what our survey respondents all outsourcing decision-makers predict the market will look like in 2032. The study breaks the market by revenue and volume (wherever applicable) and price history to estimate the size and trend analysis and identify gaps and…

Global Anti Money Laundering (AML) Software Market Size, Share and Forecast By K …

𝐔𝐒𝐀, 𝐍𝐞𝐰 𝐉𝐞𝐫𝐬𝐞𝐲- According to the Market Research Intellect, the global Anti Money Laundering (AML) Software market is projected to grow at a robust compound annual growth rate (CAGR) of 14.78% from 2024 to 2031. Starting with a valuation of 7.83 Billion in 2024, the market is expected to reach approximately 17.9 Billion by 2031, driven by factors such as Anti Money Laundering (AML) Software and Anti Money Laundering (AML)…

What is AML Verification? A Detailed Guide

With the rise of cryptocurrencies and the increasing adoption of digital assets, regulatory frameworks have become a critical component for ensuring that the cryptocurrency space remains secure and compliant. One of the most important elements in this regulatory framework is AML verification, which stands for Anti-Money Laundering.

Image: https://revbit.net/wp-content/uploads/2024/10/aml-in-crypto-3-1024x640.png

What is AML Verification?

AML (Anti-Money Laundering) verification [https://revbit.net/] refers to a set of procedures and regulations designed to prevent illegal activities such as…