Press release

Naphtha Prices, Latest Trend, Demand, Index & Uses Nov 2025

Northeast Asia Prices Movement Nov 2025In November 2025, naphtha prices in Northeast Asia stood at 1.05 USD/KG, reflecting a 2.2% decline. The downturn was driven by softer upstream crude values and reduced petrochemical cracker demand. Regional refiners operated steadily, but subdued purchasing from olefin producers and ample spot availability continued to pressure market sentiment and pricing levels.

Get the Real-Time Prices Analysis: https://www.imarcgroup.com/naphtha-pricing-report/requestsample

Europe Naphtha Prices Movement Nov 2025

Naphtha prices in Europe reached 0.66 USD/KG in November 2025, marking a 5.8% decrease. Declining crude benchmarks, weak steam cracker margins, and lower downstream polymer offtake weighed on demand. Elevated inventories and cautious buying behavior contributed to further downward pressure, keeping regional market fundamentals largely bearish throughout the month.

Regional Analysis: The price analysis can be expanded to include detailed Naphtha price data for a wide range of European countries, such as Germany, France, the United Kingdom, Italy, Spain, Russia, Turkey, the Netherlands, Poland, Sweden, Belgium, Austria, Ireland, Switzerland, Norway, Denmark, Romania, Finland, the Czech Republic, Portugal, and Greece, along with other European nations.

Middle East Naphtha Prices Movement Nov 2025

In November 2025, the Middle East recorded naphtha prices at 0.57 USD/KG, reflecting a 4.2% increase. The price uptick was supported by firmer export demand from Asian petrochemical units and tighter regional supply. Planned refinery maintenance and improved freight economics also helped lift market sentiment, underpinning the month's upward momentum.

Regional Analysis: The price analysis can be expanded to include detailed Naphtha price data for a wide range of Middle East countries such as Saudi Arabia, United Arab Emirates (UAE), Qatar, Kuwait, Bahrain, Oman, Yemen, Iran, Iraq, Syria, Jordan, Lebanon, Israel, Palestine, Turkey & Egypt

North America Naphtha Prices Movement Nov 2025

Naphtha prices in North America were assessed at 0.55 USD/KG in November 2025, showing a 5.6% decline. Softer crude oil values, muted petrochemical consumption, and comfortable stock levels weighed on pricing. Steam cracker operators limited spot procurement, while stable domestic production further contributed to the downward trajectory across the regional market.

Regional Analysis: The price analysis can be extended to provide detailed Naphtha price information for the following list of countries.

United States of America (USA), Canada & Mexico

What is Naphtha?

Naphtha is a highly versatile, flammable liquid hydrocarbon mixture derived from crude oil refining and natural gas processing. It serves as a key feedstock for petrochemical production-especially for steam crackers producing ethylene and propylene. Naphtha is also used in gasoline blending, solvents, and various industrial processes due to its wide boiling range and reactivity.

Factors Affecting Naphtha Supply and Prices

Naphtha supply and pricing depend on multiple interconnected factors. Crude oil values remain the primary driver, as naphtha is a direct derivative of crude refining. Regional refinery operation rates, petrochemical cracker demand, and gasoline blending requirements also influence availability. Freight costs, geopolitical tensions, and currency fluctuations further impact import parity and export competitiveness. Seasonal demand shifts in heating or gasoline sectors can add additional volatility.

Naphtha Price Index - November 2025

The November 2025 price index reflected mixed regional movements driven by shifting crude oil benchmarks and varied petrochemical demand across markets. Regions with robust cracker activity showed stronger pricing support, while those experiencing inventory pressure and subdued polymer demand saw price declines. Refinery turnarounds, export flows, and logistics rates contributed to index fluctuations during the month.

Latest News - November 2025

In November 2025, global naphtha markets were influenced by easing crude prices, cautious petrochemical consumption, and improved freight conditions. Steam cracker operators continued optimizing feedstock choices amid margin pressures. Refinery maintenance in key exporting regions tightened supply in select markets, while balanced inventories in Asia kept downward pressure on spot values.

Naphtha Market Trend - November 2025

The overall trend for November 2025 displayed a varied pattern across regions. Asia and Europe witnessed downward price corrections due to weaker cracker demand and ample supply. Meanwhile, the Middle East saw upward momentum supported by export demand and tighter supplies. North America remained under pressure from lower crude benchmarks and comfortable inventories.

Future Demand Outlook for Naphtha

Future demand for naphtha is expected to be shaped by evolving petrochemical expansion, gasoline blending requirements, and feedstock competition with LPG and ethane. Growth in packaging, automotive plastics, and construction materials will drive long-term demand for olefins derived from naphtha. However, refinery capacity shifts, alternative feedstocks, and energy-transition policies may moderate growth.

Current Demand and Uses

Currently, naphtha is primarily used as a feedstock for producing ethylene, propylene, and aromatics in steam crackers-key building blocks for plastics, resins, and synthetic fibers. It also plays a role in gasoline blending to improve volatility. Additional applications include industrial solvents, cleaning agents, and fuel for specialized equipment, keeping overall demand steady across multiple industries.

Speak to An Analyst: https://www.imarcgroup.com/request?type=report&id=22707&flag=C

Key Coverage :

• Market Analysis

•Market Breakup by Region

•Demand Supply Analysis by Type

•Demand Supply Analysis by Application

•Demand Supply Analysis of Raw Materials

•Price Analysis

•Spot Prices by Major Ports

•Price Breakup

•Price Trends by Region

•Factors influencing the Price Trends

•Market Drivers, Restraints, and Opportunities

•Competitive Landscape

•Recent Developments

•Global Event Analysis

How IMARC Pricing Database Can Help

The latest IMARC Group study, "Naphtha Prices, Trend, Chart, Demand, Market Analysis, News, Historical and Forecast Data 2025 Edition," presents a detailed analysis of Naphtha price trend, offering key insights into global Naphtha market dynamics. This report includes comprehensive price charts, which trace historical data and highlights major shifts in the market.

The analysis delves into the factors driving these trends, including raw material costs, production fluctuations, and geopolitical influences. Moreover, the report examines Naphtha demand, illustrating how consumer behavior and industrial needs affect overall market dynamics. By exploring the intricate relationship between supply and demand, the prices report uncovers critical factors influencing current and future prices.

About Us:

IMARC Group is a global management consulting firm that provides a comprehensive suite of services to support market entry and expansion efforts. The company offers detailed market assessments, feasibility studies, regulatory approvals and licensing support, and pricing analysis, including spot pricing and regional price trends. Its expertise spans demand-supply analysis alongside regional insights covering Asia-Pacific, Europe, North America, Latin America, and the Middle East and Africa. IMARC also specializes in competitive landscape evaluations, profiling key market players, and conducting research into market drivers, restraints, and opportunities. IMARC's data-driven approach helps businesses navigate complex markets with precision and confidence.

Contact us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United State: +1-631-791-1145

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Naphtha Prices, Latest Trend, Demand, Index & Uses Nov 2025 here

News-ID: 4287093 • Views: …

More Releases from IMARC Group

United States Jewelry Market Size, Share, Industry Overview, Growth and Forecast …

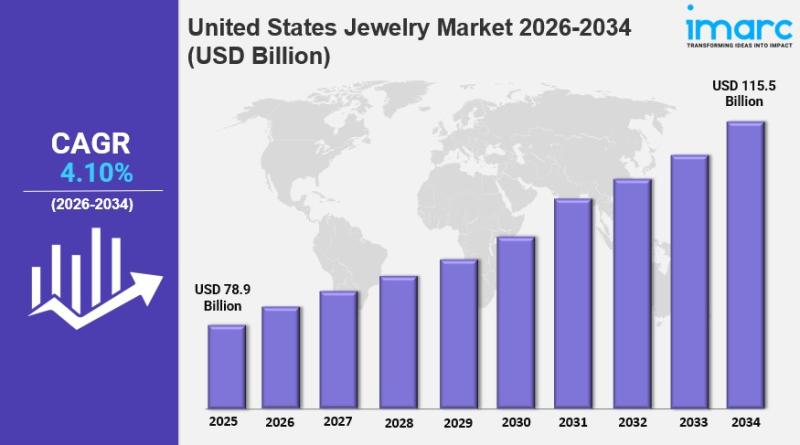

IMARC Group has recently released a new research study titled "United States Jewelry Market Report by Product (Necklace, Ring, Earrings, Bracelet, and Others), Material (Gold, Platinum, Diamond, and Others), and Region 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

United States Jewelry Market Overview

The United States jewelry market size reached USD 78.9 Billion in 2025.…

United States Air Freight Market Size, Share, Industry Trends, Growth and Foreca …

IMARC Group has recently released a new research study titled "United States Air Freight Market Size, Share, Trends and Forecast by Service, Destination, End User, and Region, 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

United States Air Freight Market Overview

The United States air freight market size was valued at USD 64.06 Billion in 2025.…

Mexico Medical Tourism Market 2026 : Industry Size to Reach USD 10.6 Billion by …

IMARC Group has recently released a new research study titled "Mexico Medical Tourism Market Size, Share, Trends and Forecast by Type, Treatment Type, and Region, 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Mexico Medical Tourism Market Overview

The Mexico medical tourism market size reached USD 2.1 Billion in 2025. Looking forward, the market is projected…

Saudi Arabia Pilates & Yoga Studios Market Size to Surpass USD 3.6 Billion by 20 …

Saudi Arabia Pilates & Yoga Studios Market Overview

Market Size in 2024: USD 1.6 Billion

Market Forecast in 2033: USD 3.6 Billion

Market Growth Rate 2025-2033: 8.20%

According to IMARC Group's latest research publication, "Saudi Arabia Pilates & Yoga Studios Market Size, Share, Trends and Forecast by Activity Type, Application, and Region, 2025-2033", the Saudi Arabia pilates & yoga studios market size reached USD 1.6 Billion in 2024. Looking forward, IMARC Group expects the…

More Releases for Naphtha

Track Naphtha Price Trend Historical and Forecast

Executive Summary

The global Naphtha market continued to experience a highly fluid pricing landscape through 2024 and 2025, shaped by volatile crude benchmarks, shifting feedstock preferences, supply fluctuations, and evolving downstream petrochemical demand. For the quarter ending September 2025, pricing trajectories diverged across major regions. North America observed a mild decline due to softer crude arbitrage and stable refinery runs, APAC recorded modest price gains driven by supply tightness and regional…

Naphtha Prices September 2025 | Global Trend Analysis

Northeast Asia Naphtha Prices Movement September 2025

In September 2025, Naphtha Prices in Northeast Asia averaged 1.08 USD/KG, showing a 2.8% decline from the previous month. The downturn was driven by weak demand from the petrochemical sector and reduced cracker operating rates. Lower crude oil prices and sufficient regional supply further contributed to the overall market softness.

Regional Analysis: The price analysis can be expanded to include detailed Naphtha data for a…

How to Setup a Naphtha Manufacturing Plant

Setting up a naphtha manufacturing facility necessitates a detailed market analysis alongside granular insights into various operational aspects, including unit processes, raw material procurement, utility provisions, infrastructure setup, machinery and technology specifications, workforce planning, logistics, and financial considerations.

IMARC Group's report titled "Naphtha Manufacturing Plant Project Report 2025: Industry Trends, Plant Setup, Machinery, Raw Materials, Investment Opportunities, Cost and Revenue" offers a comprehensive guide for establishing a naphtha manufacturing plant,…

Global Solvent Naphtha Industry Professional 2019

The global Solvent Naphtha market is valued at 7200 million US$ in 2018 is expected to reach 10900 million US$ by the end of 2025, growing at a CAGR of 5.3% during 2019-2025.

This report focuses on Solvent Naphtha volume and value at global level, regional level and company level. From a global perspective, this report represents overall Solvent Naphtha market size by analyzing historical data and future prospect. Regionally, this…

Naphtha Market Size, Share, Development by 2024

Global Info Research offers a latest published report on Naphtha Market Analysis and Forecast 2019-2025 delivering key insights and providing a competitive advantage to clients through a detailed report. The report contains 102 pages which highly exhibit on current market analysis scenario, upcoming as well as future opportunities, revenue growth, pricing and profitability.

Click to view the full report TOC, figure and tables:

https://www.globalinforesearch.com/global-naphtha-market_p128678.html

This report studies the Naphtha market, from angles of…

Global Naphtha Market Insights, Forecast to 2025

Market Research Report Store offers a latest published report on Naphtha Market Analysis and Forecast 2019-2025 delivering key insights and providing a competitive advantage to clients through a detailed report. The report contains 158 pages which highly exhibit on current market analysis scenario, upcoming as well as future opportunities, revenue growth, pricing and profitability.

Click to view the full report TOC, figure and tables:

https://www.marketresearchreportstore.com/reports/620323/global-naphtha-market-insights

This report studies the Naphtha market, from angles…