Press release

Key Players in the Car Insurance Market - Allstate Corporation, State Farm Mutual Automobile Insurance Company, Progressive Corporation, Progressive Corporation, AXA Group

The global car insurance market continues to evolve rapidly as digital transformation, connected mobility, and changing consumer expectations reshape the competitive landscape. Leading insurers are shifting from traditional underwriting models toward data-rich, technology-enabled, customer-centric offerings. Competition is intensifying as global leaders, regional insurers, and InsurTech disruptors race to build smarter risk evaluation models, elevate customer experience, and expand product diversity. In this climate, strategic differentiation-not pricing alone-is becoming the defining factor in long-term leadership and brand loyalty. The Car Insurance Market is now a battleground for innovation in telematics, AI-based fraud detection, usage-based insurance (UBI), and digital claim automation.➤ Request Free Sample PDF Report @ https://www.researchnester.com/sample-request-8221

Top Companies & Their Strategies

1. Allstate Corporation

Allstate commands a strong presence in North America with its diversified portfolio and intelligent risk-scoring models. The company has invested heavily in telematics-driven Drivewise technology to personalize policy premiums and enhance customer retention. Its digital claim management capabilities provide faster settlements and superior customer experience-key advantages in the Car Insurance Market.

2. State Farm Mutual Automobile Insurance Company

State Farm continues to lead with an expansive agent network and customer-first approach. Its strategy hinges on combining human interaction with digital convenience-such as mobile-based claim filing and policy management. The company also focuses on competitive pricing and loyalty programs, strengthening its recurring customer base.

3. Progressive Corporation

A dominant digital innovator in the Car Insurance Market, Progressive has excelled through Snapshot® telematics-based products and data-driven pricing strategies. Its specialization in UBI has positioned the company as a forward-leaning leader in personalization and risk transparency. Progressive also prioritizes online distribution, significantly reducing acquisition costs.

4. Ping An Insurance (China)

Ping An leverages AI, big data analytics, and mobile-based services to optimize underwriting and customer experience. Its powerful ecosystem of financial services and health platforms provides cross-selling strength and high customer lifetime value. With rapid technology integration and strong growth in emerging markets, Ping An is positioned as an aggressive innovator in the Car Insurance Market.

➤ Explore detailed profiles of top players and new entrants in this space - access your free sample report → https://www.researchnester.com/sample-request-8221

5. AXA Group

AXA has focused on geographic expansion and digital partnerships to strengthen its presence across Europe, the Middle East, and Asia. Advanced predictive modeling and mobility-as-a-service solutions are central to its future-ready roadmap. AXA's collaboration with OEMs and EV manufacturers is a differentiating strength in new-age automotive insurance.

6. Tokio Marine Holdings

Tokio Marine maintains high customer trust and operational efficiency with robust underwriting capabilities and thoughtful regional expansion. Its risk-based pricing, strong corporate insurance segment, and resilience strategy have built long-term stability for the brand across the Car Insurance Market.

➤ Gain access to expanded insights on competitive strategies, market size, and regional analysis. View our Car Insurance Market Report Overview here: https://www.researchnester.com/reports/car-insurance-market/8221

SWOT Analysis of Leading Companies

Strengths

Top players in the Car Insurance Market benefit from their well-established distribution networks, diversified product offerings, and advanced data-driven pricing models. Many have invested in telematics, satellite analytics, and automated claim processing to strengthen customer satisfaction and retention. Several major brands have achieved high economies of scale, allowing for competitive pricing and strong brand trust worldwide.

Weakness

Despite strong digital transformation, high operational costs and legacy core systems remain challenges for many companies. Premium pricing models sometimes lack transparency for customers, leading to churn in highly price-sensitive regions. Additionally, the reliance on third-party tech vendors for digital integration limits the strategic flexibility of some insurers.

Opportunities

Technology adoption and regulatory support in favor of UBI, EV insurance, and cross-border insurance solutions open major avenues for expansion. Companies with strong analytics capabilities can enter new customer segments such as ride-sharing fleets, autonomous vehicles, and gig-economy commercial drivers. Significant scope exists for M&A, OEM partnerships, and embedded insurance integration within the Car Insurance Market.

Threats

Rising competition from InsurTech startups and digital-only insurance providers is intensifying price pressure. Increasing fraud sophistication, cyber risk, and data privacy issues pose financial and reputational threats. Moreover, regional regulatory shifts and fluctuating repair costs create ongoing unpredictability in claim liability.

➤ Interested in a customized SWOT for your target competitor? Request your tailored assessment → https://www.researchnester.com/sample-request-8221

Investment Opportunities & Emerging Trends

The most attractive investment themes in the Car Insurance Market include telematics-driven products, AI-powered underwriting engines, and automation in claim settlement. Investors are increasingly channeling funds into startups specializing in usage-based insurance, embedded insurance solutions for automakers, and predictive risk analytics platforms. Growth opportunities are strongest in North America, Europe, and Asia-Pacific, where digital adoption and EV penetration are rapidly accelerating.

Key market players are forming partnerships with automobile OEMs to bundle insurance with new vehicle purchases, especially for electric and connected cars. Automotive ecosystem integration-connecting insurers with car makers, dealerships, and servicing chains-is becoming a core competitive strategy.

Recent Developments

Major insurers have expanded telematics-based offerings to reduce risk and incentivize safe driving behavior.

Multiple InsurTech companies have secured new funding rounds to scale AI-first insurance platforms and claims automation.

New policies targeting EVs, self-driving cars, and shared mobility fleets have gained traction.

Notable acquisitions have centered around digital underwriting, predictive analytics vendors, and insurance distribution platforms.

➤ Request Free Sample PDF Report @ https://www.researchnester.com/sample-request-8221

➤ Related News -

https://www.linkedin.com/pulse/what-future-digital-transformation-consulting-services-ehsyf

https://www.linkedin.com/pulse/what-future-fraud-management-banking-market-labdc/

Contact Data

AJ Daniel

Corporate Sales, USA

Research Nester

77 Water Street 8th Floor, New York, 10005

Email: info@researchnester.com

USA Phone: +1 646 586 9123

Europe Phone: +44 203 608 5919

About Research Nester

Research Nester is a one-stop service provider with a client base in more than 50 countries, leading in strategic market research and consulting with an unbiased and unparalleled approach towards helping global industrial players, conglomerates and executives for their future investment while avoiding forthcoming uncertainties. With an out-of-the-box mindset to produce statistical and analytical market research reports, we provide strategic consulting so that our clients can make wise business decisions with clarity while strategizing and planning for their forthcoming needs and succeed in achieving their future endeavors. We believe every business can expand to its new horizon, provided a right guidance at a right time is available through strategic minds.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Key Players in the Car Insurance Market - Allstate Corporation, State Farm Mutual Automobile Insurance Company, Progressive Corporation, Progressive Corporation, AXA Group here

News-ID: 4285072 • Views: …

More Releases from Research Nester Pvt Ltd

Lutein and Zeaxanthin Market - Key Players, Capability Assessment & M&A Indicato …

The lutein and zeaxanthin market has expanded steadily as demand for eye-health supplements, functional foods, and preventive nutrition increases across global consumer segments. Lutein and zeaxanthin, two essential carotenoids concentrated in the retina, are widely recognized for their protective roles against oxidative stress, age-related macular degeneration (AMD), blue-light exposure, and general visual fatigue. Their adoption has accelerated with the rise of digital lifestyles, an aging population, and growing clinical evidence…

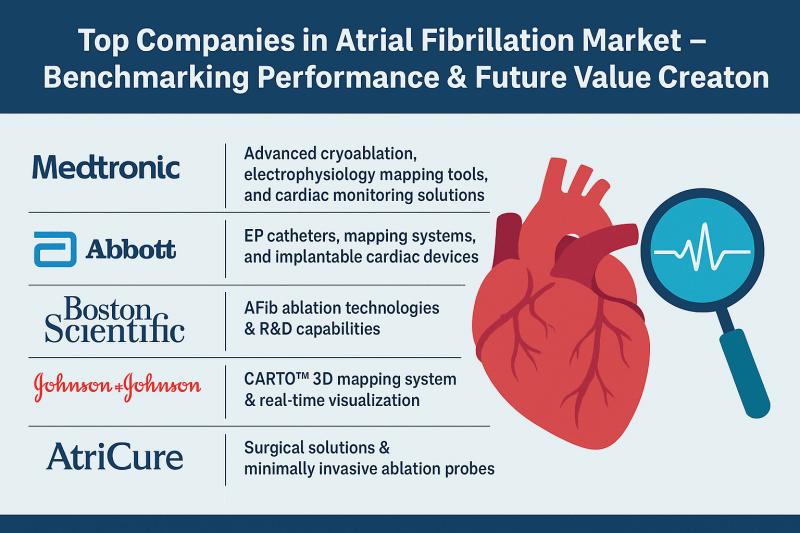

Top Companies in Atrial Fibrillation Market - Benchmarking Performance & Future …

The atrial fibrillation market is undergoing a period of rapid transformation as diagnostic technologies, catheter-based therapies, and antiarrhythmic solutions continue to advance. Atrial fibrillation (AFib) is one of the most prevalent cardiac arrhythmias globally, prompting significant demand for improved detection, early intervention, and minimally invasive treatment. The shift toward advanced ablation systems, AI-enabled diagnostics, wearable monitoring, and next-generation electro-mapping tools has strengthened competition across the market. Companies are expanding their…

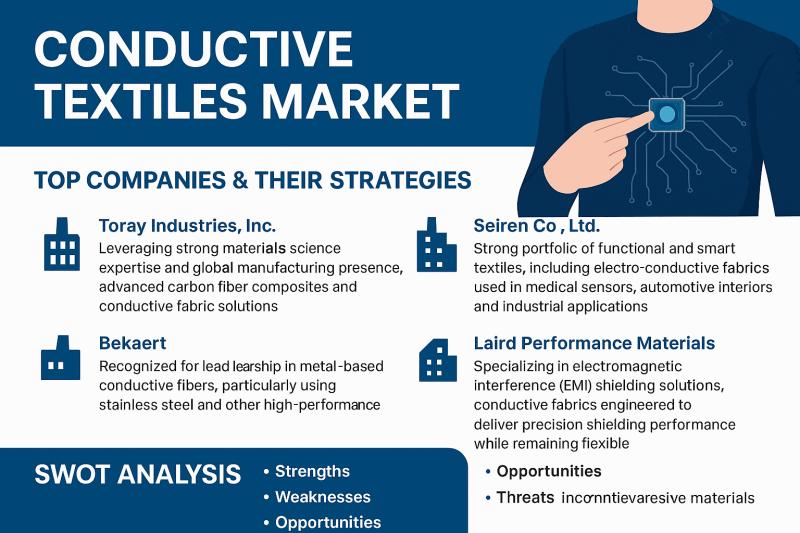

Conductive Textiles Market - Top Companies, SWOT Deep Dive & Capital Flow Trends

The conductive textiles market is undergoing a rapid transformation as wearable electronics, smart apparel, and advanced sensor-integrated fabrics move from niche applications to mainstream adoption. Conductive textiles-engineered using conductive polymers, metal-coated fibers, or intrinsically conductive yarns-have become integral to next-generation healthcare wearables, military gear, automotive interiors, and consumer smart devices. As industries push for lighter, flexible, and more energy-efficient electronic systems, conductive materials embedded within fabrics are emerging as a…

Global Osteosynthesis Devices Market: Top Companies, Market Share Rankings & Inv …

The osteosynthesis devices market continues to evolve as orthopedic care moves toward minimally invasive procedures, biologically compatible materials, and technology-enabled implants. These devices-ranging from plates and screws to intramedullary nails and fixation systems-are essential for treating fractures, deformities, and complex bone injuries. Companies operating in this space are adopting strategies centered around product innovation, clinical efficacy, and expansion into fast-growing regions. As trauma care volumes rise in both developed and…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…