Press release

Global Packaging Machinery Market to Hit USD 90.1 Bn by 2035, Driven by Automation Demand

The global packaging machinery market size was valued at USD 54.5 Bn in 2024 and is projected to reach USD 90.1 Bn by 2035, expanding at a CAGR of 4.7% from 2025 to 2035. The market growth is driven by rising manufacturer shifts toward automated packaging systems featuring advanced intelligent technologies, coupled with expanding food-processing sectors that boost production efficiency, equipment innovation, and collaborative machine product integration globally.The packaging machinery market is growing owing to the rising demand for energy efficiency, automation, and sustainability. Advancements in robotics, AI, and machine learning are driving greater precision and speed at lower cost in packaging. An increase in consumer demand for packaged food in the food, pharmaceutical, and e-Commerce industries is also driving expansion of the market. Industry dynamics are being transformed by trends such as sustainable packaging and increased automation.

Dive Deeper into Data: Get Your In-Depth Sample Now! https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=3076

Another significant trend is the introduction of intelligent packaging solutions that can track product integrity and provide extended shelf life. These innovations are enhancing the efficiency of production and are also leading to reduction in waste, along with an improvement in the quality of products. With the industry's demand for faster production and lower cost, packaging machinery manufacturers are paying more attention to automation and AI-based technology.

Key growth characteristics over 2025-2035:

Steady volume growth in units of machinery sold, alongside increasing value per machine due to higher automation and digital capabilities

Capex cycles re-accelerating in developing markets (India, Southeast Asia, Latin America) and replacement/upgrade cycles dominating in mature markets (North America, Western Europe, Japan)

Increasing share of after-sales service, retrofits, and digital upgrades, adding recurring revenue streams to equipment vendors

Market Segmentation

By Service Type

Installation & Commissioning Services

Turnkey line setup, integration with upstream/downstream equipment, validation and line balancing

Critical for new greenfield and major brownfield projects

Maintenance, Repair & Spare Parts

Preventive and predictive maintenance, OEM spares, emergency repairs

Growing as machinery becomes more complex and uptime requirements intensify

Upgrades, Retrofit & Automation Integration

Control system upgrades, servo drives, robotics integration, vision system retrofits

High growth segment as manufacturers digitalize existing machinery instead of full replacement

Consulting, Training & Line Optimization

Productivity audits, format changeover optimization, operator training, OEE improvement programs

Increasingly bundled with digital services and remote support

By Sourcing Type

In-house Packaging Operations

End users own and operate packaging machinery within their plants

Still the dominant model in large food, beverage, pharma, and FMCG companies

Outsourced / Contract Packaging (Co-packers, CPOs)

Equipment owned by specialized contract packers

Growing rapidly with the rise of e-commerce, seasonal SKUs, and short-run promotions, particularly for consumer goods

Hybrid Models

Mix of in-house lines for core products and outsourced packaging for niche or regional SKUs

Increasingly common in global brands optimizing capital allocation and flexibility

By Application

Primary Packaging

Form-fill-seal, bottling, blister packing, sachet & pouch filling, tube filling, etc.

Largest revenue share, driven by high volumes in food, beverage, and pharma

Secondary & Tertiary Packaging

Cartoning, case packing, shrink wrapping, palletizing & depalletizing

Benefiting from warehouse automation and logistics optimization

Labeling, Coding & Marking

Serialization, track-and-trace, barcoding, date/lot coding, RFID integration

Strong regulatory and compliance-driven demand in pharma and food

Specialty & Customized Packaging

Aseptic packaging, vacuum and MAP systems, smart packaging equipment, multi-component kits

Growing with premiumization and brand differentiation needs

By Industry Vertical

Food & Beverage

Largest consumer of packaging machinery, with some studies indicating ~39% share of end-user demand.

Strong uptake of high-speed filling, aseptic systems, multi-lane pouching, and robotic pick-and-place

Pharmaceuticals & Healthcare

High growth, driven by stringent regulatory norms, serialization, blister and vial packaging, and sterile processing

Strong shift toward fully validated, track-and-trace-enabled lines

Personal Care & Cosmetics

Demand for flexible, quick-changeover lines handling diverse formats, shapes, and materials

Chemicals & Industrial Products

Includes agrochemicals, lubricants, paints, building materials, and industrial goods

Focus on safety, hazardous material handling, and large container filling

E-commerce, Logistics & Other Verticals

Carton erectors, auto-box sizers, void-fill equipment, and labeling systems for fulfillment centers

Highly dynamic, driven by parcel automation and omni-channel retail

By Region

Asia Pacific (East Asia; South Asia & Pacific)

Holds the largest share (≈39% in 2024) and is expected to remain the dominant and fastest-growing regional market.

North America

Mature but innovation-driven market, with strong investments in robotics and digitalization

Europe

Home to several leading machinery OEMs; focuses heavily on sustainability, energy efficiency, and regulatory compliance

Latin America

Increasing food and beverage processing capacities, especially in Brazil and Mexico

Middle East & Africa

Smaller but rapidly expanding, tied to growth in food processing, beverages, and pharmaceuticals

Regional Analysis

Asia Pacific

Led by China, India, Japan, and Southeast Asia, the region benefits from rapid industrialization, urbanization, and growing packaged food consumption.

Government initiatives (e.g., "Make in India") and multinational investments in local plants drive demand for automated packaging lines.

Flexible packaging and small-pack formats are particularly strong, encouraging investments in form-fill-seal and pouching equipment.

North America

High adoption of advanced automation, cobots, and digital twin technology to optimize throughput and labor productivity.

Strong regulatory requirements in food safety and pharma drive investments in inspection, X-ray, metal detection, and serialization-ready lines.

Replacement and upgrade cycles dominate, with emphasis on integrating legacy lines into smart factories.

Europe

Germany, Italy, and the Nordics act as design and manufacturing hubs for premium packaging machinery.

Europe leads in sustainability, pushing machinery innovations for paper-based packaging, lightweighting, and recyclability.

Stringent regulations for pharmaceuticals and food standards sustain strong demand for high-performance, validated equipment.

Latin America

Growing middle-class consumption in Brazil, Mexico, and Argentina supports investments in food & beverage and household products packaging lines.

Currency volatility and capex constraints can delay projects, but local manufacturing and financing solutions are improving adoption.

Middle East & Africa

Demand is emerging from beverages, dairy, and processed foods, often relying on imported machinery from Europe and Asia.

Free trade zones and logistics hubs in GCC countries support investments in bulk and re-packaging operations.

Market Drivers and Challenges

Key Drivers

Automation & Labor Shortages

Rising labor costs and shortages push manufacturers toward highly automated packaging lines, including robotics and vision-guided systems.

Growth in Food Processing and Packaged Goods

Expanding food processing sectors, convenience foods, ready-to-drink beverages, and e-commerce demand create high throughput requirements for packaging.

Sustainability and Material Transition

Shift from traditional plastics to recyclable, compostable, or lightweight materials requires new or modified machinery capable of handling these substrates.

Regulatory Compliance and Product Safety

Serialization, tamper-evidence, and hygienic design are especially crucial in pharma and food sectors, driving upgrades in coding, sealing, and inspection equipment.

Key Challenges

High Initial Capital Investment

Advanced machinery with robotics and digital controls entails significant upfront costs, limiting adoption among SMEs.

Skilled Workforce Requirements

Operation and maintenance of complex, software-intensive machinery require skilled technicians, which can be scarce in emerging markets.

Integration Complexity and Legacy Systems

Integrating new equipment with existing lines, MES/ERP, and plant networks creates technical and cybersecurity challenges.

Raw Material and Supply Chain Volatility

Supply chain disruptions in components (drives, sensors, electronics) can delay deliveries and raise costs.

Market Trends

Smart, Connected Packaging Lines

Adoption of IIoT, edge analytics, and cloud platforms to monitor OEE, energy usage, and predictive maintenance.

Robotics and Collaborative Robots (Cobots)

Increased deployment of cobots for case packing, palletizing, and pick-and-place in space-constrained lines.

Modular and Flexible Machinery Design

Quick format changeover, multi-product capability, and modular stations supporting SKU proliferation and shorter product lifecycles.

Sustainable Packaging Solutions

Equipment optimized for paper-based, mono-material, refillable, or lightweight packs, as brands chase sustainability targets.

Growth of Contract Packaging and Co-packing

Brands leveraging co-packers to manage promotions, regional launches, and e-commerce-specific formats, boosting machinery demand at specialized facilities.

Integration of Vision and Inspection Systems

100% in-line quality checks, print verification, seal integrity testing, and foreign body detection becoming standard in many sectors.

Future Outlook (2025-2035)

From 2025 to 2035, the global packaging machinery market is expected to transition from largely mechanical systems toward holistic, digitally managed packaging ecosystems. With revenues rising from around US$ 57 billion in 2025 to US$ 90.1 billion in 2035, the sector will:

Evolve business models from pure equipment sales to service-centric, outcome-based offerings (uptime-as-a-service, subscription software, remote monitoring).

See Asia Pacific consolidate its leadership, while India and Southeast Asia become key global manufacturing and packaging hubs.

Experience strong demand from sustainability transitions (e.g., aluminum and paper packaging investments), highlighted by large capex commitments in downstream packaging operations that, in turn, pull through machinery demand.

Witness increasing consolidation among machinery vendors, as global players acquire niche firms in robotics, inspection, and digital solutions.

Overall, the market outlook remains structurally positive, with mid-single-digit growth and expanding value per installed line.

Key Market Study Points

For a detailed market research study on the Packaging Machinery Market 2025-2035, key analytical points include:

Total Addressable Market (TAM) by revenue and units, segmented by service type, sourcing type, application, industry vertical, and region.

Growth decomposition: volume vs. price/mix vs. services contribution.

Technology adoption curves for robotics, vision systems, IIoT connectivity, and predictive maintenance platforms.

Regulatory and compliance mapping across food, pharma, and chemical sectors influencing machinery specs.

Investment and capex trends by region and industry vertical, including replacement vs. greenfield demand.

Sustainability impact assessment: how material shifts and ESG goals alter machinery specifications and purchasing decisions.

Cost-benefit and ROI analysis of automation projects, including labor savings, throughput gains, and waste reduction.

Competitive benchmarking of key OEMs and regional players by product portfolio, technology depth, and after-sales capabilities.

Scenario analysis (base, optimistic, conservative) linked to macroeconomic conditions, supply chain resilience, and regulatory changes.

End-user buying criteria: TCO, flexibility, reliability, digital readiness, and ease of integration.

Buy this Premium Research Report: https://www.transparencymarketresearch.com/checkout.php?rep_id=3076<ype=S

Competitive Landscape

The packaging machinery market is moderately consolidated at the top, with a mix of global OEMs and strong regional manufacturers. Key players include:

Syntegon Technology GmbH (formerly Bosch Packaging), IMA Group, Tetra Pak International, Coesia S.p.A., Marchesini Group S.p.A.

Krones AG, KHS Group, SIG, ProMach Inc., GEA Group, Ishida Co., Barry-Wehmiller

Additional notable players such as Langley Holdings, Rovema, Douglas Machine, Sacmi, Duravant, and specialized regional OEMs.

Competitive strategies focus on:

Expanding portfolio depth (from primary to tertiary packaging and end-of-line automation)

Geographic expansion into high-growth emerging markets

M&A and partnerships with robotics, software, and inspection technology firms

Building lifecycle service offerings (maintenance, retrofits, remote monitoring, training) to ensure recurring revenue

Recent Developments

Recent developments shaping the packaging machinery landscape include:

Advances in flexible and sustainable packaging machinery, capable of handling paper-based, mono-material, and recyclable laminates for snacks, beverages, and personal care products.

Increased investment in digitalization, with OEMs offering machine health dashboards, predictive analytics, and remote service capabilities to improve uptime and lower maintenance costs.

Region-specific capacity expansions in packaging and related industries-such as large-scale investments in sustainable aluminum and flexible packaging facilities in India and Asia-indirectly boost demand for high-speed, automated packaging lines.

Niche equipment launches targeting pharma, cosmetic, and high-hygiene food applications with improved cleanability, aseptic features, and precise dosing and sealing capabilities.

Explore Latest Research Reports by Transparency Market Research:

Lamination Films Market - https://www.transparencymarketresearch.com/lamination-film-market.html

Thermoformed Shallow Trays Market - https://www.transparencymarketresearch.com/thermoformed-shallow-trays-market.html

Perfume Packaging Market - https://www.transparencymarketresearch.com/perfume-packaging-market.html

Plastic Punnets Market - https://www.transparencymarketresearch.com/plastics-punnets-market.html

Wrapping Paper Market - https://www.transparencymarketresearch.com/wrapping-paper-market.html

About Transparency Market Research

Transparency Market Research, a global market research company registered at Wilmington, Delaware, United States, provides custom research and consulting services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insights for thousands of decision makers. Our experienced team of Analysts, Researchers, and Consultants use proprietary data sources and various tools & techniques to gather and analyses information.

Our data repository is continuously updated and revised by a team of research experts, so that it always reflects the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in developing distinctive data sets and research material for business reports.

Contact:

Transparency Market Research Inc.

CORPORATE HEADQUARTER DOWNTOWN,

1000 N. West Street,

Suite 1200, Wilmington, Delaware 19801 USA

Tel: +1-518-618-1030

USA - Canada Toll Free: 866-552-3453

Website: https://www.transparencymarketresearch.com

Email: sales@transparencymarketresearch.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Global Packaging Machinery Market to Hit USD 90.1 Bn by 2035, Driven by Automation Demand here

News-ID: 4284901 • Views: …

More Releases from transparencymarketresearch

Online Dermatology Consultation Market to Reach USD 9.2 Billion by 2035, Growing …

The online dermatology consultation market was valued at USD 2.8 billion in 2024 and is projected to reach USD 9.2 billion by 2035. Driven by the rising adoption of telemedicine, increasing prevalence of skin disorders, and growing demand for convenient, remote healthcare services, the industry is expected to expand at a CAGR of 11.4% from 2025 to 2035, reflecting strong long-term growth potential.

Technological advancements in telemedicine and artificial intelligence is…

Human Milk Bank Market to Reach USD 843.1 Million by 2035, Growing at a CAGR of …

The global human milk bank market was valued at USD 422.7 million in 2024 and is projected to grow steadily, reaching USD 843.1 million by 2035. This growth reflects the rising awareness of the benefits of donor human milk, the increasing prevalence of preterm births, and the expanding neonatal care infrastructure worldwide. The industry is expected to expand at a CAGR of 6.4% from 2025 to 2035, supported by favourable…

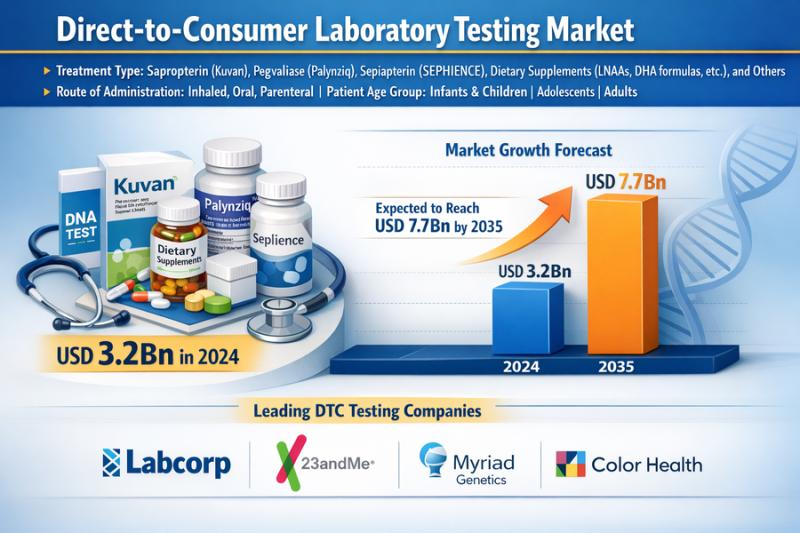

Direct-to-Consumer Laboratory Testing Market Set to Reach US$ 7.7 Bn by 2035, Gr …

The direct-to-consumer laboratory testing market was valued at US$ 3.2 billion in 2024 and is projected to reach US$ 7.7 billion by 2035. Driven by rising consumer awareness, increasing demand for at-home diagnostic solutions, and advancements in digital health platforms, the industry is expected to grow at a CAGR of 8.3% from 2025 to 2035, reflecting strong adoption of convenient and accessible testing services worldwide.

The direct-to-consumer laboratory testing market is…

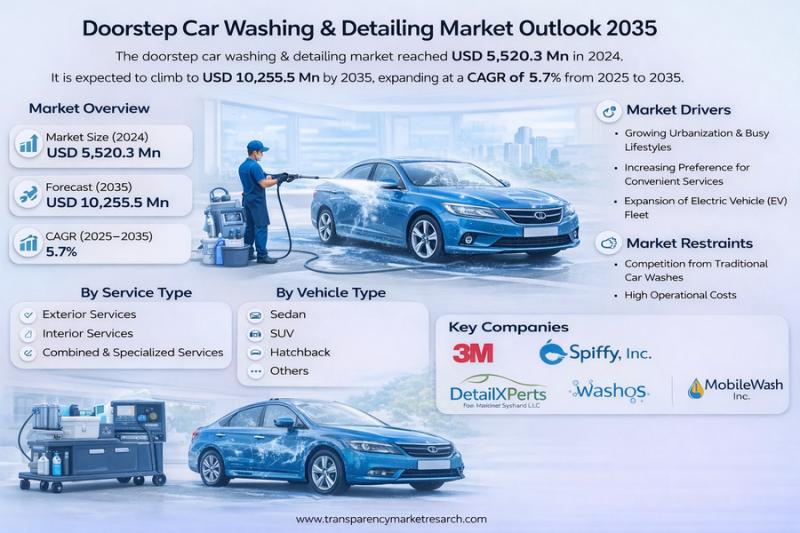

Doorstep Car Washing & Detailing Market to Reach USD 10.25 Billion by 2035, Grow …

The doorstep car washing and detailing market was valued at USD 5,520.3 million in 2024 and is projected to reach USD 10,255.5 million by 2035, reflecting steady expansion over the forecast period. Driven by rising urbanization, busy consumer lifestyles, and increasing demand for convenient vehicle maintenance services, the industry is expected to grow at a CAGR of 5.7% from 2025 to 2035, with mobile and on-demand service models gaining strong…

More Releases for Packaging

Personalized Packaging Market 2019 By Key Players: Owens Illinois, Salazar Packa …

Personalized Packaging Market research report delivers a close watch on leading competitors with strategic analysis, micro and macro market trend and scenarios, pricing analysis and a holistic overview of the market situations in the forecast period.

Download PDF Sample of this Report @

http://www.supplydemandmarketresearch.com/home/contact/277379?ref=Sample-and-Brochure&toccode=SDMRCH277379&utm_source=S2

The following manufacturers are covered:

Owens Illinois

Salazar Packaging

Design Packaging

PrimeLine Packaging

International Packaging

Elegant Packaging

Pak Factory

ABOX Packaging

ACG Ecopak

CB Group

SoOPAK Company

Huhtamaki…

E-Commerce Packaging Market by Top Key Players - Pioneer Packaging, Arihant pack …

E-commerce packaging involves the use of materials for safe packaging of products sold by the e-commerce industry. E-commerce packaging plays a vital role in the consumers' perception about the e-retailer. It also indicates the perceived value of the item received. Packaging reflects the value of shipment in the e-commerce supply chain, that is, better the packaging, better the product inside it.

Get Sample Copy of this Report @ https://www.bigmarketresearch.com/request-sample/2904563

The E-Commerce…

Luxury Packaging Market 2019 SWOT Analysis By Top Key Players; MW Luxury Packagi …

Luxury Packaging Market report provides an in-depth overview of product specification, technology, product type and production analysis considering major factors such as revenue, cost, gross and gross margin. The company profiles of all the key players and brands that are dominating the Luxury Packaging Market with moves like product launches, joint ventures, merges and accusations which in turn is affecting the sales, import, export, revenue and CAGR values are mentioned…

Global Luxury Packaging Market 2019 Top Key Players: MW Luxury Packaging, Progre …

Summary

WiseGuyReports.com adds “Luxury Packaging Market 2019 Global Analysis, Growth, Trends and Opportunities Research Report Forecasting to 2024” reports to its database.

This report provides in depth study of “Luxury Packaging Market” using SWOT analysis i.e. Strength, Weakness, Opportunities and Threat to the organization. The Luxury Packaging Market report also provides an in-depth survey of key players in the market which is based on the various objectives of an organization such as…

Top Manufacturer in Luxury Packaging Market 2019: MW Luxury Packaging, Progress …

Luxury packaging is used for packaging and decorating high-end products.An increase in the luxury product consumption rate and the number of product launches in the fashion and cosmetic sectors are some major factors driving the market growth.

The global Luxury Packaging market is valued at xx million US$ in 2018 and will reach xx million US$ by the end of 2025, growing at a CAGR of xx% during 2019-2025. The objectives…

Personalized Packaging Market 2025 | Design Packaging, Inc., PrimeLine Packaging …

As per the new market report published by Research Report Insights titled ‘Personalized Packaging Market’: Global Industry Analysis and Forecast 2017-2025’, global personalized packaging market attained a value worth US$ 25,577.9 Mn in 2017 and will possibly thrive at a promising CAGR of 5.1% over the forecast period (2017-2025). The global personalized packaging market has witnessed solid growth during the past few decades, owing to the increasing trend of luxury…