Press release

Digital Insurance Solutions Market Set to Flourish by 2031: Trends, Industry Analysis, Business Outlook, Current and Future Growth

QY Research has recently published a research report titled, "Global Digital Insurance Solutions Market Share and Ranking, Overall Sales and Demand Forecast 2025-2031", assessing various factors impacting its trajectory. The research study offers deep evaluation of the global Digital Insurance Solutions market and helps market participants to gain a strong foothold in the industry. It sheds light on critical market dynamics such as drivers, restraints, trends, and opportunities to help businesses prepare for any challenges ahead in time. It provides regional analysis of the global Digital Insurance Solutions market to unveil key opportunities available in different parts of the world. The competitive landscape is broadly assessed along with company profiling of leading players operating in the global Digital Insurance Solutions market. The report provides detailed statistics and accurate market figures, viz. market share, CAGR, gross margin, and those related to revenue, production, consumption, and sales.The global market for Digital Insurance Solutions was estimated to be worth US$ 2715 million in 2024 and is forecast to a readjusted size of US$ 4594 million by 2031 with a CAGR of 7.6% during the forecast period 2025-2031.

Download Exclusive Research Report PDF Sample: (Including Full TOC, List of Tables & Figures, Chart) @ https://www.qyresearch.in/request-sample/service-software-digital-insurance-solutions-market-share-and-ranking-overall-sales-and-demand-forecast-2025-2031

The report has been compiled with the use of latest primary and secondary research methodologies. Our sources are reliable and trustworthy - so you don't have to worry about the authenticity and accuracy of this research study. We have made use of qualitative and quantitative analysis to present to you an all-inclusive, all-encompassing research study on the global Digital Insurance Solutions market. The report also includes SWOT analysis, PESTLE analysis, and Porter's Five Forces Model analysis to offer you a complete and comprehensive study on crucial aspects of the global Digital Insurance Solutions market.

Driven by both technological innovation and evolving consumer demand, the digital insurance solutions market is undergoing unprecedented transformation. Globally, the market continues to expand, technological applications deepen, and product and service innovation accelerates. Meanwhile, regulatory systems and the competitive landscape are dynamically adjusting, resulting in an overall diversified, intelligent, and ecological development.

Digital technologies, such as artificial intelligence, blockchain, big data, and cloud computing, are reshaping the insurance industry's business logic from the ground up, driving both efficiency and user experience upgrades. In terms of AI applications, intelligent customer service provides 24/7 uninterrupted service, automated claims review significantly reduces manual intervention, and risk assessment algorithms leverage multi-dimensional data for precise pricing. It is expected that over 80% of core insurance processes will be AI-enabled in the next three years. Blockchain technology, with its decentralized and tamper-proof nature, effectively resolves insurance contract disputes and claims fraud. Its increasingly mature applications in contract signing and claims automation are significantly enhancing business transparency and trust. Big data analysis has become a core pillar of product design and risk control.

Insurance companies analyze massive amounts of data, including user behavior and market trends, to accurately identify demand and potential risks, thereby optimizing product competitiveness and operational security. Cloud computing technology provides elastic scalability for insurance businesses, reduces IT infrastructure costs, and supports efficient data storage and analysis services, becoming the foundational framework for digital operations.

Leading players of the global Digital Insurance Solutions market are analyzed taking into account their market share, recent developments, new product launches, partnerships, mergers or acquisitions, and markets served. We also provide an exhaustive analysis of their product portfolios to explore the products and applications they concentrate on when operating in the global Digital Insurance Solutions market. Furthermore, the report offers two separate market forecasts - one for the production side and another for the consumption side of the global Digital Insurance Solutions market. It also provides useful recommendations for new as well as established players of the global Digital Insurance Solutions market.

Key Players Mentioned in the Global Digital Insurance Solutions Market Research Report:

Oracle

EY

SAP

SilverBridge

OpenText

Avanade

Entsia

Salesforce

Persistent Systems

MIC Global

Asseco

Virtusa

Xceedance

Mendix

Appian

Cogitate

Capgemini

Hexaware

Swiss Re

Comarch

Market Segments

Our market analysts are experts in deeply segmenting the global Digital Insurance Solutions market and thoroughly evaluating the growth potential of each and every segment studied in the report. Right at the beginning of the research study, the segments are compared on the basis of consumption and growth rate for a review period of nine years. The segmentation study included in the report offers a brilliant analysis of the global Digital Insurance Solutions market, taking into consideration the market potential of different segments studied. It assists market participants to focus on high-growth areas of the global Digital Insurance Solutions market and plan powerful business tactics to secure a position of strength in the industry.

Details of Digital Insurance Solutions Market Segmentation: -

Segment by Type:

Cloud-based

On-premise

Segment by Application:

Marketing

Distribution

Underwriting

Claims

Others

All of the segments studied in the research study are analyzed on the basis of BPS, market share, revenue, and other important factors. Our research study shows how different segments are contributing to the growth of the global Digital Insurance Solutions market. It also provides information on key trends related to the segments included in the report. This helps market players to concentrate on high-growth areas of the global Digital Insurance Solutions market. The research study also offers separate analysis on the segments on the basis of absolute dollar opportunity.

Segment by Region

North America (U.S., Canada, Mexico)

Europe (Germany, France, UK, Italy, etc.)

Asia Pacific (China, Japan, South Korea, Southeast Asia, India, etc.)

South America (Brazil, etc.)

Middle East and Africa (Turkey, GCC Countries, Africa, etc.)

How can the research study help your business?

(1) The information presented in the Digital Insurance Solutions report helps your decision makers to become prudent and make the best business choices.

(2) The report enables you to see the future of the global Digital Insurance Solutions market and accordingly take decisions that will be in the best interest of your business.

(3) It offers you a forward-looking perspective of the global Digital Insurance Solutions market drivers and how you can secure significant market gains in the near future.

(4) It provides SWOT analysis of the global Digital Insurance Solutions market along with useful graphics and detailed statistics providing quick information about the market's overall progress throughout the forecast period.

(5) It also assesses the changing competitive dynamics of the global Digital Insurance Solutions market using pin-point evaluation.

Request Pre-Order Enquiry or Customized Research on This Report: https://www.qyresearch.in/pre-order-inquiry/service-software-digital-insurance-solutions-market-share-and-ranking-overall-sales-and-demand-forecast-2025-2031

Table of Contents

"1 Market Overview

1.1 Digital Insurance Solutions Product Introduction

1.2 Global Digital Insurance Solutions Market Size Forecast (2020-2031)

1.3 Digital Insurance Solutions Market Trends & Drivers

1.3.1 Digital Insurance Solutions Industry Trends

1.3.2 Digital Insurance Solutions Market Drivers & Opportunity

1.3.3 Digital Insurance Solutions Market Challenges

1.3.4 Digital Insurance Solutions Market Restraints

1.4 Assumptions and Limitations

1.5 Study Objectives

1.6 Years Considered

2 Competitive Analysis by Company

2.1 Global Digital Insurance Solutions Players Revenue Ranking (2024)

2.2 Global Digital Insurance Solutions Revenue by Company (2020-2025)

2.3 Key Companies Digital Insurance Solutions Manufacturing Base Distribution and Headquarters

2.4 Key Companies Digital Insurance Solutions Product Offered

2.5 Key Companies Time to Begin Mass Production of Digital Insurance Solutions

2.6 Digital Insurance Solutions Market Competitive Analysis

2.6.1 Digital Insurance Solutions Market Concentration Rate (2020-2025)

2.6.2 Global 5 and 10 Largest Companies by Digital Insurance Solutions Revenue in 2024

2.6.3 Global Top Companies by Company Type (Tier 1, Tier 2, and Tier 3) & (based on the Revenue in Digital Insurance Solutions as of 2024)

2.7 Mergers & Acquisitions, Expansion

3 Segmentation by Type

3.1 Introduction by Type

3.1.1 Cloud-based

3.1.2 On-premise

3.2 Global Digital Insurance Solutions Sales Value by Type

3.2.1 Global Digital Insurance Solutions Sales Value by Type (2020 VS 2024 VS 2031)

3.2.2 Global Digital Insurance Solutions Sales Value, by Type (2020-2031)

3.2.3 Global Digital Insurance Solutions Sales Value, by Type (%) (2020-2031)

4 Segmentation by Insurance

4.1 Introduction by Insurance

4.1.1 Digital Property Insurance

4.1.2 Digital Life Insurance

4.2 Global Digital Insurance Solutions Sales Value by Insurance

4.2.1 Global Digital Insurance Solutions Sales Value by Insurance (2020 VS 2024 VS 2031)

4.2.2 Global Digital Insurance Solutions Sales Value, by Insurance (2020-2031)

4.2.3 Global Digital Insurance Solutions Sales Value, by Insurance (%) (2020-2031)

5 Segmentation by Service Models

5.1 Introduction by Service Models

5.1.1 B2C

5.1.2 B2B

5.2 Global Digital Insurance Solutions Sales Value by Service Models

5.2.1 Global Digital Insurance Solutions Sales Value by Service Models (2020 VS 2024 VS 2031)

5.2.2 Global Digital Insurance Solutions Sales Value, by Service Models (2020-2031)

5.2.3 Global Digital Insurance Solutions Sales Value, by Service Models (%) (2020-2031)

6 Segmentation by Application

6.1 Introduction by Application

6.1.1 Marketing

6.1.2 Distribution

6.1.3 Underwriting

6.1.4 Claims

6.1.5 Others

6.2 Global Digital Insurance Solutions Sales Value by Application

6.2.1 Global Digital Insurance Solutions Sales Value by Application (2020 VS 2024 VS 2031)

6.2.2 Global Digital Insurance Solutions Sales Value, by Application (2020-2031)

6.2.3 Global Digital Insurance Solutions Sales Value, by Application (%) (2020-2031)

7 Segmentation by Region

7.1 Global Digital Insurance Solutions Sales Value by Region

7.1.1 Global Digital Insurance Solutions Sales Value by Region: 2020 VS 2024 VS 2031

7.1.2 Global Digital Insurance Solutions Sales Value by Region (2020-2025)

7.1.3 Global Digital Insurance Solutions Sales Value by Region (2026-2031)

7.1.4 Global Digital Insurance Solutions Sales Value by Region (%), (2020-2031)

7.2 North America

7.2.1 North America Digital Insurance Solutions Sales Value, 2020-2031

7.2.2 North America Digital Insurance Solutions Sales Value by Country (%), 2024 VS 2031

7.3 Europe

7.3.1 Europe Digital Insurance Solutions Sales Value, 2020-2031

7.3.2 Europe Digital Insurance Solutions Sales Value by Country (%), 2024 VS 2031

7.4 Asia Pacific

7.4.1 Asia Pacific Digital Insurance Solutions Sales Value, 2020-2031

7.4.2 Asia Pacific Digital Insurance Solutions Sales Value by Region (%), 2024 VS 2031

7.5 South America

7.5.1 South America Digital Insurance Solutions Sales Value, 2020-2031

7.5.2 South America Digital Insurance Solutions Sales Value by Country (%), 2024 VS 2031

7.6 Middle East & Africa

7.6.1 Middle East & Africa Digital Insurance Solutions Sales Value, 2020-2031

7.6.2 Middle East & Africa Digital Insurance Solutions Sales Value by Country (%), 2024 VS 2031

8 Segmentation by Key Countries/Regions

8.1 Key Countries/Regions Digital Insurance Solutions Sales Value Growth Trends, 2020 VS 2024 VS 2031

8.2 Key Countries/Regions Digital Insurance Solutions Sales Value, 2020-2031

8.3 United States

8.3.1 United States Digital Insurance Solutions Sales Value, 2020-2031

8.3.2 United States Digital Insurance Solutions Sales Value by Type (%), 2024 VS 2031

8.3.3 United States Digital Insurance Solutions Sales Value by Application, 2024 VS 2031

8.4 Europe

8.4.1 Europe Digital Insurance Solutions Sales Value, 2020-2031

8.4.2 Europe Digital Insurance Solutions Sales Value by Type (%), 2024 VS 2031

8.4.3 Europe Digital Insurance Solutions Sales Value by Application, 2024 VS 2031

8.5 China

8.5.1 China Digital Insurance Solutions Sales Value, 2020-2031

8.5.2 China Digital Insurance Solutions Sales Value by Type (%), 2024 VS 2031

8.5.3 China Digital Insurance Solutions Sales Value by Application, 2024 VS 2031

8.6 Japan

8.6.1 Japan Digital Insurance Solutions Sales Value, 2020-2031

8.6.2 Japan Digital Insurance Solutions Sales Value by Type (%), 2024 VS 2031

8.6.3 Japan Digital Insurance Solutions Sales Value by Application, 2024 VS 2031

8.7 South Korea

8.7.1 South Korea Digital Insurance Solutions Sales Value, 2020-2031

8.7.2 South Korea Digital Insurance Solutions Sales Value by Type (%), 2024 VS 2031

8.7.3 South Korea Digital Insurance Solutions Sales Value by Application, 2024 VS 2031

8.8 Southeast Asia

8.8.1 Southeast Asia Digital Insurance Solutions Sales Value, 2020-2031

8.8.2 Southeast Asia Digital Insurance Solutions Sales Value by Type (%), 2024 VS 2031

8.8.3 Southeast Asia Digital Insurance Solutions Sales Value by Application, 2024 VS 2031

8.9 India

8.9.1 India Digital Insurance Solutions Sales Value, 2020-2031

8.9.2 India Digital Insurance Solutions Sales Value by Type (%), 2024 VS 2031

8.9.3 India Digital Insurance Solutions Sales Value by Application, 2024 VS 2031

9 Company Profiles

9.1 Oracle

9.1.1 Oracle Profile

9.1.2 Oracle Main Business

9.1.3 Oracle Digital Insurance Solutions Products, Services and Solutions

9.1.4 Oracle Digital Insurance Solutions Revenue (US$ Million) & (2020-2025)

9.1.5 Oracle Recent Developments

9.2 EY

9.2.1 EY Profile

9.2.2 EY Main Business

9.2.3 EY Digital Insurance Solutions Products, Services and Solutions

9.2.4 EY Digital Insurance Solutions Revenue (US$ Million) & (2020-2025)

9.2.5 EY Recent Developments

9.3 SAP

9.3.1 SAP Profile

9.3.2 SAP Main Business

9.3.3 SAP Digital Insurance Solutions Products, Services and Solutions

9.3.4 SAP Digital Insurance Solutions Revenue (US$ Million) & (2020-2025)

9.3.5 SAP Recent Developments

9.4 SilverBridge

9.4.1 SilverBridge Profile

9.4.2 SilverBridge Main Business

9.4.3 SilverBridge Digital Insurance Solutions Products, Services and Solutions

9.4.4 SilverBridge Digital Insurance Solutions Revenue (US$ Million) & (2020-2025)

9.4.5 SilverBridge Recent Developments

9.5 OpenText

9.5.1 OpenText Profile

9.5.2 OpenText Main Business

9.5.3 OpenText Digital Insurance Solutions Products, Services and Solutions

9.5.4 OpenText Digital Insurance Solutions Revenue (US$ Million) & (2020-2025)

9.5.5 OpenText Recent Developments

9.6 Avanade

9.6.1 Avanade Profile

9.6.2 Avanade Main Business

9.6.3 Avanade Digital Insurance Solutions Products, Services and Solutions

9.6.4 Avanade Digital Insurance Solutions Revenue (US$ Million) & (2020-2025)

9.6.5 Avanade Recent Developments

9.7 Entsia

9.7.1 Entsia Profile

9.7.2 Entsia Main Business

9.7.3 Entsia Digital Insurance Solutions Products, Services and Solutions

9.7.4 Entsia Digital Insurance Solutions Revenue (US$ Million) & (2020-2025)

9.7.5 Entsia Recent Developments

9.8 Salesforce

9.8.1 Salesforce Profile

9.8.2 Salesforce Main Business

9.8.3 Salesforce Digital Insurance Solutions Products, Services and Solutions

9.8.4 Salesforce Digital Insurance Solutions Revenue (US$ Million) & (2020-2025)

9.8.5 Salesforce Recent Developments

9.9 Persistent Systems

9.9.1 Persistent Systems Profile

9.9.2 Persistent Systems Main Business

9.9.3 Persistent Systems Digital Insurance Solutions Products, Services and Solutions

9.9.4 Persistent Systems Digital Insurance Solutions Revenue (US$ Million) & (2020-2025)

9.9.5 Persistent Systems Recent Developments

9.10 MIC Global

9.10.1 MIC Global Profile

9.10.2 MIC Global Main Business

9.10.3 MIC Global Digital Insurance Solutions Products, Services and Solutions

9.10.4 MIC Global Digital Insurance Solutions Revenue (US$ Million) & (2020-2025)

9.10.5 MIC Global Recent Developments

9.11 Asseco

9.11.1 Asseco Profile

9.11.2 Asseco Main Business

9.11.3 Asseco Digital Insurance Solutions Products, Services and Solutions

9.11.4 Asseco Digital Insurance Solutions Revenue (US$ Million) & (2020-2025)

9.11.5 Asseco Recent Developments

9.12 Virtusa

9.12.1 Virtusa Profile

9.12.2 Virtusa Main Business

9.12.3 Virtusa Digital Insurance Solutions Products, Services and Solutions

9.12.4 Virtusa Digital Insurance Solutions Revenue (US$ Million) & (2020-2025)

9.12.5 Virtusa Recent Developments

9.13 Xceedance

9.13.1 Xceedance Profile

9.13.2 Xceedance Main Business

9.13.3 Xceedance Digital Insurance Solutions Products, Services and Solutions

9.13.4 Xceedance Digital Insurance Solutions Revenue (US$ Million) & (2020-2025)

9.13.5 Xceedance Recent Developments

9.14 Mendix

9.14.1 Mendix Profile

9.14.2 Mendix Main Business

9.14.3 Mendix Digital Insurance Solutions Products, Services and Solutions

9.14.4 Mendix Digital Insurance Solutions Revenue (US$ Million) & (2020-2025)

9.14.5 Mendix Recent Developments

9.15 Appian

9.15.1 Appian Profile

9.15.2 Appian Main Business

9.15.3 Appian Digital Insurance Solutions Products, Services and Solutions

9.15.4 Appian Digital Insurance Solutions Revenue (US$ Million) & (2020-2025)

9.15.5 Appian Recent Developments

9.16 Cogitate

9.16.1 Cogitate Profile

9.16.2 Cogitate Main Business

9.16.3 Cogitate Digital Insurance Solutions Products, Services and Solutions

9.16.4 Cogitate Digital Insurance Solutions Revenue (US$ Million) & (2020-2025)

9.16.5 Cogitate Recent Developments

9.17 Capgemini

9.17.1 Capgemini Profile

9.17.2 Capgemini Main Business

9.17.3 Capgemini Digital Insurance Solutions Products, Services and Solutions

9.17.4 Capgemini Digital Insurance Solutions Revenue (US$ Million) & (2020-2025)

9.17.5 Capgemini Recent Developments

9.18 Hexaware

9.18.1 Hexaware Profile

9.18.2 Hexaware Main Business

9.18.3 Hexaware Digital Insurance Solutions Products, Services and Solutions

9.18.4 Hexaware Digital Insurance Solutions Revenue (US$ Million) & (2020-2025)

9.18.5 Hexaware Recent Developments

9.19 Swiss Re

9.19.1 Swiss Re Profile

9.19.2 Swiss Re Main Business

9.19.3 Swiss Re Digital Insurance Solutions Products, Services and Solutions

9.19.4 Swiss Re Digital Insurance Solutions Revenue (US$ Million) & (2020-2025)

9.19.5 Swiss Re Recent Developments

9.20 Comarch

9.20.1 Comarch Profile

9.20.2 Comarch Main Business

9.20.3 Comarch Digital Insurance Solutions Products, Services and Solutions

9.20.4 Comarch Digital Insurance Solutions Revenue (US$ Million) & (2020-2025)

9.20.5 Comarch Recent Developments

10 Industry Chain Analysis

10.1 Digital Insurance Solutions Industrial Chain

10.2 Digital Insurance Solutions Upstream Analysis

10.2.1 Key Raw Materials

10.2.2 Raw Materials Key Suppliers

10.2.3 Manufacturing Cost Structure

10.3 Midstream Analysis

10.4 Downstream Analysis (Customers Analysis)

10.5 Sales Model and Sales Channels

10.5.1 Digital Insurance Solutions Sales Model

10.5.2 Sales Channel

10.5.3 Digital Insurance Solutions Distributors

11 Research Findings and Conclusion

12 Appendix

12.1 Research Methodology

12.1.1 Methodology/Research Approach

12.1.1.1 Research Programs/Design

12.1.1.2 Market Size Estimation

12.1.1.3 Market Breakdown and Data Triangulation

12.1.2 Data Source

12.1.2.1 Secondary Sources

12.1.2.2 Primary Sources

12.2 Author Details

12.3 Disclaimer

About US:

QYResearch is a leading global market research and consulting company established in 2007. With over 17 years' experience and professional research team in various cities over the world QY Research focuses on management consulting, database and seminar services, IPO consulting, industry chain research and customized research to help our clients in providing non-linear revenue model and make them successful. We are globally recognized for our expansive portfolio of services, good corporate citizenship, and our strong commitment to sustainability.

Contact US

QY Research, INC.

India Office -

315Work Avenue, Raheja Woods, Kalyani Nagar,

Pune, Maharashtra 411006, India

Web - https://www.qyresearch.in

Tel: +91-8149736330

Email- ankit@qyresearch.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Digital Insurance Solutions Market Set to Flourish by 2031: Trends, Industry Analysis, Business Outlook, Current and Future Growth here

News-ID: 4284536 • Views: …

More Releases from QY Research India

WBG Power Devices Market Expansion Accelerates, Projected to Reach US$ 17,550 Mi …

Pune, India: The global WBG Power Devices market is brilliantly evaluated in the research study that explores vital aspects such as market competition, segmentation, revenue and production growth, and regional expansion. The authors of the report have provided a thorough assessment of the global WBG Power Devices market on the basis of CAGR, sales, consumption, price, gross margin, and other significant factors. We have studied key players of the global…

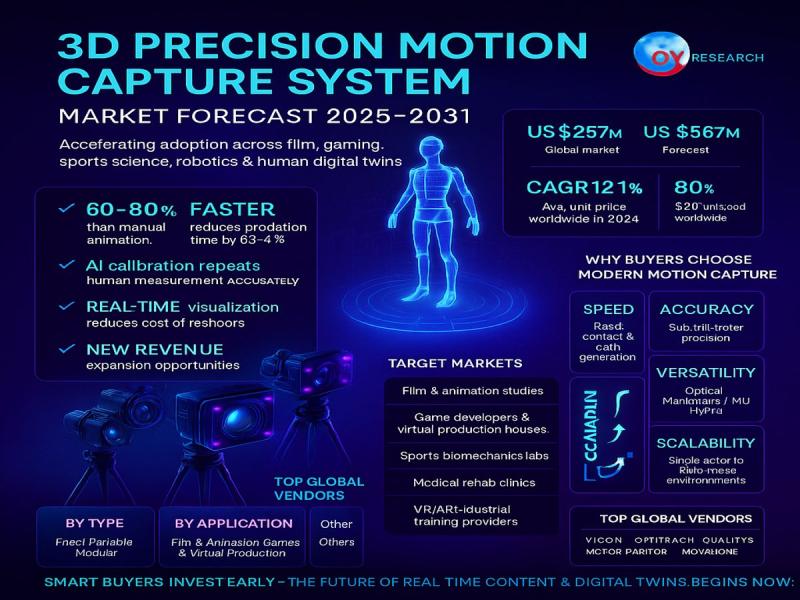

Global 3D Precision Motion Capture System Market Poised for 12.1% CAGR Growth Th …

The report presented here prepares market players to achieve consistent success while effectively dealing with unique challenges in the global 3D Precision Motion Capture System market. The analysts and researchers authoring the report have taken into consideration multiple factors predicted to positively and negatively impact the global 3D Precision Motion Capture System market, including policy risks such as the potential shifts in the 2025 U.S. tariff framework. The report includes…

Fully Hermetic Compressor Market Outlook 2025, Industry Demand, Emerging Applica …

QY Research has recently published a research report titled, "Global Fully Hermetic Compressor Market Share and Ranking, Overall Sales and Demand Forecast 2025-2031", assessing various factors impacting its trajectory. The research study offers deep evaluation of the global Fully Hermetic Compressor market and helps market participants to gain a strong foothold in the industry. It sheds light on critical market dynamics such as drivers, restraints, trends, and opportunities to help…

Engine Exhaust Silencers Market Set for Sustainable Growth by 2031, Key Trends, …

QY Research has recently published a research report titled, "Global Engine Exhaust Silencers Market Share and Ranking, Overall Sales and Demand Forecast 2025-2031", assessing various factors impacting its trajectory. The research study offers deep evaluation of the global Engine Exhaust Silencers market and helps market participants to gain a strong foothold in the industry. It sheds light on critical market dynamics such as drivers, restraints, trends, and opportunities to help…

More Releases for Solutions

WealthTech Solutions Market: Transforming Financial Services with Technological …

Transforming Wealth Management: Understanding WealthTech Solutions

The WealthTech Solutions Market, valued at USD 5.60 Billion in 2022, is on a trajectory to reach a staggering USD 15.44 Billion by 2029, projecting a remarkable CAGR of 15.58% during the forecast period (2023-2029).

Overview:

Revolutionary shifts are reshaping global wealth management, fueled by changing customer preferences and technological advancements. The relentless pace of technology has spurred demand for instant, remote solutions in financial services. WealthTech…

Offshore Solutions Market Is Booming Worldwide | AV One Solutions, MacDermid Off …

Advance Market Analytics added research publication document on Worldwide Offshore Solutions Market breaking major business segments and highlighting wider level geographies to get deep dive analysis on market data. The study is a perfect balance bridging both qualitative and quantitative information of Worldwide Offshore Solutions market. The study provides valuable market size data for historical (Volume** & Value) from 2018 to 2022 which is estimated and forecasted till 2028*. Some…

VLC Solutions Releases Cybersecurity Maturity Model Certification (CMMC) Solutio …

VLC Solutions, a leading provider of Digital solutions, is excited to announce the release of their new Cybersecurity Maturity Model Certification (CMMC) solutions. Designed to help businesses achieve compliance with the CMMC framework, VLC's solutions provide a comprehensive approach to cybersecurity that is tailored to each client's unique needs.

The CMMC framework was developed by the U.S. Department of Defense (DoD) to ensure that contractors and subcontractors meet a minimum level…

Insight into Digital Mobile Radio Market to 2025 - Flatworld Solutions, Simoco W …

The market research report on "Digital Mobile Radio Market" is now available with Market Growth Insight (MGI). The report offers insights on major impacting factors like drivers, restraints, opportunities, and trends for the business owners, marketing personnel and strategy planners to plan operational strategies. The report also presents list of key players in the market along with essential information on each player.

In order to give the users of this report…

Revenue Management Solutions Market : Key Vendors : Revenue Management Solutions …

Revenue management can provide enormous opportunities to the companies and enterprises via helping them in identifying profitable ways in order to stimulate demand. It is an organized way to rise profits by means of pricing, inventory and other controllable methods in ways that are consistent with higher customer service. Revenue management, also called yield management permits different businesses to optimize product profitability and availability by predicting consumer behaviour and apportioning…

MEDIFIX Solutions™ - Adhesive Solutions for Wearable Medical Devices

Scapa Healthcare announces the launch of MEDIFIX Solutions™ as a complete turnkey solution for wearable mobile device applications.

MEDIFIX Solutions™ offers a portfolio of materials, adhesives, conversion, printing, and packaging to support wearable device attachment to the skin. The combination of MEDIFIX® materials and converting, in conjunction with a global design and manufacturing footprint, enables efficient custom development and scalable production across the diverse and growing needs of wearable applications, including…