Press release

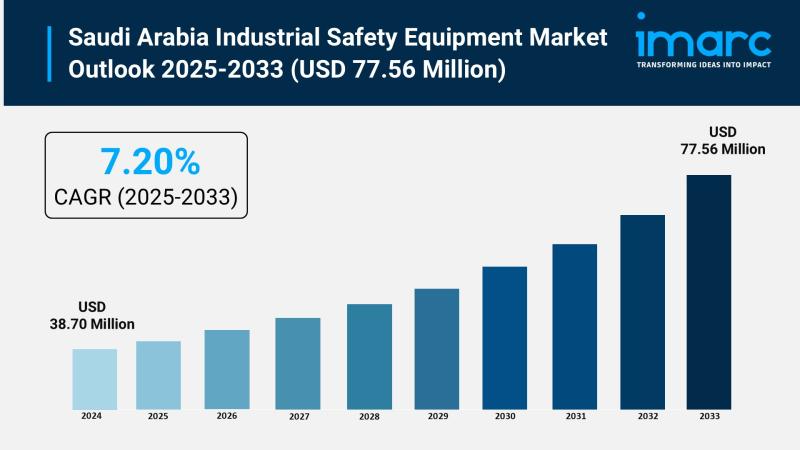

Saudi Arabia Industrial Safety Equipment Market Size to Expand at a CAGR of 7.20% during 2025-2033

Saudi Arabia Industrial Safety Equipment Market OverviewMarket Size in 2024: USD 38.70 Million

Market Size in 2033: USD 77.56 Million

Market Growth Rate 2025-2033: 7.20%

According to IMARC Group's latest research publication, "Saudi Arabia Industrial Safety Equipment Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", The Saudi Arabia industrial safety equipment market size was valued at USD 38.70 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 77.56 Million by 2033, exhibiting a CAGR of 7.20% during 2025-2033.

How AI is Reshaping the Future of Saudi Arabia Industrial Safety Equipment Market

● AI-powered predictive analytics monitor equipment performance in real-time, detecting potential safety failures before they occur and reducing workplace accidents across Saudi industrial facilities significantly.

● Smart PPE integrated with AI sensors tracks worker vitals and environmental hazards continuously, alerting supervisors instantly to dangerous conditions in oil and gas operations.

● AI-driven risk assessment systems analyze historical incident data and workplace patterns, enabling Saudi companies to proactively implement targeted safety measures in high-risk zones.

● Automated compliance monitoring uses AI to verify PPE usage and safety protocol adherence across construction sites, ensuring regulatory compliance with Vision 2030 standards.

● AI-enhanced training platforms deliver personalized safety education through virtual reality simulations, improving worker preparedness for hazardous industrial environments across the Kingdom.

Grab a sample PDF of this report: https://www.imarcgroup.com/saudi-arabia-industrial-safety-equipment-market/requestsample

How Vision 2030 is Transforming Saudi Arabia Industrial Safety Equipment Industry

Saudi Arabia's Vision 2030 is revolutionizing the industrial safety equipment industry by prioritizing worker protection, regulatory compliance, and economic diversification amid rapid industrial expansion. The initiative drives demand for advanced safety gear, integrating cutting-edge technologies to combat occupational hazards across key sectors. This transformation aligns with infrastructure development goals, promoting sophisticated PPE and safety instruments in megaprojects like NEOM, Qiddiya, and The Red Sea Project. Local manufacturing incentives spur innovation and reduce import dependence, while stringent safety regulations push companies to invest in premium protective equipment that meets international standards. Ultimately, Vision 2030 elevates the sector as a cornerstone of workplace safety, enhancing worker well-being and positioning Saudi Arabia as a leader in industrial safety compliance.

Saudi Arabia Industrial Safety Equipment Market Trends & Drivers:

Saudi Arabia's industrial safety equipment market is experiencing robust growth, driven by enhanced government regulations and increasing safety compliance requirements across multiple industries. The market is fueled by the government's proactive implementation of tougher safety measures across numerous industries, including oil and gas, construction, and manufacturing sectors, resulting in consistent demand for superior safety equipment like helmets, gloves, and protective gear. Organizations are responding by integrating high-quality industrial safety equipment to meet legal standards and avoid expensive fines, while the government's ongoing efforts to improve worker safety standards create a strong foundation for safety equipment suppliers to expand their presence and offerings across the region.

The rapid expansion of construction activities and industrial infrastructure development is significantly boosting market demand. With massive initiatives including new oil refineries, petrochemical facilities, and major construction projects under Vision 2030, Saudi authorities endorsed a strong budget for 2025 amounting to SR1.3tn designed to support the construction industry. Recent information from the Investment Ministry shows that building permits granted in 2024 highlighted significant sector activity. Businesses engaged in these projects are presently ordering safety equipment to reduce risks posed by dangerous work environments, with employees in construction, manufacturing, and energy sectors utilizing personal protective equipment and other safety devices to reduce injury risks, driving demand for advanced cooling systems across residential, healthcare, commercial, and industrial sectors.

Saudi Arabia Industrial Safety Equipment Market Industry Segmentation:

The report has segmented the market into the following categories:

Product Type Insights:

● Personal Protective Equipment (PPE)

● Head Protection

● Eye and Face Protection

● Hearing Protection

● Respiratory Protection

● Hand Protection

● Protective Clothing

● Foot Protection

● Safety Instruments

● Safety Sensors

● Safety Controllers/Relays

● Safety Valves

● Emergency Shutdown Systems (ESD)

● Fire and Gas Monitoring Systems

● High Integrity Pressure Protection Systems (HIPPS)

● Burner Management Systems (BMS)

End-Use Industry Insights:

● Manufacturing

● Construction

● Oil and Gas

● Chemicals

● Mining

● Transportation

● Pharmaceuticals

● Others

Breakup by Region:

● Northern and Central Region

● Western Region

● Eastern Region

● Southern Region

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Purchase the 2026 Comprehensive Updated data: https://www.imarcgroup.com/checkout?id=36197&method=1315

Recent News and Developments in Saudi Arabia Industrial Safety Equipment Market

● January 2025: Saudi Arabia became the first Arab nation to introduce a National Policy on Forced Labour and Worker Rights, led by the Ministry of Human Resources and Social Development, aiming to enhance workplace safety and ensure fairer working conditions across all industrial sectors, aligning with international human rights standards and driving increased demand for certified safety equipment.

● February 2025: Red Sea Global, owned by Saudi Arabia's Public Investment Fund, inaugurated its first Health & Safety Training Academy at the AMAALA luxury wellness destination, following a successful pilot phase that trained workers, offering free training to workforce, partners, and contractors on essential construction skills and safety practices supporting Vision 2030 megaprojects.

● March 2025: UL Solutions and Aramco signed a memorandum of understanding to collaborate on enhancing safety in Saudi Arabia, focusing on advancing fire and life safety, conducting field engineering evaluations, and providing training on UL Standards, supporting Aramco's In-Kingdom Total Value Add program and aligning with Vision 2030 goals to develop the local energy sector and improve public safety.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Saudi Arabia Industrial Safety Equipment Market Size to Expand at a CAGR of 7.20% during 2025-2033 here

News-ID: 4284488 • Views: …

More Releases from IMARC Group

Base Oil Price Trend Analysis: Current Prices, Index & Forecast 2026

The Base Oil Price Index has shown notable fluctuations in late 2025 and early 2026 due to shifts in crude oil markets, refinery output, and global demand. Tracking the price of Base Oil is essential for lubricants manufacturers, industrial users, and traders seeking insights into market dynamics. This report provides a comprehensive overview of Base Oil Prices, including historical data, price trends, forecasts for 2026, and regional variations. By analyzing…

Mexico Industrial Heaters Market Share, Size, In-Depth Insights, Trends and Fore …

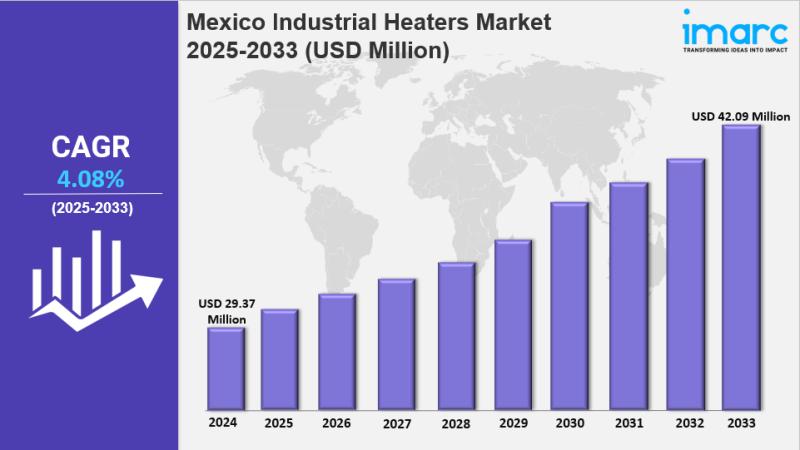

IMARC Group has recently released a new research study titled "Mexico Industrial Heaters Market Size, Share, Trends and Forecast by Product, Technology, End User, and Region, 2025-2033", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

The Mexico industrial heaters market was valued at USD 29.37 Million in 2024 and is expected to reach USD 42.09…

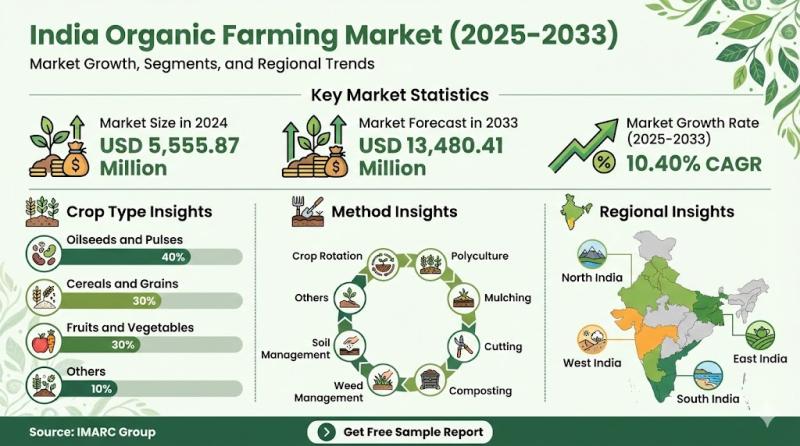

India Organic Farming Market 2025-2033: $13,480.41Mn Industry Growth, Trends & S …

Source: IMARC Group | Category: Agriculture | Author: Tarang

Report Introduction

According to IMARC Group's latest report titled "India Organic Farming Market Size, Share, Trends and Forecast by Crop Type, Method, and Region, 2025-2033", this study offers a granular analysis of the industry's rapid transition towards sustainable agricultural practices and chemical-free food production. The study offers a profound analysis of the industry, encompassing market share, size, India organic farming market growth factors,…

Electric Vehicle Manufacturing Plant DPR - 2026, Machinery Cost, ROI, and Market …

The global automotive industry stands at a historic inflection point as the world accelerates its transition from conventional internal combustion engines to electric mobility. Electric vehicles represent a transformative shift in personal and commercial transportation, offering zero tailpipe emissions, significantly lower operating costs, and quieter operation compared to traditional gasoline and diesel vehicles. As tightening emission regulations, rising fuel prices, government incentives for clean mobility, expanding charging infrastructure, and increasing…

More Releases for Saudi

Saudi Wakala Offers Efficient and Reliable Saudi Visa Stamping Services

Saudi Wakala, a renowned agency specializing in Saudi visa stamping services, is proud to announce its commitment to providing swift and reliable visa processing for travelers to Saudi Arabia. Located in New Delhi, Saudi Wakala has established itself as a trusted partner for individuals and businesses requiring efficient visa stamping services.

Efficient Visa Processing

Understanding the complexities and time-sensitivity associated with visa stamping, Saudi Wakala offers a streamlined process managed by an…

saudi construction company,TOP saudi arabia construction companies list,civil co …

Abdul Ali Al-Ajmi Company

Advanced Support Company

Al Ashbelya Engineering

Al-Dour Engineering Contracting Est.

https://www.gdwatches.cn/

Free engineering construction consultation

Email:nolan@wholsale9.com

Alfanar

Arabian Tile Co. Ltd. (ARTIC)

Assad Said for Contracting Co Ltd

Automated Buildings Company

Bazy Trading and Contracting

Bin Dayel Contracting

Cercon

City Cement Company

Dar Al Majd

EG & G Middle East

East Consulting Engineering Center

El Seif Engineering Contracting Company

El Seif Engineering Contracting Company

Engineering Development Co for Contracting

FCC Company

https://www.gdwatches.cn/

Free engineering construction consultation

Email:nolan@wholsale9.com

Jones Engineering Group

Masar Consulting Engineer

Meinhardt Arabia

Mohammed M. Al Rashid Co. (MARCO)

Qureshi Telecom Contracting &…

Saudi Arabia Agriculture Market, Saudi Arabia Agriculture Industry, Saudi Arabia …

Saudi Arabia Agriculture is focussed on the spread of dates, dairy farm merchandise, eggs, fish, poultry, vegetables, and flowers to markets round the creation because it has attained its own potency within the production of such merchandise. The private sector additionally plays a role within the nation's agriculture, because the government offers long-term interest-free loans and inexpensive water, fuel, electricity, and duty-free imports of raw materials and machinery. Over the past…

Saudi Arabia Pharmaceutical Market | pharmaceutical companies in saudi arabia, p …

In order to study the various trends and patterns prevailing in the concerned market, Market Research Reports Search Engine (MRRSE) has included a new report titled “Saudi Arabia Pharmaceutical Market” to its wide online database. This research assessment offers a clear insight about the influential factors that are expected to transform the global market in the near future.

The report examines Saudi Arabia pharmaceutical market for the period 2016–2026. The primary…

Saudi Arabia Airport Privatization Sector Saudi Arabia Airport Sales Report 2022

For Report Sample Contact: neeraj@kuickresearch.com or +91-11-47067990

Report Table of Contents

Saudi Arabia Aviation Industry Overview

Privatization in Saudi Arabia

Saudi Arabia Civil Aviation Regulatory Authority

3.1 General Authority of Civil Aviation (GACA)

3.2 International Air Transport Association

Saudi…

Saudi Arabia Mutual Fund Sector Saudi Arabia Mutual Fund Sales Report 2022

For Report Sample Contact: neeraj@kuickresearch.com or +91-11-47067990

Report Table of Contents

1. Saudi Arabia Financial Sector Overview

2. Saudi Arabia Stock Market and Exchange Overview

3. Saudi Arabia Mutual Fund Market Overview

4. Saudi Arabia Mutual Fund Program and Managers

4.1 Fund Managers and Companies

4.2 Types of Mutual Funds

5. Saudi Arabia Mutual Fund Asset Allocation

5.1 Market Overview

5.2 Mutual Fund Market Indicators

…