Press release

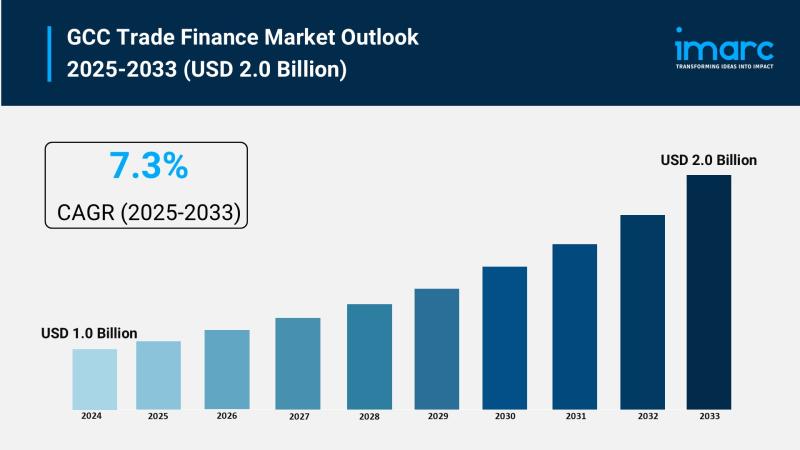

GCC Trade Finance Market Size to Reach USD 2.0 Billion by 2033 | With a 7.3% CAGR

GCC Trade Finance Market OverviewMarket Size in 2024: USD 1.00 Billion

Market Size in 2033: USD 2.00 Billion

Market Growth Rate 2025-2033: 7.3%

According to IMARC Group's latest research publication, "GCC Trade Finance Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", The GCC trade finance market size was valued at USD 1.00 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 2.00 Billion by 2033, exhibiting a CAGR of 7.3% during 2025-2033.

How AI is Reshaping the Future of GCC Trade Finance Market

● Digital Process Automation: AI automates trade documentation and verification, reducing processing times by up to 30% for banks in UAE and Saudi Arabia while minimizing errors in letters of credit and boosting efficiency for SMEs.

● Risk Assessment Enhancements: Machine learning predicts fraud and credit risks in real-time, enabling faster approvals for supply chain financing and helping GCC institutions manage volatile oil-linked trades with greater confidence.

● Personalized Financing Solutions: AI analyzes trade patterns to deliver tailored products like dynamic factoring, especially benefiting e-commerce exporters in Qatar and Oman and supporting non-oil sector growth across the region.

● Blockchain Integration: AI-powered smart contracts automate compliance in green trade finance, accelerating sustainable imports and renewable energy projects with projected 20% growth in eco-friendly transactions by 2030.

How Vision 2030 is Revolutionizing GCC Trade Finance Industry

With the vision of Saudi 2030, GCC Trade Finance is aimed at diversification, digitalization, and small business, making non-oil exports grow quickly. The trade finance can be decreased by 25 percent through AI, which will expand the GCC businesses reaching Asia and Europe, performing better than traditional paper-based systems. This enhances economic stability and resilience of the region and creates trade ties with the markets in Asia and Europe. Riyadh, Dubai and Doha banks are using more blockchain letters of credit and supply chain finance, green finance and Islamic finance to finance imports of renewable power and megaprojects in infrastructures.

Regional regulatory reforms, intra-GCC free trade programs and fintech ecosystem platforms, including DIFC FinTech Hive and Riyadh Season, have seen the trend spread to the UAE, Qatar, Oman and Bahrain as the region markets itself as a major East-West trade crossing hub. GCC trade finance market will therefore keep growing steadily by 7-8% per annum annually till 2030 as a less oil and technology driven trade ecosystem which will be more competitive on the global front.

Download a sample copy of the Report: https://www.imarcgroup.com/gcc-trade-finance-market/requestsample

GCC Trade Finance Market Trends & Drivers:

GCC trade finance is becoming digitalized at a high rate. Open account platforms and AI, along with blockchain, are accelerating the transaction and reducing fraud. The demand of the supply chain finance is driven by the expansion of the e-commerce and logistics like the global trade hubs of Jebel Ali and King Abdullah Port. Green and sustainable financial instruments, like green letters of credit and ESG-linked facilities are also sought after as the governments shift towards net-zero targets. This is facilitated by intra-regional trade agreements that are based on harmonized regulatory standards.

National diversification programs, increasing FDI, and colossal infrastructure investment after the COVID-19 are very high boosting demand. Fintech is an SME financing solution and has more than 300 regional startups. The successful mega-events such as Expo 2020 and recovery of tourism put pressure on availability of working capital. The sector is also offered with more liquidity due to the stable oil prices, as well as growing regional trade with Asia.

Purchase the 2026 Comprehensive Updated data: https://www.imarcgroup.com/checkout?id=11297&method=940

GCC Trade Finance Industry Segmentation:

The report has segmented the market into the following categories:

Breakup by Finance Type:

● Structured Trade Finance

● Supply Chain Finance

● Traditional Trade Finance

Breakup by Offering:

● Letters of Credit

● Bill of Lading

● Export Factoring

● Insurance

● Others

Breakup by Service Provider:

● Banks

● Trade Finance Houses

Breakup by End User:

● Small and Medium Sized Enterprise (SMEs)

● Large Enterprises

Breakup by Country:

● Saudi Arabia

● UAE

● Qatar

● Bahrain

● Kuwait

● Oman

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Recent News and Developments in GCC Trade Finance Market

● January 2025: Emirates NBD launched its AI-powered trade finance platform "TradeConnect 2.0," featuring automated document processing and real-time risk assessment, reducing letter of credit processing time by 60% and serving over 500 corporate clients in the first month.

● February 2025: Saudi Arabia's National Commercial Bank (NCB) partnered with JPMorgan to implement blockchain-based trade finance solutions, successfully completing the region's first fully digital cross-border trade transaction worth $50 million between Riyadh and Dubai.

● March 2025: Qatar National Bank introduced its SME trade finance digital portal, offering instant pre-approval for trade facilities up to $1 million, resulting in a 45% increase in SME trade finance applications and supporting over 2,000 small businesses in the first quarter.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release GCC Trade Finance Market Size to Reach USD 2.0 Billion by 2033 | With a 7.3% CAGR here

News-ID: 4284291 • Views: …

More Releases from IMARC Group

Taiwan Construction Market Size, Share, In-Depth Insights, Trends and Forecast 2 …

IMARC Group has recently released a new research study titled "Taiwan Construction Market Report by Sector (Residential, Commercial, Industrial, Infrastructure (Transportation), Energy and Utilities Construction), and Region 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

The Taiwan construction market size reached USD 37.4 Billion in 2025 and is projected to grow to USD 50.4…

Mexico Whiskey Market Size to Hit USD 1,468.1 Million by 2034: Trends & Forecast

IMARC Group has recently released a new research study titled "Mexico Whiskey Market Size, Share, Trends and Forecast by Product Type, Quality, Distribution Channel, and Region, 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

The Mexico whiskey market size reached USD 905.2 Million in 2025. It is projected to grow to USD 1,468.1 Million…

Mexico LED Lights Market 2026 : Industry Size to Reach USD 2,904.4 Million by 20 …

IMARC Group has recently released a new research study titled "Mexico LED Lights Market Size, Share, Trends and Forecast by Product Type, Application, Import and Domestic Manufacturing, and Region, 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

The Mexico LED lights market was valued at USD 1,466.9 million in 2025 and is projected to…

Mexico High-Brightness LED Market Size, Share, Latest Insights and Forecast 2025 …

IMARC Group has recently released a new research study titled "Mexico High-Brightness LED Market Size, Share, Trends and Forecast by Application, Distribution Channel, Indoor and Outdoor Application, End-Use Sector, and Region, 2025-2033" which offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends, and competitive landscape to understand the current and future market scenarios.

Market Overview

The Mexico high-brightness LED market size reached USD 349.2 Million in 2024 and is…

More Releases for GCC

RNTrust Announces GCC Cybersecurity Virtual Summit

Dubai, UAE - November 26, 2025 - RNTrust Group announces a high-level Cybersecurity Summit taking place in Dubai on Wednesday, December 10, 2025. Designed exclusively for cybersecurity leaders and professionals across the GCC region, the summit will serve as a premier platform to examine emerging cyber threats, strengthen regional security capabilities, and promote strategic cooperation among government entities, critical-infrastructure operators, and industry stakeholders.

Summit Overview

The summit, titled "GCC Cybersecurity Virtual Summit,"…

GCC Herbal Ingredients and Functional Beverages Market CAGR 5.5% from 2018 to 20 …

According to a new report published by Allied Market Research, titled, "GCC Herbal Ingredients and Functional Beverages Market By Functional Beverage and Herbal Ingredients: GCC Opportunity Analysis and Industry Forecast, 2018-2027," The herbal ingredients market was valued at $46.4 million in 2017 and is projected to reach $73.5 million by 2027, registering a CAGR of 4.9% from 2018 to 2027. The functional beverages market revenue was valued at $750.2 million…

GCC Artificial Intelligence Market

When any business seek to lead the market or make a mark in the market as a fresh emergent, market research report is always central. A comprehensive GCC Artificial Intelligence Market report encompasses a market data that provides a detailed analysis of the ABC industry and its impact based on applications and different geographical regions. The report gives current as well as upcoming technical and financial details of the industry…

GCC LED Lighting Market

According to the latest report by IMARC Group, titled "𝗚𝗖𝗖 𝗟𝗘𝗗 𝗟𝗶𝗴𝗵𝘁𝗶𝗻𝗴 𝗠𝗮𝗿𝗸𝗲𝘁: 𝗜𝗻𝗱𝘂𝘀𝘁𝗿𝘆 𝗧𝗿𝗲𝗻𝗱𝘀, 𝗦𝗵𝗮𝗿𝗲, 𝗦𝗶𝘇𝗲, 𝗚𝗿𝗼𝘄𝘁𝗵, 𝗢𝗽𝗽𝗼𝗿𝘁𝘂𝗻𝗶𝘁𝘆 𝗮𝗻𝗱 𝗙𝗼𝗿𝗲𝗰𝗮𝘀𝘁 𝟮𝟬𝟮𝟮-𝟮𝟬𝟮𝟳", the GCC LED lighting market size reached a value of US$ 689.2 Million in 2021. Looking forward, IMARC Group expects the market to reach US$ 1,452.1 Million by 2027, exhibiting a CAGR of 14.1% during 2022-2027..

𝗬𝗲𝗮𝗿 𝗖𝗼𝗻𝘀𝗶𝗱𝗲𝗿𝗲𝗱 𝘁𝗼 𝗘𝘀𝘁𝗶𝗺𝗮𝘁𝗲 𝘁𝗵𝗲 𝗠𝗮𝗿𝗸𝗲𝘁 𝗦𝗶𝘇𝗲:

Base Year of the Analysis: 2021

Historical Period:…

GCC Contact Lens Market Size, Growth Opportunities, Statistics, Market Scope, Tr …

The GCC Contact Lens Market Report provides a thorough study of the competitive landscape, market participants, geographical regions, and application areas. In order to comprehend future demand and industry prognosis, the research includes a complete assessment of growth variables, market definitions, manufacturers, market potential, and influential trends. The research also contains a comprehensive analysis of the market, taking into account key growth-influencing elements.

The study gives a detailed breakdown of important…

GCC Digital Signage Market-(2017-2023)

Market Forecast By Components (Display Screens, Content Players and Software), By Display Screen Types (Single Screen, Video Wall or Multi Screen and Digital Signage Kiosk), By Display Screen Technologies (LED, OLED and QLED), By Display Screen Size (Below 40", 40"-55" and Above 55"), By End User Applications (Government & Transportation, Retail, Healthcare & Hospitality, Education, Entertainment, Banks & Financial Institutions and Commercial Offices & Buildings), By Countries (Saudi Arabia, Bahrain…