Press release

Lithium Carbonate Prices, Latest Trend, Demand, Index & Uses Nov 2025

Northeast Asia Lithium Carbonate Prices Movement Nov 2025Lithium Carbonate prices in Northeast Asia rose to USD 9.04/kg in November 2025, marking a 4.4% increase. The uptrend was driven by improved downstream EV battery demand, moderate supply tightening, and higher procurement from cathode manufacturers. Stabilizing inventories and renewed industrial activity also contributed to the positive price movement in the region.

Regional Analysis: The price analysis can be expanded to include detailed Lithium Carbonate price data for a wide range of Northeast Asia countries such as China, Japan, South Korea, North Korea, Mongolia & Taiwan

Get the Real-Time Prices Analysis: https://www.imarcgroup.com/lithium-carbonate-pricing-report/requestsample

Europe Lithium Carbonate Prices Movement Nov 2025

In Europe, Lithium Carbonate prices reached USD 11.18/kg, reflecting a 0.8% upward movement in November 2025. The slight increase was supported by consistent demand from battery producers, limited local supply, and reliance on imports. Higher energy costs and logistical constraints also kept prices elevated across the European market.

Regional Analysis: The price analysis can be expanded to include detailed Lithium Carbonate price data for a wide range of European countries, such as Germany, France, the United Kingdom, Italy, Spain, Russia, Turkey, the Netherlands, Poland, Sweden, Belgium, Austria, Ireland, Switzerland, Norway, Denmark, Romania, Finland, the Czech Republic, Portugal, and Greece, along with other European nations.

South America Lithium Carbonate Prices Movement Nov 2025

South America recorded Lithium Carbonate prices at USD 7.10/kg, rising 2.3% during November 2025. Strong export demand from Asian and European buyers, coupled with steady production from major brine-based lithium facilities, supported the price increase. Market sentiment improved as global EV manufacturers ramped up procurement from South American lithium suppliers.

Regional Analysis: The price analysis can be expanded to include detailed Lithium Carbonate price data for a wide range of South America countries such as Argentina, Bolivia, Brazil, Chile, Colombia, Ecuador, Guyana, Paraguay, Peru, Suriname, Uruguay & Venezuela

North America Lithium Carbonate Prices Movement Nov 2025

In North America, Lithium Carbonate prices fell to USD 8.86/kg, reflecting a 3.9% decline in November 2025. The downward trend resulted from weaker spot demand, higher inventories, and increased competition from imported material. Slower EV sales and cautious purchasing activity from battery manufacturers further pressured regional prices.

Regional Analysis: The price analysis can be extended to provide detailed Lithium Carbonate price information for the following list of countries.

United States of America (USA), Canada & Mexico

Note: The analysis can be tailored to align with the customer's specific needs.

Purchase Options: https://www.imarcgroup.com/checkout?id=22524&method=1925

• Biannual Updates: For 2 Deliverables, Billed Annually

• Quarterly Updates: For 4 Deliverables, Billed Annually

• Monthly Updates: For 12 Deliverables, Billed Annually

We Also Provide News and Historical Data of Lithium Carbonate:

• Historical Data: Comprehensive historical pricing and market trends.

• Quarterly Analysis: Detailed insights into price fluctuations and market dynamics.

• Regional and Global Data: Coverage of key markets and their performance.

• Forecast Comparisons: Historical data paired with future market projections.

• Customizable Reports: Tailored analysis to meet specific business needs.

What is Lithium Carbonate?

Lithium Carbonate (Li2CO3) is an essential inorganic compound widely used in the production of lithium-ion batteries. It serves as a key precursor for cathode materials such as LFP (Lithium Iron Phosphate) and NMC (Nickel Manganese Cobalt) chemistries. The compound is also used in ceramics, pharmaceuticals, and glass manufacturing, making it critical for modern industrial supply chains.

Factors Affecting Lithium Carbonate Supply and Prices

1. EV Battery Demand

Surging electric vehicle (EV) production continues to be the leading driver of Lithium Carbonate consumption. Any expansion or slowdown in EV manufacturing directly influences demand and price movements.

2. Mining Output and Brine Extraction

Supply depends heavily on production from major lithium mining regions such as Chile, Argentina, Australia, and China. Weather-related disruptions, regulatory changes, or operational issues can tighten supply and raise prices.

3. Processing & Refining Capacity

Limited conversion capacity for transforming raw lithium ore into battery-grade Lithium Carbonate often leads to supply bottlenecks, affecting global price stability.

4. Energy and Transportation Costs

Since lithium processing is energy-intensive, fluctuations in electricity and fuel prices influence production costs. Higher freight rates also increase the final market prices.

5. Government Policies & Trade Regulations

Environmental laws, export restrictions, and incentives for battery production in key markets (EU, US, China) significantly shape global supply and pricing trends.

6. Market Speculation & Inventory Levels

Investor sentiment, stockpiling behavior by battery manufacturers, and futures market dynamics contribute to short-term price volatility.

Lithium Carbonate Price Index - November 2025

In November 2025, the Lithium Carbonate price index showed mixed movement across global regions:

• Northeast Asia: Strong increase due to revived battery sector demand

• Europe: Moderate rise supported by import reliance

• South America: Price uplift driven by higher export orders

• North America: Decline due to weak spot demand and higher inventories

Latest News - November 2025

• Major battery makers in China announced production ramp-ups ahead of 2026 EV launches.

• South American lithium producers expanded export contracts to Europe and Asia.

• A few North American EV manufacturers slowed output due to oversupply concerns, pressuring domestic Lithium Carbonate prices.

• New investments in lithium refining facilities were announced in the EU to reduce dependency on imports.

Lithium Carbonate Market Trend - November 2025

The market trend in November 2025 indicated gradual strengthening, supported by:

• Growing EV and energy storage system (ESS) requirements

• Improved procurement activity as inventories normalized

• Long-term confidence in renewable energy adoption

However, regional disparities persisted, with some markets experiencing oversupply while others faced tightened availability.

Current & Future Demand for Lithium Carbonate (2025 and Beyond)

Current Demand (2025)

Demand remains robust due to:

• Expanding EV sector in China, Europe, and the U.S.

• Rising adoption of home and grid-scale energy storage solutions

• Continued use in ceramics and specialty industrial applications

Future Demand Outlook (2026-2030)

Future demand is expected to grow significantly, driven by:

• Massive global EV penetration targets

• Gigafactory expansions and increased cell production

• Advances in LFP battery technology, which heavily relies on Lithium Carbonate

• Renewable energy storage integration in smart grids

• Increasing strategic stockpiling by battery manufacturers

Key Uses of Lithium Carbonate

Lithium Carbonate is vital for:

• Lithium-ion battery cathodes (LFP, NMC, NCA)

• Ceramics and glass production for improved durability and thermal resistance

• Pharmaceutical applications, particularly in mood-stabilizing medications

• Aluminum production as an additive

• Air purification systems in specialized industrial environments

Speak to an Analyst: https://www.imarcgroup.com/request?type=report&id=22524&flag=C

Key Coverage:

• Market Analysis

•Market Breakup by Region

•Demand Supply Analysis by Type

•Demand Supply Analysis by Application

•Demand Supply Analysis of Raw Materials

•Price Analysis

•Spot Prices by Major Ports

•Price Breakup

•Price Trends by Region

•Factors influencing the Price Trends

•Market Drivers, Restraints, and Opportunities

•Competitive Landscape

•Recent Developments

•Global Event Analysis

How IMARC Pricing Database Can Help

The latest IMARC Group study, "Lithium Carbonate Prices, Trend, Chart, Demand, Market Analysis, News, Historical and Forecast Data 2025 Edition," presents a detailed analysis of Lithium Carbonate price trend, offering key insights into global Lithium Carbonate market dynamics. This report includes comprehensive price charts, which trace historical data and highlights major shifts in the market.

The analysis delves into the factors driving these trends, including raw material costs, production fluctuations, and geopolitical influences. Moreover, the report examines Lithium Carbonate demand, illustrating how consumer behavior and industrial needs affect overall market dynamics. By exploring the intricate relationship between supply and demand, the prices report uncovers critical factors influencing current and future prices.

About Us:

IMARC Group is a global management consulting firm that provides a comprehensive suite of services to support market entry and expansion efforts. The company offers detailed market assessments, feasibility studies, regulatory approvals and licensing support, and pricing analysis, including spot pricing and regional price trends. Its expertise spans demand-supply analysis alongside regional insights covering Asia-Pacific, Europe, North America, Latin America, and the Middle East and Africa. IMARC also specializes in competitive landscape evaluations, profiling key market players, and conducting research into market drivers, restraints, and opportunities. IMARC's data-driven approach helps businesses navigate complex markets with precision and confidence.

Contact us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United State: +1-631-791-1145

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Lithium Carbonate Prices, Latest Trend, Demand, Index & Uses Nov 2025 here

News-ID: 4284012 • Views: …

More Releases from IMARC Group

Cost of Setting Up a PET Bottle Manufacturing Plant & DPR 2026

The global PET bottle industry is experiencing sustained growth propelled by rising packaged beverage consumption, pharmaceutical packaging expansion, increasing demand for ready-to-drink products, and the lightweight, recyclable advantages of PET packaging. As urbanization accelerates, consumer lifestyles shift toward convenience packaging, and regulatory frameworks increasingly mandate recyclable materials, establishing a PET bottle manufacturing plant positions investors in one of the most stable and essential segments of the consumer packaging value chain.

IMARC…

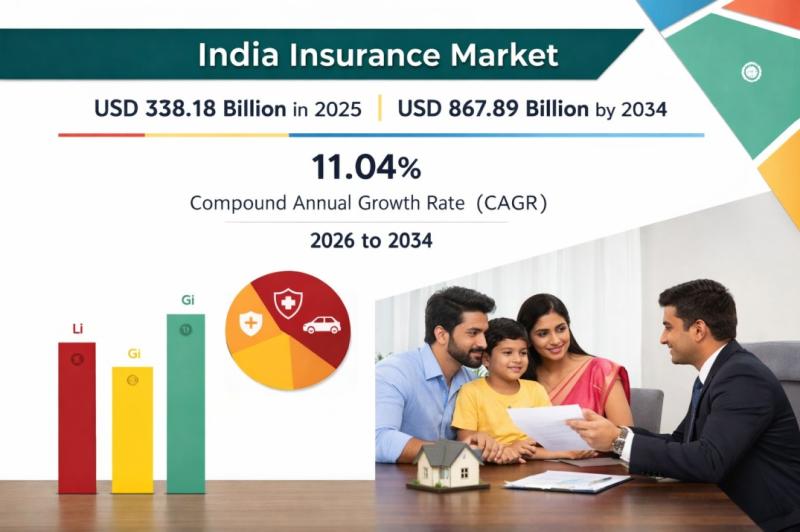

India Insurance Market Forecast 2026: Industry Size, Expansion & Future Scope 20 …

India Insurance Market Overview 2026-2034

According to IMARC Group's report titled India Insurance Market Size, Share, Trends and Forecast by Type of Product, Distribution Channel, End User, and Region, 2026-2034 the report offers a comprehensive analysis of the industry, including market share, growth, trends, and regional insights.

The India insurance market size was valued at USD 338.18 Billion in 2025 and is projected to reach USD 867.89 Billion by 2034, growing at…

Global Diammonium Phosphate (DAP) Prices January 2026: Asia Gains, Europe Steady …

What is Diammonium Phosphate (DAP)?

Diammonium Phosphate (DAP) is a widely used phosphorus-based fertilizer crucial for global agriculture. Monitoring Diammonium Phosphate (DAP) prices helps manufacturers, distributors, and buyers make informed procurement decisions and manage costs amid fluctuating demand and supply conditions.

Global Price Overview

The global Diammonium Phosphate (DAP) market shows moderate stability with regional supply differences affecting prices. The Diammonium Phosphate (DAP) price trend has remained mixed, while the price index and…

Titanium Prices, Index, Supply Factors & Uses | Jan 2026

North America Titanium Prices Movement Jan 2026

In January 2026, Titanium prices in North America reached USD 7.09/KG, reflecting a 3.1% increase. The upward movement was supported by firm demand from aerospace, automotive, and defense industries. Stable raw material supply and improving manufacturing activity strengthened market sentiment, contributing to positive pricing momentum across the region.

Regional Analysis: The price analysis can be extended to provide detailed Titanium price information for the following…

More Releases for Lithium

Lithium Compounds Market To Witness Massive Growth | Competitive Outlook Albemar …

Lithium compounds market is expected to gain market growth in the forecast period of 2020 to 2027. Data Bridge Market Research analyses the market to account 20.04 billion by 2027 growing with the CAGR of 20.90% in the above-mentioned forecast period. Huge investments in infrastructure developments is a vital factor driving the growth of lithium compounds market swiftly.

The Lithium Compounds Market research report assesses the ongoing as well as future…

Lithium Compounds Market 2020-2025 Global Analysis & Opportunity Assessment | Li …

The global Lithium Compound market size is projected to reach over USD 9 billion by 2025. Lithium is an alkali metal that is generally present among the soil, human body, animals, and plants. It is a light weight metal with less density when compared to other elements. The lithium compounds, primarily find its application in rechargeable and non-rechargeable batteries. The lithium is primarily used across glass & ceramics, Li-ion batteries,…

Lithium Compounds Market Analysis & Industry Outlook 2019-2025| Livent Corporati …

The global Lithium Compound market size is projected to reach over USD 9 billion by 2025. Lithium is an alkali metal that is generally present among the soil, human body, animals, and plants. It is a light weight metal with less density when compared to other elements. The lithium compounds, primarily find its application in rechargeable and non-rechargeable batteries. The lithium is primarily used across glass & ceramics, Li-ion batteries,…

Lithium Compounds Market Scenario & Industry Outlook 2019-2025| Livent Corporati …

The global lithium compound market size is projected to reach over USD 9 billion by 2025.The report on lithium compound market is aimed to equip report readers with versatile understanding on diverse marketing opportunities that are rampantly available across regional hubs. A thorough assessment and evaluation of these factors are likely to influence incremental growth prospects in the lithium compound market.

Request sample copy of this report at: https://www.adroitmarketresearch.com/contacts/request-sample/1445

Additionally, in this…

Lithium Fluoride Market players Jiangxu Ganfeng Lithium, Harshil Fluoride Brivo …

The developing in the glass, optics and electronic and electrical industries has initiated a high demand for Lithium and related compounds. Lithium and lithium based compounds are one the key substances that have dynamic usage, either as a feedstock or as product. One of the most commercially important compound is Lithium fluoride. Lithium fluoride is an odorless, crystalline lithium salt manufactured by the reaction of lithium hydroxide with hydrogen fluoride.…

Lithium Hydroxide Market | Key Players are FMC Corporation, Sociedad Quimica Min …

Lithium Hydroxide (LiOH) is an inorganic compound that is insoluble in water and partially soluble in ethanol. It is commercially available as a monohydrate (LiOH.H2O) and in anhydrous form, both of which are strong bases. On the basis of purity level, it is also available in battery grade and technical grade. Lithium hydroxide is manufactured by means of a metathesis reaction between calcium hydroxide and lithium carbonate and it finds…