Press release

Carbon Credit/Carbon Offset Market Growth Fueled by Sustainability Mandates, Reaching US$ 2,507.1 Bn by 2032 | Focus on Carbon Credits

The Carbon Credit/Carbon Offset Market is witnessing unprecedented momentum as global economies accelerate decarbonization efforts, driven by net-zero commitments, corporate sustainability mandates, and stringent environmental regulatory frameworks. According to the latest study by Persistence Market Research, the global market for carbon credit/carbon offset is projected to expand at a robust CAGR of 12.1%, increasing from a value of US$ 1,124.4 Bn in 2025 to US$ 2,507.1 Bn by the end of 2032. With climate consciousness penetrating across industries, the carbon offset ecosystem is transforming into a critical financial and environmental instrument for achieving emission reduction targets worldwide.Get Your FREE Sample Report Instantly - Click Now: https://www.persistencemarketresearch.com/samples/33769

Rising Climate Commitments Strengthen Carbon Credit Market Growth

The rapid expansion of the carbon credit/carbon offset market is fundamentally driven by both voluntary and compliance procurement mechanisms as organizations strive to reduce greenhouse gas emissions. Net-zero targets announced by multinational corporations have created a surge in demand for verified offset units, especially in energy, aviation, transportation, agriculture, and forestry sectors. Government-led carbon pricing instruments, such as emission trading schemes (ETS), are catalyzing adoption further by making it mandatory for high-emitting industries to compensate for unavoidable emissions.

In parallel, consumers and investors are increasingly prioritizing climate-friendly products and business operations, compelling organizations to integrate carbon neutrality into their brand identity and operational strategies. The accelerated transition toward low-carbon technologies, coupled with active carbon credit trading platforms, is reinforcing market expansion on a global scale.

Carbon Credit/Carbon Offset Market Segmentation

To offer a comprehensive understanding of market performance, the carbon credit/carbon offset market is segmented based on:

By Type

Compliance Market

Voluntary Market

By Project Type

Forestry and Land Use

Renewable Energy Projects

Waste Management and Methane Capture

Industrial Carbon Capture and Storage (CCS)

Agricultural Emission Reduction Initiatives

By End Use Industry

Power & Energy

Oil & Gas

Transportation & Logistics

Manufacturing Industries

Building & Construction

Others (Agriculture, Mining, etc.)

By Region

North America

Europe

Asia-Pacific

Latin America

Middle East & Africa

This structured segmentation reflects how diverse industries contribute to demand creation and project development within the evolving carbon economy.

Compliance-Based Carbon Credits Lead Market Dominance

The compliance segment continues to lead revenue contribution owing to government-enforced carbon pricing programs. Entities operating across polluting sectors such as oil & gas, power generation, cement, and industrial manufacturing rely heavily on purchasing credits to meet mandatory emission thresholds. The expansion of cap-and-trade programs - particularly the EU ETS, China's national ETS, and regional frameworks in the U.S. and Canada - is further cementing the prominence of the compliance category.

Voluntary Carbon Markets on Fast Growth Trajectory

Voluntary carbon markets are emerging as one of the fastest-growing components of the global carbon offset ecosystem. Corporations striving for sustainability certification, ESG integration, and stakeholder transparency contribute significantly to voluntary offset purchases. These markets promote investments in renewable projects, forest preservation, regenerative agriculture, and emerging carbon removal solutions. Rapid scaling of digital registries and satellite-based measurement technologies enhance transparency and credibility, unlocking broader investor confidence.

Get a Customized Market View in One Click: https://www.persistencemarketresearch.com/request-customization/33769

Forestry and Land Use Projects Drive Largest Offset Generation

Forestry and land use initiatives dominate offset generation due to their high carbon sequestration capacity and global environmental benefits, including biodiversity restoration and soil conservation. Afforestation, reforestation, conservation, and nature-based solutions (NbS) are being prioritized by both governments and private investors. These projects align closely with Sustainable Development Goals (SDGs), making them preferred choices for ESG-oriented funding and compliance credit procurement alike.

Rapid Integration of Carbon Capture and Technological Innovations

Technological innovation plays a central role in expanding carbon offset supply. Breakthroughs in carbon capture, utilization, and storage (CCUS), along with direct air capture (DAC), biochar, and ocean-based carbon removal systems, are paving the way toward scalable climate solutions. Digital MRV (Monitoring, Reporting, and Verification) platforms powered by blockchain and AI are enhancing transparency, trust, and traceability in the market. These innovations are helping to overcome credibility challenges historically associated with carbon credit certification.

Regional Market Insights: Asia-Pacific to Exhibit Strongest Growth

North America and Europe currently hold substantial market shares due to early policy adoption, strict emission reduction mandates, and advanced carbon trading infrastructure. However, Asia-Pacific is poised to deliver the strongest growth in the coming years. Rapid industrialization, cross-border carbon trading expansion, and large-scale investments in renewable energy and forestry initiatives in China, India, Indonesia, and Southeast Asia are key drivers.

Latin America and Africa are gaining attention as project development hotspots, due to abundant forest reserves and significant potential for land-use-based carbon capture projects.

Market Drivers: ESG Investments and Net-Zero Declarations Fuel Demand

Global capital markets are steering rapid adoption of the carbon offset market. Financial institutions are prioritizing low-carbon portfolios, while green bonds, sustainability-linked loans, and climate funds continue to flourish. The booming climate finance sector ensures a steady flow of investments into carbon reduction initiatives.

Corporations are increasingly setting science-based targets (SBTs), with carbon offsets playing a crucial transitional role where emissions are currently technologically or economically difficult to eliminate.

Public-private partnerships are accelerating the rollout of climate projects with measurable and audited carbon benefits.

Challenges and Opportunities in Carbon Credit Market Expansion

While the carbon offset market is projected to scale rapidly, challenges related to standardization, price volatility, certification discrepancies, and double-counting concerns need continued attention. Strengthening governance frameworks under organizations like the Integrity Council for the Voluntary Carbon Market (ICVCM) and emerging global standards will help enhance trust and uptake.

Opportunities are immense for sustainable businesses, financial traders, landowners, project developers, technology disruptors, and marketplaces supporting verified carbon credit exchange. As transparency increases, more corporations and governments are expected to participate actively, unlocking multi-billion-dollar value potential.

Company Insights: Competitive Landscape and Key Players

The carbon credit/carbon offset market features a blend of environmental project developers, carbon trading exchanges, digital climate platforms, and environmental advisory service providers. Leading companies continuously innovate project portfolios and digital traceability tools to improve quality and market access.

Key players operating in the market include:

✦ South Pole Group

✦ Verra

✦ Gold Standard Foundation

✦ ClimatePartner GmbH

✦ 3Degrees Group, Inc.

✦ First Climate AG

✦ Terrapass, Inc.

✦ Carbon Credit Capital, LLC

✦ Anew Climate, LLC

✦ Shell plc (Carbon Solutions)

✦ The Carbon Trust

✦ AirCarbon Exchange

✦ NativeEnergy

✦ Finite Carbon

These companies are shaping market competition and expanding the availability of credible, verified carbon offset products worldwide.

For In-Depth Competitive Analysis, Buy Now: https://www.persistencemarketresearch.com/checkout/33769

Conclusion: A Transformational Decade for Carbon Offset Expansion

As the world enters a critical decade of climate action, the carbon credit/carbon offset market is set to play a decisive role in closing the emissions gap. The industry is witnessing major transformations in pricing, project scalability, digital validation, and cross-border climate cooperation. With projections revealing an impressive rise from US$ 1,124.4 Bn in 2025 to US$ 2,507.1 Bn by 2032, the market stands at the forefront of global sustainability efforts.

Corporations, policymakers, investors, and climate innovators must collaborate strategically to ensure that carbon offsets continue to deliver real environmental impact while supporting equitable economic growth. As demand intensifies and climate accountability becomes central to corporate governance, the carbon credit marketplace will remain a cornerstone instrument in shaping global progress toward a net-zero future.

Explore the Latest Trending Research Reports:

• Aluminosilicates Market Analysis - https://www.persistencemarketresearch.com/market-research/aluminosilicates-market.asp

• Methyl Mercaptan Market Analysis - https://www.persistencemarketresearch.com/market-research/methyl-mercaptan-market.asp

• Vapor Recovery Services Market Analysis - https://www.persistencemarketresearch.com/market-research/vapor-recovery-services-market.asp

Contact Us:

Persistence Market Research

Second Floor, 150 Fleet Street,

London, EC4A 2DQ, United Kingdom

USA Phone: +1 646-878-6329

UK Phone: +44 203-837-5656

Email: sales@persistencemarketresearch.com

Web: https://www.persistencemarketresearch.com

About Persistence Market Research:

At Persistence Market Research, we specialize in creating research studies that serve as strategic tools for driving business growth. Established as a proprietary firm in 2012, we have evolved into a registered company in England and Wales in 2023 under the name Persistence Research & Consultancy Services Ltd. With a solid foundation, we have completed over 3600 custom and syndicate market research projects, and delivered more than 2700 projects for other leading market research companies' clients.

Our approach combines traditional market research methods with modern tools to offer comprehensive research solutions. With a decade of experience, we pride ourselves on deriving actionable insights from data to help businesses stay ahead of the competition. Our client base spans multinational corporations, leading consulting firms, investment funds, and government departments. A significant portion of our sales comes from repeat clients, a testament to the value and trust we've built over the years.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Carbon Credit/Carbon Offset Market Growth Fueled by Sustainability Mandates, Reaching US$ 2,507.1 Bn by 2032 | Focus on Carbon Credits here

News-ID: 4282452 • Views: …

More Releases from Persistence Market Research

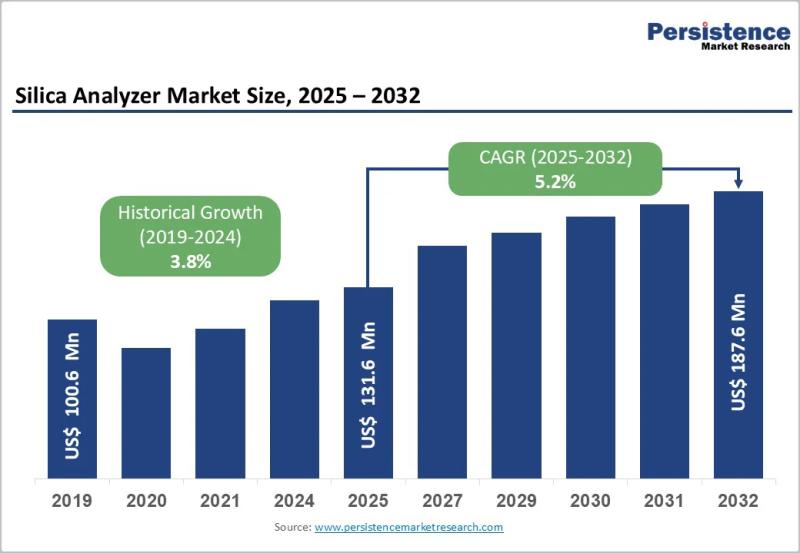

Silica Analyzer Market Size to Reach US$187.6 Million by 2032 - Persistence Mark …

The silica analyzer market plays a critical role in industrial water quality monitoring, particularly in sectors where high purity water is essential for operational efficiency and equipment longevity. Silica analyzers are specialized instruments used to detect and measure silica concentrations in water and steam cycles, preventing scale formation and corrosion in boilers, turbines, and cooling systems. Industries such as power generation, oil and gas, pharmaceuticals, semiconductors, and chemical processing rely…

Soybean Derivatives Market to Hit $390.8B by 2033, Growing at 4.5% CAGR

The global soybean derivatives market is poised for sustained expansion, driven by growing demand across food, feed, and industrial applications. The market is projected to be valued at US$ 288.1 billion in 2026 and is expected to reach US$ 390.8 billion by 2033, reflecting a compound annual growth rate (CAGR) of 4.5% during the forecast period from 2026 to 2033. This growth underscores the continued significance of soybean derivatives as…

Europe Electric Vehicle Market to Reach US$ 571.9 Bn by 2033 as Tesla, Volkswage …

The Europe electric vehicle market is witnessing unprecedented growth, driven by increasing consumer awareness, government policies promoting sustainability, and rapid advancements in electric mobility technologies. As countries across Europe adopt stricter emission regulations and incentivize the adoption of electric vehicles (EVs), manufacturers are accelerating their transition from conventional vehicles to electric alternatives. This shift is not only redefining the automotive industry but is also shaping the region's energy, transportation, and…

Nutmeg Butter Market to Reach $57.6M by 2033, Driven by Rising Demand in Food

The global nutmeg butter market is witnessing significant growth, driven by rising demand from the cosmetic, pharmaceutical, and food industries. The market is estimated to be valued at US$ 39.1 million in 2026 and is projected to reach US$ 57.6 million by 2033, reflecting a compound annual growth rate (CAGR) of 5.7% over the forecast period from 2026 to 2033.

The growth of the nutmeg butter market is largely attributed to…

More Releases for Carbon

Carbon-Carbon Composite Market to Reach $3.31 Billion by 2031 | SGL Carbon, Toyo …

NEW YORK, (UNITED STATES) - QY Research latest 'Carbon-Carbon Composite Market 2025 Report' offers an unparalleled, in-depth analysis of the industry, delivering critical market insights that empower businesses to enhance their knowledge and refine their decision-making processes. This meticulously crafted report serves as a catalyst for growth, unlocking immense opportunities for companies to boost their return rates and solidify their competitive edge in an ever-evolving market. What sets this report…

Carbon Black Market Next Big Thing | Cabot, Tokai Carbon, Jiangxi Black Carbon, …

Market Research Forecast published a new research publication on "Global U.S. U.S. Carbon Black Market Insights, to 2030" with 232 pages and enriched with self-explained Tables and charts in presentable format. In the Study, you will find new evolving Trends, Drivers, Restraints, Opportunities generated by targeting market-associated stakeholders. The growth of the U.S. U.S. Carbon Black Market was mainly driven by the increasing R&D spending across the world.

Get Free Exclusive…

Carbon-Carbon Composite Material Market Size, Share 2024, Impressive Industry Gr …

Report Description: -

QY Research's latest report 'Carbon-Carbon Composite Material Market 2024 Report' provides a comprehensive analysis of the industry with market insights will definitely facilitate to increase the knowledge and decision-making skills of the business, thus providing an immense opportunity for growth. Finally, this will increase the return rate and strengthen the competitive advantage within. Since it's a personalised market report, the services are catered to the particular difficulty. The…

Carbon Black Market Scenario & Industry Applications 2020-2025 | Phillips Carbon …

The global carbon black market size is projected to surpass USD 18 billion by 2025. Carbon black act as a reinforcement material for tires and rubber, and possess electrical conductive properties. Carbon black provide pigmentation, conductivity, and UV protection for a number of coating applications along with toners and printing inks for specific color requirements. Its multiple application across various end product along with rising economic outlook has significantly enhanced…

Global Carbon-Carbon Composite Market 2020-2026 SGL Carbon, Toyo Tanso, Tokai Ca …

Global Carbon-Carbon Composite Market 2020-2026 analysis Report offers a comprehensive analysis of the market. It will therefore via depth Qualitative insights, Historical standing and verifiable projections regarding market size. The projections featured inside the report square measure derived victimisation verified analysis methodologies and assumptions. Report provides a progressive summary of the Carbon-Carbon Composite business 2020 together with definitions, classifications, Carbon-Carbon Composite market research, a decent vary of applications and Carbon-Carbon…

Global Carbon Black Market to 2026| Cabot, Orion Engineered Carbons, Birla Carbo …

Albany, NY, 10th January : Recent research and the current scenario as well as future market potential of "Carbon Black Market - Global Industry Analysis, Size, Share, Growth, Trends, and Forecast 2018 - 2026" globally.

Carbon Black Market - Overview

Carbon black (CB) is manufactured through partial combustion of heavy hydrocarbons under controlled temperature and pressure to obtain fine particles and aggregates having a wide range of structure and surface properties. This…