Press release

Digital Payments and Remittances Market 2025: Future Scope, Growth Analysis, Key Developments, Investment

DataM Intelligence has published a new research report on "Digital Money Transfer and Remittances Market Size 2025". The report explores comprehensive and insightful Information about various key factors like Regional Growth, Segmentation, CAGR, Business Revenue Status of Top Key Players and Drivers. The purpose of this report is to provide a telescopic view of the current market size by value and volume, opportunities, and development status.Get a Sample PDF Of This Report (Get Higher Priority for Corporate Email ID):- https://datamintelligence.com/download-sample/digital-money-transfer-and-remittances-market?kb

Latest M&A Activity

Shift4 Payments announced plans to acquire Global Blue Group for $2.4 billion, expanding its global footprint in payments and digital remittances across retail and travel sectors.

Fintech company Ripple acquired payment infrastructure platform Rail for $200 million in August 2025 to strengthen secure and scalable remittance services through blockchain technology.

Western Union expanded its US retail presence by acquiring Intermex for $500 million, enhancing its digital remittance offerings especially targeting Latin America corridors.

Key Players:

Western Union (WU), Ria Financial Services, PayPal/Xoom, TransferWise, WorldRemit, MoneyGram, Remitly and Azimo.

Growth Forecast Projected:

The Global Digital Money Transfer and Remittances Market is anticipated to rise at a considerable rate during the forecast period, between 2025 and 2032. In 2024, the market is growing at a steady rate, and with the rising adoption of strategies by key players, the market is expected to rise over the projected horizon.

Research Process:

Both primary and secondary data sources have been used in the global Digital Money Transfer and Remittances Market research report. During the research process, a wide range of industry-affecting factors are examined, including governmental regulations, market conditions, competitive levels, historical data, market situation, technological advancements, upcoming developments, in related businesses, as well as market volatility, prospects, potential barriers, and challenges.

Buy Now & Get 30% OFF - (Grab 50% OFF on 2+ reports) @: https://www.datamintelligence.com/buy-now-page?report=digital-money-transfer-and-remittances-market

Key Segments:

By Product Type: (Domestic Money Transfer, International Money Transfer)

By Channel: (Banks, Money Transfer Operators, Online Platforms, Others)

By Application: (Consumer, Enterprise)

Regional Analysis for Market:

⇥ North America (U.S., Canada, Mexico)

⇥ Europe (U.K., Italy, Germany, Russia, France, Spain, The Netherlands and Rest of Europe)

⇥ Asia-Pacific (India, Japan, China, South Korea, Australia, Indonesia Rest of Asia Pacific)

⇥ South America (Colombia, Brazil, Argentina, Rest of South America)

⇥ Middle East & Africa (Saudi Arabia, U.A.E., South Africa, Rest of Middle East & Africa)

Benefits of the Report:

Chapter 1: Sets the stage by outlining the report's coverage, summarizing key market segments by region, product type, and application. Presents a snapshot of market sizes, growth potential across segments, and anticipated industry evolution both short and long term.

Chapter 2: Highlights pivotal market insights and uncovers the most significant emerging trends driving change within the industry.

Chapter 3: Offers an in-depth look at the competitive landscape among Digital Money Transfer and Remittances producers, including revenue shares, strategic moves, and recent mergers and acquisitions.

Chapter 4: Presents comprehensive profiles of the market's key players, delving into details such as revenue, profit margins, product portfolios, and company milestones.

Chapters 5 & 6: Analyze Digital Money Transfer and Remittances revenue at both regional and country levels, providing quantitative breakdowns of market sizes, growth opportunities, and development prospects worldwide.

Chapter 7: Focuses on different market segments by type, examining their individual sizes and potential, guiding readers toward high-impact, untapped market areas.

Chapter 8: Explores segmentation by application, evaluating industry growth potential in various downstream markets and pinpointing promising sectors for expansion.

Chapter 9: Provides a thorough review of the industry's supply chain mapping out both upstream and downstream activities.

Chapter 10: Concludes with a summary of the report's key findings and highlights the most critical takeaways for industry stakeholders.

Get Customization in the report as per your requirements: https://datamintelligence.com/customize/digital-money-transfer-and-remittances-market?kb

Recent Product Launches and Innovations

IDFC First Bank launched 'RemitFIRST2India,' a digital remittance platform for Non-Resident Indians (NRIs) in Singapore and Hong Kong offering real-time tracking, competitive forex rates, and fee-free paperless transfers.

Mastercard enhanced AI-powered remittance capabilities through collaboration with Félix, enabling voice-note initiated remittances between the U.S. and Latin America via Mastercard Move.

Kuda Technologies relaunched a multi-currency digital wallet supporting international remittances directly to Nigerian bank accounts, focusing on simplification and integrated financial services tailored to diaspora users.

Get 2-Day Free Trial + 50% OFF DataM Subscription@: https://www.datamintelligence.com/reports-subscription?kb

Power your decisions with real-time competitor tracking, strategic forecasts, and global investment insights all in one place.

Have a look at our Subscription Dashboard: https://www.youtube.com/watch?v=x5oEiqEqTWg

Contact Us -

Company Name: DataM Intelligence

Contact Person: Sai Kiran

Email: Sai.k@datamintelligence.com

Phone: +1 877 441 4866

Website: https://www.datamintelligence.com

About Us -

DataM Intelligence is a Market Research and Consulting firm that provides end-to-end business solutions to organizations from Research to Consulting. We, at DataM Intelligence, leverage our top trademark trends, insights and developments to emancipate swift and astute solutions to clients like you. We encompass a multitude of syndicate reports and customized reports with a robust methodology.

Our research database features countless statistics and in-depth analyses across a wide range of 6300+ reports in 40+ domains creating business solutions for more than 200+ companies across 50+ countries; catering to the key business research needs that influence the growth trajectory of our vast clientele.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Digital Payments and Remittances Market 2025: Future Scope, Growth Analysis, Key Developments, Investment here

News-ID: 4282341 • Views: …

More Releases from DataM Intelligence 4 Market Research LLP

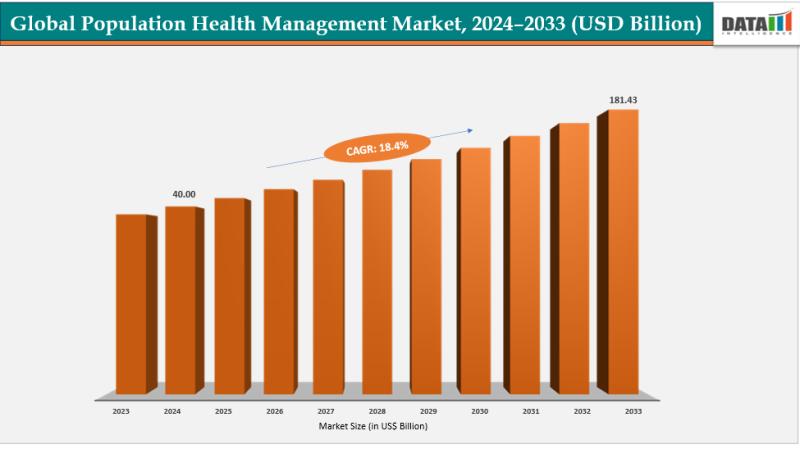

Population Health Management Market Set for Explosive Growth to USD 181.43 Billi …

The Global Population Health Management Market size reached USD 40.00 billion in 2024 and is expected to reach USD 181.43 billion by 2033, growing at a CAGR of 18.4% during the forecast period 2025-2033.

Market growth is driven by the rising prevalence of chronic diseases, increasing adoption of digital health solutions, and growing demand for value-based care models. Advancements in AI and predictive analytics, expanding healthcare IT infrastructure, surging investments in…

Organic Infant Formula Market Set to Grow to US$ 36,046 Million by 2032 at 6.3% …

AUSTIN, Texas and TOKYO -- According to DataM Intelligence, The Organic Infant Formula Market Size reached US$ 20,800 million in 2023, rose to US$ 22,110 million in 2024 and is projected to reach US$ 36,046 million by 2032, expanding at a CAGR of 6.3% from 2025 to 2032. The Organic Infant Formula Market is transforming early childhood nutrition by providing parents with certified organic, high-quality alternatives free from synthetic pesticides,…

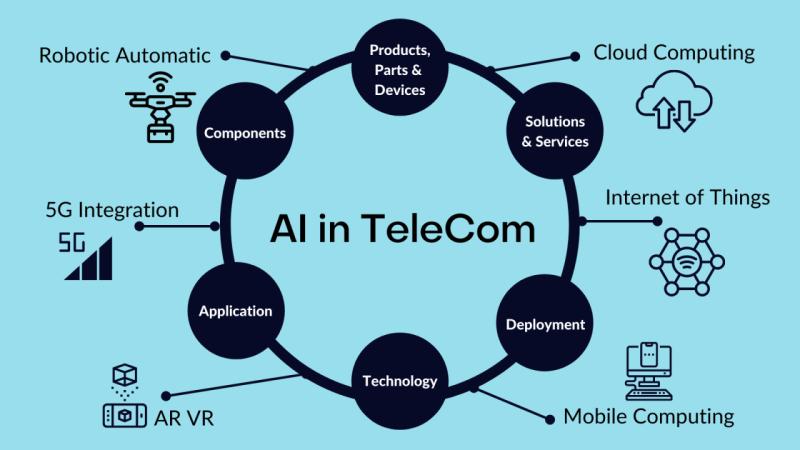

Future of Ai in telecommunication market. AI + Telecommunications Top Technologi …

The global AI in telecommunication market reached US$ 2.25 billion in 2023, with a rise to US$ 2.90 billion in 2024, and is expected to reach US$ 48.98 billion by 2033, growing at a CAGR of 36.9% during the forecast period 2025-2033.

AI in telecommunication market growth is driven by rising data traffic, demand for automated network optimization, predictive maintenance, improved customer experience, cost reduction, and rapid deployment of 5G and…

Bioresorbable Implants Market to Double, Reaching US$ 14.34 Billion by 2033 at 7 …

AUSTIN, Texas and TOKYO -- According to DataM Intelligence, The Bioresorbable Implants Market Size reached US$ 7.00 billion in 2024 and is projected to reach US$ 14.34 billion by 2033, expanding at a CAGR of 7.4% during the forecast period 2025-2033. The Bioresorbable Implants Market is transforming surgical outcomes by dissolving after fulfilling their role, leaving no permanent foreign body and lowering revision risks.

The shift from traditional metallic implants to…

More Releases for Money

Miracle Money Magnets Review: Reprogram Your Money Vibration for Lasting Wealth

Miracle Money Magnets is a mindset transformation program created by Croix Sather that focuses on raising your personal money vibration to attract financial abundance effortlessly. The course teaches how subconscious beliefs, emotional resistance, and daily language patterns create blocks that repel wealth, and provides simple steps to reset them for consistent money flow. Priced accessibly at an introductory $7, it promises to shift users from financial struggle to prosperity by…

Just Between Friends Can Help Save Money & Make Money

Image: https://www.getnews.info/uploads/314b3c2c783a4157e147efd33935356f.jpg

Kids are expensive. Just Between Friends can help you save money and make money.

At Just Between Friends, we understand that children grow fast, which can quickly become expensive for parents.

That's why we host a community event twice a year, where families can sell the things their children no longer use and buy what they need at 50-90% below retail.

Discover a sense of Pride and Purpose when participating at Just…

The Money Wave Reviews (Controversial Or Fake 2023) The Money Wave Price Legitim …

Self-improvement and wealth promotion the The Money Wave has come to light as an innovative concept drawing the attention of thousands around the world. This revolutionary approach, grounded in the latest neuroscience research and antiquated wisdom, will unlock the potential hidden within our brains and allow our brains to generate prosperity and wealth effortlessly. It was developed in the lab of the Dr. Thomas Summers, a top neuroscientist who is…

Mobile Money Market to Witness Huge Growth by 2029 | Orange Money, Epress Union, …

The Latest research study released by HTF MI "Global Mobile Money Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying the importance of different factors that aid market growth. Some of the Major Companies covered in this Research are MTN…

Rising Money Laundering Cases To Boost Anti-Money Laundering Market Growth

Factors such as the surging number of money laundering cases and mounting information technology (IT) expenditure will facilitate the anti-money laundering (AML) market growth during the forecast period (2021-2030). According to P&S Intelligence, the market generated a revenue of $2.4 billion revenue in 2020. Moreover, the surging volume of digital payments, rising technological advancements, and mounting internet traffic will also accelerate the market growth in the foreseeable future. Financial institutions…

Increasing Prevalence of Money Laundering Driving Anti-Money Laundering Market G …

The global anti-money laundering market reached a value of $3 billion in 2020 and it is predicted to exhibit huge expansion between 2021 and 2030 (forecast period). The market is being driven by the surging incidence of money laundering cases and the burgeoning demand for monitoring money laundering activities. Additionally, the soaring information technology (IT) expenditure in several countries is also pushing up the requirement for anti-money laundering (AML) solutions…