Press release

Asset Finance Software Market Estimated to Grow at 11.4% CAGR by 2032 - Persistence Market Research

Market OverviewThe global asset finance software market is entering a high-growth phase as enterprises increasingly rely on automated, data-driven systems to manage leasing, lending, and asset lifecycle operations. According to Persistence Market Research, the market is projected to grow from US$ 4,273.4 Mn in 2025 to US$ 9,098.5 Mn by 2032, registering a robust CAGR of 11.4%. This rising adoption reflects the industry's transition toward digital platforms that optimize asset utilization and enhance ROI across multiple sectors.

A major factor supporting market expansion is the accelerated shift toward subscription-based models, usage-based billing, and Equipment-as-a-Service (EaaS). As businesses move away from traditional ownership to asset-light operations, software platforms capable of managing complex asset portfolios are gaining prominence. The leasing and finance management segment currently dominates due to its extensive application across BFSI and enterprise ecosystems. Regionally, North America leads the global market, driven by high technological adoption, mature leasing ecosystems, and strong demand for automation in financial services.

Elevate your business strategy with comprehensive market data. Request a sample report now: https://www.persistencemarketresearch.com/samples/35431

Key Highlights from the Report

Asset finance software market to reach US$ 9,098.5 Mn by 2032.

Market expected to grow at a CAGR of 11.4% from 2025 to 2032.

Rising demand for EaaS and usage-based financing accelerates adoption.

Leasing and finance management segment leads the overall market.

North America remains the dominant regional market.

AI-driven analytics and automation are key innovation trends.

Market Segmentation

The asset finance software market is segmented based on product type, which typically includes leasing management software, loan management systems, asset lifecycle management platforms, and integrated financial software suites. Leasing and loan management categories continue to account for the largest share due to their extensive use among banks, NBFCs, and leasing companies. These systems streamline credit assessments, automate workflows, and enhance compliance, making them indispensable to organizations operating across global financial markets.

Segmentation by end-user includes BFSI, manufacturing, construction, transportation, healthcare, and IT services. BFSI dominates the market because financial institutions handle vast asset portfolios requiring enhanced monitoring, risk mitigation, and lifecycle tracking. Meanwhile, industries such as construction and manufacturing are rapidly adopting asset finance software to manage heavy equipment, improve accuracy in project costing, and minimize operational downtime.

Secure Your Full Report - Proceed to Checkout: https://www.persistencemarketresearch.com/checkout/35431

Regional Insights

North America holds the largest share of the asset finance software market, driven by advanced fintech ecosystems, high adoption of cloud-based financial platforms, and strong investments in automation across banks and leasing companies. The presence of leading software providers and rapid integration of AI and analytics further strengthens regional growth.

Asia Pacific is the fastest-growing region, supported by expanding digital lending ecosystems, rapid industrialization, and increased adoption of subscription and leasing models among SMEs. Countries such as India, China, and Southeast Asian economies are witnessing rising demand for flexible financing and digitally managed asset systems.

Market Drivers, Restraints & Opportunities

Market Drivers

The market is primarily driven by the global transition toward subscription and usage-based billing models, which require advanced software to manage recurring payments, asset tracking, and contract lifecycle management. Additionally, businesses are increasingly adopting EaaS, fueling demand for platforms capable of automating leasing workflows, predicting asset depreciation, and enabling real-time fleet or equipment monitoring. Rising digital transformation in BFSI and enterprise operations further accelerates software adoption.

Market Restraints

Despite strong growth, the market faces challenges such as high implementation costs and system integration complexities, especially for large enterprises with legacy IT frameworks. Data privacy concerns and regulatory compliance requirements also pose hurdles for financial institutions. Moreover, small businesses often struggle with the initial transition to digital asset management due to limited technical expertise.

Market Opportunities

Significant opportunities emerge from increasing investments in AI-powered financial analytics, predictive maintenance, and cloud-native leasing platforms. The growing adoption of automated risk evaluation tools presents new avenues for software vendors to innovate. Furthermore, rapid digital lending adoption across emerging markets creates strong demand for scalable, cost-effective asset finance software solutions.

Do You Have Any Query Or Specific Requirement? Request Customization of Report: https://www.persistencemarketresearch.com/request-customization/35431

Reasons to Buy the Report

✔ Gain detailed insights into market trends, size, and growth projections.

✔ Understand competitive dynamics and strategic developments by key players.

✔ Identify emerging opportunities across product and end-user segments.

✔ Access reliable regional analysis to support market entry strategies.

✔ Utilize data-backed insights for investment, expansion, and product planning.

Frequently Asked Questions (FAQs)

How big is the asset finance software market?

Who are the key players in the global market for asset finance software?

What is the projected growth rate of the asset finance software market?

What is the market forecast for 2032?

Which region is estimated to dominate the industry through the forecast period?

Company Insights

Oracle Corporation

Finastra

Alfa Financial Software

Cass Information Systems

LTi Technology Solutions

NETSOL Technologies Inc.

TCS (Tata Consultancy Services)

Odessa Technologies

FIS Global

IDS (International Decision Systems)

Recent Developments

NETSOL Technologies launched an upgraded cloud-native version of its flagship leasing and financing platform, enhancing automation and customer experience for enterprise clients.

Odessa Technologies announced AI-powered enhancements to its asset lifecycle management tools, improving predictive analytics and risk modeling capabilities.

Conclusion

The asset finance software market is poised for transformative growth as enterprises adopt digital-first strategies to manage complex asset portfolios. From automated leasing systems to AI-enabled risk assessment tools, modern asset finance solutions are reshaping the financial landscape. With rising demand for subscription-based and EaaS models, vendors who prioritize automation, cloud adoption, and advanced analytics will hold a competitive edge. As global markets evolve, the future of asset finance will rely heavily on intelligent, integrated software ecosystems capable of powering smarter, faster, and more flexible financial operations.

Related Reports:

Photo Printers Market https://www.persistencemarketresearch.com/market-research/photo-printers-market.asp

Automotive Predictive Analytics Market https://www.persistencemarketresearch.com/market-research/automotive-predictive-analytics-market.asp

Crisis, Emergency, and Incident Management Platforms Market https://www.persistencemarketresearch.com/market-research/crisis-emergency-and-incident-management-platforms-market.asp

Nanoscale 3D Printing Market https://www.persistencemarketresearch.com/market-research/nanoscale-3d-printing-market.asp

Contact Us:

Persistence Market Research

Second Floor, 150 Fleet Street,

London, EC4A 2DQ, United Kingdom

USA Phone: +1 646-878-6329

UK Phone: +44 203-837-5656

Email: sales@persistencemarketresearch.com

Web: https://www.persistencemarketresearch.com

About Persistence Market Research:

At Persistence Market Research, we specialize in creating research studies that serve as strategic tools for driving business growth. Established as a proprietary firm in 2012, we have evolved into a registered company in England and Wales in 2023 under the name Persistence Research & Consultancy Services Ltd. With a solid foundation, we have completed over 3600 custom and syndicate market research projects, and delivered more than 2700 projects for other leading market research companies' clients.

Our approach combines traditional market research methods with modern tools to offer comprehensive research solutions. With a decade of experience, we pride ourselves on deriving actionable insights from data to help businesses stay ahead of the competition. Our client base spans multinational corporations, leading consulting firms, investment funds, and government departments. A significant portion of our sales comes from repeat clients, a testament to the value and trust we've built over the years.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Asset Finance Software Market Estimated to Grow at 11.4% CAGR by 2032 - Persistence Market Research here

News-ID: 4282276 • Views: …

More Releases from Persistence Market Research

India Aluminum Beverage Can Market Size to Reach US$ 0.8 Bn by 2032 - Persistenc …

The India aluminum beverage can market is undergoing a significant transformation, driven by changing consumer lifestyles, rising urbanization, and a noticeable shift toward sustainable and convenient packaging formats. Aluminum beverage cans are increasingly preferred across carbonated soft drinks, energy drinks, sports beverages, alcoholic drinks, and ready-to-drink juices due to their lightweight structure, portability, fast chilling properties, and superior recyclability. In India, where on-the-go consumption is accelerating rapidly, aluminum cans are…

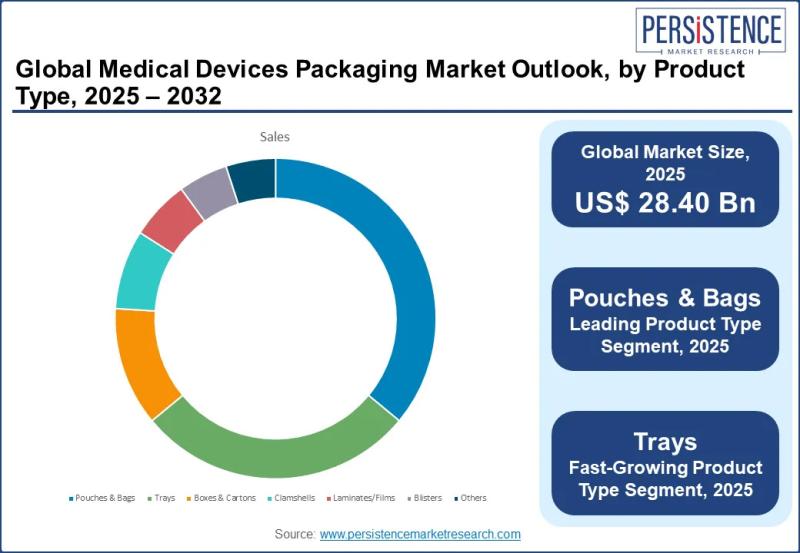

Medical Devices Packaging Market Size to Reach US$ 41.57 Billion by 2032 - Persi …

The medical devices packaging market plays a vital role within the global healthcare ecosystem, acting as a protective and regulatory bridge between manufacturers and end users. Medical device packaging refers to specialized materials and formats designed to safeguard medical instruments, implants, diagnostic tools, and consumables throughout storage, transportation, and clinical use. These packaging solutions are engineered to maintain sterility, prevent contamination, ensure ease of handling, and comply with strict regulatory…

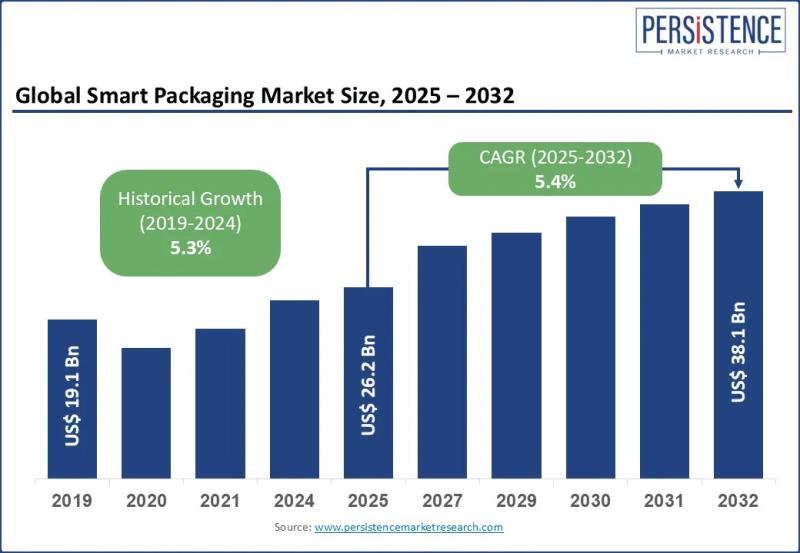

Smart Packaging Market Size Valued at US$ 26.2 Bn in 2025, Projected to Reach US …

The smart packaging market is rapidly transforming the global packaging landscape by integrating advanced technologies with traditional packaging materials to deliver enhanced functionality, traceability, and consumer engagement. Smart packaging refers to packaging systems embedded with features such as sensors indicators QR codes RFID tags and data tracking mechanisms that monitor product condition authenticity and movement across the supply chain. These solutions are increasingly adopted as businesses shift from passive containment…

Football Equipment Market Set for Strong Global Growth Through 2032

The global football equipment market continues to display resilient growth driven by rising participation in football across all age groups, expanding commercial opportunities, and technological advancements in sports gear. The industry is expected to grow from an estimated US$ 18.7 billion in 2025 to approximately US$ 24.1 billion by 2032, registering a compound annual growth rate (CAGR) of 3.7% over the forecast period.

➤ Download Your Free Sample & Explore Key…

More Releases for Asset

Klydex Global Inc Expands Asset Coverage with New Multi-Asset Listing Framework

The new listing structure accelerates asset onboarding and improves market diversification.

Colorado, United States, 1st Dec 2025 - Klydex Global, Inc introduced an expanded multi-asset listing framework that accelerates the onboarding of high-quality digital assets. The new structure enhances screening procedures, technical integration, and market-readiness evaluation to support global asset diversification.

Klydex Global, Inc announced the launch of its enhanced multi-asset listing framework, representing a significant step toward diversifying asset choices for…

Asset Performance Management Market Is Driven By Asset Performance Management In …

Asset Performance Management (APM) has emerged as a critical solution for industries aiming to enhance the performance, reliability, and efficiency of their assets. APM systems utilize data analytics, predictive maintenance, and monitoring technologies to optimize asset performance, minimize downtime, and maximize operational efficiency. The global Asset Performance Management market is characterized by key drivers and notable trends that are reshaping how industries manage and maintain their critical assets.

Download Free PDF…

Asset Management Software

In today's dynamic business landscape, efficient asset management is more critical than ever. Sunsmart Asset Management Software is designed to empower organizations of all sizes and industries to streamline their asset-related processes, enhance control, and maximize the value of their assets.

Key Features and Benefits:

Comprehensive Asset Tracking: Our software provides a centralized platform to track and manage assets, offering real-time visibility into asset location, condition, and history, reducing the risk of…

Asset Evaluation Service Market 2023-2030 Comprehensive Research Study and Stron …

Infinity Business Insights published a new research publication on Asset Evaluation Service Market Insights, to 2030 with 113+ pages and enriched with self-explained Tables and charts in presentable format. The worldwide Asset Evaluation Service market is expected to grow at a booming CAGR during 2023-2030. It also shows the importance of the Asset Evaluation Service market main players in the sector, including their business overviews, financial summaries, and SWOT assessments.

The…

Big Boom in Asset Recovery Software Market 2020-2027 |HPE , Terrapin Systems , C …

According to a report on Asset Recovery Software Market, recently added to the vast repository of Research N Reports, the global market is likely to gain significant impetus in the near future. The report, titled “Global Asset Recovery Software Market Research Report 2020,” further explains the major drivers manipulating industry, the possibility of development, and the challenges going up against the administrations and industrialists in the market. This research study…

Crypto Asset Management Market | Digital Asset Custody Company, Crypto Finance A …

Global Crypto Asset Management Market: Snapshot

The demand within the global market for crypto asset management has been rising on account of advancements in the field of crypto currency. The past years have been an era of advancements in the global digital industry and have paved way for several new technologies. In this stampede of digital transformations, crypto currency has emerged as a matter of discussion and recourse. Hence, the global…