Press release

Automotive Usage-Based Insurance Market to Surge to US$270.3 Billion by 2032, Exhibiting a Powerful 21.3% CAGR

The global Automotive Usage-Based Insurance (UBI) Market is undergoing a rapid and transformative shift as insurers, automakers, and technology providers embrace data-driven risk assessment models. According to Persistence Market Research, the market is valued at US$ 69.8 billion in 2025 and is projected to rise at a remarkable CAGR of 21.3%, ultimately reaching US$ 270.3 billion by 2032. This rapid growth reflects the rising adoption of telematics, increasing consumer preference for personalized premium structures, and regulatory support for advanced mobility solutions. As vehicle connectivity expands and insurers move toward behavior-based pricing, the UBI market is expected to become a mainstream insurance model worldwide.The study reveals that the market's momentum is strongly influenced by the integration of IoT, sophisticated analytics, and smartphone-based monitoring platforms. Consumers, particularly younger drivers, prefer usage-based models for their transparency and cost-saving potential. Among all segments, Pay-How-You-Drive (PHYD) insurance is emerging as the leading category due to its direct correlation between driving behavior and premium calculations. Regionally, North America dominates the market, driven by high telematics penetration, strong insurer participation, and favorable regulatory frameworks that encourage real-time data usage. Meanwhile, Europe and Asia-Pacific are rapidly catching up, supported by growing smart mobility ecosystems and rising road safety initiatives.

Get a Sample PDF Brochure of the Report (Use Corporate Email ID for Quick Response): https://www.persistencemarketresearch.com/samples/29038

The key players studied in the report include:

Key players operating in the Automotive Usage-Based Insurance Market include:

• Progressive Corporation

• Allstate Corporation

• State Farm Mutual Automobile Insurance Company

• Liberty Mutual Insurance

• Nationwide Mutual Insurance Company

• American Family Insurance

• Esurance (a subsidiary of Allstate)

• Metromile

• Root Insurance

• Aviva

Key Highlights from the Report

➤ The market is projected to reach US$ 270.3 billion by 2032, growing at 21.3% CAGR from 2025 to 2032.

➤ Pay-How-You-Drive (PHYD) remains the most preferred UBI model, driven by demand for cost-efficient insurance.

➤ Telematics-based insurance adoption is rising as connected-car penetration increases globally.

➤ North America leads the market due to higher consumer awareness and widespread telematics integration.

➤ Smartphone-based UBI solutions are gaining traction due to low installation costs and easy accessibility.

➤ Growing demand for personalized, data-driven insurance pricing is reshaping insurer product portfolios worldwide.

Automotive Usage-based Insurance Market Segmentation

By Type

• Pay-As-You-Drive (PAYD)

• Pay-How-You-Drive (PHYD)

• Pay-As-You-Go (PAYG)

• Manage-How-You-Drive (MHYD)

By Technology

• OBD-II-based UBI

• Smartphone-based UBI

• Black Box-based UBI

• Embedded System-based UBI

• Others

By Vehicle Usage

• New Vehicle

• Old Vehicle

By Vehicle Type

• Passenger Vehicles

• Commercial Vehicles

By Region

• North America

• Europe

• East Asia

• South Asia and Oceania

• Latin America

• Middle East and Africa

Do You Have Any Query Or Specific Requirement? Request Customization of Report: https://www.persistencemarketresearch.com/request-customization/29038

Regional Insights

North America continues to command a significant share of the global automotive usage-based insurance market. The region's dominance stems from high technology adoption, robust insurer engagement, and structured telematics regulatory frameworks. The U.S. leads with widespread implementation of connected-car services, while Canada follows closely behind with increasing consumer acceptance of behavior-based insurance products. As a result, insurers operating in the region invest heavily in mobile telematics applications and data analytics tools to provide personalized policies.

Europe exhibits strong momentum as well, driven by rising safety regulations, expanding electric vehicle adoption, and growing smart mobility initiatives. Countries such as the U.K., Italy, and Germany have seen rapid UBI uptake as insurers collaborate with automakers to embed telematics systems directly into vehicles. Meanwhile, Asia-Pacific markets including China, India, and Japan are witnessing accelerating UBI adoption due to expanding urbanization, rising vehicle ownership, and increased awareness of road safety benefits.

Market Drivers

The automotive usage-based insurance market is powered by multiple strong growth drivers, with telematics technology serving as the cornerstone for innovation. As vehicles become increasingly connected through IoT-enabled systems, insurers gain real-time access to detailed driving metrics such as acceleration patterns, braking frequency, and mileage. This surge in accessible data enables insurers to offer highly personalized and transparent insurance premiums, motivating safe driving and resulting in reduced overall risk for insurance providers. Additionally, growing consumer awareness regarding cost-efficient insurance models is accelerating the shift from traditional fixed-premium policies to behavior-based, usage-focused insurance plans. Younger, tech-savvy drivers are particularly drawn to UBI as it provides control over premiums based on their driving performance.

Another major driver is the rising push for road safety across global markets. Governments and regulatory bodies are increasingly promoting telematics adoption to improve traffic safety and reduce accident rates. Fleet operators also contribute significantly to market demand as they leverage UBI solutions to monitor driver behavior, reduce operational risks, and enhance fleet productivity. These factors collectively fuel the rapid expansion of the UBI market, making advanced data analytics, machine learning, and real-time monitoring central pillars of modern automotive insurance.

Market Restraints

Despite its strong growth trajectory, the automotive usage-based insurance market faces several notable restraints. One of the major challenges is consumer concern over data privacy and security. The extensive collection of real-time driver data raises questions regarding how insurers store, process, and utilize the information. In regions with stringent data protection laws, such as Europe, insurers must invest heavily in secure data infrastructure and regulatory compliance, which can increase operational costs. Additionally, some drivers remain skeptical about continuous monitoring, fearing potential misuse of their behavioral data or unexpected premium adjustments based on occasional driving anomalies.

Another significant restraint stems from technological limitations and infrastructure gaps in emerging markets. While telematics adoption is rising, the high cost of black-box installations and inconsistent network connectivity can hinder widespread use in developing regions. Moreover, insurers may struggle to integrate telematics data with legacy systems, causing delays in product deployment. The lack of standardized telematics protocols across regions also complicates scalability, reducing the speed at which insurers can introduce new usage-based insurance solutions. These constraints may temporarily slow adoption in specific markets, requiring coordinated efforts among insurers, technology providers, and regulators to overcome them.

Market Opportunities

The automotive UBI market offers substantial opportunities as advanced mobility trends continue to reshape global transportation ecosystems. The rapid expansion of connected vehicles and electric vehicles provides insurers with new entry points to embed telematics and real-time data solutions directly into onboard systems. As automakers increasingly partner with insurers, new innovations such as integrated in-car UBI dashboards and automated premium updates are likely to emerge. This collaboration opens the door for insurers to provide dynamic, responsive coverage that evolves alongside driver behavior and vehicle health conditions, creating a seamless customer experience.

Another promising opportunity lies in the rise of autonomous and semi-autonomous vehicles, which will require entirely new insurance frameworks. Usage-based models are well positioned to support this shift, as insurers can assess risk based not only on human driving behavior but also on vehicle performance data. Furthermore, commercial fleets-including logistics operators, last-mile delivery services, and ride-sharing companies-represent a growing customer base for UBI adoption. These enterprises increasingly seek flexible, scalable insurance solutions that reduce claim costs and improve operational efficiency. As digital mobility ecosystems expand, UBI is expected to play a critical role in shaping the future of automotive insurance.

Buy Now to get exclusive insights: https://www.persistencemarketresearch.com/checkout/29038

Recent Developments:

• Several insurers have expanded smartphone-based telematics programs to reduce hardware installation costs and improve user accessibility.

• Strategic partnerships between automakers and UBI providers have intensified, enabling factory-fitted telematics systems for seamless insurance integration.

Frequently Asked Questions

➤ What are the main factors influencing the Automotive Usage-Based Insurance Market 2025-2032?

➤ Which companies are the major sources in this industry?

➤ What are the market's opportunities, risks, and general structure?

➤ Which of the top Automotive Usage-Based Insurance Market 2025-2032 companies compare in terms of sales, revenue, and prices?

➤ How are market types and applications and deals, revenue, and value explored?

Future Opportunities and Growth Prospects

The future of the automotive usage-based insurance market is shaped by the convergence of intelligent mobility solutions, digital platforms, and advanced data analytics. As the global shift toward smart transportation accelerates, insurers are poised to unlock new growth avenues by offering hyper-personalized, flexible insurance models tailored to diverse mobility behaviors. The integration of 5G networks, AI-powered risk scoring, and vehicle-to-everything (V2X) communication will further enhance the accuracy of usage-based insurance systems. With connected and autonomous vehicles on the horizon, UBI is expected to evolve from a niche product to a standard insurance model, supporting a safer, more efficient, and more transparent global mobility ecosystem.

Explore the Latest Trending Research Reports:

Automotive Active Rear Spoiler Market: https://www.persistencemarketresearch.com/market-research/automotive-active-rear-spoiler-market.asp

Automotive Decorative Films Market: https://www.persistencemarketresearch.com/market-research/automotive-decorative-film-market.asp

Automotive Grab Handle Market: https://www.persistencemarketresearch.com/market-research/automotive-grab-handle-market.asp

Automotive Intelligent Door System Market: https://www.persistencemarketresearch.com/market-research/automotive-intelligent-door-system-market.asp

Contact Us:

Persistence Market Research

Second Floor, 150 Fleet Street, London, EC4A 2DQ, United Kingdom

USA Phone: +1 646-878-6329

UK Phone: +44 203-837-5656

Email: sales@persistencemarketresearch.com

Web: https://www.persistencemarketresearch.com

About Persistence Market Research:

At Persistence Market Research, we specialize in creating research studies that serve as strategic tools for driving business growth. Established as a proprietary firm in 2012, we have evolved into a registered company in England and Wales in 2023 under the name Persistence Research & Consultancy Services Ltd. With a solid foundation, we have completed over 3600 custom and syndicate market research projects, and delivered more than 2700 projects for other leading market research companies' clients.

Our approach combines traditional market research methods with modern tools to offer comprehensive research solutions. With a decade of experience, we pride ourselves on deriving actionable insights from data to help businesses stay ahead of the competition. Our client base spans multinational corporations, leading consulting firms, investment funds, and government departments. A significant portion of our sales comes from repeat clients, a testament to the value and trust we've built over the years.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Automotive Usage-Based Insurance Market to Surge to US$270.3 Billion by 2032, Exhibiting a Powerful 21.3% CAGR here

News-ID: 4279961 • Views: …

More Releases from Persistence Market Research

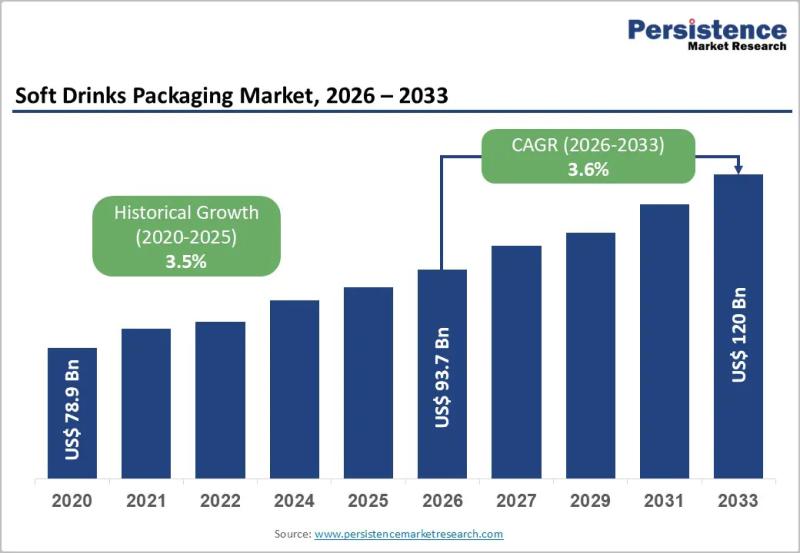

Soft Drinks Packaging Market to Reach US$120.0 Billion by 2033 - Persistence Mar …

The soft drinks packaging market plays a central role in the global beverage industry, serving carbonated drinks, juices, flavored water, energy drinks, and ready to drink teas and coffees. Packaging is no longer limited to containment and transportation; it has evolved into a critical component of branding, sustainability strategy, consumer convenience, and supply chain efficiency. Manufacturers are increasingly focusing on lightweight materials, recyclable packaging formats, and innovative designs that improve…

Christmas Tree Valves Market Size to Reach US$8.1 Billion by 2033 - Persistence …

The Christmas Tree Valves Market plays a critical role in the upstream oil and gas industry, serving as a central component in wellhead equipment systems. Christmas tree valves are installed on oil and gas wells to control pressure, regulate flow, and ensure safe extraction of hydrocarbons. These assemblies, commonly referred to as "Christmas trees," consist of multiple valves, spools, and fittings arranged in a structure that resembles a decorated tree.…

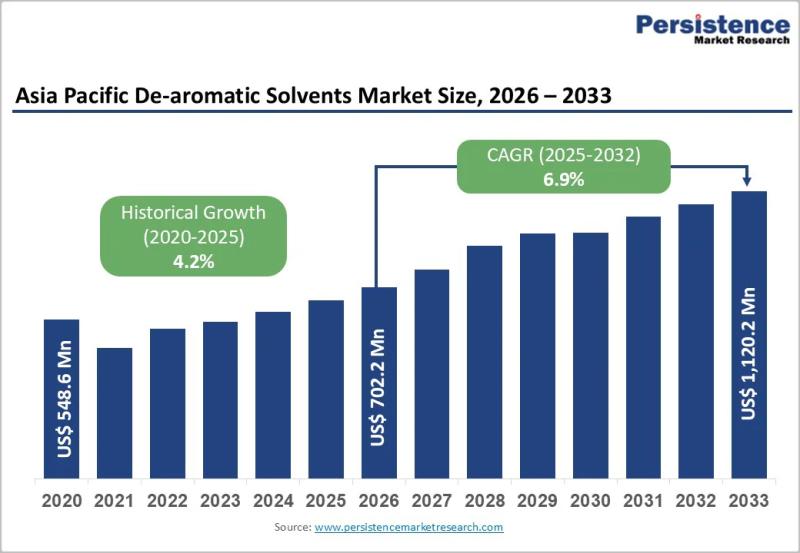

Asia Pacific De-aromatic Solvents Market to Reach US$1,120.2 Million by 2033 - P …

The Asia Pacific De-aromatic Solvents Market is gaining steady momentum as industries across the region increasingly shift toward low aromatic, high purity solvent formulations. De-aromatic solvents are hydrocarbon solvents that have significantly reduced aromatic content, making them suitable for applications requiring low odor, lower toxicity, and improved environmental performance. These solvents are widely used in paints and coatings, adhesives, inks, metalworking fluids, agrochemicals, and cleaning formulations. As regulatory scrutiny around…

Off-Highway Radiators Market to Reach US$ 7.2 Bn by 2033 as Leading Players Like …

The off-highway radiators market plays a vital role in ensuring efficient thermal management in heavy-duty equipment used across construction, agriculture, mining, and forestry sectors. These radiators regulate engine temperatures, prevent overheating, and support consistent equipment performance under extreme operating conditions. Growing mechanization and the expansion of infrastructure projects worldwide are increasing reliance on durable cooling systems. Equipment manufacturers are prioritizing high-performance radiators that offer reliability, longer service life, and resistance…

More Releases for UBI

Usage Based Insurance (Ubi) Market: A Comprehensive Overview

The Usage-Based Insurance (UBI) Market was valued at USD 43.38 billion in 2023 and is expected to grow to approximately USD 87.0 billion by 2033, reflecting a CAGR of about 7.2% from 2024 to 2033.

Usage Based Insurance (Ubi) Market Overview

The Usage-Based Insurance (UBI) Market is experiencing significant growth, driven by advancements in telematics and the increasing adoption of connected vehicles. UBI models, such as Pay-As-You-Drive (PAYD) and Pay-How-You-Drive (PHYD), utilize…

Usage Based Insurance (Ubi) Market Size Unlocking New Opportunities for Success

The global Usage-Based Insurance (UBI) Market was valued at approximately USD 33.27 billion in 2023 and is projected to reach around USD 232.94 billion by 2032, growing at a compound annual growth rate (CAGR) of 24.14% from 2024 to 2032.

Usage Based Insurance (Ubi) Market Overview

Usage-Based Insurance (UBI) is an innovative auto insurance model that determines premiums based on individual driving behaviors, such as distance traveled, speed, braking patterns, and time…

Usage-based Insurance (UBI) Market Revenue Sizing Outlook Appears Bright

Global Usage-based Insurance (UBI) Market Report from Market Insights Report highlights deep analysis on market characteristics, sizing, estimates and growth by segmentation, regional breakdowns & country along with competitive landscape, player's market shares, and strategies that are key in the market. The exploration provides a 360° view and insights, highlighting major outcomes of the industry. These insights help the business decision-makers to formulate better business plans and make informed decisions…

Usage-based Insurance (UBI) Market Will Generate Record Revenue by 2029

The global UBI market is anticipated to grow at a CAGR of 27.9% during the forecast period. Due to the increasing demand for usage-based insurance for automotive continues, along with the strong ecosystem is getting created around connected automotive services. This ecosystem involves participants such as automotive IoT and insurance platform providers, data platform and analytics companies, automotive insurance black box and telematics providers, big data companies, and cloud service providers. For…

Usage-based Insurance (UBI) Market to Witness Growth Acceleration by 2029

The global UBI market is anticipated to grow at a CAGR of 27.9% during the forecast period. Due to the increasing demand for usage-based insurance for automotive continues, along with the strong ecosystem is getting created around connected automotive services. This ecosystem involves participants such as automotive IoT and insurance platform providers, data platform and analytics companies, automotive insurance black box and telematics providers, big data companies, and cloud service providers. For…

Usage-Based Insurance (UBI) Market by Policy Type [Pay-As-You-Drive Insurance (P …

UBI Market Size

The global usage-based insurance market size was valued at $28.7 billion in 2019, and is projected to reach $149.2 billion by 2027, growing at a CAGR of 25.1% from 2020 to 2027. Usage-based insurance is expected to grow rapidly in the coming years. Key drivers of the usage-based insurance market include the growing adoption of telematics technology in the automotive insurance space.

Download Free Sample: https://reports.valuates.com/request/sample/ALLI-Auto-0U87/Usage_Based_Insurance

Trends Influencing the Global…