Press release

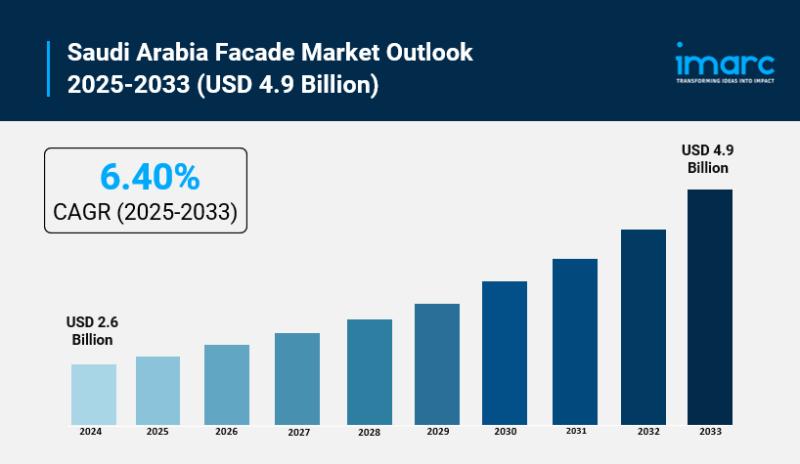

Saudi Arabia Facade Market Size Projected to Reach USD 4.9 Billion by 2033, At CAGR 6.40%

Saudi Arabia Facade Market OverviewMarket Size in 2024: USD 2.6 Billion

Market Size in 2033: USD 4.9 Billion

Market Growth Rate 2025-2033: 6.40%

According to IMARC Group's latest research publication, "Saudi Arabia Facade Market Size, Share, Trends and Forecast by Product Type, Material, End Use, and Region, 2025-2033", The Saudi Arabia facade market size reached USD 2.6 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 4.9 Billion by 2033, exhibiting a growth rate (CAGR) of 6.40% during 2025-2033.

Download a sample PDF of this report: https://www.imarcgroup.com/saudi-arabia-facade-market/requestsample

How AI is Reshaping the Future of Saudi Arabia Facade Market

● AI-driven design tools are transforming Saudi Arabia's facade market, enabling architects to create more energy-efficient and visually striking buildings with greater precision and speed.

● Government initiatives under Vision 2030 promote AI adoption in construction, fueling smart facades that dynamically adjust to environmental conditions, improving energy savings and occupant comfort.

● Companies like IHCC Industries and Ladun Investment are leveraging AI-enabled manufacturing and installation processes to ensure high quality, reduce waste, and meet rising demand for advanced facade solutions.

● AI-powered digital twins and simulation platforms enhance facade performance by analyzing solar exposure, thermal behavior, and structural integrity before actual construction begins.

● Saudi Arabia's expanding AI ecosystem, with investments in data centers and strategic partnerships with global tech firms, accelerates innovation in smart building facades, supporting the broader sustainable urban development agenda.

How Vision 2030 is Transforming Saudi Arabia Facade Industry?

Vision 2030 is transforming the Saudi Arabia façade market by driving large-scale construction, urban redevelopment, and sustainable building initiatives across key cities. With rising investments in smart infrastructure, mixed-use projects, and giga-developments, demand for high-performance façades featuring energy efficiency, thermal insulation, and advanced materials is increasing. The government's push for green building standards and modern architectural aesthetics is also encouraging innovation in glass, aluminum, and modular façade systems, strengthening market growth and technological advancement.

Saudi Arabia Facade Market Trends & Drivers:

The rapid urbanization and extensive infrastructure development under Saudi Arabia's Vision 2030 plan are major forces boosting the facade market. With around 85% of the population now living in urban areas, cities like Riyadh, Jeddah, and Dammam are expanding fast, fueling demand for modern building exteriors that cope with the harsh desert climate. Large-scale projects like Neom and the Mukaab mixed-use development require advanced facade solutions offering thermal insulation, solar control, and durability. Government incentives and urban development policies further spur investment in high-tech facade materials and systems, helping the market grow alongside the country's broader economic transformation.

Sustainability is becoming a game changer in the Saudi facade market as energy efficiency and green building practices take center stage. Policies like the Saudi Green Building Code mandate eco-friendly designs and sustainable materials, ramping up the use of ventilated facades, smart glass, and kinetic shading systems. Companies such as IHCC Industries and major developers are pushing innovations that balance aesthetics with environmental performance. This shift is reflected in rising market revenues, with the facade segment valued at around $2.6 billion recently and a steady rise in demand for products that lower energy consumption and boost indoor comfort.

Technological innovation and strategic partnerships are also shaping the sector's growth. Saudi companies are collaborating with international players like Schüco to bring cutting-edge facade engineering solutions. Recent deals such as Ladun Investment's $27 million aluminum facade contract for luxury projects highlight the appetite for high-end, custom designs that strengthen brand identity and architectural prestige. These collaborations not only elevate design standards but also embed durability, energy efficiency, and smart functionality, positioning Saudi Arabia as a regional hub for advanced facade technologies and sustainable construction practices.

Access the Latest 2026 Data & Forecasts: https://www.imarcgroup.com/checkout?id=32149&method=1315

Saudi Arabia Facade Industry Segmentation:

The report has segmented the market into the following categories:

Product Type Insights:

● Ventilated

● Non-Ventilated

● Others

Material Insights:

● Glass

● Metal

● Plastic and Fiber

● Stones

● Others

End Use Insights:

● Commercial

● Residential

● Industrial

Regional Insights:

● Northern and Central Region

● Western Region

● Eastern Region

● Southern Region

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Recent News and Developments in Saudi Arabia Facade Market

● November 2025: Ladun Investment secured $27.19 million contracts for aluminum facade installation, boosting premium facade projects with advanced materials.

● November 2025: Sika acquired Awazil Al Khaleej Industrial, enhancing waterproofing and facade solutions, expanding its footprint across Saudi and GCC construction markets.

● October 2025: Saudi Build 2025 showcased innovations in concrete and decorative facades, highlighting sustainable coatings and smart building materials.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Saudi Arabia Facade Market Size Projected to Reach USD 4.9 Billion by 2033, At CAGR 6.40% here

News-ID: 4279424 • Views: …

More Releases from IMARC Group

Green Tea Bags Manufacturing Plant DPR 2026: Investment Cost, Market Growth & RO …

Setting up a green tea bags manufacturing plant positions investors within one of the steadily expanding and health-oriented segments of the global beverage industry, driven by increasing consumer awareness of wellness, rising preference for natural antioxidants, and growing demand for convenient herbal drink options. Green tea is widely valued for its perceived health benefits, including metabolism support and antioxidant properties, making it popular among health-conscious urban populations.

The shift toward…

Calcium Acetate Prices Q4 2025: USA Reaches USD 1,165/MT While China Trades at U …

North America Calcium Acetate Price Outlook Q4 2025:

United States Calcium Acetate Price Overview:

In Q4 2025, calcium acetate prices in the United States reached USD 1165 per metric ton. The market remained firm due to steady demand from food processing, pharmaceuticals, and wastewater treatment sectors. Stable consumption patterns and moderate production costs supported pricing levels. Supply chain efficiency and consistent raw material availability helped prevent sharp fluctuations during the quarter.

Get the…

Automotive Radiator Manufacturing Plant DPR & Unit Setup - 2026: Demand Analysis …

Setting up an Automotive Radiator manufacturing plant positions investors in one of the most critical and high-demand segments of the global automotive components and thermal management industry, backed by sustained global growth driven by rising vehicle production, increasing regulatory focus on engine efficiency and emission reduction, and the growing adoption of electric and hybrid vehicles requiring advanced cooling solutions. As global automotive production expands across emerging economies, regulatory frameworks continue…

Watch Manufacturing Plant DPR & Unit Setup - 2026: Machinery, CapEx/OpEx, ROI an …

Setting up a watch manufacturing plant positions investors at the convergence of precision engineering, consumer lifestyle, luxury goods, and wearable technology - one of the most dynamic and diversified segments of the global consumer goods industry - driven by rising demand for luxury and premium accessories, increasing adoption of smart and hybrid watches, growing disposable incomes across emerging markets, and expanding e-commerce and organized retail channels enabling access to global…

More Releases for Saudi

Saudi Wakala Offers Efficient and Reliable Saudi Visa Stamping Services

Saudi Wakala, a renowned agency specializing in Saudi visa stamping services, is proud to announce its commitment to providing swift and reliable visa processing for travelers to Saudi Arabia. Located in New Delhi, Saudi Wakala has established itself as a trusted partner for individuals and businesses requiring efficient visa stamping services.

Efficient Visa Processing

Understanding the complexities and time-sensitivity associated with visa stamping, Saudi Wakala offers a streamlined process managed by an…

saudi construction company,TOP saudi arabia construction companies list,civil co …

Abdul Ali Al-Ajmi Company

Advanced Support Company

Al Ashbelya Engineering

Al-Dour Engineering Contracting Est.

https://www.gdwatches.cn/

Free engineering construction consultation

Email:nolan@wholsale9.com

Alfanar

Arabian Tile Co. Ltd. (ARTIC)

Assad Said for Contracting Co Ltd

Automated Buildings Company

Bazy Trading and Contracting

Bin Dayel Contracting

Cercon

City Cement Company

Dar Al Majd

EG & G Middle East

East Consulting Engineering Center

El Seif Engineering Contracting Company

El Seif Engineering Contracting Company

Engineering Development Co for Contracting

FCC Company

https://www.gdwatches.cn/

Free engineering construction consultation

Email:nolan@wholsale9.com

Jones Engineering Group

Masar Consulting Engineer

Meinhardt Arabia

Mohammed M. Al Rashid Co. (MARCO)

Qureshi Telecom Contracting &…

Saudi Arabia Agriculture Market, Saudi Arabia Agriculture Industry, Saudi Arabia …

Saudi Arabia Agriculture is focussed on the spread of dates, dairy farm merchandise, eggs, fish, poultry, vegetables, and flowers to markets round the creation because it has attained its own potency within the production of such merchandise. The private sector additionally plays a role within the nation's agriculture, because the government offers long-term interest-free loans and inexpensive water, fuel, electricity, and duty-free imports of raw materials and machinery. Over the past…

Saudi Arabia Pharmaceutical Market | pharmaceutical companies in saudi arabia, p …

In order to study the various trends and patterns prevailing in the concerned market, Market Research Reports Search Engine (MRRSE) has included a new report titled “Saudi Arabia Pharmaceutical Market” to its wide online database. This research assessment offers a clear insight about the influential factors that are expected to transform the global market in the near future.

The report examines Saudi Arabia pharmaceutical market for the period 2016–2026. The primary…

Saudi Arabia Airport Privatization Sector Saudi Arabia Airport Sales Report 2022

For Report Sample Contact: neeraj@kuickresearch.com or +91-11-47067990

Report Table of Contents

Saudi Arabia Aviation Industry Overview

Privatization in Saudi Arabia

Saudi Arabia Civil Aviation Regulatory Authority

3.1 General Authority of Civil Aviation (GACA)

3.2 International Air Transport Association

Saudi…

Saudi Arabia Mutual Fund Sector Saudi Arabia Mutual Fund Sales Report 2022

For Report Sample Contact: neeraj@kuickresearch.com or +91-11-47067990

Report Table of Contents

1. Saudi Arabia Financial Sector Overview

2. Saudi Arabia Stock Market and Exchange Overview

3. Saudi Arabia Mutual Fund Market Overview

4. Saudi Arabia Mutual Fund Program and Managers

4.1 Fund Managers and Companies

4.2 Types of Mutual Funds

5. Saudi Arabia Mutual Fund Asset Allocation

5.1 Market Overview

5.2 Mutual Fund Market Indicators

…