Press release

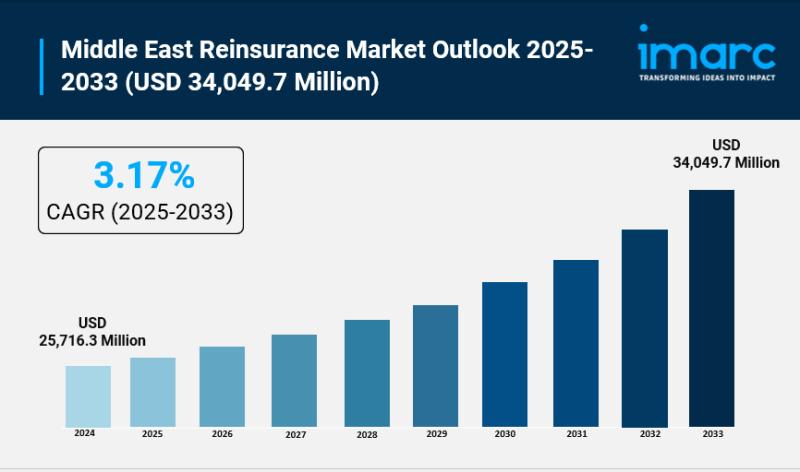

Middle East Reinsurance Market Size to Hit USD 34,049.7 Million by 2033 | With a 3.17% CAGR

Middle East Reinsurance Market OverviewMarket Size in 2024: USD 25,716.3 Million

Market Size in 2033: USD 34,049.7 Million

Market Growth Rate 2025-2033: 3.17%

According to IMARC Group's latest research publication, "Middle East Reinsurance Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", The Middle East reinsurance market size was valued at USD 25,716.3 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 34,049.7 Million by 2033, exhibiting a CAGR of 3.17% during 2025-2033.

How AI is Reshaping the Future of Middle East Reinsurance Market

● AI streamlines underwriting processes across Middle East reinsurance operations, automating risk assessment and pricing decisions while reducing processing time significantly.

● Machine learning algorithms enhance catastrophe modeling capabilities, enabling Middle East reinsurers to predict natural disaster impacts and optimize coverage portfolios more accurately.

● AI-powered fraud detection systems protect Middle East reinsurance companies by identifying suspicious claims patterns and anomalies in real-time across diverse markets.

● Automated claims processing platforms integrated with AI accelerate settlement timelines, improving customer satisfaction while reducing operational costs for regional reinsurers.

● Predictive analytics driven by AI help Middle East reinsurance firms optimize capital allocation, forecast market trends, and make data-driven strategic decisions across treaty and facultative business.

Grab a sample PDF of this report: https://www.imarcgroup.com/middle-east-reinsurance-market/requestsample

How Vision 2030 is Transforming Middle East Reinsurance Industry

The Middle East reinsurance industry is experiencing profound transformation driven by ambitious national development programs, particularly Saudi Arabia's Vision 2030, which emphasizes economic diversification, financial sector development, and localization of critical financial services including reinsurance capacity. This strategic shift is catalyzing the establishment of domestic reinsurance companies, exemplified by the launch of Riyadh Reinsurance Company backed by Tawuniya with substantial capital to serve regional and international markets, reducing historical dependence on foreign reinsurance capacity and retaining premium income within the Kingdom. Vision 2030's emphasis on mega-infrastructure projects including NEOM, The Red Sea Project, Qiddiya, and extensive transportation networks is creating unprecedented demand for specialized reinsurance coverage across property, casualty, engineering, construction, marine, energy, and aviation sectors, requiring sophisticated risk transfer solutions and fostering partnerships between local and international reinsurers to support these transformative developments.

Middle East Reinsurance Market Trends & Drivers:

The Middle East reinsurance market is experiencing robust growth driven by increasing frequency and severity of natural catastrophes including floods, earthquakes, droughts, and extreme weather events that are compelling reinsurers to revisit risk models and develop innovative solutions while collaborating with scientific institutions, meteorological agencies, and technology firms to enhance predictive capabilities and pricing strategies. The market is propelled by rapid economic diversification efforts across the region, particularly in Saudi Arabia, UAE, Qatar, and Kuwait, where substantial investments in infrastructure, real estate, tourism, renewable energy, and technology sectors are expanding risk pools beyond traditional oil and gas exposures, creating demand for specialized reinsurance coverage across property, casualty, engineering, construction, and emerging risk categories including cyber insurance as digitization increases across business processes.

The rising integration of artificial intelligence and blockchain technologies is transforming reinsurance operations by streamlining underwriting processes, enhancing claims management efficiency, improving fraud detection capabilities, and optimizing transaction transparency, while the growing adoption of parametric insurance solutions is replacing traditional indemnity-based models to provide faster claims settlements based on predefined triggers, addressing the need for more efficient and responsive risk transfer mechanisms particularly relevant for catastrophe-exposed portfolios. Regulatory developments emphasizing robust risk management frameworks, capital adequacy requirements, and localization mandates requiring cedants to place designated portions of reinsurance treaties with domestic reinsurers are reshaping market dynamics and fostering development of regional capacity, while increasing competition from new market entrants and improved global reinsurance market conditions following years of rate hardening are creating favorable pricing environments and expanded coverage availability across Saudi Arabia, Turkey, Israel, United Arab Emirates, Iran, Iraq, Qatar, Kuwait, Oman, Jordan, Bahrain, and other regional markets experiencing insurance penetration growth and evolving risk landscapes.

Middle East Reinsurance Market Industry Segmentation:

The report has segmented the market into the following categories:

Type Insights:

● Facultative Reinsurance

● Treaty Reinsurance

● Proportional Reinsurance

● Non-Proportional Reinsurance

Mode Insights:

● Online

● Offline

Distribution Channel Insights:

● Direct Writing

● Broker

Application Insights:

● Property and Casualty Reinsurance

● Life and Health Reinsurance

● Disease Insurance

● Medical Insurance

Breakup by Country:

● Saudi Arabia

● Turkey

● Israel

● United Arab Emirates

● Iran

● Iraq

● Qatar

● Kuwait

● Oman

● Jordan

● Bahrain

● Others

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Buy Full Report: https://www.imarcgroup.com/checkout?id=19865&method=1392

Recent News and Developments in Middle East Reinsurance Market

● January 2025: Major reinsurers including Swiss Re removed restrictive property reinsurance clauses that previously allowed them to cancel coverage for the Middle East region if conflicts escalated, reflecting greater market competition and improved capacity availability during the January renewal season across regional markets.

● May 2025: Swiss Re published its Middle East outlook report forecasting regional insurance premium growth driven by economic diversification efforts, infrastructure investments, mandatory health insurance expansion, and adoption of artificial intelligence and automation technologies reshaping the insurance and reinsurance landscape across Gulf Cooperation Council countries.

● November 2025: Riyadh Reinsurance Company officially launched operations after receiving final licensing from the Insurance Authority, establishing headquarters in Riyadh to provide facultative and treaty reinsurance solutions across property, casualty, engineering, construction, marine, energy, aviation, financial, and cyber risks throughout Saudi Arabia, GCC, and broader MENA markets.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Middle East Reinsurance Market Size to Hit USD 34,049.7 Million by 2033 | With a 3.17% CAGR here

News-ID: 4279346 • Views: …

More Releases from IMARC Group

Mexico High-Brightness LED Market Size, Share, Latest Insights and Forecast 2025 …

IMARC Group has recently released a new research study titled "Mexico High-Brightness LED Market Size, Share, Trends and Forecast by Application, Distribution Channel, Indoor and Outdoor Application, End-Use Sector, and Region, 2025-2033" which offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends, and competitive landscape to understand the current and future market scenarios.

Market Overview

The Mexico high-brightness LED market size reached USD 349.2 Million in 2024 and is…

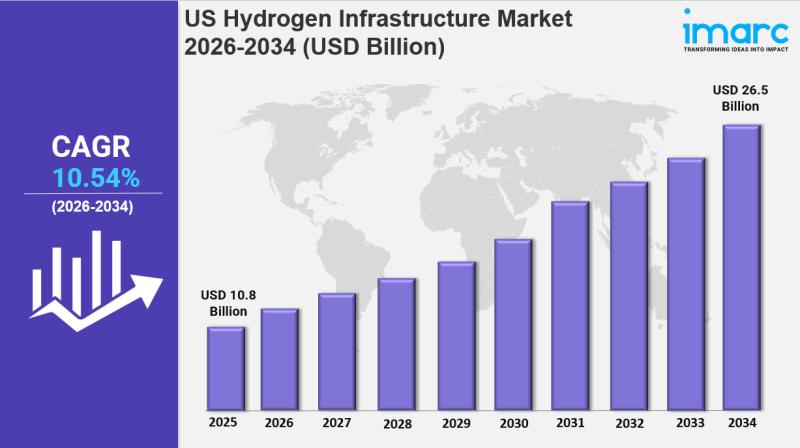

US Hydrogen Infrastructure Market Size, Growth, Latest Trends and Forecast 2026- …

IMARC Group has recently released a new research study titled "US Hydrogen Infrastructure Market Report by Production (Steam Methane Reforming, Coal Gasification, Electrolysis, and Others), Storage (Compression, Liquefaction, Material Based), Delivery (Transportation, Refinery, Power Generation, Hydrogen Refueling Stations), and Region 2026-2034" which offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends, and competitive landscape to understand the current and future market scenarios.

Market Overview

The U.S. hydrogen infrastructure market…

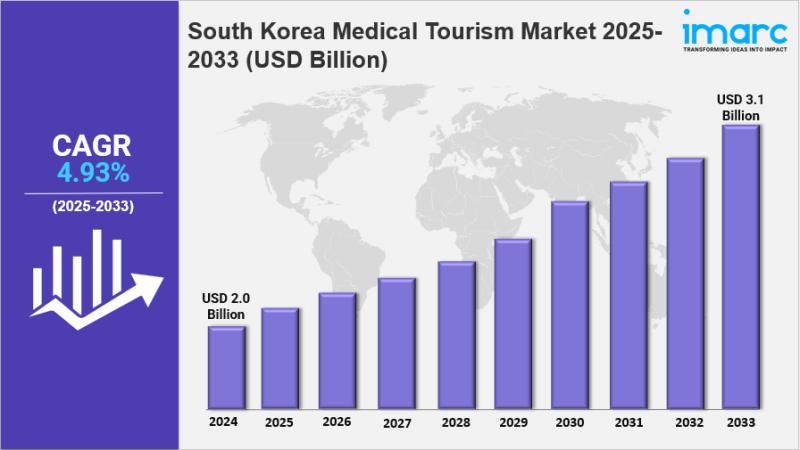

South Korea Medical Tourism Market Size, Share, Industry Overview, Trends and Fo …

IMARC Group has recently released a new research study titled "South Korea Medical Tourism Market Report by Type (Outbound, Inbound, Intrabound), Treatment Type (Cosmetic Treatment, Dental Treatment, Cardiovascular Treatment, Orthopaedic Treatment, Bariatric Surgery, Fertility Treatment, Ophthalmic Treatment, and Others) 2025-2033", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

South Korea Medical Tourism Market Overview

The South Korea…

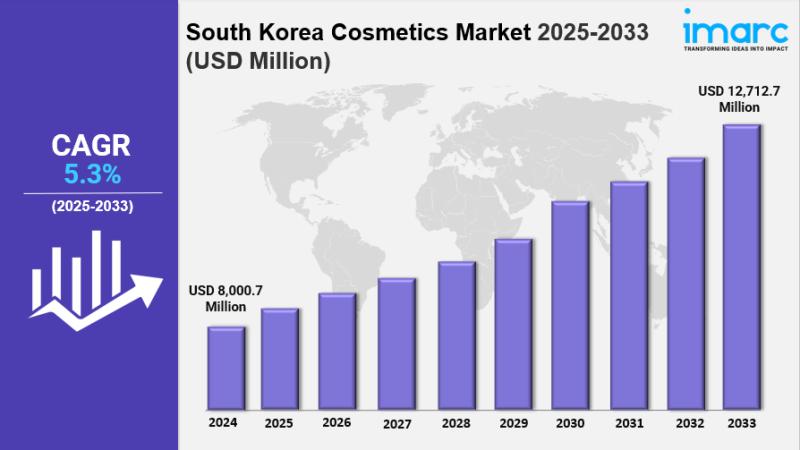

South Korea Cosmetics Market Size, Share, Industry Overview, Trends and Forecast …

IMARC Group has recently released a new research study titled "South Korea Cosmetics Market Report by Product Type (Skin and Sun Care Products, Hair Care Products, Deodorants and Fragrances, Makeup and Color Cosmetics, and Others), Category (Conventional, Organic), Gender (Men, Women, Unisex), Distribution Channel (Supermarkets and Hypermarkets, Specialty Stores, Pharmacies, Online Stores, and Others), and Region 2025-2033", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and…

More Releases for Middle

Finnovex Middle East 2025: Middle East's Fintech Metamorphosis: Digital, Decentr …

Dubai, UAE, 9th October 2025, ZEX PR WIRE, Exibex is proud to announce the 33rd global edition of Finnovex Middle East, returning on November 11-12, 2025, in Dubai, the innovation capital of the Middle East. Under the theme "Middle East's Fintech Metamorphosis: Digital, Decentralized & Disruptive," this leading summit will convene over 300 banking and fintech leaders, policymakers, regulators, and technology innovators to explore the region's transformative financial journey.

As the…

Coupon Craze Hits the Middle East: Introducing Middle East's Elite Coupon Platfo …

The Middle East is about to experience a great shift with the launch of Claimea, the region's elite coupon platform set to revolutionize how people save while shopping online. Considering the growing trend of online coupons, Claimea offers a comprehensive solution for shoppers looking for working and verified deals.

Claimea aims to enhance the shopping experience for consumers across the Middle East. With an interactive user interface and well-known partner merchants,…

Middle East Travel Retail

Report Overview

The report covers exhaustive analysis of the Middle east travel retail market in terms of qualitative and quantitative aspects. The report provides in-depth information on market size & forecast, current market trends, driving & restraining factors, challenges, and future opportunities of the Middle east travel retail market. The report provides analysis on key market segments along with market size and forecast information for each of the segments. The report…

Middle East Auto Component Market Significant Growth over Forecast Period 2020-2 …

Auto Component Market is those markets which are manufacture components or parts required in the automobile industry. Middle East Auto Components market was valued at $ 28 billion in 2019 and is expected to surpass $ 39.7+ billion by 2028. Projected growth in the market can be recognized as snowballing automobile vehicle fleet and rising manufacture and infrastructural activities across different countries of the region. Moreover, mounting demand for vehicle…

Studying the Middle East Yacht Market,Studying the Middle East Yacht Industry, S …

Latest industry research report on: Studying the Middle East Yacht Market : Industry Size, Share, Research, Reviews, Analysis, Strategies, Demand, Growth, Segmentation, Parameters, Forecasts

Our analysts believe that the long-term outlook for the yacht market in the Middle East is positive. Demand for yachts in the Middle East has remained stable and is expected to continue being so. Yachting has emerged as a key aspect of the luxury lifestyle in the…

Middle East Railway Sector Middle East Railway Sales Report

For Report Sample Contact: neeraj@kuickresearch.com or +91-11-47067990

Report Table of Contents

Middle East Outlook

1.1 Countries Overview

1.2 Middle East Economy

1.3 Transportation in Middle East

Middle East Rail Transport Outlook

2.1 Overall Status of Rail Transport in Middle East

2.2 Trends in Railway Infrastructure Development in Middle East

Saudi Arabia

3.1 Existing Railway Infrastructure

3.2 Proposed/Planned Railway Infrastructure

3.3 Regulatory Framework

3.4…