Press release

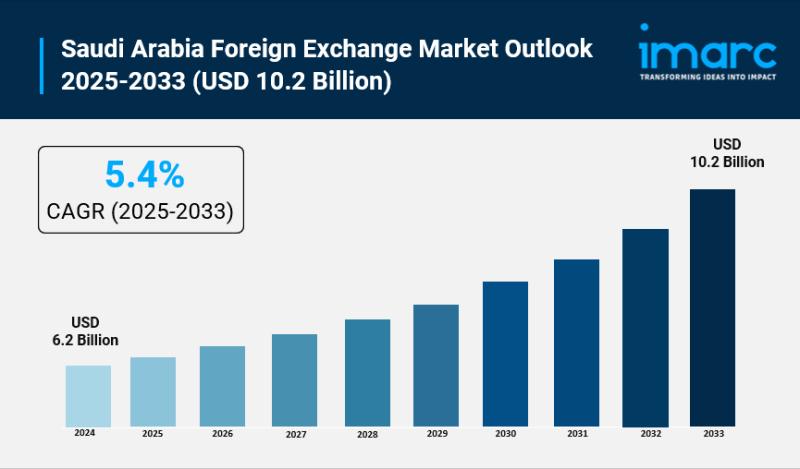

Saudi Arabia Foreign Exchange Market Size to Hit USD 10.2 Billion by 2033 | With a 5.4% CAGR

Saudi Arabia Foreign Exchange Market OverviewMarket Size in 2024: USD 6.2 Billion

Market Size in 2033: USD 10.2 Billion

Market Growth Rate 2025-2033: 5.4%

According to IMARC Group's latest research publication, "Saudi Arabia Foreign Exchange Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", The Saudi Arabia foreign exchange market size was valued at USD 6.2 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 10.2 Billion by 2033, exhibiting a CAGR of 5.4% during 2025-2033.

How AI is Reshaping the Future of Saudi Arabia Foreign Exchange Market

● AI enhances algorithmic trading systems across Saudi financial institutions, improving trade execution speed and reducing manual intervention in forex operations significantly.

● Government-backed fintech initiatives employ AI-powered monitoring systems for real-time transaction analysis, strengthening compliance with SAMA regulations and detecting suspicious activities.

● AI-driven predictive analytics optimize currency risk management, enabling forex traders to anticipate fluctuations and develop sophisticated hedging strategies for Saudi businesses.

● Saudi forex platforms utilize AI to personalize trading experiences, adapting recommendations and automated execution strategies based on individual trader profiles and market conditions.

● AI sentiment analysis processes vast financial data and economic indicators, delivering real-time market intelligence that empowers traders to capitalize on opportunities with enhanced accuracy.

Grab a sample PDF of this report: https://www.imarcgroup.com/saudi-arabia-foreign-exchange-market/requestsample

How Vision 2030 is Transforming Saudi Arabia Foreign Exchange Industry

Saudi Arabia's Vision 2030 is rapidly transforming the foreign exchange (forex) industry by modernizing the financial sector and positioning the Kingdom as a regional trading hub. Through major regulatory reforms, advanced digital infrastructure, and strong fintech investments, the government is improving transparency, efficiency, and accessibility for both institutional and retail traders. Programs like the Financial Sector Development Program boost market innovation, support digital payments, and attract global investors. Economic diversification is increasing cross-border trade and FDI, driving steady demand for advanced currency exchange services across sectors such as manufacturing, tourism, retail, and technology. Vision 2030 also promotes fintech growth, including AI-based monitoring tools, regulated stable coins, and Sharia-compliant trading mechanisms. With upgraded trading systems at the Saudi Exchange, new forex-focused fintech accelerators, and deeper integration with global financial markets, the Kingdom is creating new jobs in trading, compliance, risk management, and technology while strengthening its role as a major global forex center.

Saudi Arabia Foreign Exchange Market Trends & Drivers:

Saudi Arabia's foreign exchange market is experiencing robust growth, driven by the Kingdom's strategic economic diversification under Vision 2030 and deepening integration with global financial markets, with increasing participation from institutional investors, multinational corporations, and retail traders creating unprecedented demand for advanced forex trading solutions that facilitate international commerce, hedging operations, and investment portfolio management. The market is propelled by rapid technological advancement transforming the forex landscape through implementation of cutting-edge algorithmic trading platforms, automated execution systems, and fintech solutions that enhance transaction speed and reduce operational costs, while the rising adoption of mobile trading applications and digital payment infrastructure enables convenient access to currency markets for both seasoned professionals and newcomers across Northern and Central, Western, Eastern, and Southern regions of the Kingdom.

The regulatory environment is fundamentally reshaping market dynamics, with SAMA and the Capital Market Authority implementing comprehensive reforms aimed at enhancing transparency, efficiency, and investor protection across forex operations, including stringent compliance frameworks that monitor transactions for suspicious activities while maintaining alignment with Sharia law principles governing financial transactions. The explosive growth of Saudi Arabia's international trade relationships, exemplified by expanding exports beyond petroleum to include petrochemicals, metals, and manufactured goods alongside surging imports of machinery, consumer products, and technology equipment, is creating consistent demand for currency swap, outright forward and FX swap, and FX option instruments utilized by reporting dealers, non-financial customers, and other market participants to manage exchange rate risks and optimize international payment flows supporting the Kingdom's transformation into a diversified, globally connected economy.

Saudi Arabia Foreign Exchange Market Industry Segmentation:

The report has segmented the market into the following categories:

Counterparty Insights:

● Reporting Dealers

● Non-Financial Customers

● Others

Type Insights:

● Currency Swap

● Outright Forward and FX Swaps

● FX Options

Breakup by Region:

● Northern and Central Region

● Western Region

● Eastern Region

● Southern Region

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Ask analyst of customized report: https://www.imarcgroup.com/request?type=report&id=20585&flag=E

Recent News and Developments in Saudi Arabia Foreign Exchange Market

● February 2025: Saudi Arabian Monetary Authority launched an advanced monitoring system in collaboration with major banks, implementing automated compliance tools and transaction analysis capabilities that strengthen oversight of forex operations across the Kingdom and enhance detection of irregular trading patterns.

● April 2025: Limitless Payments announced plans to transform foreign exchange operations across high-growth markets with a major funding initiative headquartered in Riyadh, focusing on automated payment processing and multi-currency management solutions for businesses operating in Saudi Arabia and regional markets.

● November 2025: Saudi Arabia unveiled plans to introduce regulated stablecoins in collaboration with the Capital Market Authority and Saudi Central Bank, aiming to enhance digital payment infrastructure and position the Kingdom as a regional leader in fintech innovation aligned with Vision 2030 objectives.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Saudi Arabia Foreign Exchange Market Size to Hit USD 10.2 Billion by 2033 | With a 5.4% CAGR here

News-ID: 4277724 • Views: …

More Releases from IMARC Group

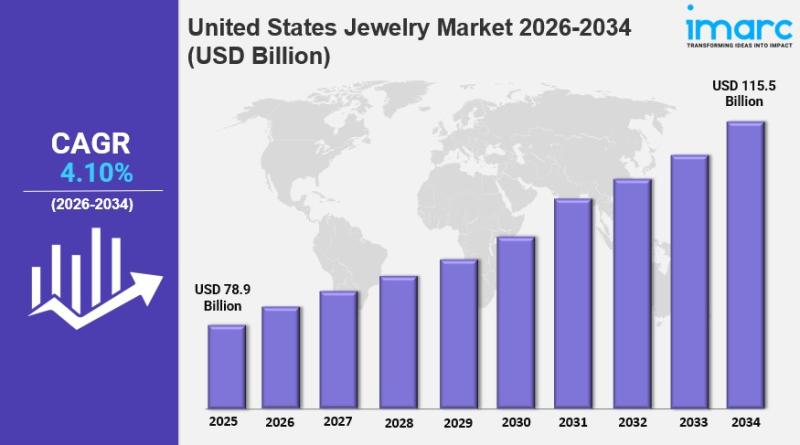

United States Jewelry Market Size, Share, Industry Overview, Growth and Forecast …

IMARC Group has recently released a new research study titled "United States Jewelry Market Report by Product (Necklace, Ring, Earrings, Bracelet, and Others), Material (Gold, Platinum, Diamond, and Others), and Region 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

United States Jewelry Market Overview

The United States jewelry market size reached USD 78.9 Billion in 2025.…

United States Air Freight Market Size, Share, Industry Trends, Growth and Foreca …

IMARC Group has recently released a new research study titled "United States Air Freight Market Size, Share, Trends and Forecast by Service, Destination, End User, and Region, 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

United States Air Freight Market Overview

The United States air freight market size was valued at USD 64.06 Billion in 2025.…

Mexico Medical Tourism Market 2026 : Industry Size to Reach USD 10.6 Billion by …

IMARC Group has recently released a new research study titled "Mexico Medical Tourism Market Size, Share, Trends and Forecast by Type, Treatment Type, and Region, 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Mexico Medical Tourism Market Overview

The Mexico medical tourism market size reached USD 2.1 Billion in 2025. Looking forward, the market is projected…

Saudi Arabia Pilates & Yoga Studios Market Size to Surpass USD 3.6 Billion by 20 …

Saudi Arabia Pilates & Yoga Studios Market Overview

Market Size in 2024: USD 1.6 Billion

Market Forecast in 2033: USD 3.6 Billion

Market Growth Rate 2025-2033: 8.20%

According to IMARC Group's latest research publication, "Saudi Arabia Pilates & Yoga Studios Market Size, Share, Trends and Forecast by Activity Type, Application, and Region, 2025-2033", the Saudi Arabia pilates & yoga studios market size reached USD 1.6 Billion in 2024. Looking forward, IMARC Group expects the…

More Releases for Saudi

Saudi Wakala Offers Efficient and Reliable Saudi Visa Stamping Services

Saudi Wakala, a renowned agency specializing in Saudi visa stamping services, is proud to announce its commitment to providing swift and reliable visa processing for travelers to Saudi Arabia. Located in New Delhi, Saudi Wakala has established itself as a trusted partner for individuals and businesses requiring efficient visa stamping services.

Efficient Visa Processing

Understanding the complexities and time-sensitivity associated with visa stamping, Saudi Wakala offers a streamlined process managed by an…

saudi construction company,TOP saudi arabia construction companies list,civil co …

Abdul Ali Al-Ajmi Company

Advanced Support Company

Al Ashbelya Engineering

Al-Dour Engineering Contracting Est.

https://www.gdwatches.cn/

Free engineering construction consultation

Email:nolan@wholsale9.com

Alfanar

Arabian Tile Co. Ltd. (ARTIC)

Assad Said for Contracting Co Ltd

Automated Buildings Company

Bazy Trading and Contracting

Bin Dayel Contracting

Cercon

City Cement Company

Dar Al Majd

EG & G Middle East

East Consulting Engineering Center

El Seif Engineering Contracting Company

El Seif Engineering Contracting Company

Engineering Development Co for Contracting

FCC Company

https://www.gdwatches.cn/

Free engineering construction consultation

Email:nolan@wholsale9.com

Jones Engineering Group

Masar Consulting Engineer

Meinhardt Arabia

Mohammed M. Al Rashid Co. (MARCO)

Qureshi Telecom Contracting &…

Saudi Arabia Agriculture Market, Saudi Arabia Agriculture Industry, Saudi Arabia …

Saudi Arabia Agriculture is focussed on the spread of dates, dairy farm merchandise, eggs, fish, poultry, vegetables, and flowers to markets round the creation because it has attained its own potency within the production of such merchandise. The private sector additionally plays a role within the nation's agriculture, because the government offers long-term interest-free loans and inexpensive water, fuel, electricity, and duty-free imports of raw materials and machinery. Over the past…

Saudi Arabia Pharmaceutical Market | pharmaceutical companies in saudi arabia, p …

In order to study the various trends and patterns prevailing in the concerned market, Market Research Reports Search Engine (MRRSE) has included a new report titled “Saudi Arabia Pharmaceutical Market” to its wide online database. This research assessment offers a clear insight about the influential factors that are expected to transform the global market in the near future.

The report examines Saudi Arabia pharmaceutical market for the period 2016–2026. The primary…

Saudi Arabia Airport Privatization Sector Saudi Arabia Airport Sales Report 2022

For Report Sample Contact: neeraj@kuickresearch.com or +91-11-47067990

Report Table of Contents

Saudi Arabia Aviation Industry Overview

Privatization in Saudi Arabia

Saudi Arabia Civil Aviation Regulatory Authority

3.1 General Authority of Civil Aviation (GACA)

3.2 International Air Transport Association

Saudi…

Saudi Arabia Mutual Fund Sector Saudi Arabia Mutual Fund Sales Report 2022

For Report Sample Contact: neeraj@kuickresearch.com or +91-11-47067990

Report Table of Contents

1. Saudi Arabia Financial Sector Overview

2. Saudi Arabia Stock Market and Exchange Overview

3. Saudi Arabia Mutual Fund Market Overview

4. Saudi Arabia Mutual Fund Program and Managers

4.1 Fund Managers and Companies

4.2 Types of Mutual Funds

5. Saudi Arabia Mutual Fund Asset Allocation

5.1 Market Overview

5.2 Mutual Fund Market Indicators

…