Press release

Track Polycarbonate Price Trend Across Top Countries: Index, News, Monitor, and Demand Insights

Polycarbonate Price Trend and Forecast Report | Global, North America, APAC, and Europe AnalysisExecutive Summary

The global Polycarbonate (PC) market navigated a complex pricing environment over the recent quarters, characterized by fluctuating feedstock values, shifting procurement behavior, varying downstream demand, and evolving trade dynamics across major regions. Although the polymer's intrinsic value proposition-exceptional transparency, durability, impact resistance, and adaptability-continues to anchor market fundamentals, pricing has remained sensitive to feedstock Bisphenol-A (BPA) and Phosgene values, energy market instability, supply chain adjustments, and region-specific regulatory or industrial shifts.

During the latest assessment periods, pricing across North America, Europe, and the Asia-Pacific (APAC) region demonstrated mixed momentum. While APAC experienced periods of volatility driven by upstream fluctuations and changes in manufacturing operating rates, Europe saw comparatively firmer pricing supported by constrained logistics and supply interruptions. North America maintained a balanced but cautious environment shaped by controlled inventories and moderate demand from automotive, construction, and electronics sectors.

This comprehensive Polycarbonate Price Trend and Forecast article presents a detailed examination of global pricing patterns, quarterly movements, cost structures, supply dynamics, procurement sentiment, logistics behavior, and forward-looking expectations. It also provides a historical quarterly review, a breakdown of production economics, and region-wise insights crucial for buyers, traders, converters, and strategic procurement teams.

◼ Get Instant Access to Live Polycarbonate Prices Today: https://www.chemanalyst.com/ChemAnalyst/PricingForm?Product=Polycarbonate

Introduction

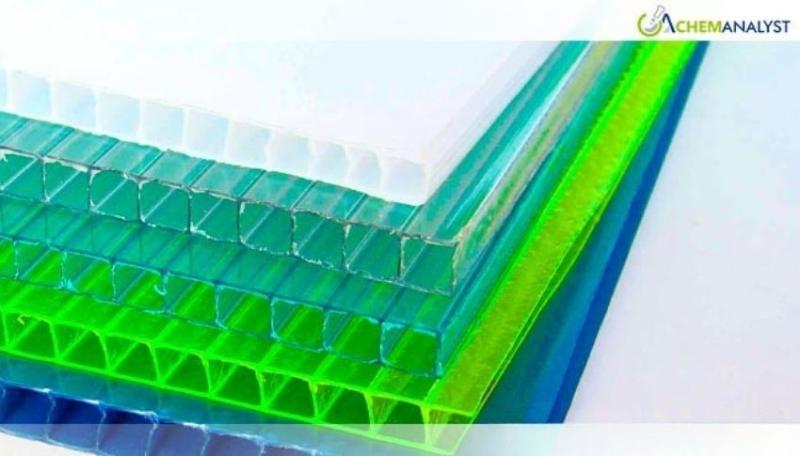

Polycarbonate, a high-performance engineering thermoplastic, remains integral across industries such as automotive, electrical and electronics, optical media, building and construction, medical devices, and packaging. Its unique properties-high impact strength, thermal stability, clarity, and design flexibility-reinforce its importance as a material of choice for lightweighting initiatives, precision components, and durable consumer products.

Given its dependence on upstream aromatics-primarily BPA and phosgene-Polycarbonate pricing naturally mirrors developments in petrochemicals, crude oil, and regional manufacturing economics. Additionally, policy-driven changes, environmental regulations, and evolving consumer product specifications also shape production and downstream demand.

As the industry progresses through a period of supply-chain recalibration, varying economic momentum across key regions, and sector-specific demand shifts, understanding Polycarbonate's price dynamics has become crucial for buyers seeking informed procurement decisions. This PR-style analytical report brings together market intelligence, trend interpretation, and strategic perspectives to support stakeholders across the global Polycarbonate value chain.

Global Price Overview

Global Polycarbonate prices showed differentiated movements across regions as markets grappled with a combination of upstream fluctuations, operational changes in manufacturing hubs, and sector-driven demand variations.

Key Global Drivers

Upstream Volatility: BPA and phosgene feedstock trends exerted consistent influence. Changes in phenol-acetone market conditions, refinery operating rates, and crude oil benchmarks amplified cost-side fluctuations.

Demand Variability: Automotive demand recovery remained inconsistent globally, while electronics and consumer goods sectors demonstrated selective restocking behaviors.

Regional Imbalances: APAC's significant production footprint often determined global sentiment, with changes in operating rates in China or South Korea influencing international offers.

Logistics and Trade Barriers: Freight rate adjustments, container availability, and port congestion created additional price differentials between regions.

Macroeconomic Pressures: Currency fluctuations, inflation-driven purchasing hesitancy, and varied economic growth patterns impacted procurement confidence globally.

While the global Polycarbonate landscape showed no unified price trajectory, the market consistently reflected the push-and-pull between downstream demand stability and cost-driven supply pressures.

Regional Market Analysis

North America Polycarbonate Price Trend

Quarterly Market Movements

In North America, Polycarbonate prices across recent quarters exhibited a moderate but steady performance. Market participants reported that pricing remained balanced as producers maintained controlled inventory positions. Although feedstock BPA values fluctuated, downstream sectors did not show broad consumption spikes.

Steady demand from automotive injection molding, industrial equipment, lighting components, and consumer electronics helped support market fundamentals. However, buying momentum remained measured as downstream converters adopted cautious procurement strategies amid macroeconomic uncertainties.

◼ Monitor Real-Time Polycarbonate Price Swings and Stay Ahead of Competitors: https://www.chemanalyst.com/ChemAnalyst/PricingForm?Product=Polycarbonate

Reasons Behind Price Changes

Several factors shaped the North American Polycarbonate market:

Stable Demand: Automotive, medical, and electrical sectors saw consistent but not surging orders.

Feedstock Cost Movements: BPA and phenol variations created cost-side pressure but did not lead to significant volatility.

Inventory Management: Producers maintained balanced stock levels, limiting abrupt price swings.

Energy Market Influence: Moderating natural gas and power cost variations supported stable operating conditions.

Supply and Production Conditions

Operating rates remained largely consistent in the region. Maintenance shutdowns were minimal, and no major supply shocks were reported. Import competition correlated with Asian offers, but domestic producers benefitted from shorter lead times and dependable delivery schedules.

Procurement Behavior

Buyers in North America adopted short-term purchasing cycles, favoring contractual stability over aggressive restocking. Demand from injection molders and sheet extrusion units remained adequate to support price floors.

Logistics and Trade Flow Impacts

North American logistics operated more smoothly compared to previous years. Freight normalization helped mitigate landed-cost disparities between domestic and imported Polycarbonate materials.

APAC Polycarbonate Price Trend

Quarterly Market Movements

The Asia-Pacific region, being the world's largest Polycarbonate production base, experienced a mix of upward and downward pricing adjustments. Market volatility stemmed from variable feedstock dynamics, changing operating rates in Chinese and South Korean plants, and uneven demand recovery.

Some months saw firmer pricing on account of rising BPA costs or temporary supply tightness. In contrast, periods of weaker domestic consumption, especially within China, pushed prices down as suppliers sought to stimulate offtakes.

Reasons Behind Price Changes

Key factors influencing regional movements included:

Demand Oscillation: Electronics, optical media, household goods, and automotive sectors showed alternating strengths and slowdowns.

Feedstock Influence: BPA price swings, influenced by phenol-acetone fundamentals, rapidly transmitted across markets.

Manufacturing Rates: Producers adjusted operating rates based on market sentiment, occasionally reducing runs to avoid oversupply.

Export Competitiveness: Competitive FOB Asian offers shaped global pricing bandwidth, especially during weaker domestic demand cycles.

Supply Conditions

APAC Polycarbonate operations frequently aligned with cost conditions. When upstream costs climbed, producers rationalized outputs, helping support price recovery. Imports and exports across intra-Asian routes also shifted based on tariff structures and bilateral trade dynamics.

Procurement Trends

Buyers in APAC preferred tactical purchasing. Many downstream processors maintained limited inventories, choosing to buy on demand rather than commit to long-term stocking. Spot transactions occasionally increased during favorable pricing dips.

Logistics and Trade Flow

Trade flow adjustments were prominent in APAC. Freight changes, variable container availability, and shifting FOB/ CFR margins influenced arbitrage opportunities for buyers in India, Southeast Asia, and the Middle East.

◼ Track Daily Polycarbonate Price Updates and Strengthen Your Procurement Decisions: https://www.chemanalyst.com/ChemAnalyst/PricingForm?Product=Polycarbonate

Europe Polycarbonate Price Trend

Quarterly Market Movements

In Europe, Polycarbonate prices held relatively firm compared to other regions. Despite steady upstream volatility, regional supply constraints and higher logistics costs contributed to elevated price levels.

Demand from the automotive industry, construction materials producers, and electrical equipment manufacturers provided a foundation of stability.

Reasons Behind Price Changes

European price trends were influenced by:

Upstream Cost Pressure: Higher energy costs in Europe frequently inflated production costs.

Regional Supply Tightness: Reduced imports from Asia due to freight challenges contributed to elevated regional prices.

Demand Stability: Strategic industries such as automotive and electronics supported ongoing offtakes.

Regulatory Conditions: Sustainability regulations and stringent plastics compliance norms added layers of complexity to production economics.

Supply and Production Landscape

European producers often operated at controlled rates to avoid inventory overhang. Occasional maintenance turnarounds influenced short-term availability, supporting price resilience.

Procurement Behavior

European buyers maintained an active but cautious purchasing pattern. With transportation costs higher in this region, procurement teams often prioritized local sourcing.

Trade and Logistics

High freight rates and longer lead times from overseas suppliers helped shield local producers from aggressive import competition. This dynamic contributed to sustained price firmness.

Historical Quarterly Review

Over the past several quarters, the global Polycarbonate market passed through multiple phases:

Volatility Driven by Upstream Fluctuation

BPA price spikes and fluctuations in phenol-acetone supply chains influenced Polycarbonate cost structures.

Demand Recovery Periods

Intermittent rebounds in electronics and automotive sectors contributed to periods of firming prices.

Supply Rationalization Cycles

Producers worldwide periodically lowered operating rates to counter oversupply risks.

Logistics Challenges

Global freight surges, port congestion, and container shortages created temporary cost inflation.

Stabilization Phases

As logistics normalized and operating rates balanced, price movements calmed across major regions.

Production and Cost Structure Insights

Polycarbonate manufacturing is closely tied to:

Feedstock Cost Components

Bisphenol-A (BPA): The primary cost driver; price volatility directly impacts PC production costs.

Phosgene or Melt Technology Inputs: Depending on production route, variations in inputs influence margins.

Energy Costs: A major contributor in North America and Europe.

Operational Costs

Utilities (power, steam, cooling)

Labor and maintenance

Logistics and warehousing

Environmental compliance

Producer Strategies

Flexible operating rates

Export allocation adjustments

Dynamic stock management

Strategic feedstock sourcing

These factors collectively shape Polycarbonate cost structures globally.

Procurement Outlook

The near-term Polycarbonate procurement landscape is expected to reflect:

Balanced but Cautious Demand

Downstream industries are likely to maintain need-based purchasing.

◼ Unlock Live Pricing Dashboards for Accurate and Timely Insights: https://www.chemanalyst.com/Pricing-data/polycarbonate-47

◼ Stay Updated Each Day with Verified Polycarbonate Price Movements: https://www.chemanalyst.com/ChemAnalyst/PricingForm?Product=Polycarbonate

Feedstock-Driven Volatility

Any disruption in BPA or phenol-acetone pricing could influence Polycarbonate values.

Shifts in Trade Patterns

Some regions may see increased imports depending on freight trends and regional supply tightness.

Moderate Price Movements

Barring extreme upstream turbulence, most regions are expected to witness controlled price fluctuations.

Buyer Strategy Recommendations

Prefer staggered procurement

Monitor upstream aromatics markets

Track regional freight developments

Consider multi-supplier sourcing

Maintain optimal safety stocks

Frequently Asked Questions (FAQ)

What are the key factors influencing global Polycarbonate prices?

Prices are primarily driven by BPA feedstock costs, regional demand patterns, energy costs, supply availability, and logistics conditions.

Why do Polycarbonate prices vary between regions?

Differences in feedstock sourcing, local demand, freight rates, supply tightness, and production costs create regional price disparities.

How do BPA prices affect Polycarbonate markets?

As the main feedstock, BPA directly influences Polycarbonate production costs. Any fluctuation in BPA typically mirrors in PC pricing.

Which industries are driving Polycarbonate demand?

Major consumers include automotive, electronics, construction, medical devices, and consumer goods.

What is the expected pricing trend in the next quarter?

Prices are likely to remain moderately stable with mild fluctuations driven by upstream volatility and region-specific supply conditions.

How ChemAnalyst Supports Buyers with Real-Time Polycarbonate Insights

ChemAnalyst offers a comprehensive suite of tools and intelligence solutions designed to empower procurement teams, manufacturers, traders, and supply chain professionals in navigating the dynamic Polycarbonate market.

◼ Stay Updated Each Day with Verified Polycarbonate Price Movements: https://www.chemanalyst.com/ChemAnalyst/PricingForm?Product=Polycarbonate

Key Benefits for Buyers:

Live Price Tracking: Access real-time Polycarbonate price assessments across global regions.

Quarterly Forecast Models: AI-driven and analyst-verified projections to guide budgeting and procurement planning.

Cost Structure Analysis: Detailed breakdowns of feedstock, energy, logistics, and operational cost components.

Supply Chain Intelligence: Monitor plant operating rates, shutdowns, feedstock availability, and regional supply shifts.

Trade Data Insights: Evaluate import-export trends, trade barriers, and freight movements.

Market News Alerts: Stay updated with industry events that influence pricing-upstream issues, policy changes, or logistics developments.

Custom Advisory: Tailored consultations to optimize procurement, mitigate risk, and enhance supplier negotiations.

With ChemAnalyst's deep-dive analytics and real-time data integration, stakeholders gain a decisive edge in understanding price trends, anticipating market shifts, and executing cost-efficient strategies in the evolving Polycarbonate landscape.

Contact Us:

UNITED STATES

Call +1 3322586602

420 Lexington Avenue, Suite 300, New York, NY,

United States, 10170

Germany

Call +49-221-6505-8833

S-01, 2.floor, Subbelrather Straße,

15a Cologne, 50823, Germany

Website: https://www.chemanalyst.com/

About Us:

Welcome to ChemAnalyst, a next-generation platform for chemical and petrochemical intelligence where innovation meets practical insight. Recognized as "Product Innovator of the Year 2023" and ranked among the "Top 100 Digital Procurement Solutions Companies," we lead the digital transformation of the global chemical sector. Our online platform helps companies handle price volatility with structured analysis, real-time pricing, and reliable news and deal updates from across the world. Tracking over 500 chemical prices in more than 40 countries becomes simple and efficient with us.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Track Polycarbonate Price Trend Across Top Countries: Index, News, Monitor, and Demand Insights here

News-ID: 4277009 • Views: …

More Releases from ChemAnalyst

Track Clarithromycin Price Chart Historical and Forecast

Executive Summary

The global Clarithromycin price trend in 2025 reflected a year shaped by supply chain disruptions, tariff adjustments, freight volatility, seasonal demand shifts, and evolving procurement strategies across key pharmaceutical markets. Across North America, APAC, and Europe, price movements oscillated between temporary supply tightness and oversupply corrections, creating a dynamic pricing environment.

In Q1 2025, prices strengthened globally amid logistical bottlenecks, Lunar New Year disruptions, and strategic restocking. Q2 witnessed freight-driven…

Track Citric Acid Price Trend Historical and Forecasts

Citric Acid Price Trend and Forecast Report 2025

Comprehensive Market Intelligence Across North America, APAC, and Europe

Executive Summary

The global Citric Acid price trend in 2025 reflected pronounced volatility driven by shifting trade flows, tariff adjustments, supply disruptions, feedstock cost fluctuations, and evolving downstream demand patterns. While Q1 began with broad-based price weakness across most regions due to oversupply and high inventories, Q2 marked a sharp inflection point as global supply tightened,…

Track Cetirizine Dihydrochloride Price Chart Historical and Forecast

Cetirizine Dihydrochloride Prices, Index, Supply and Demand, Forecast, Market Analysis and News

Executive Summary

The global Cetirizine Dihydrochloride market demonstrated measured volatility through 2025, shaped by tariff disruptions, freight normalization, seasonal demand cycles, and evolving procurement strategies across key pharmaceutical regions. During Q2 2025, sharp tariff actions and trade realignments triggered temporary supply shocks and frontloaded purchasing in North America, while oversupply conditions weighed heavily on APAC and European prices. Q3 reflected…

Track Biotin Price Trend Historical and Forecasts

Comprehensive Global Market Review with Regional Insights and Procurement Outlook

Executive Summary

The global Biotin market experienced measured yet regionally divergent price movements throughout 2025, shaped by supply-demand rebalancing, feedstock stability, logistics normalization, and procurement discipline across pharmaceutical, nutraceutical, and animal nutrition sectors. While APAC faced price softness due to inventory overhang and large-scale fermentation capacity, Europe maintained relative stability amid balanced imports and cautious distributor stocking. North America displayed resilience, supported…

More Releases for Polycarbonate

Key Trends Reshaping the Polycarbonate Market: Essentium Inc. Sets New Standards …

Use code ONLINE30 to get 30% off on global market reports and stay ahead of tariff changes, macro trends, and global economic shifts.

Polycarbonate Market Size Growth Forecast: What to Expect by 2025?

The size of the polycarbonate market has seen considerable growth over recent years. The market is set to increase from a valuation of $24.06 billion in 2024, to $25.39 billion in 2025, at a compound annual growth rate of…

Flame Retardant Polycarbonate Market Size Analysis by Application, Type, and Reg …

USA, New Jersey- According to Market Research Intellect, the global Flame Retardant Polycarbonate market in the Internet, Communication and Technology category is projected to witness significant growth from 2025 to 2032. Market dynamics, technological advancements, and evolving consumer demand are expected to drive expansion during this period.

The market for flame retardant polycarbonate is expanding steadily as a result of rising demand in the construction, automotive, and electrical industries. The usage…

Polycarbonate Chocolate Mold Research:the global Polycarbonate Chocolate Mold ma …

QY Research Inc. (Global Market Report Research Publisher) announces the release of 2025 latest report "Polycarbonate Chocolate Mold- Global Market Share and Ranking, Overall Sales and Demand Forecast 2025-2031". Based on current situation and impact historical analysis (2020-2024) and forecast calculations (2025-2031), this report provides a comprehensive analysis of the global Wire Drawing Dies market, including market size, share, demand, industry development status, and forecasts for the next few years.

…

Polycarbonate Diols Market Size to Hit $300 Million by 2028 | Polycarbonate Diol …

Market Overview:

According to our experience research team, Polycarbonate Diols Market was valued at USD 212 Million in 2021, and the global Polycarbonate Diols industry is projected to reach a value of USD 300 Million by 2028, at a CAGR of 4.8% during the forecast period 2022-2028

Vantage Market Research is a collection of market research studies on several industries, such as Chemicals, semiconductors & Electronics, Food & Beverages Technology, Energy &…

Polycarbonate Diols Market Global Briefing

Global Polycarbonate Diols Market: Overview

Polycarbonate diols are chemically studied to be thermoplastic building blocks for polyurethane dispersions and polyurethane compounds such as thermoplastic polyurethane (TPU) and thermoplastic elastomers (TPE). They offer better compatibility with several polyols and solvents and easy handling with their viscous nature at room temperature. Oxidative degradation resistance, intrinsic flexibility, and hydrolytic stability are key properties possessed by polycarbonate diols. Other properties such as optical, temperature resistance,…

Polycarbonate(PC) Resin Market 2018 : Covestro, SABIC, Mitsubishi, Saudi Kayan, …

Global Polycarbonate(PC) Resin market could be classified into different regions and countries for a clear understanding of business prospects available across the globe. This intelligence research study presents a wide-ranging study of the global market by evaluating the growth drivers and detaining factors at length. This detailed study of significant factors supports the market participants in understanding the issues they will be facing while operative in this market over a…