Press release

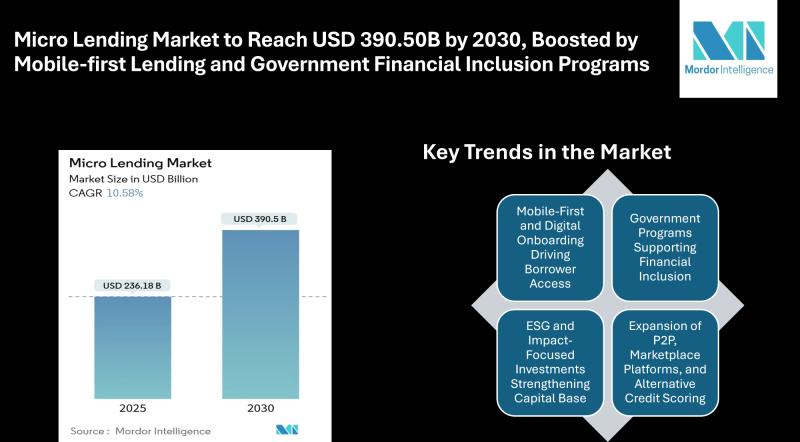

Micro Lending Market to Reach USD 390.50 Billion by 2030, Boosted by Mobile-first Lending and Government Financial Inclusion Programs

Mordor Intelligence has published a new report on the Micro Lending Market, offering a comprehensive analysis of trends, growth drivers, and future projections.Outlook to Micro Lending Market

The Micro Lending Market size is valued at USD 236.18 billion in 2025 and is forecasted to reach USD 390.50 billion by 2030, reflecting a solid 10.58% CAGR. The growing involvement of impact investors and ESG-focused funds has strengthened the Micro Lending Market share, while collaborations with embedded finance platforms are enabling quicker and more convenient access to loans for borrowers globally.

Report overview: https://www.mordorintelligence.com/industry-reports/micro-lending-market?utm_source=openpr

Key Trends in the Micro Lending Market

1. Mobile-First and Digital Onboarding Driving Borrower Access

Lenders using mobile-first platforms and AI-driven alternative data expand reach, assess borrowers with limited credit history, and offer smaller loans efficiently.

2. Government Programs Supporting Financial Inclusion

Government policies, guarantee schemes, and subsidized interest programs improve microloan access, support SMEs and underserved borrowers, reduce lender risk, and boost market participation.

3. ESG and Impact-Focused Investments Strengthening Capital Base

Impact and ESG-focused funding gives micro lenders affordable capital, supporting women entrepreneurship, environmental sustainability, poverty alleviation, and overall growth of the micro lending ecosystem.

4. Expansion of P2P, Marketplace Platforms, and Alternative Credit Scoring

Peer-to-peer and marketplace lenders bridge small business financing gaps, using cash-flow underwriting and AI-driven credit scoring to expand financial inclusion and Micro Lending Market share.

Check out more details and stay updated with the latest industry trends, including the Japanese version for localized insights: https://www.mordorintelligence.com/ja/industry-reports/micro-lending-market?utm_source=openpr

Market Segmentation of Micro Lending

By Institution:

Banks

Micro-Finance Institutions (MFIs) and Others

By End-Users:

Businesses

Retail (Consumers)

By Channel:

Online

Offline

By Region:

North America: United States, Canada, Mexico

South America: Brazil, Argentina, Chile, Colombia, Rest of South America

Europe: United Kingdom, Germany, France, Spain, Italy, Benelux (Belgium, Netherlands, Luxembourg), Nordics (Sweden, Norway, Denmark, Finland, Iceland), Rest of Europe

Asia-Pacific: China, India, Japan, South Korea, Australia, South-East Asia (Singapore, Indonesia, Malaysia, Thailand, Vietnam, Philippines), Rest of Asia-Pacific

Middle East and Africa: United Arab Emirates, Saudi Arabia, South Africa, Nigeria, Rest of Middle East and Africa

Explore Our Full Library of Financial Services and Investment Intelligence Research Reports- https://www.mordorintelligence.com/market-analysis/financial-services-and-investment-intelligence?utm_source=openpr

Key Players in the Micro Lending Market

Accion International - A global nonprofit focused on providing microfinance and financial services to underserved populations, supporting small business growth and financial inclusion.

BlueVine Inc. - A fintech company offering online lending and banking solutions for small businesses, including lines of credit and invoice financing.

Funding Circle - A peer-to-peer lending platform that connects small businesses with investors, providing fast and flexible business loans.

Kabbage Inc. - A fintech lender providing automated funding solutions and working capital to small businesses using data-driven credit assessment.

OnDeck - A digital lender offering term loans and lines of credit to small businesses, leveraging technology for quick approvals and disbursements.

Explore more insights on the Micro Lending Market competitive landscape: https://www.mordorintelligence.com/industry-reports/micro-lending-market/companies?utm_source=openpr

Conclusion

The Micro Lending Market is on a steady growth trajectory, driven by digital lending, government financial inclusion initiatives, and increasing demand for business lending. Asia-Pacific continues to lead the market, while online channels and fintech platforms are enhancing access to micro loans.

Get the latest industry insights on the Micro Lending Market: https://www.mordorintelligence.com/industry-reports/micro-lending-market?utm_source=openpr

Industry Related Reports:

Micro Finance Market

The Micro Finance Market size is projected to grow from USD 256.74 billion in 2025 to USD 424.51 billion by 2030, at a CAGR of 10.58%. Growth is driven by increasing digital lending adoption and government-backed financial inclusion programs, enabling wider access to small loans for underserved individuals and micro-enterprises.

Get more insights: https://www.mordorintelligence.com/industry-reports/micro-finance-market?utm_source=openpr

Alternative Financing Market

The Alternative Financing Market is set to grow from USD 1.29 trillion in 2025 to USD 2.08 trillion by 2030, at a CAGR of 10.01%. This growth is driven by the rising adoption of digital lending platforms and increased investor participation in peer-to-peer lending and crowdfunding, expanding credit access for SMEs and retail investors globally.

Get more insights: https://www.mordorintelligence.com/industry-reports/alternative-financing-market?utm_source=openpr

China Fintech Market

The China Fintech Market is projected to grow from USD 51.28 billion in 2025 to USD 107.55 billion by 2030, at a CAGR of 15.97%. Growth is driven by rapid digital payment adoption, increased smartphone penetration, and supportive government policies promoting financial technology innovation across both urban and rural areas.

Get more insights: https://www.mordorintelligence.com/industry-reports/china-fintech-market?utm_source=openpr

For any inquiries or to access the full report, please contact:

media@mordorintelligence.com

https://www.mordorintelligence.com/

Mordor Intelligence, 11th Floor, Rajapushpa Summit, Nanakramguda Rd, Financial District, Gachibowli, Hyderabad, Telangana - 500032, India.

About Mordor Intelligence:

Mordor Intelligence is a trusted partner for businesses seeking comprehensive and actionable market intelligence. Our global reach, expert team, and tailored solutions empower organizations and individuals to make informed decisions, navigate complex markets, and achieve their strategic goals.

With a team of over 550 domain experts and on-ground specialists spanning 150+ countries, Mordor Intelligence possesses a unique understanding of the global business landscape. This expertise translates into comprehensive syndicated and custom research reports covering a wide spectrum of industries, including aerospace & defense, agriculture, animal nutrition and wellness, automation, automotive, chemicals & materials, consumer goods & services, electronics, energy & power, financial services, food & beverages, healthcare, hospitality & tourism, information & communications technology, investment opportunities, and logistics.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Micro Lending Market to Reach USD 390.50 Billion by 2030, Boosted by Mobile-first Lending and Government Financial Inclusion Programs here

News-ID: 4273542 • Views: …

More Releases from Mordor Intelligence

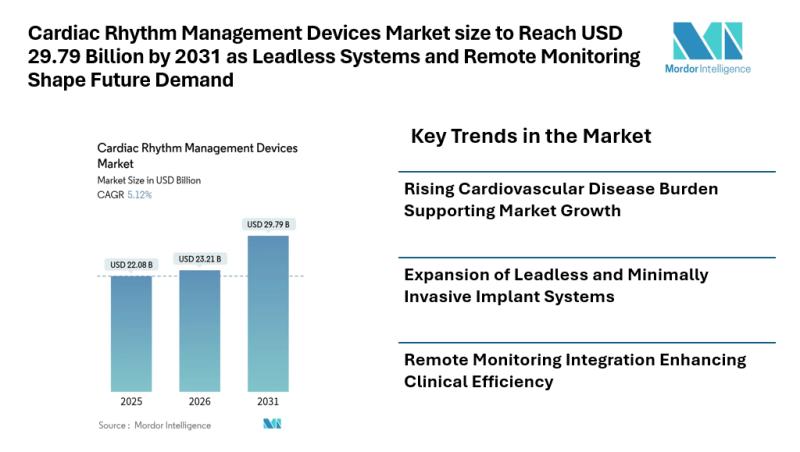

Cardiac Rhythm Management Devices Market size to Reach USD 29.79 Billion by 2031 …

Mordor Intelligence has published a new report on the cardiac rhythm management devices market, offering a comprehensive analysis of trends, growth drivers, and future projections.

Cardiac Rhythm Management Devices Market Overview

According to Mordor Intelligence, the cardiac rhythm management devices market is set to expand from USD 22.08 billion in 2025 to USD 23.21 billion in 2026 and is projected to reach USD 29.79 billion by 2031, registering a…

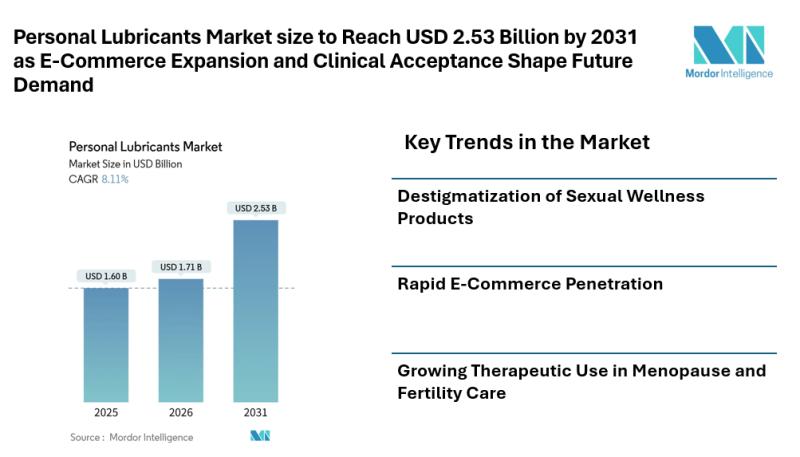

Personal Lubricants Market size to Reach USD 2.53 Billion by 2031 as E-Commerce …

Mordor Intelligence has published a new report on the personal lubricants market, offering a comprehensive analysis of trends, growth drivers, and future projections.

Introduction

According to Mordor Intelligence, the personal lubricants market size is estimated at USD 1.71 billion in 2026 and is projected to reach USD 2.53 billion by 2031, registering a CAGR of 8.11% during the forecast period. These steady personal lubricants market growth reflects wider…

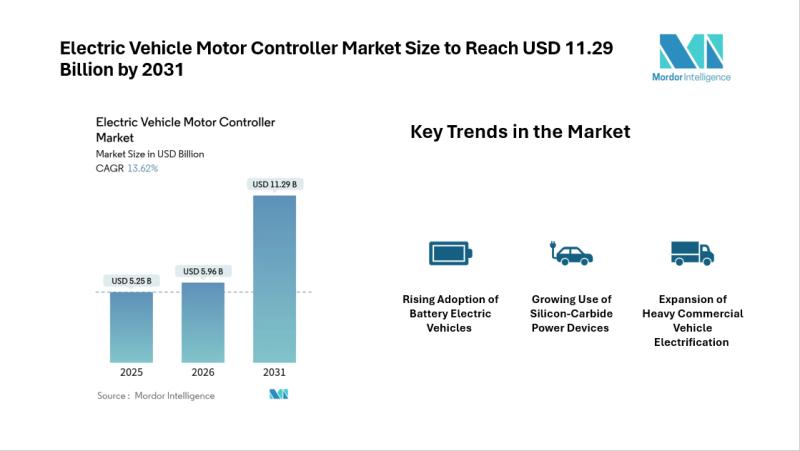

Electric Vehicle Motor Controller Market Size to Reach USD 11.29 Billion by 2031 …

Electric Vehicle Motor Controller Market Overview

According to Mordor Intelligence, the electric vehicle motor controller market size is projected to reach USD 11.29 billion by 2031, growing from USD 5.96 billion in 2026 at a CAGR of 13.62% during the forecast period. The electric vehicle motor controller market forecast reflects steady expansion supported by stricter emission regulations, rising battery electric vehicle adoption, and the increasing use of silicon-carbide power devices.…

Beverage Market Size to Reach USD 2.67 Trillion by 2031, Driven by Health and Su …

Introduction: Beverage Market Growth Outlook

According to a research report by Mordor Intelligence, the global Beverage Market is projected to grow from an estimated USD 2.03 trillion in 2026 to USD 2.67 trillion by 2031, reflecting a steady CAGR of 5.65% over the forecast period. This growth is supported by increasing consumer awareness around health, wellness, and sustainable consumption, along with the rising demand for premium and functional beverages. Non-alcoholic…

More Releases for Micro

Micro and Ultra-Micro Balances Market Size Report 2025

"Global Micro and Ultra-Micro Balances Market 2025 by Manufacturers, Regions, Type and Application, Forecast to 2031" is published by Global Info Research. It covers the key influencing factors of the Micro and Ultra-Micro Balances market, including Micro and Ultra-Micro Balances market share, price analysis, competitive landscape, market dynamics, consumer behavior, and technological impact, etc.At the same time, comprehensive data analysis is conducted by national and regional sales, corporate competition rankings,…

Micro Mobility Revolution: Exploring the Growing Micro Cars Market

The term micro car is used for small-sized and lightweight cars, with an engine small than 700 cc. Bubble cars, cycle cars and quadricycles are defined as micro cars. This is usually three-wheeled and four-wheeled vehicle, available for personal and commercial usage. It is often used as a second or commuter car due to its low cost and fuel efficiency. This car is suitable for urban and suburban environment, as…

Micro Injection Molded Plastic Market worth $1,692 million by 2026 | Key players …

According to recent market research the "Micro Injection Molded Plastic Market by Material Type (Liquid-Crystal Polymer (LCP), Polyether Ether (PEEK), Polycarbonate (PC), Polyethylene (PE), Polyoxymethylene (POM)), Application and Region - Global Forecast to 2026", published by MarketsandMarkets, the micro injection molded plastic market is projected to reach USD 1,692 million by 2026, at a CAGR of 11.2% from USD 995 million in 2021.

Micro injection molded plastics are made of micro…

Micro Combined Heat & Power (Micro CHP) Market 2022 | Detailed Report

The Micro Combined Heat & Power (Micro CHP) research report combines vital data incorporating the competitive landscape, global, regional, and country-specific market size, market growth analysis, market share, recent developments, and market growth in segmentation. Furthermore, the Micro Combined Heat & Power (Micro CHP) research report offers information and thoughtful facts like share, revenue, historical data, and global market share. It also highlights vital aspects like opportunities, driving, product scope,…

Micro-Invasive Glaucoma Implants Micro-Invasive Glaucoma Implants

Global Micro-Invasive Glaucoma Implants Market Definition: Micro-invasive glaucoma implants is performed for the treatment of the open- angle glaucoma and is done through an ab- interno approach. It is very safe and provides faster recovery as compared to the traditional methods. They usually lower the intraocular by increasing the flow or reducing the production of the aqueous humor. Increasing cases of the glaucoma worldwide is the major factor fueling the…

Comprehensive Analysis On Micro Welding Equipment Market 2019 : Pro-Fusion, OR L …

Up Market Research added a new Micro Welding Equipment Market research report for the period of 2019 – 2026. Report focuses on the major drivers and restraints providing analysis of the market share, segmentation, revenue forecasts and geographic regions of the market.

Get Sample Copy Of This Report @

https://www.upmarketresearch.com/home/requested_sample/108038

The report contains 112 pages which highly exhibit on current market analysis scenario, upcoming as well as future opportunities, revenue growth, pricing…