Press release

United State Open Banking Market Overview | Fintech Disruption, Top Companies are Banco Bilbao Vizcaya Argentaria S.A, Plaid Inc., TrueLayer Ltd

WILMINGTON, DE, UNITED STATES:United States Open Banking Market size US$ 7.14 B in 2024 to projected US$ 34.5 B by 2032 with CAGR 25%

Japan Open Banking Market Size US$ 1.11 B in 2024 to grow US$ 4.78 B by 2030 with CAGR 27%

Global Open Banking Market reached US$ 20.9 billion in 2022 and is expected to reach US$ 129.8 billion by 2030, growing with a CAGR of 25.7% during the forecast period 2024-2031

According to DataM Intelligence has published a new research report on "Open Banking Market Size 2025". The report explores comprehensive and insightful Information about various key factors like Regional Growth, Segmentation, CAGR, Business Revenue Status of Top Key Players and Drivers. The purpose of this report is to provide a telescopic view of the current market size by value and volume, opportunities, and development status.

Get a Free Sample PDF Of This Report (Get Higher Priority for Corporate Email ID):- https://datamintelligence.com/download-sample/open-banking-market?kb

Latest M & A

HSBC acquired Silicon Valley Bank UK Limited to strengthen its banking franchise in the UK, reflecting major consolidation trends in open banking enablers and payment infrastructure.

Tide, a leading UK digital business bank, completed the acquisition of Funding Options, a marketplace for business finance, integrating credit intermediation capabilities.

Financial sector M&A surged in India, with notable deals including Emirates NBD acquiring a 60% stake in RBL Bank for $3 billion, reflecting heightened activity in fintech and banking sectors relevant to open banking.

Broader fintech M&A also shows vertical consolidation and strategic expansions of international markets by financial technology companies.

Top Industry Players:

Banco Bilbao Vizcaya Argentaria S.A, Plaid Inc., TrueLayer Ltd, Finleap Connect, Finastra, Tink, Jack Henry & Associates, Inc, Mambu, MuleSoft and NCR Corporation

Key Industry Sector Development:

The US Consumer Financial Protection Bureau (CFPB) is revising its open banking rule after a preliminary injunction, but data sharing between banks and fintechs continues to grow rapidly, with API connections increasing over 50% in the past year. JPMorgan Chase's data-sharing deals with fintechs marked a key milestone.

The UK Financial Conduct Authority (FCA) unveiled a five-year strategy aimed at driving growth in financial services, including open banking initiatives to foster innovation and competition.

Open Banking Limited in the UK launched plans to create an "independent central operator" intended to accelerate Variable Recurring Payments (VRPs) adoption, a significant development in payment innovation.

Buy Now & Get 30% OFF - (Grab 50% OFF on 2+ reports) @: https://www.datamintelligence.com/buy-now-page?report=open-banking-market?kb

Key Segments:

By Service

✅ Payments - 42%, the largest share driven by instant payments, A2A transfers, and PSD2 adoption

✅ Banking & Capital Markets - 28%, supported by API-driven wealth and credit services

✅ Digital Currencies - 19%, fueled by crypto integration and tokenized assets

✅ Value-Added Services - 11%, including budgeting apps, analytics, and fraud tools

By Deployment

✅ Cloud - 64%, dominating due to scalability, API integration, and lower deployment cost

✅ On-premise - 36%, preferred by large banks requiring high data control

By Distribution Channel

✅ Bank Channels - 48%, the leading segment as banks increasingly expose APIs directly

✅ App Markets - 27%, driven by fintech apps and digital wallets

✅ Aggregators - 17%, expanding due to unified API solutions

✅ Distributors - 8%, niche partners enabling third-party integrations

Regional Analysis for Market:

✅ Europe - 44%

The global leader due to PSD2, strong regulatory push, and widespread API adoption.

✅ North America - 32%

Growing rapidly with voluntary open banking frameworks, fintech expansion, and strong digital banking demand.

✅ Asia Pacific - 21%

Accelerating due to digital banking initiatives in India, Singapore, Australia, and Japan.

Get Customization in the report as per your requirements: https://datamintelligence.com/customize/open-banking-market?kb

Product Launches

Virgin Money partnered with Mastercard to enhance its credit card app using open banking technology, demonstrating how banks are embedding open banking capabilities for enhanced user experiences.

New digital banking platforms and API engines have been launched, enabling faster integration and payments infrastructure adoption (e.g., UPI API engines, peer-to-peer payment features) primarily in emerging markets like India.

Open banking data APIs are becoming publicly accessible from several providers, improving direct debit, standing orders, and bank product data access for developers.

Have any Enquiry of This Report @ https://www.datamintelligence.com/enquiry/open-banking-market?kb

Power your decisions with real-time competitor tracking, strategic forecasts, and global investment insights all in one place.

Get 2-Day Free Trial + 50% OFF DataM Subscription@ https://www.datamintelligence.com/reports-subscription?kb

Have a look at our Subscription Dashboard: https://www.youtube.com/watch?v=x5oEiqEqTWg

Contact Us -

Company Name: DataM Intelligence

Contact Person: Sai Kiran

Email: Sai.k@datamintelligence.com

Phone: +1 877 441 4866

Website: https://www.datamintelligence.com

Linkedin: https://www.linkedin.com/company/datam-intelligence/

Twitter: https://x.com/DataM_Research

About Us -

DataM Intelligence is a Market Research and Consulting firm that provides end-to-end business solutions to organizations from Research to Consulting. We, at DataM Intelligence, leverage our top trademark trends, insights and developments to emancipate swift and astute solutions to clients like you. We encompass a multitude of syndicate reports and customized reports with a robust methodology.

Our research database features countless statistics and in-depth analyses across a wide range of 6300+ reports in 40+ domains creating business solutions for more than 200+ companies across 50+ countries; catering to the key business research needs that influence the growth trajectory of our vast clientele.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release United State Open Banking Market Overview | Fintech Disruption, Top Companies are Banco Bilbao Vizcaya Argentaria S.A, Plaid Inc., TrueLayer Ltd here

News-ID: 4272763 • Views: …

More Releases from DataM Intelligence 4 Market Research LLP

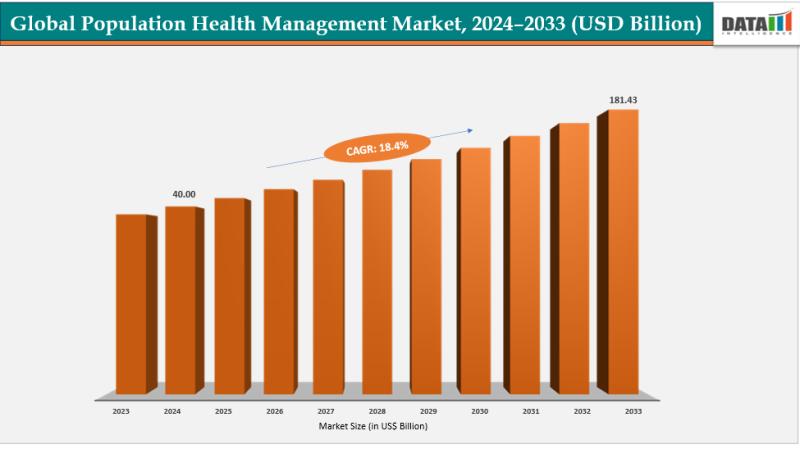

Population Health Management Market Set for Explosive Growth to USD 181.43 Billi …

The Global Population Health Management Market size reached USD 40.00 billion in 2024 and is expected to reach USD 181.43 billion by 2033, growing at a CAGR of 18.4% during the forecast period 2025-2033.

Market growth is driven by the rising prevalence of chronic diseases, increasing adoption of digital health solutions, and growing demand for value-based care models. Advancements in AI and predictive analytics, expanding healthcare IT infrastructure, surging investments in…

Organic Infant Formula Market Set to Grow to US$ 36,046 Million by 2032 at 6.3% …

AUSTIN, Texas and TOKYO -- According to DataM Intelligence, The Organic Infant Formula Market Size reached US$ 20,800 million in 2023, rose to US$ 22,110 million in 2024 and is projected to reach US$ 36,046 million by 2032, expanding at a CAGR of 6.3% from 2025 to 2032. The Organic Infant Formula Market is transforming early childhood nutrition by providing parents with certified organic, high-quality alternatives free from synthetic pesticides,…

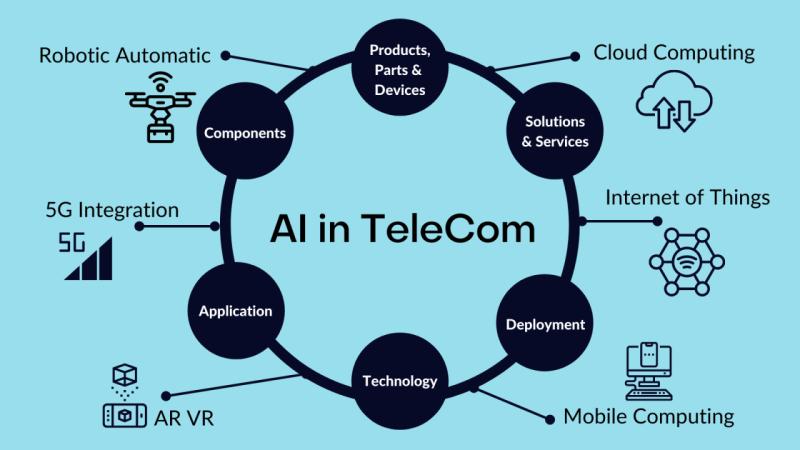

Future of Ai in telecommunication market. AI + Telecommunications Top Technologi …

The global AI in telecommunication market reached US$ 2.25 billion in 2023, with a rise to US$ 2.90 billion in 2024, and is expected to reach US$ 48.98 billion by 2033, growing at a CAGR of 36.9% during the forecast period 2025-2033.

AI in telecommunication market growth is driven by rising data traffic, demand for automated network optimization, predictive maintenance, improved customer experience, cost reduction, and rapid deployment of 5G and…

Bioresorbable Implants Market to Double, Reaching US$ 14.34 Billion by 2033 at 7 …

AUSTIN, Texas and TOKYO -- According to DataM Intelligence, The Bioresorbable Implants Market Size reached US$ 7.00 billion in 2024 and is projected to reach US$ 14.34 billion by 2033, expanding at a CAGR of 7.4% during the forecast period 2025-2033. The Bioresorbable Implants Market is transforming surgical outcomes by dissolving after fulfilling their role, leaving no permanent foreign body and lowering revision risks.

The shift from traditional metallic implants to…

More Releases for Bank

Mortgage-Backed Security Market 2022: Industry Manufacturers Forecasts- Construc …

The Mortgage-Backed Security research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Mortgage-Backed Security market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers formulate effective…

Doorstep Banking Services Market Challenges and Opportunities in Banking Service …

Doorstep banking is a facility provided so that user don't have to visit bank branches for routine banking activities like cash deposit, cash withdrawal, cheque deposit, or making a demand draft. The bank extends these facilities at user work place by appointing a service provider on your behalf.

This service was earlier available only to senior citizens but it is available to everyone with nominal fee charges, depending on the type…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank of …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance,…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank o …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance, regulatory, and other…