Press release

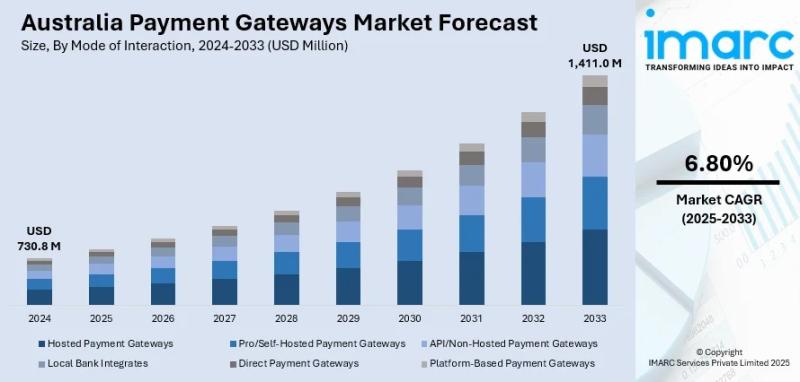

Australia Payment Gateways Market Projected to Reach USD 1,411.0 million by 2033

Market OverviewThe Australia payment gateways market size reached USD 730.8 million in 2024. The market is expected to grow to USD 1,411.0 million by 2033, with a forecast period from 2025 to 2033. This growth is driven by factors such as regulatory modernization by the Reserve Bank of Australia and Australian Prudential Regulation Authority, integration of the New Payments Platform, support for ISO 20022, PCI DSS compliance, real-time settlement, and the adoption of alternative payment methods including BNPL and omnichannel merchant services. These innovations support expanding cross-border e-commerce and enhanced fraud screening tools.

Explore the Australia Payment Gateways Market report for detailed insights.

https://www.imarcgroup.com/australia-payment-gateways-market

How AI is Reshaping the Future of Australia Payment Gateways Market:

• AI-driven fraud screening tools are increasingly integrated into payment gateways to detect and prevent fraudulent transactions in real time, enhancing security and consumer trust.

• Adaptive AI-based authorization solutions like Stripe's Adaptive Acceptance improve payment authorization rates, reducing payment failures and involuntary customer churn.

• AI-powered analytics enable merchants to optimize payment processes and provide data-driven insights for better decision-making and customer experience.

• Machine learning facilitates seamless currency conversion and tax management across jurisdictions, supporting the growth of cross-border e-commerce.

• AI enhances omnichannel payment systems by integrating data-rich messaging and real-time settlement features, fostering fraud detection and improving payment speed.

• Strategic partnerships focusing on AI, such as collaborations between technology firms and payments platforms, accelerate real-time payment adoption and improve user experience design, earning industry recognitions.

Grab a sample PDF of this report: https://www.imarcgroup.com/australia-payment-gateways-market/requestsample

Australia Payment Gateways Market Growth Factors

Regulatory Standards and Interbank Infrastructure Modernization: The Australia payment gateways market is strongly influenced by regulatory bodies such as the Reserve Bank of Australia (RBA) and the Australian Prudential Regulation Authority (APRA), which drive innovation, transparency, and security in digital transactions. The New Payments Platform (NPP) enables real-time bank transfers with data-rich messaging, prompting gateways to support NPP compatibility, ISO 20022 data standards, and real-time settlements. Compliance with PCI DSS and Consumer Data Right (CDR) elevates service standards, leading merchants and developers to favor platforms with strong encryption, fast authorization, and robust analytics. This regulatory modernization advances the ecosystem towards seamless integration with legacy banks and fintech systems, supporting diverse retail and service models with multi-currency and POS integration capabilities.

Expansion of Cross-Border E-Commerce and Alternative Payment Methods: Payment gateways in Australia are adapting to a surge in cross-border e-commerce, fueled by consumers' preference for payment options like Afterpay, Zip, PayPal, and Apple Pay across international platforms. This necessitates gateways to offer diverse payment types, fraud screening mechanisms, and currency conversion to maintain compliance and a smooth user experience. Gateways that minimize chargeback risks and simplify tax handling for Australian merchants targeting foreign markets gain preference. Fintech firms contribute by providing APIs that enable customizable checkouts, local payment supports, and automated reconciliation, all crucial for direct-to-consumer brands, online marketplaces, and digital-first providers.

Demand for Omnichannel Merchant Services and Digital Payment Adoption: The increasing adoption of digital wallets and Buy Now, Pay Later (BNPL) systems, especially for mobile transactions, is transforming payment gateway requirements. Gateways that ensure low transaction latency and security across hybrid retail environments are in growing demand. Investments target omnichannel capabilities aligned with domestic and international payment rails and regulatory frameworks. Partnerships such as Australian Payments Plus and Thoughtworks' alliance to boost real-time payments like PayTo highlight the push towards enhanced user-centric digital payment solutions. These trends underscore competition among gateway providers to offer scalable, secure, and innovative services catering to evolving consumer preferences.

Australia Payment Gateways Market Segmentation

Application:

• Large Enterprises

• Micro and Small Enterprises

• Mid-Size Enterprises

Mode of Interaction:

• Hosted Payment Gateways

• Pro/Self-Hosted Payment Gateways

• API/Non-Hosted Payment Gateways

• Local Bank Integrates

• Direct Payment Gateways

• Platform-Based Payment Gateways

Region:

• Australia Capital Territory & New South Wales

• Victoria & Tasmania

• Queensland

• Northern Territory & Southern Australia

• Western Australia

Key Players

• Fiserv

• Pinch Payments

• Stripe

Recent Development & News

• April 2025: Fiserv expanded its market presence through the acquisition of Pinch Payments, which serves about 2,000 merchants in Australia and New Zealand. This integration enhances Fiserv's service portfolio with the Glassbox platform, improving regulatory compliance and operational management in the region.

• August 2025: Australian streaming service Stan partnered with Stripe to manage online payments and subscription billing. This partnership leverages Stripe's advanced billing solutions like Adaptive Acceptance and Smart Retries, aiming to boost payment authorization rates and reduce involuntary churn.

• September 2025: Australian Payments Plus (AP+) and Thoughtworks launched a strategic collaboration to accelerate the adoption of PayTo, a real-time digital payment solution. The customer-centric design of PayTo received recognition at the Good Design Awards, signaling enhanced user experience and digital payment adoption in Australia.

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

https://www.imarcgroup.com/request?type=report&id=32888&flag=F

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: sales@imarcgroup.com,

Tel No: (D) +91 120 433 0800,

United States: +1-201971-6302

About Us

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Australia Payment Gateways Market Projected to Reach USD 1,411.0 million by 2033 here

News-ID: 4270597 • Views: …

More Releases from IMARC Group

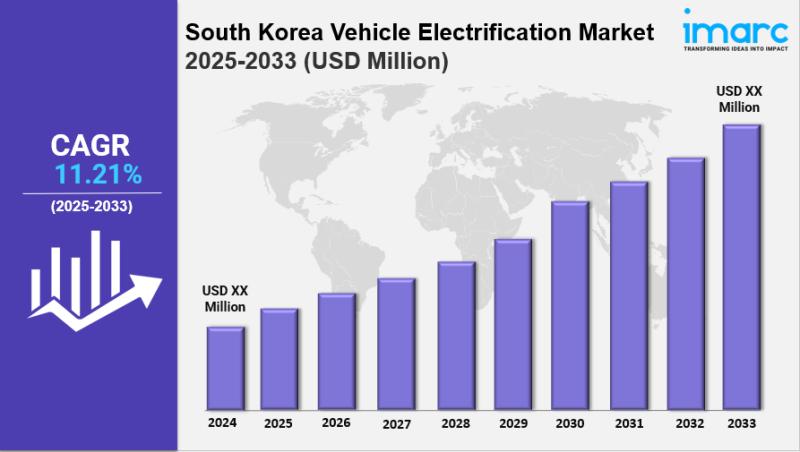

South Korea Vehicle Electrification Market Size, Growth, Key Players, Latest Tre …

IMARC Group has recently released a new research study titled "South Korea Vehicle Electrification Market Report by Product Type (Starter Motor, Alternator, Electric Car Motors, Electric Water Pump, Electric Oil Pump, Electric Vacuum Pump, Electric Fuel Pump, Electric Power Steering, Actuators, Start/Stop System), Vehicle Type (Internal Combustion Engine (ICE) and Micro-Hybrid Vehicle, Plug-in Hybrid Electric Vehicle (PHEV) and Battery Electric Vehicle (BEV), Hybrid Electric Vehicle (HEV)), Sales Channel (Original Equipment…

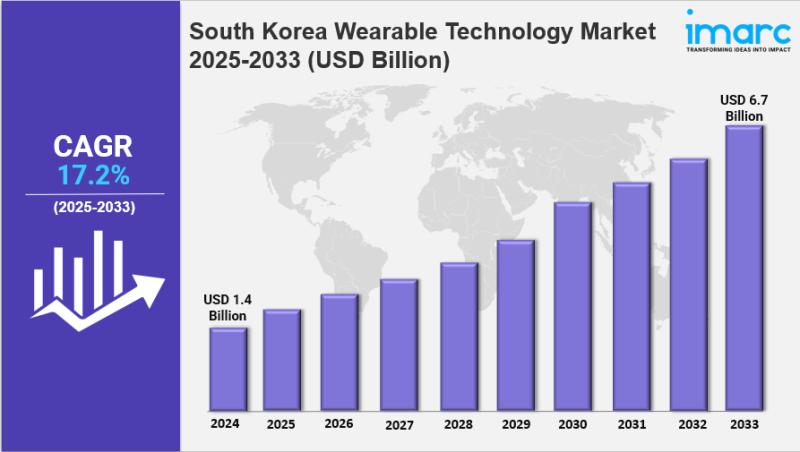

South Korea Wearable Technology Market Size, Share, Industry Overview, Trends an …

IMARC Group has recently released a new research study titled "South Korea Wearable Technology Market Report by Product (Wrist-Wear, Eye-Wear and Head-Wear, Foot-Wear, Neck-Wear, Body-Wear, and Others), Application (Consumer Electronics, Healthcare, Enterprise and Industrial Application, and Others), and Region 2025-2033" This report offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends, and competitive landscape to understand the current and future market scenarios.

South Korea Wearable Technology Market Overview

The…

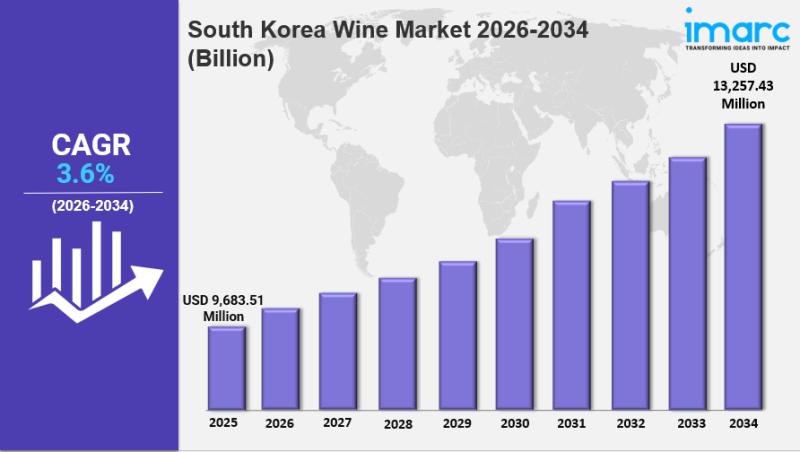

South Korea Wine Market Size, Share, Industry Overview, Trends and Forecast 2026 …

IMARC Group has recently released a new research study titled "South Korea Wine Market Size, Share, Trends and Forecast by Product Type, Color, Distribution Channel, and Region, 2026-2034", which offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends, and competitive landscape to understand the current and future market scenarios.

South Korea Wine Market Report Overview

The South Korea wine market size was valued at USD 9,683.51 Million in 2025.…

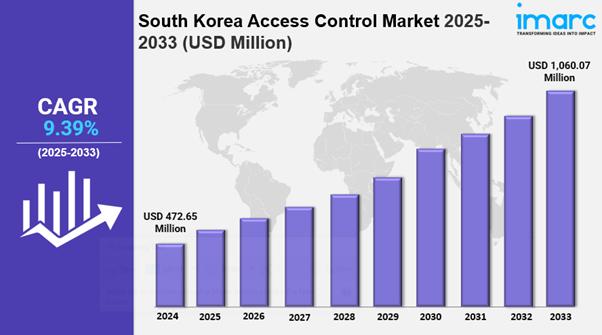

South Korea Access Control Market Size, Share, Industry Overview, Trends and For …

IMARC Group has recently released a new research study titled "South Korea access control market Size, Share, Trends and Forecast by Component, Deployment Mode, SMS Traffic, Application, End User, and Region, 2025-2033", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

South Korea Access Control Market Overview

The South Korea access control market size was valued at USD…

More Releases for Pay

Mobile Payment Market to See Thriving Worldwide| Apple Pay • Google Pay • Sa …

Latest Report, titled Mobile Payment Market 2025-2032 Trends, Share, Size, Growth, Opportunity and Forecast 2025-2032, by Coherent Market Insights offers a comprehensive analysis of the industry, which comprises insights on the market analysis. As part of our Black Friday Limited-Time Discount, this premium research report is now available at up to 60% off, offering an exceptional opportunity for businesses, analysts, and stakeholders to access high-value insights at a significantly reduced…

Proximity Payment Market is Going to Boom | Major Giants Apple Pay, Google Pay, …

HTF MI just released the Global Proximity Payment Market Study, a comprehensive analysis of the market that spans more than 143+ pages and describes the product and industry scope as well as the market prognosis and status for 2025-2032. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.

𝐌𝐚𝐣𝐨𝐫 Giants in Proximity Payment Market are:

Apple Pay, Google Pay, Samsung…

Mobile Wallet (NFC, Digital Wallet) Market to Witness Stunning Growth | Apple Pa …

HTF MI recently introduced Global Mobile Wallet (NFC, Digital Wallet) Market study with 143+ pages in-depth overview, describing about the Product / Industry Scope and elaborates market outlook and status (2024-2032). The market Study is segmented by key regions which is accelerating the marketization. At present, the market is developing its presence. Some key players from the complete study are Apple Pay, Google Pay, Samsung Pay, PayPal, Alipay, WeChat Pay,…

Unified Payments Interface (UPI) Market Is Booming Worldwide | Google Pay, Amazo …

The latest study released on the Global Unified Payments Interface (UPI) Market by AMA Research evaluates market size, trend, and forecast to 2028. The Unified Payments Interface (UPI) market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about…

Unified Payments Interface (UPI) Market May See a Big Move | Major Giants Samsun …

The latest study released on the Global Unified Payments Interface (UPI) Market by AMA Research evaluates market size, trend, and forecast to 2027. The Unified Payments Interface (UPI) market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about…

Samsung Pay Market is Booming Worldwide with Samsung Pay, Apple Pay, Google Pay

HTF Market Intelligence released a new research report of 23 pages on title 'Samsung Pay - Competitor Profile' with detailed analysis, forecast and strategies. The study covers key regions that includes North America, LATAM, United States, GCC, Southeast Asia, Europe, APAC, United Kingdom, India or China etc and important players such as Samsung Pay, Apple Pay, Google Pay, Alipay, Tenpay, Samsung Electronics, Visa, Mastercard.

Request a sample report @ https://www.htfmarketreport.com/sample-report/3587660-samsung-pay-competitor-profile

Summary

Samsung…