Press release

Industrial Inspection Robot Market to Reach USD 3,009 Million by 2031 Top 20 Company Globally

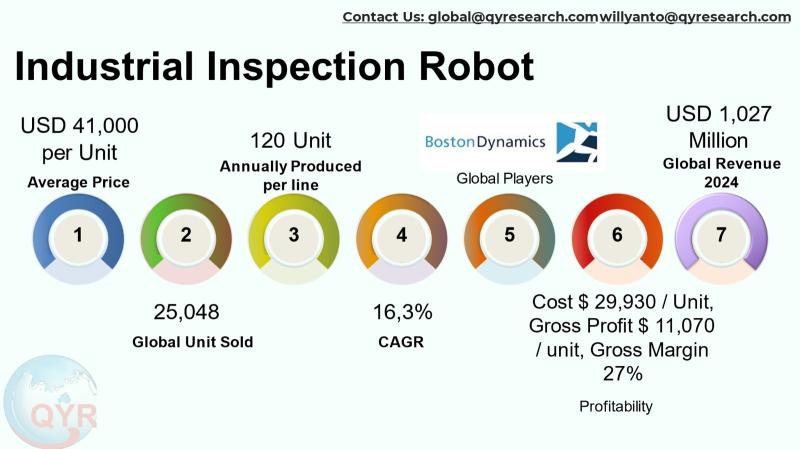

Industrial inspection robots are specialized mobile and fixed robotic systems designed to perform condition assessments, non-destructive testing, leak and gas detection, ultrasonic thickness scanning, thermography, and visual inspection in environments that are hazardous, confined, remote, or expensive to access with humans. This research emphasizes how inspection robotics converts physical-site data into actionable asset intelligence through multi-sensor payloads (ultrasonics, LiDAR, thermal imaging, acoustic imaging, gas sensors) and edge/cloud analytics. The industry has shifted from proof-of-concept trials toward operational deployments where robotics, software analytics, and enterprise asset-management systems are integrated to drive predictive maintenance, regulatory compliance, and safety improvements.The global industrial inspection robot market size is USD 1,027 million in 2024 with a projected CAGR of 16.3% to 2031 reaching market size USD 3,009 million by 2031. With an average selling price of USD 41,000 per unit, the implied total units sold globally in 2024 is approximately 25,048 units. A factory gross margin is 27%, implying a cost of goods sold per unit of roughly USD 29,930 and an average factory gross profit per unit of about USD 11,070. A COGS breakdown is electronics and sensors, mechanical structures and housings, actuators and motors, batteries/power systems, assembly and testing, to calibration & QA, packaging & outbound logistics, and reserved for warranty and spare parts provisioning. A single line full machine production capacity is around 120 units per line per year. Downstream demand is concentrated in energy & utilities, oil & gas, petrochemicals and heavy manufacturing.

Latest Trends and Technological Developments

Autonomy and sensor fusion continue to advance rapidly: ANYbotics announced a modular gas leak detection payload for its ANYmal platform, enabling autonomous detection and localization of gas leaks in industrial facilities, dated June 2025. This reflects a trend toward purpose-built sensor modules that can be hot-swapped for inspection tasks. The ANYbotics Industry Forum (AIF) in September 2024 showcased operational scaling of inspection fleets and new use cases, marking a movement from pilots to fleet rollouts. Gecko Robotics has been expanding its manufacturing footprint and commercial partnerships: press reports in late 2025 note plans for regional manufacturing (UAE/ME) to support faster local deployments, and earlier in 2025 Gecko announced major energy sector contracts both signals of industrial customers preferring local production plus integrated data-services contracts. Across the industry there is increased emphasis on AI/analytics layers that convert high-resolution inspection data into prioritized work orders, and a parallel push to certify robots for hazardous (Ex/ATEX) environments so they can operate in petrochemical and refinery settings without special human escorts.

Saudi Aramco, the world's largest integrated energy and chemicals company, has procured a fleet of "ATEX-certified RoboInspector 300X" aerial drones from SkyScout Industries for a total contract value of USD 4.7 million. This strategic purchase, amounting to approximately USD 78,000 per unit, is dedicated to automating external inspections of high-value assets like spherical storage tanks and structural piping at their Ras Tanura refinery, enhancing worker safety and data consistency.

The advanced robotic inspection system is actively deployed at a BASF SE chemical plant in Ludwigshafen, Germany. A "Serpentus XT" robotic crawler from Inuktun Services Ltd., valued at USD 125,000 per unit, was used to conduct a comprehensive internal inspection of a high-pressure ethylene oxide reactor. The robot, navigating the confined and hazardous space, captured high-resolution laser scan data and ultrasonic thickness measurements, enabling BASF to assess vessel integrity without a single minute of human entry, thereby preventing costly production downtime and ensuring operational safety.

Asia dominates global robotics demand and is a fast-growing market for inspection robots because of the regions large energy, petrochemical, and heavy-manufacturing base. Asia accounted for a strong share of industrial robot deployments in recent global statistics and the regions supply chain strengths (electronics, sensors, actuators) support local production and cost optimization for inspection robotics. Regional customers prioritize robustness, multi-sensor capability, and local support networks; as a result, suppliers that combine hardware plus local service/insight teams gain traction. Large Asian national champions (Japan, South Korea, China) plus international OEMs with local partnerships are actively targeting power plants, airports, rail networks and petrochemical complexes. The Asia Pacific region remains attractive both for sales and for colocated manufacturing because it shortens logistics cycles and reduces time-to-deployment for mission-critical assets.

Get Full PDF Sample Copy of Report: (Including Full TOC, List of Tables & Figures, Chart)

https://www.qyresearch.com/sample/5445145

Industrial Inspection Robot by Type:

Tracked Inspection Robot

Wheeled Inspection Robot

Other

Industrial Inspection Robot by Product Category:

Explosion Proof Robots

Non Explosion Proof Robots

Industrial Inspection Robot by Market Segment:

Full Autonomy

Supervised Autonomy

Teleoperation

Industrial Inspection Robot by Material:

Aluminum Alloy Frame Robots

Carbon Fiber

Stainless Steel Robots

Hybrid Material Robots

Others

Industrial Inspection Robot by Features:

AI Vision

3D LIDAR

IoT Connectivity

Waterproof Grade

Others

Industrial Inspection Robot by Application:

Oil and Gas

Power and Utilities

Mining

Transportation

Others

Global Top 20 Key Companies in the Industrial Inspection Robot Market

Eddyfi Technologies

Boston Dynamics

IPEK International

ANYbotics

Baker Hughes

Shenzhen Launch Digital Technolog

Clearpath Robotics

CSG Smart Science and Technology

Zhejiang Guozi Robotics

Taurob

Robotnik Automation

Guangzhou Guoxun Robot Technology

SMP Robotic

Hangzhou Guochen Robot Technology

Ancn Robot

Capra Robotics

SuperDroid Robots

Dali Technology

Suirui Technology

InMotion Robotic Solutions

Regional Insights

Southeast Asia (ASEAN) is in the early-to-middle phase of adoption relative to Northeast Asia. Indonesia, with its extensive mining, oil & gas, and power-generation assets, is a particularly strong ASEAN market where inspection robots address safety and operational continuity. Indonesias energy and resource operators increasingly pilot inspection fleets for tanks, boilers, pipelines and offshore platforms; demand growth is driven by tightening safety regulations, aging assets, and cost pressure to avoid shutdowns. Adoption patterns in ASEAN favor rental, managed-service, and outcome-based commercial models (inspection-as-a-service) because many operators prefer capex-light solutions and local service partners who can operate and interpret the data onsite.

Key challenges include integration complexity (robot + enterprise asset management + analytics), certification hurdles for hazardous environments, high upfront hardware cost for smaller operators, and scarcity of local skilled service personnel in some ASEAN markets. Scalability of automated inspection depends not only on robot reliability but on data pipelines and workflows that convert sensor outputs into prioritized maintenance actions; without that software integration the value proposition weakens. Supply-chain pressures on long-lead items (high-end sensors, specialty batteries, precision actuators) can also drive lead times and inflate COGS during boom cycles.

For vendors, bundling hardware with analytics, regional service teams and outcome-based contracts accelerates adoption. Localizing manufacturing and field service (regional production or partnerships) shortens delivery cycles and reduces total cost of ownership for large industrial customers a strategy already being pursued by firms expanding regional footprints. For asset owners, the most immediate ROI comes from inspections that eliminate forced shutdowns, reduce rope-access costs, and shorten outage durations by providing higher-fidelity condition data ahead of maintenance windows. Fleet strategies, repeatable inspection itineraries, and open APIs for asset-management integration are differentiators for best-in-class providers.

Product Models

Industrial inspection robots are autonomous or semi-autonomous machines designed to inspect, monitor, and analyze industrial environments such as pipelines, power plants, manufacturing sites, or hazardous zones.

Tracked inspection robots use continuous tracks (similar to those on tanks) to navigate rough, uneven, or hazardous surfaces. They are ideal for confined or complex industrial environments such as tunnels, pipelines, or disaster zones. Notable products include:

ROVVER X Envirosight: A modular tracked robot designed for sewer and pipeline inspection with adaptable wheel and track configurations.

Explorer-iX Eddyfi Technologies: A rugged crawler robot for inspecting pipelines up to 1,200 mm in diameter, featuring advanced NDT integration.

VERSATRAX 300 Inuktun: A compact tracked robot capable of operating in confined spaces and submerged conditions.

Taurob Inspector Taurob GmbH: An ATEX-certified tracked robot used in oil and gas facilities for autonomous inspection in explosive environments.

Inspector Bots SearchBot Inspector Bots: A remote-controlled tracked robot used for security and industrial inspection with onboard HD cameras.

Wheeled inspection robots are built for high mobility and speed on flat or moderately uneven surfaces. They are efficient in large facilities, warehouse environments, and smooth industrial floors, offering quick inspection capabilities and longer battery life. Examples include:

Pipe Trekker PT360 Deep Trekker: A compact wheeled robot for inspecting pipelines with 360° camera rotation and LED illumination.

Cobra Pipeline Crawler CUES Inc.: A robust wheeled crawler system for long-distance pipeline inspection.

RICO Wheeled Robot RICO Robotics: A high-speed inspection robot for industrial and warehouse surveillance applications.

ARIES Wheeled Crawler Envirosight: A durable wheeled inspection system designed for large-diameter pipes with pan-and-tilt zoom cameras.

Subsite Lateral Launch System Subsite Electronics: A wheeled robotic system for mainline and lateral pipe inspections with automated branch navigation.

Inspection robotics is transitioning from niche pilots to operational fleets driven by improvements in autonomy, specialized sensor modules, and analytics that convert raw measurements into actionable maintenance work. Asia and Southeast Asia are priority markets due to high concentrations of energy, petrochemical and heavy industrial assets and because regional supply chains can support both cost-effective manufacturing and rapid deployment. Manufacturers and investors focusing on integrated hardware+software+services models and regional service localization will be best positioned to capture the projected growth implied by the 2024 marker size and CAGR.

Investor Analysis

This report highlights three investable thesis lines: hardware platforms that own the sensor-to-cloud stack (what), managed-service/commercial models that convert capex into recurring revenue (how), and regional manufacturing/service localization that reduces customer barriers and shortens payback (why). Investors benefit from: 1) clarity on unit economics, 2) visibility into which sectors buy most (energy/oil & gas/ utilities), 3) evidence of commercial scaling from recent vendor announcements and regional expansions, and 4) near-term catalysts (product certifications, fleet contracts, regional factories) that can de-risk adoption timelines. For portfolio construction, a blended strategy of equity in market leaders, exposure to enabling component suppliers (sensors, actuators), and investments in service platforms (inspection-as-a-service) balances upside with operational risk.

Request for Pre-Order Enquiry On This Report

https://www.qyresearch.com/customize/5445145

5 Reasons to Buy This Report

To obtain a regionally focused analysis of Asia and ASEAN demand dynamics for inspection robots and the specific adoption signals in Indonesia.

To access tested unit-economics and factory KPI estimates (ASP, per-unit COGS, gross profit per unit and production capacity assumptions).

To read a concise competitive map and short list of top vendors with commercial developments and dates.

To get strategic, investor-oriented recommendations linking technology trends to monetization pathways (hardware, software, services).

To gain curated, recent news and trend citations (product launches, regional production moves, major contracts) that validate growth assumptions.

5 Key Questions Answered

What is the addressable unit volume implied by the supplied 2024 market size and ASP?

Which downstream industries will drive demand in Asia and ASEAN?

What does a plausible per-unit COGS and factory gross margin look like for inspection robot OEMs?

Which vendors are driving commercial adoption and what recent product/market moves support scaling?

What operational and go-to-market strategies reduce adoption friction for asset owners and accelerate ROI?

Chapter Outline

Chapter 1: Introduces the report scope of the report, executive summary of different market segments (by region, product type, application, etc), including the market size of each market segment, future development potential, and so on. It offers a high-level view of the current state of the market and its likely evolution in the short to mid-term, and long term.

Chapter 2: key insights, key emerging trends, etc.

Chapter 3: Manufacturers competitive analysis, detailed analysis of the product manufacturers competitive landscape, price, sales and revenue market share, latest development plan, merger, and acquisition information, etc.

Chapter 4: Provides profiles of key players, introducing the basic situation of the main companies in the market in detail, including product sales, revenue, price, gross margin, product introduction, recent development, etc.

Chapter 5 & 6: Sales, revenue of the product in regional level and country level. It provides a quantitative analysis of the market size and development potential of each region and its main countries and introduces the market development, future development prospects, market space, and market size of each country in the world.

Chapter 7: Provides the analysis of various market segments by Type, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different market segments.

Chapter 8: Provides the analysis of various market segments by Application, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different downstream markets.

Chapter 9: Analysis of industrial chain, including the upstream and downstream of the industry.

Chapter 10: The main points and conclusions of the report.

Related Report Recommendation

Global Industrial Inspection Robot Market Research Report 2025

https://www.qyresearch.com/reports/3610723/industrial-inspection-robot

Global Industrial Inspection Robot Sales Market Report, Competitive Analysis and Regional Opportunities 2025-2031

https://www.qyresearch.com/reports/3620583/industrial-inspection-robot

Global Industrial Inspection Robot Market Outlook, InDepth Analysis & Forecast to 2031

https://www.qyresearch.com/reports/5445145/industrial-inspection-robot

Industrial Inspection Robot - Global Market Share and Ranking, Overall Sales and Demand Forecast 2025-2031

https://www.qyresearch.com/reports/5445146/industrial-inspection-robot

Global 5G Inspection Robot Market Research Report 2025

https://www.qyresearch.com/reports/4796169/5g-inspection-robot

Global AI Inspection Robot Market Research Report 2025

https://www.qyresearch.com/reports/4760028/ai-inspection-robot

Global IoT Inspection Robot Market Research Report 2025

https://www.qyresearch.com/reports/4795637/iot-inspection-robot

Global Roof Inspection Robot Market Research Report 2025

https://www.qyresearch.com/reports/4581974/roof-inspection-robot

Global HVAC Inspection Robot Market Research Report 2025

https://www.qyresearch.com/reports/4564164/hvac-inspection-robot

Global Land Inspection Robot Market Research Report 2025

https://www.qyresearch.com/reports/3592968/land-inspection-robot

Contact Information:

Tel: +1 626 2952 442 (US) ; +86-1082945717 (China)

+62 896 3769 3166 (Whatsapp)

Email: willyanto@qyresearch.com; global@qyresearch.com

Website: www.qyresearch.com

About QY Research

QY Research has established close partnerships with over 71,000 global leading players. With more than 20,000 industry experts worldwide, we maintain a strong global network to efficiently gather insights and raw data.

Our 36-step verification system ensures the reliability and quality of our data. With over 2 million reports, we have become the world's largest market report vendor. Our global database spans more than 2,000 sources and covers data from most countries, including import and export details.

We have partners in over 160 countries, providing comprehensive coverage of both sales and research networks. A 90% client return rate and long-term cooperation with key partners demonstrate the high level of service and quality QY Research delivers.

More than 30 IPOs and over 5,000 global media outlets and major corporations have used our data, solidifying QY Research as a global leader in data supply. We are committed to delivering services that exceed both client and societal expectations

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Industrial Inspection Robot Market to Reach USD 3,009 Million by 2031 Top 20 Company Globally here

News-ID: 4269590 • Views: …

More Releases from QY Research

Market Overview - Ultra-low-k Dielectric Material

QY Research has recently published a comprehensive market study on Ultra-low-k Dielectric Material, a critical class of advanced insulating materials engineered to reduce parasitic capacitance and signal delay in advanced semiconductor interconnects. Ultra-low-k dielectrics are essential enablers for sub-7 nm logic nodes, advanced memory, high-performance computing, and AI accelerators, where interconnect RC delay increasingly limits device performance and power efficiency.

The market is transitioning from dense SiO2 and conventional low-k materials…

Global and U.S. Quadruped Mobile Robots Market Report, Published by QY Research.

QY Research has released a comprehensive new market report on Quadruped Mobile Robots, are four-legged robotic systems designed to move and operate in complex, unstructured environments by mimicking the locomotion of animals. They use a combination of advanced sensors, actuators, AI algorithms, and real-time control systems to maintain balance, navigate uneven terrain, climb obstacles, and adapt to dynamic conditions. Because of their high stability and mobility, quadruped robots are widely…

Global and U.S. Industrial Edge Cloud Devices Market Report, Published by QY Res …

QY Research has released a comprehensive new market report on Industrial Edge Cloud Devices, ruggedized computing platforms that bring cloud-native processing, storage, and AI analytics directly to the industrial edge-close to machines, sensors, and control systems. By executing latency-sensitive workloads locally while synchronizing with central or public clouds, these devices enable real-time decision-making, improved reliability, and secure data governance across factories, utilities, energy assets, and transportation infrastructure. As Industry 4.0,…

Top 30 Indonesian Ceramic Public Companies Q3 2025 Revenue & Performance

1) Overall companies performance (Q3 2025 snapshot)

PT Arwana Citramulia Tbk (ARNA)

PT Cahayaputra Asa Keramik Tbk (CAKK)

PT Intikeramik Alamasri Industri Tbk (IKAI)

PT Keramika Indonesia Assosiasi Tbk (KIAS)

PT Mulia Industrindo Tbk (MLIA)

PT Asahimas Flat Glass Tbk (AMFG) (glass & ceramic-adjacent)

PT Niro Ceramic Nasional Indonesia

PT Eleganza Tile Indonesia

PT Roman Ceramic International

PT Platinum Ceramics Industry

PT Granito (Citra Granito)

PT Diamond Keramik Indonesia

PT Indogress (Inti Keramik Sejahtera)

PT Indopenta Sakti Teguh

PT Sun Power Ceramics

PT Satyaraya Keramindo Indah…

More Releases for Robot

RoboPaw Robot Puppy Review: Is This Robot Dog Worth Buying?

RoboPaw Robot Puppy Review: Is This Robot Dog Worth Buying?

The rise of smart robotic pets has transformed how families introduce companionship, creativity, and safe entertainment into their daily routines. Among the newest innovations gaining massive attention is the RoboPaw Robot Puppy, a highly interactive, expressive, and surprisingly intelligent robotic companion designed for kids, adults, and even seniors who want play, comfort, and engagement without the responsibility of a real pet.

The…

Wuffy Robot Dog Reviews: All Truth about Wuffy Robot Dog (wuffy the robot dog)

Parents around the world are asking the same question right now: can a robot puppy really replace some of the comfort and fun of a real dog? In a time when many families live in apartments, juggle allergies, or simply cannot handle the responsibility of a pet, wuffy robot dog reviews are starting to stand out online for one simple reason. This is not another plastic gadget that flashes once…

Major Market Shift in Robot Kitchen Industry: Robot-Operated Or AI-Powered Resta …

What Is the Forecasted Market Size and Growth Rate for the Robot Kitchen Market?

The robot kitchen market has grown strongly in recent years. It is projected to grow from $3.35 billion in 2024 to $3.66 billion in 2025, at a CAGR of 9.3%. The growth is driven by automation and efficiency, rising labor costs, consumer demand for convenience, innovation and competition, and the emphasis on food safety and hygiene.

The robot…

AI Robot Toy Market Likely to Enjoy Massive Growth (2024-2029)ROYBI AI Robot , D …

According to HTF Market Intelligence, the Global AI Robot Toy market to witness a CAGR of 17.8% during the forecast period (2024-2029). The Latest Released AI Robot Toy Market Research assesses the future growth potential of the AI Robot Toy market and provides information and useful statistics on market structure and size.

This report aims to provide market intelligence and strategic insights to help decision-makers make sound investment decisions and identify…

TPA Robot launches a new industrial linear robot

The single axis robot KK Series, developed by TPA ROBOT, uses partially hardened U-shaped steel base track to significantly increase the robot's strength and load capacity. Due to the different environments, we have three type of linear robot series, KSR, KNR and KFR, depending on the type of cover used.

For the return system between the track and the slider, the contact surface between the ball and the ball groove adopts…

Robot Battery Market 2023- 2028 Global Insights by Industry Volume, Opportunitie …

The Robot Battery Market research report gives consistent conveyance of the substance. Information gathered in the notification is from verified and reliable sources. Besides, the report additionally breaks down the forthcoming patterns and openings likely to propel the Robot Battery Market. Moreover, the Robot Battery Market provides creative strategies and plans that help market players to stay ahead of the competition. Besides, the Robot Battery Market research report likewise evaluates…