Press release

Solar EPC Market Dominance: Top Firms Strengthening Share & Investment Appeal

The solar EPC (Engineering, Procurement, and Construction) market is emerging as a cornerstone of the global renewable energy transition, driven by declining photovoltaic (PV) costs, favorable government incentives, and rapid grid decarbonization goals. As nations intensify their solar deployment targets to meet net-zero ambitions, EPC providers are playing a pivotal role in bridging technology, execution, and investment ecosystems.The sector's evolution from utility-scale solar installations to hybrid renewable projects integrating storage, hydrogen, and AI-based performance monitoring has redefined competitive dynamics. Leading EPC companies are now blending digital engineering, modular construction, and financing partnerships to deliver cost-efficient, resilient, and sustainable solar assets.

This article explores the top companies shaping the solar EPC market, presents a comprehensive SWOT analysis, and highlights the key investment opportunities and trends reshaping the industry's future.

➤ Request Free Sample PDF Report @ https://www.researchnester.com/sample-request-5177

Top Companies & Their Strategies

1. Sterling and Wilson Renewable Energy Ltd. - Sterling and Wilson is a global leader in solar EPC solutions with operations spanning over 25 countries. The company's strategy focuses on large-scale utility solar and hybrid energy projects, emphasizing cost leadership and execution speed. It leverages strong in-house engineering capabilities, advanced design tools, and local partnerships to reduce project risk and ensure timely delivery. Its growing focus on energy storage integration and turnkey solar-hybrid EPC offerings positions it as a major enabler of sustainable grid expansion.

2. Tata Power Solar Systems Ltd. - A subsidiary of Tata Power, the company combines decades of expertise in solar module manufacturing and EPC execution. Its core strategy revolves around vertical integration - from cell production to large-scale project delivery. Tata Power Solar is strengthening its footprint across India's utility and rooftop segments while exploring international projects. It stands out for its cost optimization, digital monitoring tools, and commitment to localized supply chains that reduce import dependency.

3. Bechtel Corporation - Bechtel has emerged as a strong global player in renewable EPC through its diversification into large-scale solar and hybrid projects. Its strategy emphasizes technology collaboration, precision engineering, and advanced construction automation. Bechtel's global project management expertise and access to sophisticated analytics tools enable it to handle complex terrains and grid-integration challenges effectively. Its growing participation in solar-plus-storage projects across the Americas and Europe highlights its adaptive, innovation-driven approach.

4. Adani Solar (Adani Energy Solutions Ltd.) - Adani Solar combines EPC excellence with module manufacturing and project development, offering end-to-end solar solutions. The company's strategy focuses on scalability, vertical integration, and sustainability through indigenous manufacturing. Adani's large-scale solar parks and integrated value chain allow cost control and supply security. The firm's aggressive domestic and international expansion, supported by clean energy investment alliances, positions it as a global EPC powerhouse with a sustainability-first agenda.

➤ Get deeper insights into competitive positioning and strategic benchmarking: Download our sample Solar EPC Market report here → https://www.researchnester.com/sample-request-5177

5. JinkoSolar Holding Co., Ltd. - JinkoSolar's EPC services are underpinned by its status as one of the world's largest solar module producers. Its strategy integrates high-efficiency modules, smart O&M systems, and turnkey EPC services for commercial and utility clients. The company's focus on product innovation - such as N-type and bifacial modules - ensures project longevity and performance. JinkoSolar's strength lies in its technology leadership and ability to deliver standardized EPC models across multiple geographies.

6. Larsen & Toubro (L&T) Construction - L&T's Power Transmission & Distribution division is a key EPC contractor for solar and hybrid energy projects globally. The company emphasizes high-capacity solar parks, floating solar installations, and grid interconnection systems. L&T's strategy leverages digital twins, AI-enabled project management, and modular construction techniques to enhance productivity. Its ability to execute complex, large-scale projects with high safety and quality standards gives it a competitive edge in the solar EPC landscape.

7. First Solar, Inc. - While primarily a module manufacturer, First Solar has expanded into EPC and project development to ensure seamless deployment of its thin-film technology. The company's strategy focuses on long-term sustainability through closed-loop manufacturing, lower lifecycle emissions, and optimized field performance. Its vertically integrated model supports end-to-end project delivery from design to commissioning and its growing emphasis on domestic manufacturing aligns with regional solar policies like the U.S. Inflation Reduction Act.

8. Mahindra Susten Pvt. Ltd. - Mahindra Susten's EPC division combines engineering precision with sustainability-driven innovation. Its strategy prioritizes hybrid and storage-integrated projects, digitalized O&M platforms, and smart grid compatibility. With a strong domestic portfolio and partnerships for overseas expansion, Mahindra Susten's commitment to green design and operational transparency strengthens its position among India's leading EPC firms.

➤ View our Solar EPC Market Report Overview here: https://www.researchnester.com/reports/solar-epc-market/5177

SWOT Analysis

Strengths - Leading solar EPC firms possess deep expertise in large-scale project execution, vertical integration, and renewable infrastructure financing. Their strengths lie in cost optimization, advanced engineering design, and global procurement networks. Companies with in-house manufacturing and digital monitoring tools maintain a clear advantage in supply chain control and project reliability. Furthermore, their established relationships with utilities, investors, and governments enhance trust and scalability.

Weaknesses - Despite rapid progress, EPC firms face challenges related to material cost fluctuations, dependency on imported modules, and project execution delays due to regulatory hurdles. Smaller EPC players often struggle with working capital management and limited access to advanced technology. Additionally, the fragmented supplier ecosystem and varying regional standards can impede consistency in project delivery and quality control.

Opportunities - The surge in global renewable commitments and corporate net-zero goals offers massive growth opportunities for EPC providers. Hybrid solar-plus-storage systems, floating solar, and hydrogen-linked solar installations are emerging as lucrative investment avenues. Policy incentives for domestic manufacturing and local content requirements are encouraging vertically integrated business models. Expansion into emerging markets across Africa, Southeast Asia, and Latin America also presents new revenue streams for EPC firms focused on decentralized energy access.

Threats - Market volatility in polysilicon and battery supply chains poses cost and scheduling risks. Rising competition from regional EPC startups and potential trade barriers could impact global operations. Moreover, evolving environmental compliance norms and land acquisition constraints continue to challenge project timelines. Cybersecurity vulnerabilities within digitalized monitoring systems and geopolitical instability in energy supply chains remain long-term strategic threats.

➤ Interested in a customized SWOT for your target competitor? Request your tailored assessment → https://www.researchnester.com/sample-request-5177

Investment Opportunities & Trends

1. Vertical Integration & Local Manufacturing: Investors are increasingly backing EPC companies that combine design, manufacturing, and project delivery under one roof. Localized solar module and inverter production - especially in India, the Middle East, and the U.S. - is attracting strong financial support under government-led incentive schemes such as Production-Linked Incentives (PLI) and green industrial policies.

2. Hybrid & Storage-Integrated Projects: The integration of solar with battery storage, wind, and hydrogen systems is reshaping investment priorities. EPC companies leading in hybrid infrastructure design and energy storage integration are witnessing rising capital inflows. These projects are particularly attractive in grid-constrained regions across Asia-Pacific and Africa, where energy reliability is a critical factor.

3. Digitalization & Smart EPC Platforms: Investment momentum is strong in EPC companies leveraging AI, IoT, and digital twins for predictive maintenance and operational analytics. Smart EPC platforms that use real-time project management and energy yield forecasting tools are driving efficiency and investor confidence. The digital EPC model is also enabling transparent carbon tracking and ESG compliance reporting.

4. M&A and Strategic Partnerships: The past 12 months have seen intensified M&A activity in the solar EPC market, with major engineering firms acquiring regional contractors and technology startups to enhance design and automation capabilities. Strategic alliances between EPC firms and renewable financiers are also gaining ground, ensuring long-term project viability through integrated funding and risk management frameworks.

5. Policy-Driven Investments: Governments worldwide are reinforcing solar EPC expansion through fiscal incentives, net metering reforms, and green finance mechanisms. Initiatives such as the European Green Deal, India's National Solar Mission, and the U.S. Inflation Reduction Act are propelling investments in both utility-scale and distributed solar EPC markets. These regulatory tailwinds are boosting investor confidence in sustainable infrastructure development.

Notable Developments in the Last 12 Months:

• Adani Solar expanded its integrated manufacturing and EPC footprint with new module lines to support upcoming gigawatt-scale solar parks.

• Tata Power Solar commissioned multiple hybrid projects combining solar and battery storage for grid stabilization.

• Bechtel partnered with renewable developers to deploy AI-based digital twin models for EPC optimization.

• L&T Construction completed a record-breaking floating solar installation in India, reinforcing its leadership in large-scale renewable EPC.

• Mahindra Susten launched an AI-powered monitoring platform to enhance plant performance analytics and operational visibility.

• Governments in the EU and Asia-Pacific introduced stricter sustainability certification for EPC contractors, fostering transparency and accountability in renewable projects.

➤ Request Free Sample PDF Report @ https://www.researchnester.com/sample-request-5177

Related News -

https://www.linkedin.com/pulse/how-renewable-energy-market-powering-global-transition-yrhmf

Contact Data

AJ Daniel

Corporate Sales, USA

Research Nester

77 Water Street 8th Floor, New York, 10005

Email: info@researchnester.com

USA Phone: +1 646 586 9123

Europe Phone: +44 203 608 5919

About Research Nester

Research Nester is a one-stop service provider with a client base in more than 50 countries, leading in strategic market research and consulting with an unbiased and unparalleled approach towards helping global industrial players, conglomerates and executives for their future investment while avoiding forthcoming uncertainties. With an out-of-the-box mindset to produce statistical and analytical market research reports, we provide strategic consulting so that our clients can make wise business decisions with clarity while strategizing and planning for their forthcoming needs and succeed in achieving their future endeavors. We believe every business can expand to its new horizon, provided a right guidance at a right time is available through strategic minds.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Solar EPC Market Dominance: Top Firms Strengthening Share & Investment Appeal here

News-ID: 4269446 • Views: …

More Releases from Research Nester Pvt Ltd

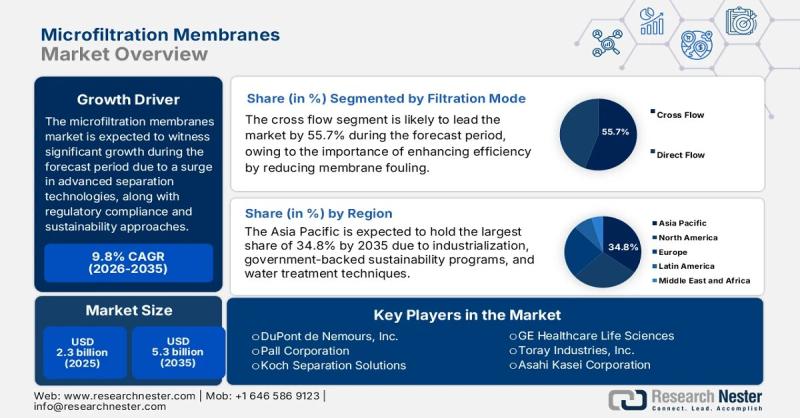

Microfiltration Membranes Market size to reach $5.3Billion by 2035 | Key players …

Market Outlook and Forecast

The microfiltration membranes market size reached USD 2.3 billion in 2025 and is projected to expand to USD 5.3 billion by 2035, reflecting strong industry fundamentals and sustained adoption across diverse end-use industries. The market is expected to grow at a compound annual growth rate (CAGR) of 9.8% between 2026 and 2035, driven by industrial modernization, environmental regulations, and technological innovation.

➤ Request Free Sample PDF Report @…

Top Companies in Food Grade Alcohol Market - Benchmarking Performance & Future V …

The food grade alcohol market is shaped by multinational ingredient producers, regional distillation leaders, and specialized ethanol processors. Competitive positioning is largely determined by feedstock access, regulatory compliance, supply chain resilience, and product customization for food and beverage applications.

➤ Request Free Sample PDF Report @ https://www.researchnester.com/sample-request-8307

Top Companies & Their Strategies

Archer Daniels Midland Company (ADM)

ADM remains one of the most influential players in the Food Grade Alcohol Market due to…

Energy Harvesting System Market Dominance: Top Companies Strengthening Share & I …

The energy harvesting system market is rapidly evolving as industries seek sustainable, maintenance-free power solutions for IoT devices, wireless sensor networks, industrial automation, healthcare wearables, and smart infrastructure. Energy harvesting systems convert ambient energy sources - including solar, thermal, vibration, and radio frequency (RF) - into usable electrical power.

As the global transition toward energy efficiency and decentralized power accelerates, the competitive landscape within the energy harvesting system market is intensifying.…

Luxury Hotel Market Players - Competitive Positioning, Strategic Strengths & Inv …

The Luxury Hotel Market is undergoing structural transformation as global travelers increasingly prioritize curated experiences, sustainability, and digital-first service models. No longer defined solely by opulence, the luxury hotel market now revolves around personalization, wellness integration, brand storytelling, and technological innovation. Leading hospitality companies are repositioning portfolios, expanding into high-growth destinations, and investing in asset-light models to strengthen competitive positioning.

This strategic analysis explores the top companies shaping the luxury hotel…

More Releases for EPC

Solar EPC Market Outlook 2035: Clean Energy Adoption and EPC Advancements Fuel R …

The global Solar EPC (Engineering, Procurement, and Construction) market is set to witness remarkable expansion in the coming decade, driven by rising clean energy adoption, technological innovation, and government-led renewable energy initiatives. The market was valued at US$ 95.3 billion in 2024 and is projected to reach US$ 294.5 billion by 2035, growing at a CAGR of 10.8% from 2025 to 2035. With solar power emerging as one of the…

Key Trend Reshaping the Solar EPC Market in 2025: Jingoli Power Spearheads Solar …

"What Are the Projections for the Size and Growth Rate of the Solar EPC Market?

The solar EPC market has grown strongly in recent years. It will increase from $232.58 billion in 2024 to $248.35 billion in 2025, at a CAGR of 6.8%. This growth is driven by government incentives and subsidies, declining costs of solar technology, environmental sustainability awareness, energy independence goals, and rising energy demand.

The solar EPC market is…

Underground Cabling EPC Market

Report Summary:

The report titled “Underground Cabling EPC Market” offers a primary overview of the Underground Cabling EPC industry covering different product definitions, classifications, and participants in the industry chain structure. The quantitative and qualitative analysis is provided for the global Underground Cabling EPC market considering competitive landscape, development trends, and key critical success factors (CSFs) prevailing in the Underground Cabling EPC industry.

Historical Forecast Period

2013 – 2017 – Historical Year for…

What’s driving the solar EPC market analysis?

Solar EPC market across the APAC region has gained impetus owing to positive government reforms and growing renewable fund allocation. Favorable self-consumption schemes, regulatory support programs, investment subsidies, renewable incorporation targets and similar regulatory initiatives have substantially energized the industry dynamics. Ongoing economic expansion across emerging nations coupled with rising energy demand across developing power markets have further nurtured the business landscape.

Request for a sample of this research report @…

Unleashing Upcoming EPC Opportunities in India 2017

ReportsWorldwide has announced the addition of a new report title Unleashing Upcoming EPC Opportunities in India 2017 to its growing collection of premium market research reports.

As country, shifts its portfolio from thermal to renewable in terms of capacity generation , the transcend also observed in terms of investment in the thermal and renewable space respectively. With India, completely witnessing drying up of orders from private project developers ,…

Renewable Energy Industry Adopts Firmex for EPC

Wind, solar and biodiesel energy developers are increasingly using Firmex virtual data room technology to share confidential engineering, procurement and construction documents.

Most renewable energy analysts predict the clean-tech sector will grow in worldwide revenue from $116 billion to $325 billion over the next decade, making it the largest single industrial sector in the world. Globally, clean energy investments have increased 230 percent since 2005, according to research conducted by…