Press release

Green Energy Market Leaders - Competitive Positioning, Strategic Strengths & Investor Outlook

The Green Energy Market stands at the core of the global energy transition, driven by the accelerating shift toward sustainability, decarbonization, and energy independence. As governments intensify net-zero commitments and corporations move toward ESG-aligned business models, renewable technologies such as solar, wind, hydro, and bioenergy have become central to long-term growth strategies. Within this evolving landscape, leading companies are not just competing on technology - they are redefining energy ecosystems through innovation, partnerships, and strategic acquisitions.➤ Request Free Sample PDF Report @ https://www.researchnester.com/sample-request-3366

Top Companies & Their Strategies

Siemens Gamesa Renewable Energy

Siemens Gamesa remains a powerhouse in the wind energy sector, leveraging its advanced turbine technologies and offshore capabilities. The company focuses heavily on R&D for high-efficiency turbines that reduce cost per megawatt. Its global supply chain and strategic alliances with utility-scale developers strengthen its market presence in Europe and Asia-Pacific. Siemens Gamesa's hybrid renewable solutions and digitalized maintenance platforms also enhance performance reliability.

Vestas Wind Systems

Vestas has established itself as one of the most diversified wind turbine manufacturers worldwide. Its strategy revolves around scalability and customization - designing turbines optimized for varied wind conditions. Vestas has also expanded into energy-as-a-service models, providing digital monitoring and predictive maintenance. A robust aftersales service network and continuous investment in offshore projects reinforce its long-term competitiveness, particularly in emerging markets like India and Brazil.

NextEra Energy

NextEra Energy represents one of the largest clean energy operators in North America, with a strategic focus on solar and wind generation coupled with energy storage. The company's integrated approach - combining generation with advanced grid storage systems - positions it as a leader in the evolving energy storage frontier. Its subsidiary, NextEra Energy Resources, plays a critical role in expanding renewables across the U.S. through partnerships and corporate power purchase agreements (PPAs).

Ørsted A/S

Ørsted's transformation from a traditional fossil fuel utility to a 100% renewable energy company is a hallmark of the global decarbonization movement. With a primary focus on offshore wind, Ørsted has built one of the most extensive project pipelines across Europe, the U.S., and Asia. The company's success stems from its early entry into offshore development, vertical integration, and strong regulatory engagement. Ørsted continues to diversify into green hydrogen and renewable-based ammonia production.

➤ Explore detailed profiles of top players and new entrants in this space - access your free sample report → https://www.researchnester.com/sample-request-3366

Enel Green Power

Enel Green Power, a subsidiary of Italy's Enel Group, operates across solar, wind, geothermal, and hydropower segments. Its diversified technology mix and global footprint across Europe, Latin America, and Africa offer significant resilience against market volatility. The company prioritizes digitalization and predictive analytics to optimize plant performance. Enel's active role in energy communities and smart grid integration demonstrates a forward-looking approach to sustainable electrification.

Tesla, Inc.

Tesla's contribution to the green energy ecosystem extends beyond electric vehicles. Through its Energy Generation and Storage division, Tesla develops solar panels, solar roofs, and the Powerwall battery system. The company's competitive edge lies in product integration - linking EVs, home energy storage, and grid-connected solar solutions. Tesla's continued investment in Gigafactories and battery innovation underscores its ambition to lead the renewable energy value chain.

Brookfield Renewable Partners

Brookfield Renewable Partners operates one of the largest portfolios of renewable assets globally, spanning hydro, solar, wind, and storage. Its investment-driven approach, backed by Brookfield Asset Management, emphasizes long-term capital deployment and strategic acquisitions. Recent expansion into distributed generation and corporate PPAs has diversified its revenue streams. The company's strong financial capacity provides an advantage in acquiring undervalued renewable assets.

Iberdrola S.A.

Iberdrola has positioned itself as a leader in integrated renewable energy solutions, particularly in Europe and North America. The company combines generation, distribution, and smart grid operations, allowing vertical control across the green energy chain. Iberdrola's continuous investment in offshore wind and hydrogen projects, alongside partnerships with technology firms, supports its decarbonization roadmap and competitiveness in next-generation energy technologies.

➤ View our Green Energy Market Report Overview here: https://www.researchnester.com/reports/green-energy-market/3366

SWOT Analysis

Strengths

Leading players in the green energy market benefit from diversified portfolios spanning solar, wind, hydro, and energy storage. Their strong financial positions enable continuous R&D and large-scale project development. Many, like Ørsted and NextEra Energy, maintain long-term PPAs, ensuring stable cash flows. Moreover, strategic partnerships with governments and industrial consumers enhance market credibility and access to infrastructure incentives.

Weaknesses

Despite impressive technological progress, green energy companies face challenges related to supply chain dependency and raw material costs, particularly for critical components like rare earth metals and batteries. Intermittency remains an operational limitation, demanding heavy investment in grid integration and storage solutions. Some companies also encounter regional regulatory barriers or project delays due to complex permitting and environmental assessments.

Opportunities

The sector is poised for growth through energy storage innovations, green hydrogen, and hybrid renewable systems. The expansion of smart grids, EV charging networks, and distributed solar installations opens new revenue streams. Public-private partnerships (PPPs) and climate finance mechanisms continue to channel investment toward developing nations, creating vast opportunities for regional expansion. Emerging markets in Asia, the Middle East, and Africa are becoming major hubs for new installations and manufacturing bases.

Threats

The increasing competition and entry of new players intensify pricing pressures, especially in solar and onshore wind markets. Policy uncertainties, such as changes in subsidy frameworks or carbon pricing, can affect project viability. Additionally, geopolitical tensions and trade restrictions on renewable equipment components may disrupt supply chains. Climate-induced variability in weather patterns could also impact energy generation consistency and project returns.

➤ Access a complete SWOT breakdown with company-specific scorecards: Claim your sample report → https://www.researchnester.com/sample-request-3366

Investment Opportunities & Trends

The investment landscape in the green energy market is evolving rapidly, characterized by consolidation, innovation, and regional diversification. Over the past year, institutional investors, private equity firms, and sovereign wealth funds have accelerated their entry into renewable infrastructure, seeking stable, long-term returns aligned with ESG mandates.

Mergers & Acquisitions (M&A)

M&A activity has surged, particularly in the offshore wind and solar sectors, as companies seek scale and geographic diversification. Brookfield Renewable acquired significant solar assets in the U.S., while Ørsted and Equinor expanded their offshore portfolios through joint ventures. Utilities are also acquiring energy storage startups to strengthen grid flexibility capabilities. These moves underline a strategic shift toward integrated renewable ecosystems rather than standalone generation assets.

Funding in Startups and Technology Integration

Venture capital and corporate investors are pouring capital into cleantech startups specializing in battery innovation, hydrogen fuel cells, and carbon capture technologies. Tesla and Enel have both invested in advanced battery R&D, while Siemens Gamesa explores digital twins and AI-based predictive maintenance to enhance asset performance. The rise of green fintech - financing platforms that support small-scale renewable projects - is another emerging investment niche.

Regional Expansion and Policy Support

Asia-Pacific, particularly India, China, and Southeast Asia, has become a key investment destination due to strong government incentives and expanding industrial demand for clean power. Europe continues to lead in offshore wind, with cross-border grid integration projects connecting North Sea nations. In North America, the U.S. Inflation Reduction Act (IRA) has significantly boosted investor confidence by providing long-term tax credits for renewables and clean hydrogen.

Product Launches and Innovation Milestones

The last 12 months have witnessed notable technological advancements - from Vestas' launch of 15 MW offshore turbines to Tesla's updated Powerwall and NextEra's grid-scale storage deployments. Enel Green Power has piloted hybrid renewable plants combining solar, wind, and storage on a single site. These innovations reflect the industry's focus on maximizing output efficiency and grid reliability while reducing lifecycle costs.

Emerging Investment Themes

Investors are increasingly focusing on green hydrogen production, bioenergy with carbon capture and storage (BECCS), and circular energy systems. The integration of digital technologies such as AI, IoT, and blockchain for real-time energy management is enhancing operational transparency and traceability - crucial for ESG-compliant portfolios. Furthermore, corporate decarbonization commitments are fueling demand for long-term renewable PPAs, providing predictable revenue models for developers.

➤ Request Free Sample PDF Report @ https://www.researchnester.com/sample-request-3366

Related News -

https://www.linkedin.com/pulse/what-driving-rapid-evolution-generator-set-controllers-9oosf

https://www.linkedin.com/pulse/what-powering-growth-hydraulic-turbine-market-worldwide-tvvqf

Contact Data

AJ Daniel

Corporate Sales, USA

Research Nester

77 Water Street 8th Floor, New York, 10005

Email: info@researchnester.com

USA Phone: +1 646 586 9123

Europe Phone: +44 203 608 5919

About Research Nester

Research Nester is a one-stop service provider with a client base in more than 50 countries, leading in strategic market research and consulting with an unbiased and unparalleled approach towards helping global industrial players, conglomerates and executives for their future investment while avoiding forthcoming uncertainties. With an out-of-the-box mindset to produce statistical and analytical market research reports, we provide strategic consulting so that our clients can make wise business decisions with clarity while strategizing and planning for their forthcoming needs and succeed in achieving their future endeavors. We believe every business can expand to its new horizon, provided a right guidance at a right time is available through strategic minds.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Green Energy Market Leaders - Competitive Positioning, Strategic Strengths & Investor Outlook here

News-ID: 4269342 • Views: …

More Releases from Research Nester Pvt Ltd

Produced Water Treatment Market Dominance: Top Companies Strengthening Share & I …

The produced water treatment market is shaped by established oilfield service providers, water technology specialists, and emerging cleantech innovators. As regulatory scrutiny intensifies and sustainability becomes central to energy operations, leading companies are positioning themselves through technology integration, digitalization, and geographic expansion.

➤ Request Free Sample PDF Report @ https://www.researchnester.com/sample-request-8290

Top Companies & Their Strategies

1. Veolia Water Technologies

Veolia is a global leader in water and wastewater solutions, with a strong footprint…

Aquaculture Feed Market Key Players - Share Consolidation Trends & Capital Growt …

The aquaculture feed market is undergoing rapid structural transformation as global seafood consumption, sustainability mandates, and feed innovation reshape competitive dynamics. Feed represents the single largest operating cost in aquaculture production, making it a strategic lever for profitability, environmental compliance, and productivity gains. As aquaculture continues to replace wild capture fisheries in meeting protein demand, feed manufacturers are positioning themselves at the center of value creation.

This article provides a strategic…

Dark Fiber Networks Market Dominance: Top Companies Strengthening Share & Invest …

The dark fiber networks market has become a critical pillar of global digital infrastructure, enabling scalable, high-capacity connectivity for enterprises, telecom operators, hyperscale data centers, and public sector networks. As demand accelerates for low-latency communication, 5G backhaul, cloud interconnection, and private network deployments, dark fiber has emerged as a strategic asset rather than a passive infrastructure layer.

Unlike lit services, dark fiber networks offer customers full control over bandwidth, security, and…

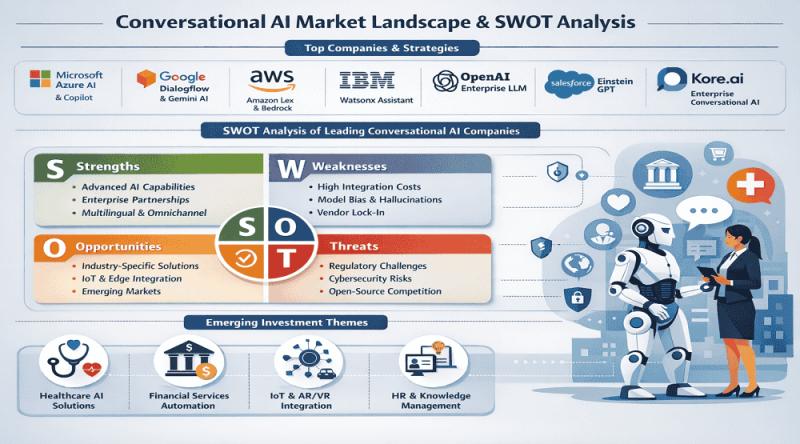

Conversational AI Market Players - Competitive Positioning, Strategic Strengths …

The Conversational AI market has rapidly evolved from rule-based chatbots to sophisticated, context-aware systems powered by large language models (LLMs), machine learning, and natural language processing (NLP). Enterprises across banking, healthcare, retail, telecom, and government are integrating conversational AI platforms to automate customer engagement, enhance operational efficiency, and deliver hyper-personalized experiences.

As adoption deepens, the competitive landscape of the conversational AI market is defined by platform scalability, data integration capabilities, model…

More Releases for Energy

Green Renewable Energy Market Next Big Thing: Enphase Energy, Bloom Energy, Clea …

Advance Market Analytics published a new research publication on "Green Renewable Energy Market Insights, to 2030" with 232 pages and enriched with self-explained Tables and charts in presentable format. In the Study you will find new evolving Trends, Drivers, Restraints, Opportunities generated by targeting market associated stakeholders. The growth of the Green Renewable Energy market was mainly driven by the increasing R&D spending across the world.

Get inside Scoop of the…

Business Energy Solution Market Size in 2023 To 2029 | SSE Energy Solutions, BES …

The large-scale Business Energy Solution market report provides valuable insights for clients looking to forecast investments in emerging markets, expand market share, or launch new products. The report presents multifaceted Business Energy Solution market insights that are simplified using established tools and techniques, making it a credible marketing report. Data is presented in a clear and easy-to-understand manner, with graphs and charts to aid comprehension. The report employs integrated approaches…

Decentralized Energy Storage Market Is Booming Worldwide | Fuelcell Energy, Enph …

A new business intelligence report released by AMA with title "Decentralized Energy Storage Market" has abilities to raise as the most significant market worldwide as it has remained playing a remarkable role in establishing progressive impacts on the universal economy. The Global Decentralized Energy Storage Market Report offers energetic visions to conclude and study market size, market hopes, and competitive surroundings. The research is derived through primary and secondary statistics…

Waste-To-Energy Technologies Market Top Growing Companies: Xcel Energy, Novo Ene …

Qurate Business Intelligence’s up-to-date research study on Waste-To-Energy Technologies was performed by highly qualified research professionals and industry experts. This is to provide an in-depth analysis on the Waste-To-Energy Technologies. The report is comprehensive and includes over 120 pages. The global energy market is witnessing a shift toward waste to energy technologies due to growing energy demands worldwide, the rapid depletion of conventional sources of energy, and concerns over…

Waste To Energy Market ||Novo Energy Ltd., Hitachi Zosen, Foster Wheeler A.G., S …

Zion Market Research published a new 110+ pages industry research "Global Waste to Energy Market Set For Rapid Growth, To Reach Value Around USD 42.74 Billion By 2024" is exhaustively researched and analyzed in the report to help market players to improve their business tactics and ensure long-term success. The authors of the report have used easy-to-understand language and uncomplicated statistical images but provided thorough information and detailed data on…

In-Pipe Hydro Systems Market | key player - Lucid Energy, Rentricity, Tecnoturbi …

Looking at the current market trends as well as the promising demand status of the “In-Pipe Hydro Systems Market” it can be projected that the future years will bring out positive outcomes. This research report added by MRRSE on its online portal delivers clear insight about the changing tendencies across the global market. Readers can gather prime facets connected to the target market which includes product, end-use and application; assisting…