Press release

Digital Banking Market Forecast 2035 | Key Driver, Restraint, and Growth Opportunity

Exploring novel growth opportunities on computer vision, "Digital Banking Market Size, Share & Trends Analysis Report by Component (Platforms, Software and Services), Type, Technology, Deployment Mode, Enterprise Size, Application, End User and Geography (North America, Europe, Asia Pacific, Middle East, Africa, and South America) - Global Industry Data, Trends, and Forecasts, 2026-2035" A comprehensive exploration of emerging market pathways in the digital banking market uncovers key growth drivers including niche market leadership, technology-enabled distribution, and evolving consumer needs underscoring computer vision's potential to scale globally.Get the Detailed Industry Analysis (including the Table of Contents, List of Figures, and List of Tables) - from the Digital Banking Market Research Report: https://marketgenics.co/press-releases/digital-banking-market-55560

Global Digital Banking Market Forecast 2035:

According to the report, the global digital banking market is likely to grow from USD 7.3 Billion in 2025 to USD 13.8 Billion in 2035 at a highest CAGR of 6.6% during the time period. While the adoption of automation, cloud technology, and AI-enabled financial technology trends across banking and financial services gain momentum, the digital banking market as a whole is growing rapidly. The ongoing shift toward a cashless society, remote banking, and customized digital services continues to drive banks to implement holistic digital banking solutions to enhance the customer experience, improve businesses operations, and meet compliance.

Moreover, governments and regulators globally are encouraging digital financial inclusion, encouraging an increase in the implementation of mobile banking, e-payment methods, and secure payment systems, to improve access, transparency, and efficiency.

Additionally, financial services are leveraging AI, blockchain and data analytics to strengthen fraud detection, automate risk assessment, and deliver more hyper-customized financial products. The use of machine learning and cloud-based APIs enables lenders to accomplish faster approvals for loan applications, real-time credit scoring, and deliver Intelligent Wealth Management solutions. Simultaneously, the development of open banking ecosystems and the collaboration of Fintech entities push financial services companies to innovate faster and empower consumers while reshaping the competitive dynamics within the global digital banking market.

To know more about the Digital Banking Market - Download our Sample Report: https://marketgenics.co/download-report-sample/digital-banking-market-55560

"Key Driver, Restraint, and Growth Opportunity Shaping the Global Digital Banking Market"

The rapid expansion of the global digital banking market is supported by the widespread acceptance of mobile banking, AI-driven personalization, and cloud-based financial services that improve user experience, security, and speed of transactions. Banks and fintechs are investing in automation and data analytical capabilities to improve core processes like account management, loan approvals, and investment advisory functions, reducing operational costs while enhancing customer experience. The transition to cashless economies and digital-first banking is advancing this trend, professionalization, and because consumers now expect 24/7 access to financial services across devices.

However, a critical challenge is managing data privacy, cybersecurity threats, and compliance with regulations in an environment where millions of sensitive financial data are being exchanged digitally. Securing authentication, preventing fraud, and complying with ever-evolving cross-border financials regulations complicates implementation of accountability and creates higher costs, especially for smaller banks and newer fintech models.

A significant opportunity for financial growth is through digital banking financial inclusion, particularly in the developing world. Mobile-first banking platforms, biometric identification systems, and AI-based micro-lending solutions are allowing unbanked populations access to credit, payments, and savings products. Digital access is fueling innovation and competition throughout the global finance ecosystem and enabling more equality in economic contributions.

Expansion of Global Digital Banking Market

"AI-driven Personalization, Open Banking Frameworks, and Government-Backed Digitization Accelerating Global Digital Banking Growth"

The digital banking market is proliferating worldwide, driven by personalization powered by AI and seamless financial experiences, as banks use predictive analytics to offer personalized products and insights. Government-led efforts are a key driver of this growth: the Indian Ministry of Finance reports the number of digital payment transactions increased from 2,071 crore in FY 2017-18 to 18,737 crores in FY 2023-24, with a total value of INR 3,659 lakh crore.

The Reserve Bank of India's Digital Payments Index reached 493.22 in March 2025, representing a 10.7% growth rate compared to the previous year and reflecting increased payment infrastructure. Open banking frameworks are also contributing to this progress: the United Kingdom Financial Conduct Authority (FCA) reports open banking payments had grown to 68 million in 2022, more than double the amount in 2021 facilitated by bank-fintech partnerships.

Furthermore, the Reserve Bank of India's Digital Payments index reached 465.33 in September 2024, highlighting the prevalence of new payment infrastructure. Together, these developments illustrate how AI advancement and government intervention are reshaping digital banking around the world.

Regional Analysis of Global Digital Banking Market

With its developed financial infrastructure, widespread smartphone accessibility, and consumer confidence, North America owns the digital banking market. Large banks have generally embraced cloud-native banking systems, AI-assisted fraud detection and real-time payments in their commitment to providing user-friendly, fully digital experiences. The U.S. Federal Reserve has reported that 80 percent of Americans use online or mobile banking due to clearly defined regulations like the Dodd Frank Act and strong cybersecurity precautions to protect their accounts. This publication establishes North America as the global leader in the digital banking space.

In the next 3-5 years, the Asia Pacific region is expected to grow the fastest due to financial inclusion, mobile adoption, and significant policy support. Countries, such as India and Indonesia, are scaling digital wallets and neobanks, while regulators, like the Reserve Bank of India (RBI) and the Monetary Authority of Singapore (MAS), provide open banking policy support and encourage market discipline and level playing fields.

According to data sourced from the World Bank, there are over 1.5 billion mobile internet users and continued financial inclusion expected with a combination of AI and biometrics to provide access to unbanked populations. As a result, it is predicted that Asia Pacific will full -fil its ambition to become the fastest growing digital banking market in the world.

Europe continues to grow at a steady pace via open banking, while the Middle East and Africa look for rapid adoption via partnerships with fintechs and government digitization initiatives.

Prominent players operating in the global digital banking market include prominent companies such as FIS, Avaloq Group, Backbase, BPC Banking Technologies, Finastra, Fiserv, Infosys Limited, Intellect Design Arena, Jack Henry & Associates, Mambu, nCino Inc., NCR Corporation, Oracle Corporation, Q2 Holdings, SAP SE, Tata Consultancy Services (TCS), Temenos, Zeta Technologies, and several other key players.

Buy Now: https://marketgenics.co/buy/digital-banking-market-55560

The global digital banking market has been segmented as follows:

Global Digital Banking Market Analysis, by Component

Platforms

Core Banking Platforms

Mobile Banking Platforms

Internet Banking Platforms

Payment Gateways and Processing Systems

API Management Platforms

Others

Software

Customer Relationship Management (CRM) Software

Risk and Compliance Management Software

Fraud Detection and Security Software

Wealth and Asset Management Software

Loan Origination and Management Software

Others

Services

Professional Services

Consulting Services

System Integration and Implementation

Training and Support

Managed Services

Cloud Hosting and Maintenance

IT Operations and Monitoring

Application Management Services

Global Digital Banking Market Analysis, by Type

Retail Banking

Corporate Banking

Investment Banking

Neo and Challenger Banking

Others

Global Digital Banking Market Analysis, by Technology

Artificial Intelligence (AI)

Blockchain

Big Data Analytics

Cloud Computing

Robotic Process Automation (RPA)

Others

Global Digital Banking Market Analysis, by Deployment Type

On-Premises

Cloud-Based

Hybrid

Global Digital Banking Market Analysis, by Enterprise Size

Small and Medium Enterprises (SMEs)

Large Enterprises

Global Digital Banking Market Analysis, by Application

Account Management

Fund Transfers and Payments

Customer Relationship Management (CRM)

Risk Management

Compliance and Security

Others

Global Digital Banking Market Analysis, by End User

Banks

Credit Unions

FinTech Companies

Insurance Companies

Investment Firms

Others

Global Digital Banking Market Analysis, by Region

North America

Europe

Asia Pacific

Middle East

Africa

South America

About Us

MarketGenics is a global market research and management consulting company empowering decision makers across healthcare, technology, and policy domains. Our mission is to deliver granular market intelligence combined with strategic foresight to accelerate sustainable growth.

We support clients across strategy development, product innovation, healthcare infrastructure, and digital transformation.

Contact:

Mr. Debashish Roy

MarketGenics India Pvt. Ltd.

800 N King Street, Suite 304 #4208, Wilmington, DE 19801, United States

USA: +1 (302) 303-2617

Email: sales@marketgenics.co

Website: https://marketgenics.co

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Digital Banking Market Forecast 2035 | Key Driver, Restraint, and Growth Opportunity here

News-ID: 4269218 • Views: …

More Releases from MarketGenics India Pvt. Ltd.

APAC Deepfake Detection Market Accelerates as Governments Tighten Digital Trust …

A Market Transforming How the World Verifies Reality

The global deepfake detection technology market, valued at USD 0.6 billion in 2025, is positioned to accelerate at a powerful 37.2% CAGR, reaching USD 15.1 billion by 2035.

This growth is driven by one undeniable truth:

Synthetic media is reshaping the threat landscape faster than humans can recognize it.

Deepfake detection technologies now determine:

How newsrooms verify breaking content

How financial institutions prevent identity-spoofing

How governments protect election integrity

How…

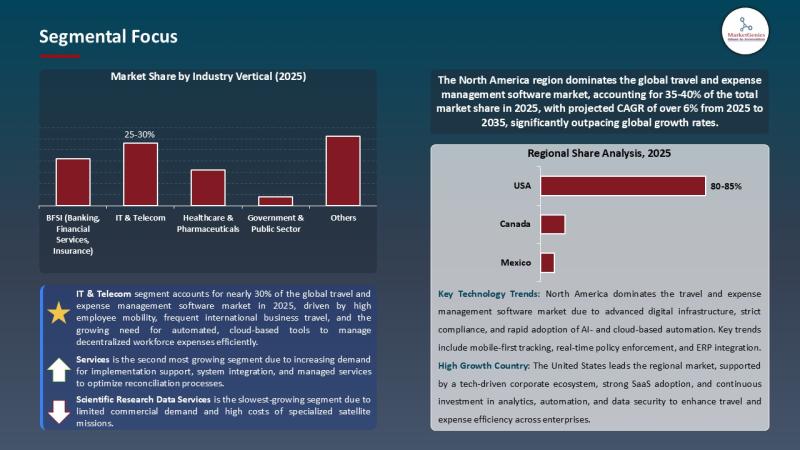

Travel & Expense Management Software Market Signals a Digital Pivot | AI, Cloud …

The Travel and Expense Management (TEM) Market Crossroads | A Sector Accelerating, Repricing Efficiency, and Redrawing the Corporate Spend Map

(Is TEM a Back-Office Tool-or the Operating System of the Next Enterprise Economy?)

For years, the travel and expense management software market lived in the administrative shadows-handed off to finance teams, constrained by spreadsheets, and dismissed as a routine cost-control tool. But the numbers now tell a radically different story.

In 2025, the…

Oilfield Equipment Market hits USD 116.2B in 2025 and grows to USD 156.5B by 203 …

Oilfield Equipment Market | The $156.5B Hardware Backbone of the Global Energy System

Every headline loves clean energy. Yet the global energy mix still demands a brutal truth: oil and gas remain the world's primary supply of heat, mobility, and petrochemicals - and the machines that drill, lift, complete, and produce hydrocarbons continue to define industrial capability.

That's why the Oilfield Equipment Market remains a strategic industry - not a relic.

In 2025,…

Machine Tools Market 2025-2035 | USD 109.9B Growth, CNC & Automation Trends

Machine Tools Market | The $109.9B Intelligence Engine of Global Manufacturing

Factories don't work without machine tools. They shape, cut, drill, grind, and define the physical world around us. Yet most end-products - cars, aircraft parts, electronics housings, surgical devices - never reveal the precision machinery behind them.

The Machine Tools Market is the invisible infrastructure that turns digital models into physical reality.

In 2025, the global Machine Tools Market stands at USD…

More Releases for Bank

Mortgage-Backed Security Market 2022: Industry Manufacturers Forecasts- Construc …

The Mortgage-Backed Security research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Mortgage-Backed Security market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers formulate effective…

Doorstep Banking Services Market Challenges and Opportunities in Banking Service …

Doorstep banking is a facility provided so that user don't have to visit bank branches for routine banking activities like cash deposit, cash withdrawal, cheque deposit, or making a demand draft. The bank extends these facilities at user work place by appointing a service provider on your behalf.

This service was earlier available only to senior citizens but it is available to everyone with nominal fee charges, depending on the type…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank of …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance,…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank o …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance, regulatory, and other…