Press release

India Microfinance Market Report 2025 | Growth, Trends & Forecast by 2033

MARKET OVERVIEWThe India Microfinance Market size reached USD 6.7 Billion in 2024. The market is projected to attain USD 15.8 Billion by 2033, growing at a CAGR of 10.08% during the forecast period 2025-2033. Growth is driven by increasing financial inclusion initiatives, government support, rising credit demand in rural and semi-urban areas, digital lending platforms, women-focused lending models, and enhanced regulatory frameworks.

STUDY ASSUMPTION YEARS

➤ Base Year: 2024

➤ Historical Year/Period: 2019-2024

➤ Forecast Year/Period: 2025-2033

INDIA MICROFINANCE MARKET KEY TAKEAWAYS

➤ Current Market Size: USD 6.7 Billion in 2024

➤ CAGR: 10.08% (2025-2033)

➤ Forecast Period: 2025-2033

➤ The microfinance market has expanded significantly due to rising financial inclusion and government schemes.

➤ Women-centric lending accounts for 99% of active borrowers, emphasizing female empowerment.

➤ Digital transformation is streamlining operations with fintech collaborations and AI-driven credit assessments.

➤ Regulatory changes by RBI promote transparency, client protection, and sector formalization.

➤ Market consolidation is occurring as smaller MFIs merge or convert to Small Finance Banks.

Sample Request Link: https://www.imarcgroup.com/india-microfinance-market/requestsample

MARKET TRENDS

India's microfinance sector grew remarkably from ₹17,264 crore in 2012 to ₹3.93 lakh crore in 2024, marking a 2,100% increase over 12 years. This surge is largely due to widespread digital transformation, including adoption of digital lending platforms, mobile banking applications, and AI-powered credit assessments, which have streamlined loan disbursal and recovery processes. Additionally, biometric-enabled eKYC and fintech partnerships have lowered operational costs and expanded financial inclusion in underserved rural areas.

The inclusion of digital repayment methods such as UPI and mobile wallets enhances convenience and repayment efficiency for customers. These technological innovations enable faster customer onboarding, improved credit monitoring, and compliance adherence. Consequently, digital advancements allow microfinance institutions to scale their operations, bridge credit access gaps, and strengthen rural credit ecosystems, fostering broader financial inclusion and formalizing small-scale lending.

Women-centric lending is a pivotal trend within the market. Women constitute 99% of the 8.67 crore active microfinance borrowers and hold a loan portfolio of ₹4.43 lakh crore in 2024. Institutions prioritize credit access through models like self-help groups (SHGs) and joint liability groups (JLGs), fostering economic independence and social empowerment in rural and semi-urban regions. Government support through schemes like the Deendayal Antyodaya Yojana complements this focus, promoting inclusive growth and reducing economic disparities.

MARKET GROWTH FACTORS

Financial inclusion initiatives and strong government support via schemes and subsidies are major growth drivers. Increasing credit demand from rural and semi-urban populations supports market expansion, alongside the proliferation of digital lending platforms. These aspects collectively foster institutional growth and transparency, propelling the microfinance market forward during 2025-2033 at a 10.08% CAGR.

Women-focused lending models significantly contribute by addressing economic inequalities and fostering community development. Prioritizing women's credit access through SHGs and JLGs stimulates entrepreneurship and financial independence. Government initiatives such as those targeting women entrepreneurs complement these efforts, thus promoting inclusive socioeconomic growth in marginalized areas.

Regulatory frameworks implemented by the Reserve Bank of India offer robust oversight, including interest rate caps, borrower indebtedness checks, and mandatory disclosure norms. These regulations enhance operational transparency and reduce exploitative lending. Concurrently, market consolidation-where smaller MFIs are acquired or transformed into Small Finance Banks-reinforces capital base strength and service quality, boosting scalability and resilience.

Ask To Analyst: https://www.imarcgroup.com/request?type=report&id=30696&flag=C

MARKET SEGMENTATION

Provider Type Insights:

➤ Banks: Financial institutions offering microfinance services, contributing a notable market segment.

➤ NBFCs: Non-Banking Financial Companies actively involved in microfinance lending operations.

➤ Fintech: Technology-driven companies leveraging digital platforms to provide microfinance services.

Purpose Insights:

➤ Agriculture: Lending directed towards agricultural activities and rural agribusiness needs.

➤ Manufacturing/Production: Credit facilities supporting manufacturing and production sectors.

➤ Trade and Services: Financial services aimed at trade activities and service-based businesses.

➤ Household: Loans catering to household-related financial requirements.

Others: Microfinance purposes beyond listed categories.

Tenure Insights:

➤ Less than 1 year: Short-term microfinance loans with under one-year repayment period.

➤ 1-2 years: Medium-term loan tenures typically spanning one to two years.

More than 2 years: Long-term lending with repayment periods exceeding two years.

REGIONAL INSIGHTS

The report provides comprehensive analysis across North, South, East, and West India regions. Specific dominant region and exact market share or CAGR statistics are not explicitly listed in the source. Notwithstanding, regional segmentation supports understanding of differential market dynamics and growth prospects across India's geographic landscape.

RECENT DEVELOPMENTS & NEWS

➤ In November 2024, Muthoot Microfin, based in Kochi, began loan disbursals via a co-lending partnership with the State Bank of India (SBI), which sanctioned a ₹500 crore facility, disbursed in ₹100 crore tranches. This initiative aims to provide affordable credit to rural entrepreneurs, especially women, enhancing financial inclusion through strengthened credit access and collaborative lending.

➤ In August 2024, Kotak Mahindra Bank announced the merger of its subsidiaries, Sonata Finance and BSS Microfinance, under an approved amalgamation scheme. Sonata Finance will merge into BSS Microfinance on a going concern basis, contingent upon regulatory and shareholder approvals. The combined net worth of the entities was less than 2% of Kotak Mahindra Bank's total net worth as of March 31, 2024.

KEY PLAYERS

➤ Muthoot Microfin

➤ State Bank of India (SBI)

➤ Kotak Mahindra Bank

➤ Sonata Finance

➤ BSS Microfinance

CUSTOMIZATION NOTE:

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

Get Your Customized Market Report: https://www.imarcgroup.com/request?type=report&id=30696&flag=E

Also Browse Related Report:

India Specialty Insurance Market Research Report:The India specialty insurance market size reached USD 9.00 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 16.50 Billion by 2033, exhibiting a growth rate (CAGR) of 6.20% during 2025-2033.

Read More About Report: https://www.imarcgroup.com/india-specialty-insurance-market

Indonesia Mortgage Loan Brokers Market Research Report:Indonesia mortgage loan brokers market size reached USD 1.3 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 2.2 Billion by 2033, exhibiting a growth rate (CAGR) of 5.58% during 2025-2033.

Read More About Report: https://www.imarcgroup.com/indonesia-mortgage-loan-brokers-market

ABOUT US

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

CONTACT US

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: sales@imarcgroup.com,

Tel No: (D) +91 120 433 0800,

United States: +1-201971-6302

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release India Microfinance Market Report 2025 | Growth, Trends & Forecast by 2033 here

News-ID: 4267937 • Views: …

More Releases from IMARC Group

India Plastic Pipes Market Outlook 2026-2034: Size, Share, Growth, Trends, Deman …

According to IMARC Group's report titled "India Plastic Pipes Market Size, Share, Trends and Forecast by Type, Diameter, End Use, and Region, 2026-2034" the report offers a comprehensive analysis of the industry, including market share, growth, trends, and regional insights.

India Plastic Pipes Market Report

The India plastic pipes market size was valued at USD 2.10 Billion in 2025 and is projected to reach USD 3.65 Billion by 2034, exhibiting a CAGR…

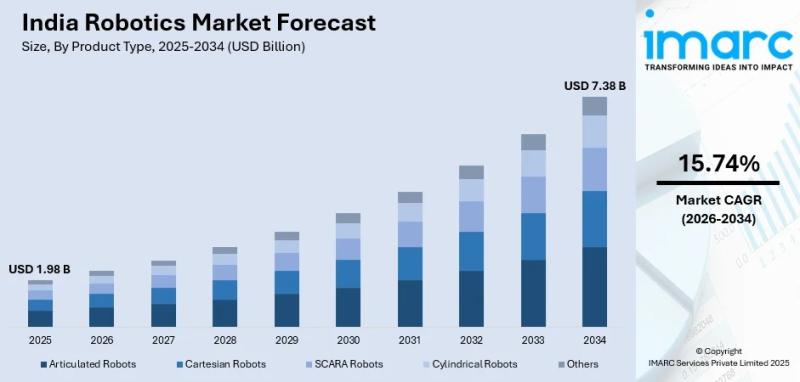

India Robotics Market Expanding at 15.74% CAGR by 2034, Driven by Make in India …

Summary

The India robotics market size reached USD 1.98 Billion in 2025, according to the latest comprehensive industry analysis by IMARC Group. Fueled by a massive push toward manufacturing modernization, rising labor costs, and robust government support for digital transformation, the market is projected to reach an impressive USD 7.38 Billion by 2034. This highlights a rapid compound annual growth rate (CAGR) of 15.74% during the forecast period (2026-2034).

Request a…

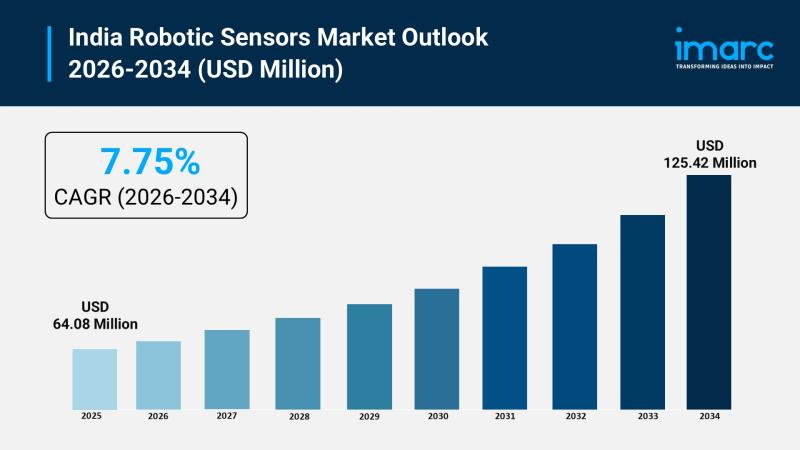

India Robotic Sensors Market Growing at 7.75% CAGR Through 2034, Driven by AI & …

Summary

The India robotic sensors market size reached USD 64.08 Million in 2025, according to the latest comprehensive industry analysis by IMARC Group. Fueled by robust government initiatives, escalating labor costs, and the rapid integration of artificial intelligence in industrial automation, the market is projected to reach USD 125.42 Million by 2034. This highlights a steady compound annual growth rate (CAGR) of 7.75% during the forecast period (2026-2034).

Request a Free Sample…

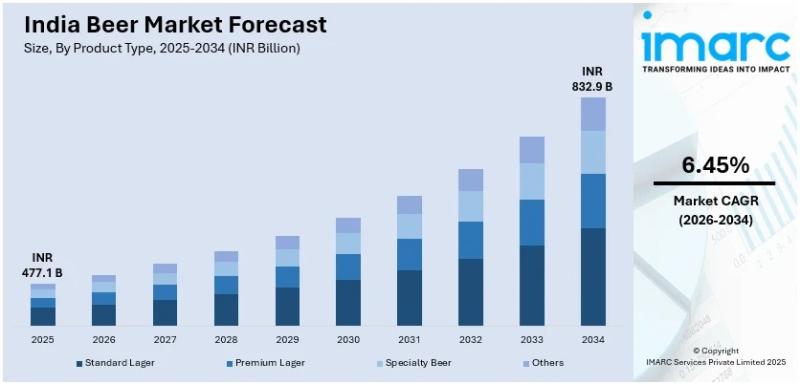

India Beer Market Size to Reach INR 832.93 Billion by 2034: Industry Trends, Gro …

Summary

The beer market size in india reached INR 477.05 Billion in 2025, according to the latest comprehensive industry analysis by IMARC Group. Driven by rapid urbanization, a burgeoning young demographic, and a massive cultural shift toward premium and craft beverages, the market is projected to reach INR 832.93 Billion by 2034. This represents a steady compound annual growth rate (CAGR) of 6.45% during the forecast period (2026-2034).

What are the Key…

More Releases for India

India Smart Air Purifier Market Set to Witness Significant Growth by 2035 | Phil …

India smart air purifier market was valued at $125.8 million in 2024 and is projected to reach $298.7 million by 2035, growing at a CAGR of 8.3% during the forecast period (2025-2035).

India Smart Air Purifier Market Overview

The Indian smart air purifier market is experiencing significant growth, driven by increasing concerns over air pollution and its impact on health. Consumers are increasingly adopting smart air purifiers equipped with advanced features…

Ayurvedic Service Market is Flourishing Like Never Before | Patanjali Ayurved Li …

RnM newly added a research report on the Ayurvedic Service market, which represents a study for the period from 2020 to 2026.

The research study provides a near look at the market scenario and dynamics impacting its growth. This report highlights the crucial developments along with other events happening in the market which are marking on the growth and opening doors for future growth in the coming years. Additionally, the…

Pasta Market Report 2019 Companies included Bambino (India), Nestle (USA), Field …

We have recently published this report and it is available for immediate purchase. For inquiry Email us on: jasonsmith@marketreportscompany.com

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2019 to 2025 in terms of volume, revenue, YOY growth rate, and CAGR for the year 2019 to 2025, etc. The report also provides detailed segmentation on the…

Interior Designers India, Designers and Architects India, Interior Design Consul …

Synergy Corporate Interiors Pvt. Ltd. are offer Designers and Architects India Our architects, designers are working an national and international client base. The final design output is then integrated with the various technical and engineering aspects and taken into production. The expression is also individualistic, based on the communication of the correct corporate identity. Our designers, engineers and architects perform any plan successfully combine handy knowledge with creative ideas into…

Domain Registration India, Web Hosting India, VPS Hosting India , SSL Certificat …

All the Domain Registration services are at affordable price and assure you for the 100% quality.

India Internet offers cheap domain name registration for many domain extensions available. We are a full-service web site solutions provider. We offer a full range of web services including domain registration India, Web Hosting India, Web design, SEO marketing and etc.

We offer different standard and different Windows .NET low-cost, full-featured, all-inclusive web hosting and domain…

Domain Registration India, Web Hosting India, Payment Gateway India

Indiainternet.in is a Quality Web Hosting Company India, provide all web related support and Web hosting services like linux web hosting, windows web hosting, web hosting packages, domain registration in india, Corporate email solution, business email hosting, payment gateway integration, SSL with supports like free php, cgi, asp, free msaccess, free cdonts, free webmail, web based control panel, unlimited ftp access, unlimited data transfer.

During the domain registration process, you will…