Press release

New Jersey Bankruptcy Attorney Daniel Straffi Issues Guidance On How Bankruptcies Appear On Background Checks

Toms River, NJ - New Jersey Bankruptcy Attorney Daniel Straffi of Straffi & Straffi Attorneys at Law (https://www.straffilaw.com/do-bankruptcies-show-up-on-background-checks/) provides clear guidance on when and how bankruptcy records surface in employment, housing, and lending background reviews. Drawing on current federal and state rules, Straffi outlines what applicants and hiring teams can expect from consumer reporting agencies, the time frames for credit reporting, and the safeguards that govern any decision influenced by a prior filing.Background screening varies by purpose, and not all checks reveal financial data. Criminal history reviews focus on convictions and pending matters, while academic and employment verifications confirm credentials and work history. Credit checks are different. They report financial information, including prior bankruptcies, which can be relevant for positions that involve fiduciary duties or access to sensitive financial systems. New Jersey Bankruptcy Attorney Daniel Straffi notes that employers must obtain written consent before ordering a credit report and must use that information in line with the Fair Credit Reporting Act.

Under the Fair Credit Reporting Act, 15 U.S.C. 1681c, reporting periods differ by chapter. A Chapter 7 filing can appear on a consumer credit report for up to ten years. A Chapter 13 filing commonly appears for up to seven years, reflecting the repayment plan structure that typically lasts three to five years. If a bankruptcy remains beyond the permitted period, consumers can dispute the entry with Experian, Equifax, or TransUnion. Federal anti-discrimination protections also apply. Section 525(b) of the Bankruptcy Code bars private employers from firing or denying employment solely because of a bankruptcy. Section 525(a) bars government entities from denying employment or altering terms based on a filing. New Jersey Bankruptcy Attorney Daniel Straffi underscores that employers must follow the adverse action process if a report influences a hiring decision.

New Jersey law aligns closely with federal requirements and adds transparency. Employers need written authorization before accessing a credit report, must provide clear notice of the type of information a report can contain, and must share a copy of the report on request if adverse action is under consideration. Housing providers may weigh bankruptcy history, particularly for recent filings, yet many give greater weight to stable income, positive rental history, and low current debt obligations. In some cases, debt discharge through bankruptcy can strengthen an applicant's capacity to meet monthly rent.

Practical preparation helps applicants navigate reviews with confidence. Order and review credit reports in advance, correct inaccuracies, and maintain on-time payments on any open accounts. Be ready to provide a concise explanation of the circumstances leading to a filing, along with evidence of recovery steps such as budgeting, emergency savings, or successful completion of a Chapter 13 plan. For wage garnishment situations, a Chapter 7 filing triggers notice to employers to stop the garnishment, while Chapter 13 plans may involve payroll deductions ordered by the court; in either scenario, federal protections continue to apply.

About Straffi & Straffi Attorneys at Law:

Straffi & Straffi Attorneys at Law is a New Jersey firm led by New Jersey Bankruptcy Attorney Daniel Straffi. The practice handles consumer bankruptcy matters under Chapters 7 and 13, debt relief, foreclosure defense, and related creditor negotiations. The firm serves clients across Ocean County, Monmouth County, and surrounding communities from offices in Toms River. For consultations or additional information, call (732) 341-3800 or visit the firm's website to schedule a confidential case evaluation.

Embeds:

Youtube Video: https://www.youtube.com/watch?v=LcyaZ2Oot7U

GMB: https://www.google.com/maps?cid=18340758732161592314

Email and website:

Email: infodocuments@straffilaw.com

Website: https://www.straffilaw.com/

Media Contact

Company Name: Straffi & Straffi Attorneys at Law

Contact Person: Daniel Straffi, Jr.

Email:Send Email [https://www.abnewswire.com/email_contact_us.php?pr=new-jersey-bankruptcy-attorney-daniel-straffi-issues-guidance-on-how-bankruptcies-appear-on-background-checks]

Phone: (732) 341-3800

Address:670 Commons Way

City: Toms River

State: New Jersey 08755

Country: United States

Website: https://www.straffilaw.com/

Legal Disclaimer: Information contained on this page is provided by an independent third-party content provider. ABNewswire makes no warranties or responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you are affiliated with this article or have any complaints or copyright issues related to this article and would like it to be removed, please contact retract@swscontact.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release New Jersey Bankruptcy Attorney Daniel Straffi Issues Guidance On How Bankruptcies Appear On Background Checks here

News-ID: 4267353 • Views: …

More Releases from ABNewswire

Self Employed Tax Software UK: Why Freelancers and Sole Traders Are Switching to …

With Many individuals are seeking software that simplifies tax filing while ensuring full compliance with HMRC requirements. Manual spreadsheets and paper-based calculations are being replaced by real-time, automated systems that give users visibility over their tax position throughout the year. Among the platforms gaining traction is Pie, a UK-based digital tax app built specifically to support self-employed individuals with modern income needs.

LONDON, United Kingdom - February 19, 2026 - Demand…

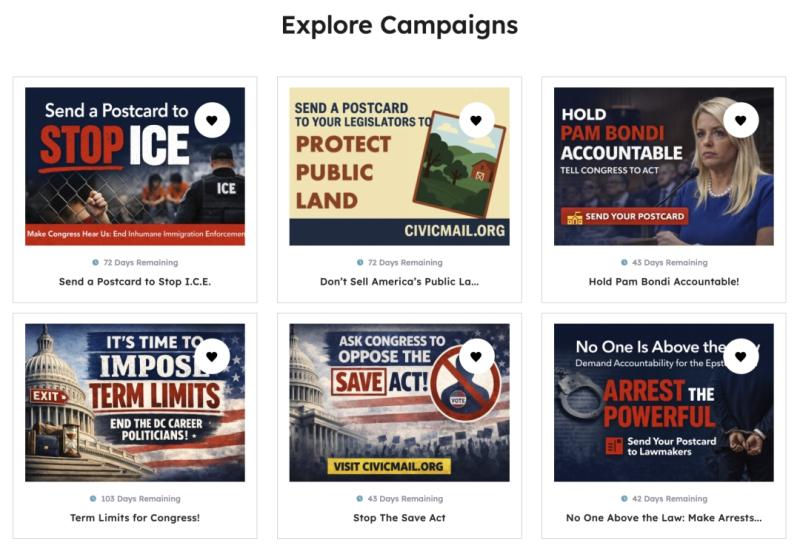

CivicMail.org Reinvents Postcard Campaigns for Grassroots Advocacy

CivicMail.org aims to bring civic engagement back to basics through the power of pen, paper, and postage.

Image: https://www.abnewswire.com/upload/2026/02/2addd1e9e0381d7e2262e1edbb064123.jpg

CivicMail.org [https://civicmail.org/] has announced its launch to help Americans send real, physical postcards to their elected officials with just a few clicks, delivering personalized messages directly to the desks of decision-makers at the local, state, and federal levels.

Research shows [https://www.concordia.ca/news/stories/2021/09/24/personalized-messages-are-more-likely-to-get-a-response-from-politicians-new-research-finds.html] that physical mail carries more weight with elected officials than petitions, emails, or…

New Children's Story: The Story of Sharin' Bear

A Heartfelt Message Of Courage, Kindness, And The True Meaning Of Giving

A pleasant new story for children, The Story of Sharin' Bear by Sharon Woods , introduces families to a lovable little cub whose journey of bravery and compassion changes him into a representation of sharing for children globally.

Entrenched in adventure, innocence, and emotional growth, this uplifting tale offers an unforgettable reminder that even the smallest acts of kindness can…

Fast-Growing Newman's Brew Combines Organic Coffee Excellence with Abandoned Ani …

Newman's Brew is experiencing rapid expansion by delivering on dual commitments that resonate with today's conscious consumers: exceptional fresh-roasted organic coffee and meaningful support for abandoned animals. The company's growing inventory and ethical business practices demonstrate that quality and social responsibility can drive sustainable business success in the competitive specialty coffee market.

Newman's Brew is riding a wave of growth that reflects fundamental shifts in how consumers approach coffee purchasing decisions.…

More Releases for Straffi

New Jersey Bankruptcy Attorney Daniel Straffi, Jr. Explains Chapter 7 Income Lim …

TOMS RIVER, NJ - Individuals considering Chapter 7 bankruptcy in New Jersey must meet specific income requirements determined by the federal means test, which compares a six-month income average against state median income guidelines. New Jersey bankruptcy attorney Daniel Straffi, Jr. of Straffi & Straffi Attorneys at Law (https://www.straffilaw.com/what-are-income-limits-chapter-7-bankruptcy/) explains how the income thresholds work, what counts as income in the calculation, and what options exist for those whose income…

New Jersey Bankruptcy Attorneys Straffi & Straffi Attorneys at Law Announce Guid …

Toms River, NJ - New Jersey bankruptcy attorneys at Straffi & Straffi Attorneys at Law (https://www.straffilaw.com/how-long-after-filing-bankruptcy-can-you-buy-a-house-in-new-jersey/), led by attorney Daniel Straffi Jr., announce comprehensive guidance for residents seeking a path to homeownership after bankruptcy. The firm's new advisory explains practical timelines, loan options, and documentation standards for applicants rebuilding credit, providing clear steps for pursuing a mortgage in New Jersey following Chapter 7 or Chapter 13 proceedings.

The guidance details how…

New Jersey Emergency Bankruptcy Attorney Daniel Straffi Provides Clarity on Emer …

Understanding how to protect assets during a financial crisis is critical, particularly when swift legal action is required. New Jersey emergency bankruptcy attorney Daniel Straffi (https://www.straffilaw.com/what-is-an-emergency-bankruptcy-filing-in-new-jersey/) explains how an emergency bankruptcy filing can provide immediate relief for those facing foreclosure, wage garnishment, or other urgent creditor actions. In a recent article published by Straffi & Straffi Attorneys at Law, Daniel Straffi outlines the essential steps and key considerations involved in…

Straffi & Straffi Attorneys at Law Publishes New Article on No Asset Bankruptcy …

New Jersey Chapter 7 bankruptcy lawyer Daniel Straffi of Straffi & Straffi Attorneys at Law has published an article discussing the concept and implications of a no asset bankruptcy New Jersey [https://www.straffilaw.com/new-jersey-chapter-7-bankruptcy-lawyer/no-asset/]. This type of bankruptcy is commonly filed by individuals who have little to no nonexempt assets available for creditors. As explained by Straffi, a no asset bankruptcy can be an effective path toward financial relief for those who…

New Jersey Bankruptcy Attorney Daniel Straffi Discusses Medical Debt Relief Thro …

Medical debt continues to be a leading cause of financial distress for many Americans, and New Jersey residents are no exception. In a detailed article titled "Can My Medical Debt Be Paid Off With Bankruptcy?", New Jersey bankruptcy attorney Daniel Straffi (https://www.straffilaw.com/can-my-medical-debt-be-paid-off-with-bankruptcy/) explains how individuals burdened with overwhelming healthcare expenses may find relief through the bankruptcy process. The article, published by Straffi & Straffi Attorneys at Law, provides a comprehensive…

New Jersey Bankruptcy Attorney Daniel Straffi Explains Debt Restructuring Soluti …

New Jersey bankruptcy attorney Daniel Straffi (https://www.straffilaw.com/what-is-debt-restructuring-in-new-jersey/) offers important insights into how individuals and businesses can regain control of their finances through debt restructuring. In a recent article titled "What is Debt Restructuring in New Jersey?", Straffi addresses the growing financial strain many face due to job loss, unexpected expenses, or business challenges, and outlines the available options for restructuring debt to avoid default. Straffi & Straffi Attorneys at Law…