Press release

Best Ways to Invest for College Students

When you think of college life, one of the last words that comes to mind is investments. After all, between tuition, textbooks, and part-time jobs, investing almost seems like a privileged luxury or a complicated concept best left for your future self.However, the best time for you to start investing was yesterday. The second-best time is now. Time is your ally, and no matter how small the amount, the sooner you start investing, the better.

Luckily, it is a lot easier than it seems. Here are the best ways for you to start investing like a pro as a college student-whether you start with $10 or $1,000.

First Step: Consider If You Can Invest Right Now.

While the idea of investing now as a college student is tempting-and viable-it is something you need to consider carefully to determine if it fits your situation and life goals.

The first step is to create a financial plan that realistically evaluates your income, expenses, assets, and liabilities, and then consider whether you will have enough extra income to begin.

As a student, you're barely starting your financial journey, and odds are that you have bigger priorities you should focus on. Before investing, ensure you can cover your essential expenses and build an emergency savings fund.

Most importantly, focus on paying off your high-interest debt as soon as possible, including your loans. No investment strategy would be more effective than eliminating interest charges.

If you have covered all these expenses and still have some extra income, an investment is an excellent option to start your long-term growth.

Best Investment Options for College Students

When considering whether you should invest as a student, there are two things you should keep in mind before starting:

1. Risk Level: Higher risk has potential for higher revenues, but you can also have significant losses. On the other hand, low risk is more reliable even if returns are lower.

2. Timeframe: Investments can be short-term for quick returns, or long-term for bigger earnings across decades.

Depending on your preferred risk level or time frame, you have various investment options available.

1. High-Yield Savings Account

Risk Level: Very Low.

Timeframe: Flexible.

While technically not an investment-it's a savings account, after all-it is one of the best first steps towards investment that you can make as a college student.

A high-yield savings account offers a higher interest rate than a regular savings account, making it an ideal option for growing your emergency funds or starting to save for short-term goals. The interest rates fluctuate, and you receive no tax advantages, but in exchange, you get no-risk and immediate access to your money.

2. Micro-Investing Apps

Risk Level: Low to Moderate.

Timeframe: Built for the long term, but you can make flexible withdrawals.

Micro-investing apps are platforms that enable you to invest small amounts of money through an automated and simplified process. They usually round up your purchases and invest the spare change in diverse portfolios of stocks or ETFs.

Since you can start investing with amounts as small as $1, micro-investing apps are an excellent way to get familiar with investing and how it works without committing a large amount of money.

3. Book Flipping

Risk Level: Low to Moderate.

Timeframe: Immediate.

As a student, you come in regular contact with textbooks or other books you might find in thrift stores, old bookshops, or garage sales. These books are valuable and, if you consider and track rates, prices, trends, and expenses, you can make flipping books a reliable investment.

Start small-with your college textbooks or any items you may have found. Conduct thorough research on price and demand, and consider that the condition of the book or its edition will impact the final price and, consequently, the return on your investment. Once you have all the information you need, you can use websites like BookScouter https://bookscouter.com/ to evaluate where to sell books online for the best price and make a profit.

While this is convenient to you as a student, it might take some time and practice to figure out which books are worth the time and effort.

4. Low-Cost Index Fund

Risk Level: Moderate.

Timeframe: Long-Term.

Index funds are mutual funds that replicate a market index and invest in the same proportions, guaranteeing instant diversification across hundreds of companies. This means that it works passively-you don't need to do individual research or any active stock picking on your end.

Low-cost index funds have minimal annual fees and low expense ratios, making them an excellent starting point for investing. While you won't beat the market and win big, it offers consistent long-term performance with a modest return, without requiring a high level of commitment on your part.

5. Certificate of Deposit

Risk Level: Very Low.

Timeframe: Fixed returns within a set timeframe.

Certificates of deposit https://www.investopedia.com/terms/c/certificateofdeposit.asp (CDs) are a low-risk fixed-income investment that offers you a fixed interest over a specific timeframe. In exchange, you agree not to withdraw the money you invested for a set period of time, lest you risk a penalty.

There are many types of CDs, but they are among the safest forms of investment. Your only risk is inflation, so you need to ensure the interest rate can keep pace with it.

6. Invest In Yourself

It may sound boring, but as a student, one of the best investments you can make is in yourself.

While building your finances and safeguarding your future stability are essential, remember that you are currently working to acquire the tools you need to face the world. Purchase online courses, obtain certifications, join student organizations, and pay small fees to attend networking events, as these are all small purchases that can have a significant impact on your future.

Make Money Work for You

Think of investing as planting the seeds of a money tree. Bury a few dollars today, and watch them flourish into something significant-a reliable tree that will offer you sturdy support, stability, and a place to rest when life burns up.

Not all investments are made equal. Some are slow and reliable, while others are volatile and can significantly impact your life for better or worse. Choosing the right option is up to you, and financial literacy is the foundation for a stable future.

P.O Bagarji Town Bagarji Village Ghumra Thesil New Sukkur District Sukkur Province Sindh Pakistan 65200.

Wiki Blogs News always keeps careful online users to provide purposeful information and to keep belief to provide solution based information.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Best Ways to Invest for College Students here

News-ID: 4267102 • Views: …

More Releases from Wikiblogsnews

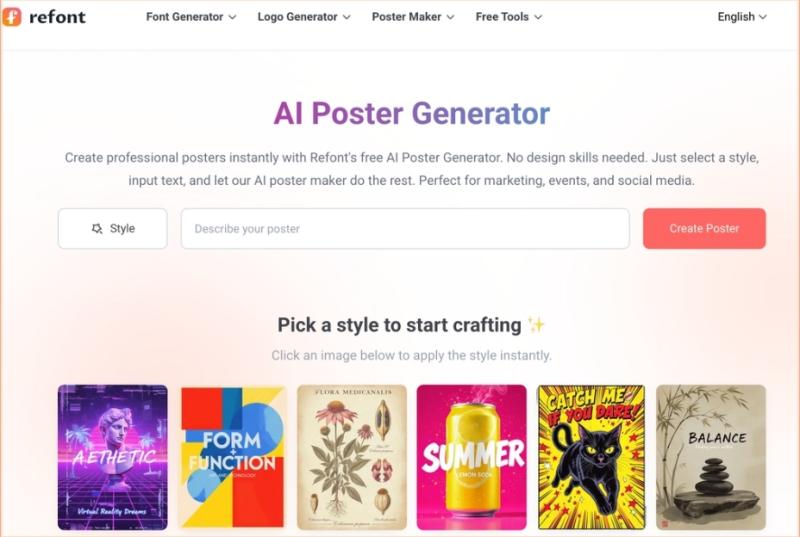

Tired of the Design Bottleneck? How I Finally Found a Practical AI Poster Genera …

If you're anything like me, you've probably spent more hours than you'd like to admit fighting with design software. We've all been there: you have a killer idea for a promotion, a social post, or a brand announcement, but by the time you've messed around with layers, alignment, and hunting for stock photos, the inspiration is gone and so is half your afternoon.

I've tried the early wave of generative AI…

Best Exotic Car Rental in Miami: Experience Luxury Without Overspending

Miami has a way of turning every drive into a cinematic experience. Picture yourself cruising down Ocean Drive at sunset with the gentle ocean breeze mixing in with the roar of your high-performance engine, smiling people looking over your car. For those who seek this experience, the best exotic car rental in Miami is your ticket to unlocking this fantasy.

But there's a catch: Miami's luxury car scene is flooded, and…

Cheap Exotic Car Rental in Miami: Drive Luxury Without Overpaying

Miami is a city made for style, speed, and excitement. Exotic cars fit perfectly into this glamorous backdrop, but many travelers immediately assume renting one is out of reach. The good news? Cheap exotic car rentals in Miami are not only possible-they're easier than most think.

When I first looked into it, I expected outrageous prices-until I stumbled upon a guide from a local rental specialist that broke down how everyday…

Top 5 Best Front and Rear Dash Cam Options for Maximum Road Safety

As a driver, ensuring your safety on the road is paramount. One way to do this is by investing in a reliable dash cam that can provide evidence in case of an accident or incident.https://wolfbox.com/collections/dash-cam-front-and-rear is ideal for capturing footage of the road ahead and behind your vehicle. Here are the top 5 best front and rear dash cam options for maximum road safety.

*1. WOLFBOX Mirror Dash Cam: The All-in-One…

More Releases for Invest

Robo-advisory Market Is Dazzling Worldwide with Major Giants TD Ameritrade, SoFi …

Latest Study on Industrial Growth of Robo-advisory Market 2024-2030. A detailed study accumulated to offer the Latest insights about acute features of the Robo-advisory market. The report contains different market predictions related to revenue size, production, CAGR, Consumption, gross margin, price, and other substantial factors. While emphasizing the key driving and restraining forces for this market, the report also offers a complete study of the future trends and developments of…

How to invest in rental properties?

Investing in rental properties can be an excellent source of income. Do you know what to do to make this investment? Check out!

The real estate market is seen as an excellent opportunity for those who want to have a little more security in their financial life since it is an extremely safe and stable area over the years. However, do you know for sure what you need to invest in…

Robo-advisory Market to Witness Huge Growth by 2028 | Axos Invest, SoFi Invest, …

Global Robo-advisory Market Report 2020 by Key Players, Types, Applications, Countries, Market Size, Forecast to 2026 (Based on 2020 COVID-19 Worldwide Spread) is latest research study released by HTF MI evaluating the market risk side analysis, highlighting opportunities and leveraged with strategic and tactical decision-making support. The report provides information on market trends and development, growth drivers, technologies, and the changing investment structure of the Global Robo-advisory Market. Some of…

Warner Goodman invest in Linetime

Leading south coast law firm Warner Goodman LLP has signed up for the full Liberate software suite from Linetime. The fully integrated accounts, case and matter management system is to be rolled out to over 150 users across three branch offices in Southampton, Portsmouth and Fareham.

Andy Munden, partner at Warner Goodman said, “We are looking forward to working with Linetime to implement state of the art systems and processes that…

How would you Invest €100,000?

How would you Invest €100,000?

The big question is nowadays….what should I invest in and what will be safe enough to not lose money on? Imagine you have €100,000 to invest…. how should you invest it now? “Scan through your portfolio to see if there are any of your assets that you should now buy more of at lower prices or venture outside the box and look at the metal…

Diversified Portfolio Management Invest – Structured Finance

DPM Invest structured finance practice is interdisciplinary, drawing on the expertise of lawyers in the areas of banking, corporate finance and securities law, secured transactions, tax, bankruptcy and banking regulation. The partners who practice in this area have available to them partners specializing in tax, bankruptcy, bank regulatory and intellectual property practice areas to assist in the structuring and execution of complex structured transactions.

DPM Invest has been…