Press release

High Purity Glass Fiber Filter Media Market to Reach USD 2,384 Million by 2031 Top 20 Company Globally

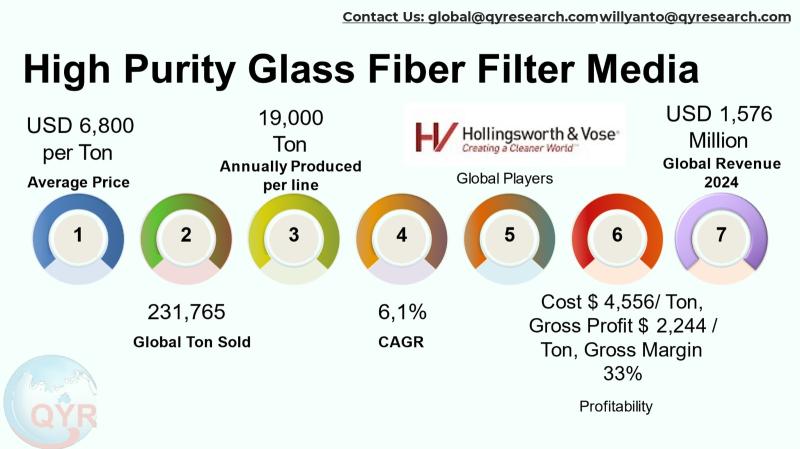

High purity glass fiber filter media often manufactured as binder-free or microglass (borosilicate) microfiber paper and depth-media is a specialized filtration substrate used where chemical inertness, thermal resistance, and sub-micron particle capture are critical. This research concentrates on the properties, supply chain and end-use dynamics of glass fiber filter media rather than reproducing baseline market forecasts. High purity grades are produced from borosilicate or specialty glass feedstocks and typically avoid organic binders when laboratory-grade inertness or ultra-clean environments are required; the manufacturing process involves high-temperature melting, fiberizing, wet-laid forming and thermal curing or binder-free drying to deliver consistent depth filtration characteristics. Major end uses span high-efficiency air filtration (HEPA/ULPA), pharmaceutical and biotech cleanrooms, critical liquid clarification in chemical and analytical labs, and demanding industrial separation tasks where fiber shedding and extractables must be minimized. Practical advantages that define the high purity segment include high dirt-holding capacity, chemical and thermal stability, and ability to retain sub-micron particles while maintaining acceptable pressure drop characteristics that sustain demand in advanced manufacturing and regulated environments.The 2024 global market value of high purity glass fiber filter media is at USD 1,576 million, and a forecast CAGR of 6.1% to 2031reaching market size USD 2,384 million by 2031. With an average selling price of USD 6,800 per ton, implies to approximately 231,765 tons of high-purity glass fiber filter media sold globally in 2024. Factory cost of goods sold per ton is USD 4,556, implying a factory gross profit of roughly USD 2,244 per ton and a factory gross margin is at 33%. A COGS breakdown is raw glass and additives, energy and furnace operation, labor and direct manufacturing costs, binders/ancillary chemicals and plant overhead/packaging. A single line full machine production capacity is around 19,000 ton per line per year. Downstream demand is concentrated in air filtration for buildings and industrial HVAC, cleanroom/biotech & healthcare (HEPA/ULPA), industrial process filtration and specialized liquid lab filtration.

Latest Trends and Technological Developments

In 2025 manufacturers and solution providers emphasized advancements in micro-glass HEPA/ULPA media engineering and higher-temperature microglass products targeted at demanding industrial and energy applications. Camfil published an educational guide on HEPA media improvements describing optimized microglass fiber distribution and depth-profile engineering to improve capture efficiency while minimizing pressure drop (September 2025). Ahlstrom-Munksjö announced a new molecular filtration media platform (PurXcel) aimed at clean-air and cabin/indoor environment applications (press release dated October 2025), illustrating how manufacturers are layering capabilities (molecular + particulate) into composite media. Several specialty fiber producers have continued to invest in additional micro-fine glass fiber capacity to serve battery and filtration markets, with Alkegen publicly describing multi-line capacity increases announced earlier as part of a global capacity build-out program (company release, 2022 announcement with ongoing follow-up coverage). These items reflect two linked technological directions: better microstructure control (for energy-efficient HEPA performance) and investments to secure supply of micro-fine glass fibers for both filtration and battery separator niches.

A major manufacturer in the life sciences sector, such as Cytiva, regularly purchases high-purity glass fiber filter media from a specialized producer like MilliporeSigma for integration into their sterile filtration assemblies. These purchases are typically made in large rolls or pre-cut sheets, with the cost being a critical factor in their supply chain. A standard procurement order might see Cytiva buying several metric tons of this specialized media annually, with prices typically ranging from USD 80,000 to USD 150,000 per metric ton, depending on the specific binder-free composition, pore size rating, and mechanical strength required for their high-throughput bioprocessing applications.

The product is used in the stringent air quality monitoring networks operated by governmental agencies like the U.S. Environmental Protection Agency (EPA). For their PM2.5 (particulate matter) monitoring stations, high-purity glass fiber filter media is installed in automated air samplers. These filters are essential for capturing fine particles from a known volume of air with extreme accuracy and minimal background contamination, allowing for precise gravimetric and chemical analysis. A single monitoring station can use hundreds of these pre-weigned filters per year, with the cost for the high-purity media itself amounting to approximately USD 15 to USD 30 per unit

Asia is the worlds most active manufacturing base for filter media and many of the sectors strategic investments are concentrated here. Asia hosts large producers and numerous mid-tier manufacturers that supply both domestic consumption and export markets; the regions dynamics are driven by fast-growing environmental regulations, expansion of advanced manufacturing (electronics, pharma) and accelerated infrastructure projects that increase HVAC demand. Japan and Korea remain sources of high-performance specialty filter media and membrane technologies, while China is a major volume producer for ASHRAE and medium-to-high efficiency glass and synthetic filter media. Several multinational producers maintain production footholds or R&D centers in Asia to be close to downstream semiconductor and pharmaceutical clusters, and manufacturers like Toray and other integrated materials groups are investing in capacity and product R&D relevant to high-precision filtration for semiconductors and life sciences applications. The Asia focus explains much of the supply-side expansion and is a principal reason the region often appears as the dominant regional market in broader air-filter media reports.

Get Full PDF Sample Copy of Report: (Including Full TOC, List of Tables & Figures, Chart)

https://www.qyresearch.com/sample/5444901

High Purity Glass Fiber Filter Media by Type:

Ultrafine (1.5 μm)

High Purity Glass Fiber Filter Media by Product Category:

Lightweight (1030 g/m2)

Medium (3080 g/m2)

Heavyweight (80200 g/m2)

High Purity Glass Fiber Filter Media by Material:

Glass Microfiber Media

Polypropylene and Polyester Media

PTFE and ePTFE Membranes

Cellulose and Natural Fiber Blends

Others

High Purity Glass Fiber Filter Media by Shape:

Flat Sheet Media

Pleated Media

Rolled Media

Composite Multilayer Media

Others

High Purity Glass Fiber Filter Media by Usage:

Cleanroom Filtration

Automotive Cabin and Engine Filtration

Industrial Air Handling Units

Liquid Filtration

Others

High Purity Glass Fiber Filter Media by Application:

Healthcare

Industrial

Cleanrooms

Electronics & Semiconductor

Others

Global Top 20 Key Companies in the High Purity Glass Fiber Filter Media Market

Hollingsworth & Vose

Freudenberg

Lydall Filtration

3M Company

Donaldson

Mann+Hummel

Meissner

Porex Technologies

Macherey-Nagel

Advantec MFS

Zhaohui Filter

Compo Filter

Daiki Filter

Nichias

Toray Industries

Schott

Ahlström

Camfil

Alkegen

Parker Hannifin

Regional Insights

Within Southeast Asia, demand growth is concentrated in rapidly urbanizing economies where building retrofits, hospitals and industrial projects create steady HVAC and process-filtration requirements. Countries such as Malaysia and Indonesia have attracted investment and plant expansions by global filter manufacturers to improve logistics and regional service. For example, Camfils regional manufacturing and service footprint expansions across APAC have targeted faster response for hospitals and cleanroom customers. Indonesia, as a large and growing market in ASEAN, shows rising demand in commercial HVAC, hospitals, and food & beverage processing all of which use glass microfiber media for either final filtration or specialty liquid clarification. Local manufacturers and contract converters in the region often supply lower-basis-weight air filter media for ASHRAE classes, while import of high-purity binder-free microglass grades serves the high-end biomedical and semiconductor segments. The regional profile is therefore mixed: volume at mid-range prices for general HVAC and pockets of high-value, low-volume demand for truly high-purity media.

The industry faces three structural challenges. First, glass melting and fiberizing are energy-intensive processes, so volatility in energy and raw-material (silica/borosilicate) costs directly compress factory margins or push prices up for customers. Second, competition from advanced synthetic nanofiber media and hybrid nonwovens which can offer lower weight and reduced handling risks places pressure on some glass-media segments; manufacturers respond with binder-free or encapsulated designs but must balance performance and cost. Third, supply-chain and environmental compliance (air emissions from melting furnaces, waste handling) raise capital and operating costs; these factors incentivize consolidation and make green-energy retrofits a competitive differentiator for plant operators. These constraints influence how companies prioritize capital investments and product development.

Buyers should monitor the move to higher-performance, energy-efficient HEPA/ULPA media (depth gradient engineering and molecular layers), because swapping to improved media can lower lifecycle energy costs for building owners. Suppliers should prioritize securing micro-fine glass fiber feedstock and reducing unit energy consumption through furnace optimization or electrification, which are immediate levers on margins. Investors should follow capacity announcements by major platform players (those adding production lines or setting up local converting facilities in Asia/ASEAN) because incremental line additions materially affect supply tightness for the relatively small high-purity segment. Finally, regulatory tightening on indoor air quality in Asia and the semiconductor/pharma nearshoring trend will expand pockets of premium demand for certified high-purity media; producers with validated binder-free offerings and ISO/EN certified HEPA/ULPA capabilities stand to capture that premium.

Product Models

High Purity Glass Fiber Filter Media are specialized filtration materials made from borosilicate glass fibers designed for precision particle collection, high chemical resistance, and consistent porosity. They are widely used in laboratory testing, air and gas filtration, cleanroom applications, and industrial processes requiring ultra-clean performance.

Ultrafine (1.5 μm) is used for pre-filtration, industrial air intake, HVAC systems, and coarse particulate capture. Notable products include:

Whatman GF/D Cytiva: 2.7 μm retention, high loading capacity for coarse filtration and pre-filtration tasks.

Ahlstrom-Munksjö Grade 141 Ahlstrom: Coarse structure for dust collection and liquid prefiltration.

Pall Type C Glass Fiber Media Pall Corporation: Coarse filter for general air handling and HVAC systems.

Millipore AP40 Merck KGaA: 2.0 μm retention for prefiltration of samples and industrial air monitoring.

Hollingsworth & Vose CoarseGlass 3000 H&V: High-durability glass fiber media for coarse dust collection.

High purity glass fiber filter media remains a strategically important but relatively specialized segment of the broader filter-media market: it serves the highest-value, high-cleanliness applications where chemical inertness and thermal stability matter. The 2024 market value used here (USD 1,576 million) and the unit pricing assumption (USD 6,800/ton) imply modest global tonnage where supply and capacity choices by a few large suppliers strongly influence availability and prices. Asia and ASEAN are central to both demand and supply Asia for high-value manufacturing and large volume production, and Southeast Asia for growing regional HVAC and industrial demand. Technology improvements (depth profile control, binder-free manufacturing and molecular media layering) combined with capacity expansions in micro-fine glass fibers will shape competitiveness and margins through the 2020s.

Investor Analysis

What this report highlights for investors is (1) a relatively small but high-value segment where per-ton economics can be attractive if energy efficiency and raw-material sourcing are managed, (2) an Asia-centric supply/demand footprint with concentrated pockets of premium demand (pharma, semiconductor, healthcare), and (3) a push toward higher-value product enhancements (molecular + particulate media, HEPA performance improvements) that can support price premia. How investors can act: prioritize companies with secure access to micro-fine glass fiber feedstock, demonstrated low unit energy intensity or electrification plans, and validated ISO/EN HEPA/ULPA product lines these are the firms that can sustain factory margins under raw-material/energy volatility. Why it matters: because the product serves regulated and mission-critical end markets, demand loss from lower-cost substitution is limited in the high-purity niche, and technological differentiation plus regional manufacturing footprint provide defensibility and potential for above-average returns as the market grows at mid-single digits CAGR. In short, capacity control, product certification and energy cost management determine which firms convert market growth to improved returns.

Request for Pre-Order Enquiry On This Report

https://www.qyresearch.com/customize/5444901

5 Reasons to Buy This Report

Get a concise regionalized read on Asia and ASEAN demand drivers for high-purity glass fiber media, including Indonesia.

Understand factory economic benchmarks (price/ton, estimated COGS composition, representative gross profit per ton and margin constraints).

See the most recent technology and capacity news that influence supply tightness and price dynamics.

Identify the leading global suppliers and strategic indicators to track for investment or supplier selection.

Obtain a practical assessment of production line capacity ranges useful for capex and sourcing decisions.

5 Key Questions Answered

What was the 2024 market size and what tonnage does that imply at USD 6,800/ton?

What are plausible factory economics (COGS per ton, gross profit per ton, and gross margin within your constraint)?

Which regions in Asia and ASEAN are driving demand, and how does Indonesia fit into regional dynamics?

What recent technology and capacity moves are shaping the high-purity glass fiber filter media market?

Who are the top suppliers and which operational metrics (energy, feedstock security, line capacity) matter most to investors?

Chapter Outline

Chapter 1: Introduces the report scope of the report, executive summary of different market segments (by region, product type, application, etc), including the market size of each market segment, future development potential, and so on. It offers a high-level view of the current state of the market and its likely evolution in the short to mid-term, and long term.

Chapter 2: key insights, key emerging trends, etc.

Chapter 3: Manufacturers competitive analysis, detailed analysis of the product manufacturers competitive landscape, price, sales and revenue market share, latest development plan, merger, and acquisition information, etc.

Chapter 4: Provides profiles of key players, introducing the basic situation of the main companies in the market in detail, including product sales, revenue, price, gross margin, product introduction, recent development, etc.

Chapter 5 & 6: Sales, revenue of the product in regional level and country level. It provides a quantitative analysis of the market size and development potential of each region and its main countries and introduces the market development, future development prospects, market space, and market size of each country in the world.

Chapter 7: Provides the analysis of various market segments by Type, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different market segments.

Chapter 8: Provides the analysis of various market segments by Application, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different downstream markets.

Chapter 9: Analysis of industrial chain, including the upstream and downstream of the industry.

Chapter 10: The main points and conclusions of the report.

Related Report Recommendation

Global High Purity Glass Fiber Filter Media Market Research Report 2025

https://www.qyresearch.com/reports/5444901/high-purity-glass-fiber-filter-media

Global High Purity Glass Fiber Filter Media Sales Market Report, Competitive Analysis and Regional Opportunities 2025-2031

https://www.qyresearch.com/reports/5444899/high-purity-glass-fiber-filter-media

Global High Purity Glass Fiber Filter Media Market Outlook, InDepth Analysis & Forecast to 2031

https://www.qyresearch.com/reports/5444900/high-purity-glass-fiber-filter-media

High Purity Glass Fiber Filter Media - Global Market Share and Ranking, Overall Sales and Demand Forecast 2025-2031

https://www.qyresearch.com/reports/5444902/high-purity-glass-fiber-filter-media

Global Glass Fiber Filters Market Research Report 2025

https://www.qyresearch.com/reports/4159937/glass-fiber-filters

Global Bag Filter Glass Fiber Market Research Report 2025

https://www.qyresearch.com/reports/3660488/bag-filter-glass-fiber

Global Glass Fiber Filter Disk Market Research Report 2025

https://www.qyresearch.com/reports/3724124/glass-fiber-filter-disk

Global Micro Glass Fiber Filter Market Research Report 2025

https://www.qyresearch.com/reports/4583655/micro-glass-fiber-filter

Global Glass Fiber Filter Paper Market Research Report 2025

https://www.qyresearch.com/reports/4041136/glass-fiber-filter-paper

Global Plate Glass Fiber Filter Market Research Report 2025

https://www.qyresearch.com/reports/3660487/plate-glass-fiber-filter

Contact Information:

Tel: +1 626 2952 442 (US) ; +86-1082945717 (China)

+62 896 3769 3166 (Whatsapp)

Email: willyanto@qyresearch.com; global@qyresearch.com

Website: www.qyresearch.com

About QY Research

QY Research has established close partnerships with over 71,000 global leading players. With more than 20,000 industry experts worldwide, we maintain a strong global network to efficiently gather insights and raw data.

Our 36-step verification system ensures the reliability and quality of our data. With over 2 million reports, we have become the world's largest market report vendor. Our global database spans more than 2,000 sources and covers data from most countries, including import and export details.

We have partners in over 160 countries, providing comprehensive coverage of both sales and research networks. A 90% client return rate and long-term cooperation with key partners demonstrate the high level of service and quality QY Research delivers.

More than 30 IPOs and over 5,000 global media outlets and major corporations have used our data, solidifying QY Research as a global leader in data supply. We are committed to delivering services that exceed both client and societal expectations.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release High Purity Glass Fiber Filter Media Market to Reach USD 2,384 Million by 2031 Top 20 Company Globally here

News-ID: 4267084 • Views: …

More Releases from QY Research

Market Overview - Ultra-low-k Dielectric Material

QY Research has recently published a comprehensive market study on Ultra-low-k Dielectric Material, a critical class of advanced insulating materials engineered to reduce parasitic capacitance and signal delay in advanced semiconductor interconnects. Ultra-low-k dielectrics are essential enablers for sub-7 nm logic nodes, advanced memory, high-performance computing, and AI accelerators, where interconnect RC delay increasingly limits device performance and power efficiency.

The market is transitioning from dense SiO2 and conventional low-k materials…

Global and U.S. Quadruped Mobile Robots Market Report, Published by QY Research.

QY Research has released a comprehensive new market report on Quadruped Mobile Robots, are four-legged robotic systems designed to move and operate in complex, unstructured environments by mimicking the locomotion of animals. They use a combination of advanced sensors, actuators, AI algorithms, and real-time control systems to maintain balance, navigate uneven terrain, climb obstacles, and adapt to dynamic conditions. Because of their high stability and mobility, quadruped robots are widely…

Global and U.S. Industrial Edge Cloud Devices Market Report, Published by QY Res …

QY Research has released a comprehensive new market report on Industrial Edge Cloud Devices, ruggedized computing platforms that bring cloud-native processing, storage, and AI analytics directly to the industrial edge-close to machines, sensors, and control systems. By executing latency-sensitive workloads locally while synchronizing with central or public clouds, these devices enable real-time decision-making, improved reliability, and secure data governance across factories, utilities, energy assets, and transportation infrastructure. As Industry 4.0,…

Top 30 Indonesian Ceramic Public Companies Q3 2025 Revenue & Performance

1) Overall companies performance (Q3 2025 snapshot)

PT Arwana Citramulia Tbk (ARNA)

PT Cahayaputra Asa Keramik Tbk (CAKK)

PT Intikeramik Alamasri Industri Tbk (IKAI)

PT Keramika Indonesia Assosiasi Tbk (KIAS)

PT Mulia Industrindo Tbk (MLIA)

PT Asahimas Flat Glass Tbk (AMFG) (glass & ceramic-adjacent)

PT Niro Ceramic Nasional Indonesia

PT Eleganza Tile Indonesia

PT Roman Ceramic International

PT Platinum Ceramics Industry

PT Granito (Citra Granito)

PT Diamond Keramik Indonesia

PT Indogress (Inti Keramik Sejahtera)

PT Indopenta Sakti Teguh

PT Sun Power Ceramics

PT Satyaraya Keramindo Indah…

More Releases for Glass

Depression Glass Market 2023- Industry Revenue and Price | Hazel-Atlas Glass Com …

The Depression Glass market research report is proficient and top to bottom research by specialists on the current state of the industry. This statistical surveying report gives the most up to date industry information and industry future patterns, enabling you to distinguish the items and end clients driving income development and benefit. It centres around the real drivers and restrictions for the key players and present challenge status with development…

Auto Glass Market Is Booming Worldwide | Fuyao Glass, Webasto, Xinyi Glass, Asah …

Advance Market Analytics published a new research publication on "Auto Glass Market Insights, to 2028" with 232 pages and enriched with self-explained Tables and charts in presentable format. In the Study you will find new evolving Trends, Drivers, Restraints, Opportunities generated by targeting market associated stakeholders. The growth of the Auto Glass market was mainly driven by the increasing R&D spending across the world. Some of the key players profiled…

Recycled Glass Market 2023 Business Strategies - Cap Glass, Glass Recycled Surfa …

Newly added by Fior Markets study on Global Recycled Glass Market 2023 contains a detailed analysis of data through industrial dynamics which has a major impact on the growth of the market. The report categorizes the global Recycled Glass market by segmented top key players, type, application, marketing channel, and regions. The report provides a complete understanding of the market in the coming years. It looks over the market with…

Glass Easy-clean Glass Market 2019| Pilkington Glass, PPG Industries, Ravensby W …

The global market status for Easy-clean Glass is precisely examined through a smart research report added to the broad database managed by Market Research Hub (MRH). This study is titled “Global Easy-clean Glass Market” Research Report 2019, which tends to deliver in-depth knowledge associated to the Easy-clean Glass market for the present and forecasted period until 2025. Furthermore, the report examines the target market based on market size, revenue and…

Global Ground Glass Market 2017- CSG, XINYI Glass, JINJING Glass, SYP Glass, Yao …

The market research report by QY Research provides detailed study on the overall Ground Glass market size, its financial positions, its unique selling points, key products, and key developments. This research report has segmented the Ground Glass market based on the segments covering all the domains in terms of type, country, region, forecasting revenues, and market share, along with analysis of latest trends in every sub-segment.

CLICK HERE to Request Sample…

Global Ground Glass Sales Market 2017 - XINYI Glass, JINJING Glass, SYP Glass, Y …

The study Global Ground Glass Sales Industry 2017 is a detailed report scrutinizing statistical data related to the Global Ground Glass Sales industry. Historical data available in the report elaborates on the development of the Ground Glass Sales market on a Global and national level. The report compares this data with the current state of the market and thus elaborates upon the trends that have brought the market shifts.

Download Sample…