Press release

Lithium Hydroxide Market Size, Share, Growth and Strategic Outlook - Global Industry Trends Forecast 2037

Top Companies & Their StrategiesThe lithium hydroxide market has become a strategic cornerstone of the global energy transition, serving as a critical raw material for lithium-ion batteries used in electric vehicles (EVs), renewable energy storage, and consumer electronics. As the global shift toward clean energy intensifies, companies are racing to secure lithium hydroxide supplies, optimize production processes, and strengthen value-chain integration.

➤ Request Free Sample PDF Report @ https://www.researchnester.com/sample-request-4972

1. Albemarle Corporation

Albemarle is one of the world's largest producers of lithium compounds, including lithium hydroxide. The company's strategic strength lies in its vertically integrated supply chain, stretching from resource extraction in Chile and Australia to conversion facilities in the U.S. and China. Albemarle's continuous investment in battery-grade lithium hydroxide and partnerships with major EV manufacturers solidify its leadership position. Its technological advantage is supported by advanced processing methods that enhance yield and purity.

2. SQM (Sociedad Química y Minera de Chile S.A.)

SQM is a dominant force in lithium brine extraction and chemical processing. Its strategic foothold in the Salar de Atacama, one of the richest lithium deposits globally, ensures low-cost production. The company's strength is its sustainable operations, emphasizing water efficiency and environmentally responsible extraction. SQM's recent expansion into lithium hydroxide conversion reflects its ambition to capture high-value segments of the battery market, particularly in Asia and Europe.

3. Ganfeng Lithium Co., Ltd.

Ganfeng Lithium is one of the most diversified lithium players worldwide, with upstream and downstream capabilities. Its strategic partnerships with EV manufacturers such as Tesla and BMW position it at the center of the electric mobility revolution. Ganfeng's technological innovation in direct lithium extraction (DLE) and investment in recycling technologies give it a strong competitive advantage in sustainability and cost control.

4. Tianqi Lithium Corporation

Tianqi Lithium has a significant global presence with production bases in China and joint ventures in Australia, notably the Greenbushes Lithium Mine, co-owned with Albemarle. Tianqi's competitive edge comes from its high-purity lithium hydroxide output tailored for premium battery applications. The company focuses on process optimization, automation, and energy efficiency, positioning itself as a technology-driven supplier for advanced battery chemistries.

➤Explore detailed profiles of top players and new entrants in this space - access your free sample report →https://www.researchnester.com/sample-request-4972

5. Livent Corporation

Livent specializes in battery-grade lithium hydroxide and has a strong heritage in lithium chemistry. Its technological expertise lies in its patented hydroxide production process, which ensures higher consistency and quality for EV batteries. Livent's recent merger with Allkem Limited created a more globally diversified lithium powerhouse with a strong resource-to-product pipeline. This merger enhances Livent's geographic reach and secures access to brine, hard-rock, and downstream assets.

6. Allkem Limited (Now part of Arcadium Lithium)

Before merging with Livent, Allkem had established itself as a leading lithium producer with assets in Argentina and Australia. The company's focus on sustainable brine extraction and low-carbon operations resonated with global ESG investors. Its integration with Livent under Arcadium Lithium now enables streamlined operations, shared R&D capabilities, and improved market agility.

7. Sigma Lithium Corporation

Sigma Lithium is a rapidly emerging player focusing on environmentally responsible lithium production in Brazil. Its flagship Grota do Cirilo project uses clean energy and dry-stack tailings to minimize environmental impact. Sigma's commitment to zero-carbon lithium hydroxide production has attracted attention from global automakers seeking sustainable supply sources. The company's ability to scale production efficiently while maintaining ESG compliance gives it a distinct niche in the global market.

8. Piedmont Lithium Inc.

Piedmont Lithium is strategically positioned in the U.S., aligning with the nation's goal to establish domestic battery material supply chains. Its partnerships with Tesla and LG Chem highlight its growing importance as a regional supplier. Piedmont's investments in hydroxide conversion facilities in North Carolina and Tennessee underscore its shift toward vertically integrated production. Its regional proximity to U.S. EV manufacturers gives it a strong competitive advantage in logistics and policy support.

➤ View our Lithium Hydroxide Market Report Overview here: https://www.researchnester.com/reports/lithium-hydroxide-market/4972

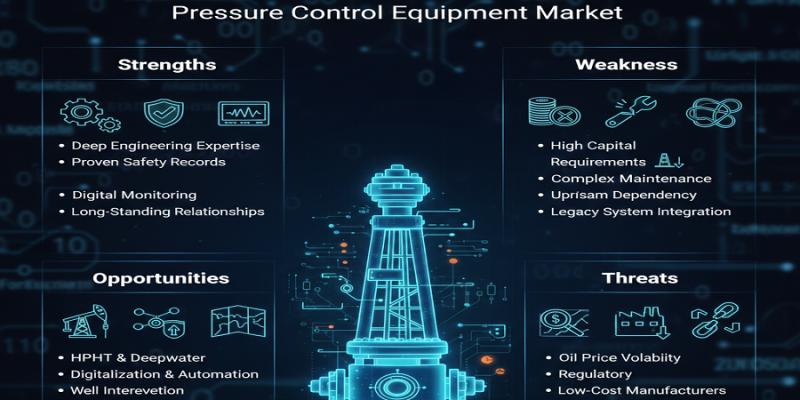

SWOT Analysis

Strengths

Leading players in the lithium hydroxide market benefit from strong vertical integration, spanning mining, refining, and processing. This integration ensures supply security and quality control. The global leaders-Albemarle, SQM, and Ganfeng-leverage advanced extraction and refining technologies, enabling high-purity lithium hydroxide for next-generation EV batteries. Strategic partnerships with major automakers further strengthen their long-term revenue visibility.

Weaknesses

The industry faces high capital expenditure requirements and long project development cycles, which limit new entrants and pose financial risks. Many established producers are vulnerable to price volatility and supply chain disruptions, especially due to geopolitical tensions or environmental regulations. Additionally, dependence on limited geographic resources, such as Chilean brines and Australian spodumene, creates operational constraints.

Opportunities

Rising EV adoption rates, energy storage demand, and government incentives for battery materials present vast opportunities for expansion. Technological advancements like direct lithium extraction (DLE), lithium recycling, and solid-state battery compatibility open new pathways for efficiency and sustainability. Growing emphasis on regional supply chain localization, especially in North America and Europe, encourages new hydroxide conversion plants and cross-border collaborations.

Threats

The volatile pricing environment for lithium chemicals poses a major threat to profitability and investment planning. Environmental regulations and community opposition to mining projects can cause delays or cancellations. Competitive threats from alternative chemistries such as sodium-ion or solid-state batteries may shift demand dynamics. Furthermore, the tight global supply of skilled labor and key inputs such as sulfuric acid can constrain production scalability.

➤Interested in a customized SWOT for your target competitor? Request your tailored assessment → https://www.researchnester.com/sample-request-4972

Investment Opportunities & Emerging Trends

The lithium hydroxide market is at the epicenter of the global electrification drive, attracting massive capital inflows from both industrial players and financial investors. Recent trends highlight increasing consolidation, vertical integration, and sustainability-focused investments.

1. Mergers and Acquisitions (M&A)

One of the most notable M&A developments has been the Livent-Allkem merger, forming Arcadium Lithium, a new global leader with balanced exposure across resource types and markets. This merger reflects the industry's shift toward consolidation to achieve scale and cost efficiency. Additionally, Ganfeng Lithium's strategic acquisitions in Argentina and Mexico demonstrate an aggressive expansion of resource control and downstream processing capacity.

2. Startups and Venture Funding

Venture capital is increasingly flowing into lithium processing technology startups, particularly those developing low-carbon refining methods and recycling capabilities. Emerging firms in Australia, Canada, and Finland are exploring new DLE technologies that promise faster, cleaner extraction. Investors are prioritizing companies capable of reducing water use and carbon emissions, aligning with ESG-focused funding mandates.

3. Regional and Policy-Driven Expansion

Governments across the U.S., Europe, and Asia-Pacific are implementing policies to secure local lithium supply chains. The U.S. Inflation Reduction Act (IRA) has accelerated domestic lithium refining investments, while the EU's Critical Raw Materials Act supports funding for European hydroxide plants. These policy frameworks are catalyzing joint ventures among mining firms, battery manufacturers, and automotive OEMs to ensure raw material resilience.

4. Technological Integration and Innovation

Technological innovation remains a central theme in investment. Companies like Albemarle and Livent are focusing on process automation, AI-driven yield optimization, and circular economy solutions to maximize recovery from spent batteries. The integration of renewable power into refining operations is also becoming a competitive differentiator.

5. Market Segments Attracting Capital

Battery-grade lithium hydroxide remains the most capital-intensive and strategically attractive segment, with demand surging from EV battery manufacturers. Asia-Pacific continues to attract the majority of new conversion plant investments, led by China, Japan, and South Korea. However, North America and Europe are rapidly emerging as new investment hubs due to localization mandates and green incentives.

6. Product Launches and Capacity Expansion

Recent developments include Albemarle's expansion of its Kemerton and La Negra plants, SQM's planned capacity increases in Chile, and Sigma Lithium's launch of its zero-carbon lithium project. Piedmont Lithium's new hydroxide facility in Tennessee is another milestone reflecting regional diversification. These initiatives underscore a market shift toward value-added processing close to demand centers.

➤ Request Free Sample PDF Report @ https://www.researchnester.com/sample-request-4972

➤ Related News -

https://www.linkedin.com/pulse/what-driving-evolution-inorganic-flame-retardants-market-o4ezf

https://www.linkedin.com/pulse/how-innovations-reshaping-pvc-additives-market-consumers-pathways-mbahf

Contact Data

AJ Daniel

Corporate Sales, USA

Research Nester

77 Water Street 8th Floor, New York, 10005

Email: info@researchnester.com

USA Phone: +1 646 586 9123

Europe Phone: +44 203 608 5919

About Research Nester

Research Nester is a one-stop service provider with a client base in more than 50 countries, leading in strategic market research and consulting with an unbiased and unparalleled approach towards helping global industrial players, conglomerates and executives for their future investment while avoiding forthcoming uncertainties. With an out-of-the-box mindset to produce statistical and analytical market research reports, we provide strategic consulting so that our clients can make wise business decisions with clarity while strategizing and planning for their forthcoming needs and succeed in achieving their future endeavors. We believe every business can expand to its new horizon, provided a right guidance at a right time is available through strategic minds.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Lithium Hydroxide Market Size, Share, Growth and Strategic Outlook - Global Industry Trends Forecast 2037 here

News-ID: 4266912 • Views: …

More Releases from Research Nester Pvt Ltd

Key Players in the Returnable Packaging Market: Share Positioning & Investor Per …

The returnable packaging market is gaining strategic importance as companies across logistics, food & beverage, automotive, and retail industries seek cost efficiency, sustainability, and supply chain resilience. Returnable packaging solutions-such as reusable pallets, crates, containers, drums, and intermediate bulk containers (IBCs)-are increasingly favored over single-use packaging due to regulatory pressure, circular economy goals, and operational efficiency.

➤ Request Free Sample PDF Report @ https://www.researchnester.com/sample-request-8352

Top Companies

1. Brambles (CHEP)

Brambles, through its…

Pressure Control Equipment Market Dominance: Top Companies Strengthening Share & …

Pressure control equipment plays a mission-critical role in ensuring safety, operational integrity, and regulatory compliance across oil & gas exploration, well intervention, drilling, and production activities. From blowout preventers (BOPs) and control heads to manifolds and pressure valves, these systems are essential for managing high-pressure environments in both onshore and offshore operations.

As upstream operators focus on deeper wells, high-pressure high-temperature (HPHT) environments, and complex well architectures, demand for advanced pressure…

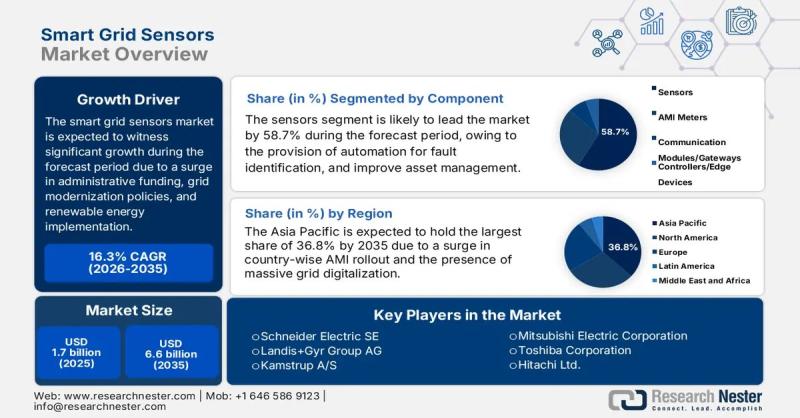

Smart Grid Sensors Market size to exceed $6.6 Billion by 2035 | General Electric …

Market Outlook and Forecast

The smart grid sensors market is emerging as a critical enabler of next-generation power infrastructure, supporting utilities and grid operators in transitioning from conventional, centralized electricity networks to intelligent, data-driven energy systems. Smart grid sensors provide real-time visibility into grid performance, enabling advanced monitoring, predictive maintenance, fault detection, and efficient energy distribution across transmission and distribution networks.

In 2025, the global smart grid sensors market is valued at…

Top Companies in Architectural Lighting Market - Benchmarking Performance & Futu …

The architectural lighting market has evolved into a design-driven, technology-intensive segment of the global lighting industry. Beyond illumination, architectural lighting now plays a critical role in enhancing aesthetics, supporting energy efficiency goals, and enabling smart building environments. Demand is increasingly shaped by urban development, commercial real estate upgrades, hospitality projects, and public infrastructure modernization.

➤ Request Free Sample PDF Report @ https://www.researchnester.com/sample-request-8342

Top Companies & Their Strategies

1. Signify (Philips Lighting)

Signify…

More Releases for Lithium

Lithium Compounds Market To Witness Massive Growth | Competitive Outlook Albemar …

Lithium compounds market is expected to gain market growth in the forecast period of 2020 to 2027. Data Bridge Market Research analyses the market to account 20.04 billion by 2027 growing with the CAGR of 20.90% in the above-mentioned forecast period. Huge investments in infrastructure developments is a vital factor driving the growth of lithium compounds market swiftly.

The Lithium Compounds Market research report assesses the ongoing as well as future…

Lithium Compounds Market 2020-2025 Global Analysis & Opportunity Assessment | Li …

The global Lithium Compound market size is projected to reach over USD 9 billion by 2025. Lithium is an alkali metal that is generally present among the soil, human body, animals, and plants. It is a light weight metal with less density when compared to other elements. The lithium compounds, primarily find its application in rechargeable and non-rechargeable batteries. The lithium is primarily used across glass & ceramics, Li-ion batteries,…

Lithium Compounds Market Analysis & Industry Outlook 2019-2025| Livent Corporati …

The global Lithium Compound market size is projected to reach over USD 9 billion by 2025. Lithium is an alkali metal that is generally present among the soil, human body, animals, and plants. It is a light weight metal with less density when compared to other elements. The lithium compounds, primarily find its application in rechargeable and non-rechargeable batteries. The lithium is primarily used across glass & ceramics, Li-ion batteries,…

Lithium Compounds Market Scenario & Industry Outlook 2019-2025| Livent Corporati …

The global lithium compound market size is projected to reach over USD 9 billion by 2025.The report on lithium compound market is aimed to equip report readers with versatile understanding on diverse marketing opportunities that are rampantly available across regional hubs. A thorough assessment and evaluation of these factors are likely to influence incremental growth prospects in the lithium compound market.

Request sample copy of this report at: https://www.adroitmarketresearch.com/contacts/request-sample/1445

Additionally, in this…

Lithium Fluoride Market players Jiangxu Ganfeng Lithium, Harshil Fluoride Brivo …

The developing in the glass, optics and electronic and electrical industries has initiated a high demand for Lithium and related compounds. Lithium and lithium based compounds are one the key substances that have dynamic usage, either as a feedstock or as product. One of the most commercially important compound is Lithium fluoride. Lithium fluoride is an odorless, crystalline lithium salt manufactured by the reaction of lithium hydroxide with hydrogen fluoride.…

Lithium Hydroxide Market | Key Players are FMC Corporation, Sociedad Quimica Min …

Lithium Hydroxide (LiOH) is an inorganic compound that is insoluble in water and partially soluble in ethanol. It is commercially available as a monohydrate (LiOH.H2O) and in anhydrous form, both of which are strong bases. On the basis of purity level, it is also available in battery grade and technical grade. Lithium hydroxide is manufactured by means of a metathesis reaction between calcium hydroxide and lithium carbonate and it finds…