Press release

Automotive Finance Market Insights, Technological Innovations, and Forecast 2035

The automotive finance market is undergoing a dynamic transformation driven by digital innovation, evolving consumer behavior, and the rapid adoption of electric and connected vehicles. Financial institutions, OEMs, and fintech startups are reinventing their lending and leasing models to enhance customer experience and accessibility. With consumers demanding flexible, transparent, and tech-enabled financing options, the industry is witnessing a convergence of traditional banking expertise and next-generation digital ecosystems.From subscription-based car ownership to embedded finance platforms integrated with dealership networks, the automotive finance market is shifting toward a customer-centric model supported by data analytics, automation, and AI-driven decision-making. Global players are investing heavily in digital lending, credit scoring models, and partnerships with EV manufacturers to tap into the future of mobility finance.

➤ Request Free Sample PDF Report @ https://www.researchnester.com/sample-request-4653

Top Companies & Their Strategies

1. Toyota Financial Services

Toyota Financial Services (TFS) stands as a benchmark in OEM-backed finance, providing comprehensive solutions spanning loans, leases, and insurance. Its strength lies in customer loyalty and integration within the Toyota ecosystem, enhancing end-to-end mobility experiences. TFS is increasingly focusing on digital finance transformation, offering online pre-approvals and seamless payment solutions. The company's regional adaptability - especially in North America and Asia - allows it to sustain consistent growth through tailored financial offerings and customer-centric digital tools.

2. Volkswagen Financial Services AG

Volkswagen Financial Services (VWFS) has established a dominant presence in Europe and expanding markets like Latin America and China. Its strategy revolves around mobility-as-a-service (MaaS) and digital leasing platforms. VWFS's strength is its alignment with Volkswagen Group's EV and connected vehicle roadmap, ensuring integrated finance solutions for evolving product lines. The company's investments in fintech collaborations and app-based financing channels enhance accessibility and engagement among younger, tech-savvy consumers.

3. BMW Group Financial Services

BMW Financial Services focuses on premium automotive financing through innovative digital platforms and customized ownership models. Its flexible leasing and subscription plans cater to changing consumer preferences in luxury mobility. BMW leverages advanced analytics to enhance credit assessment, improve residual value management, and optimize lifecycle ownership experiences. Its strategic partnerships with digital payment providers and insurers strengthen its digital footprint across Europe, the U.S., and Asia-Pacific.

4. Santander Consumer USA

As a major global financial institution, Santander Consumer USA combines traditional auto financing with next-gen digital solutions. Its strength lies in an extensive dealer network and diversified lending portfolio across both prime and subprime markets. Santander's focus on AI-based underwriting, risk management, and digital loan origination platforms has streamlined approval times and enhanced customer retention. Strategic alliances with OEMs and digital marketplaces are helping the company expand its presence in used car financing and online retail platforms.

➤ Explore detailed profiles of top players and new entrants in this space - access your free sample report → https://www.researchnester.com/sample-request-4653

5. Ally Financial Inc.

Ally Financial, a pioneer in digital automotive financing, offers end-to-end online loan origination and management services. Its direct-to-consumer model, combined with a vast dealer partnership network, positions it as a strong player in digital retail auto finance. Ally's technological investments in cloud-based lending platforms, credit automation, and mobile servicing tools reinforce its efficiency and scalability. The company's growing interest in EV financing and green lending further enhances its sustainability profile.

6. Ford Credit

Ford Credit remains a cornerstone in manufacturer-backed financing, leveraging Ford Motor Company's global reach. The company's strength lies in integrated finance offerings that cover personal loans, leases, and commercial fleet management. Ford Credit is embracing connected finance solutions, enabling real-time credit management and automated payment systems through FordPass. Its close alignment with Ford's EV roadmap provides a significant edge in financing the transition to electric mobility.

7. Capital One Auto Finance

Capital One is a key innovator in the automotive finance market, known for its digital-first lending platform and simplified online approval process. Its use of advanced analytics for personalized loan recommendations enhances transparency and customer trust. The company's competitive interest structures and expansive dealer partnerships help it maintain a strong position in the U.S. market, particularly among millennial consumers preferring digital car-buying experiences.

8. Hitachi Capital (Now Mitsubishi HC Capital Inc.)

Hitachi Capital, now part of Mitsubishi HC Capital, has a diversified financial services portfolio covering vehicle leasing, fleet finance, and retail loans. The company's focus on green mobility finance, especially for electric and hybrid vehicles, aligns with Japan's decarbonization goals. Its strength lies in combining traditional finance expertise with technology-driven asset management and predictive analytics to optimize vehicle lifecycle value.

➤ View our Automotive Finance Market Report Overview here: https://www.researchnester.com/reports/automotive-finance-market/4653

SWOT Analysis of Leading Companies

Strengths

Top automotive finance providers possess robust capital bases, diversified portfolios, and strong OEM relationships. Their integration with digital platforms enables faster loan processing, reduced risk, and enhanced customer convenience. Companies like Toyota Financial Services and Volkswagen Financial Services benefit from brand loyalty, while fintech-driven players like Ally Financial and Capital One lead in innovation and customer engagement. Global scalability, data-driven insights, and flexible leasing structures are key industry strengths enhancing profitability and resilience.

Weakness

High competition and regulatory complexities across regions often limit scalability and profit margins. Traditional financial institutions sometimes face challenges in adapting to fintech-driven models, while OEM-backed lenders may experience exposure to cyclical automotive sales. The dependency on dealer networks for lead generation can also limit direct consumer engagement. Moreover, maintaining cybersecurity and data privacy across digital platforms remains an ongoing concern for global players.

Opportunities

The shift toward electric vehicles (EVs), mobility-as-a-service, and online car buying presents vast opportunities for innovation in financing models. There is growing demand for subscription-based ownership, green vehicle loans, and AI-powered risk assessment tools. Expansion in emerging economies - particularly in Asia-Pacific, Latin America, and Africa - offers untapped growth potential. Additionally, fintech collaborations, blockchain-enabled smart contracts, and digital payment integrations are revolutionizing how auto finance companies operate and scale.

Threats

Economic fluctuations, rising interest rates, and credit risks can adversely impact loan portfolios. The entry of new fintech disruptors, offering lower-cost and fully digital services, intensifies competitive pressures. Regulatory uncertainties around data sharing, lending practices, and sustainability-linked finance also pose compliance challenges. Furthermore, the rapid evolution of EV-specific financing demands continuous innovation and portfolio diversification to mitigate risk exposure.

➤ Interested in a customized SWOT for your target competitor? Request your tailored assessment → https://www.researchnester.com/sample-request-4653

Investment Opportunities & Emerging Trends

The automotive finance market is witnessing rapid capital inflows as financial institutions and technology companies collaborate to digitalize the mobility ecosystem. Investors are targeting companies that are redefining lending through AI, blockchain, and data-driven decision-making. Key investment themes include EV financing platforms, subscription-based mobility models, and embedded finance ecosystems integrated into OEM and dealership networks.

In recent years, fintech startups have attracted significant funding for innovations in digital loan origination, customer analytics, and payment automation. Regions such as Asia-Pacific and Europe are emerging as major investment hubs, driven by government incentives for electric vehicles and digital banking infrastructure. Additionally, the U.S. market continues to lead in online car financing solutions, reflecting consumer demand for instant, app-based credit approvals.

Recent Developments

• Volkswagen Financial Services launched its "Mobility-as-a-Service" digital platform, integrating subscription and rental options across Europe.

• Toyota Financial Services partnered with fintech startups to develop AI-powered credit scoring models for unbanked customers in emerging markets.

• Santander Consumer USA introduced a blockchain-based asset tracking system to enhance loan transparency and fraud prevention.

• Ally Financial expanded its green finance program to support EV and hybrid vehicle financing.

• BMW Group Financial Services unveiled a fully digital subscription model in select European markets, enabling flexible ownership experiences.

• Ford Credit enhanced its mobile ecosystem with automated digital payment management via FordPass.

• Capital One Auto Finance integrated machine learning models for instant credit decisioning across its online lending platform.

• Mitsubishi HC Capital announced a strategic investment in EV fleet leasing across Asia to promote sustainable mobility financing.

The growing convergence of digital finance, electric mobility, and AI-powered credit management marks a significant turning point in the automotive finance market through 2035. Companies that successfully integrate technology, sustainability, and customer personalization are set to lead the next phase of market expansion and investment appeal.

➤ Request Free Sample PDF Report @ https://www.researchnester.com/sample-request-4653

➤ Related News -

https://www.linkedin.com/pulse/what-future-automotive-instrument-cluster-jyv0f/

https://www.linkedin.com/pulse/why-automotive-radiator-fan-market-crucial-zrltc/

Contact Data

AJ Daniel

Corporate Sales, USA

Research Nester

77 Water Street 8th Floor, New York, 10005

Email: info@researchnester.com

USA Phone: +1 646 586 9123

Europe Phone: +44 203 608 5919

About Research Nester

Research Nester is a one-stop service provider with a client base in more than 50 countries, leading in strategic market research and consulting with an unbiased and unparalleled approach towards helping global industrial players, conglomerates and executives for their future investment while avoiding forthcoming uncertainties. With an out-of-the-box mindset to produce statistical and analytical market research reports, we provide strategic consulting so that our clients can make wise business decisions with clarity while strategizing and planning for their forthcoming needs and succeed in achieving their future endeavors. We believe every business can expand to its new horizon, provided a right guidance at a right time is available through strategic minds.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Automotive Finance Market Insights, Technological Innovations, and Forecast 2035 here

News-ID: 4266727 • Views: …

More Releases from Research Nester Pvt Ltd

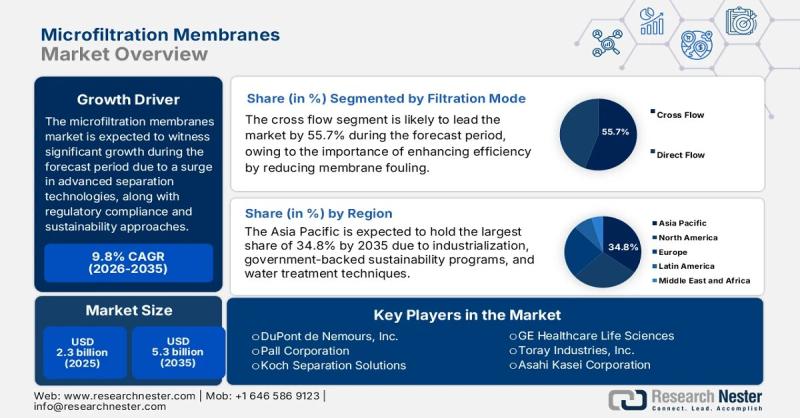

Microfiltration Membranes Market size to reach $5.3Billion by 2035 | Key players …

Market Outlook and Forecast

The microfiltration membranes market size reached USD 2.3 billion in 2025 and is projected to expand to USD 5.3 billion by 2035, reflecting strong industry fundamentals and sustained adoption across diverse end-use industries. The market is expected to grow at a compound annual growth rate (CAGR) of 9.8% between 2026 and 2035, driven by industrial modernization, environmental regulations, and technological innovation.

➤ Request Free Sample PDF Report @…

Top Companies in Food Grade Alcohol Market - Benchmarking Performance & Future V …

The food grade alcohol market is shaped by multinational ingredient producers, regional distillation leaders, and specialized ethanol processors. Competitive positioning is largely determined by feedstock access, regulatory compliance, supply chain resilience, and product customization for food and beverage applications.

➤ Request Free Sample PDF Report @ https://www.researchnester.com/sample-request-8307

Top Companies & Their Strategies

Archer Daniels Midland Company (ADM)

ADM remains one of the most influential players in the Food Grade Alcohol Market due to…

Energy Harvesting System Market Dominance: Top Companies Strengthening Share & I …

The energy harvesting system market is rapidly evolving as industries seek sustainable, maintenance-free power solutions for IoT devices, wireless sensor networks, industrial automation, healthcare wearables, and smart infrastructure. Energy harvesting systems convert ambient energy sources - including solar, thermal, vibration, and radio frequency (RF) - into usable electrical power.

As the global transition toward energy efficiency and decentralized power accelerates, the competitive landscape within the energy harvesting system market is intensifying.…

Luxury Hotel Market Players - Competitive Positioning, Strategic Strengths & Inv …

The Luxury Hotel Market is undergoing structural transformation as global travelers increasingly prioritize curated experiences, sustainability, and digital-first service models. No longer defined solely by opulence, the luxury hotel market now revolves around personalization, wellness integration, brand storytelling, and technological innovation. Leading hospitality companies are repositioning portfolios, expanding into high-growth destinations, and investing in asset-light models to strengthen competitive positioning.

This strategic analysis explores the top companies shaping the luxury hotel…

More Releases for Financial

Financial Leasing Services Market Share, Size, Financial Summaries Analysis from …

Infinity Business Insights has recently released a comprehensive research report titled "Financial Leasing Services Market Insights, Extending to 2031." This publication spans over 110+ pages and offers an engaging presentation with visually appealing tables and charts that are self-explanatory. The worldwide Financial Leasing Services market is expected to grow at a booming CAGR of 6.3% during 2024-2031. It also shows the importance of the Financial Leasing Services market main players…

Global Financial Aid Management Software Market Streamlining Financial Assistanc …

Overview for the report "Financial Aid Management Software Market" Helps in providing scope and definations, Key Findings, Growth Drivers, and Various Dynamics by Infinitybusinessinsights.com. This report will help the viewer in Better Decision Making.

At a predicted CAGR of 10.9% from 2023 to 2028, The Market for Financial Assistance Management Software will increase from USD 1.07 billion in 2022 to USD X.XX billion by 2030. The market's expansion can be attributed…

What will be Driving Growth Financial Leasing Market 2027 | Bank Financial Leasi …

Financial Leasing Market research is an intelligence report with meticulous efforts undertaken to study the right and valuable information. The data which has been looked upon is done considering both, the existing top players and the upcoming competitors. Business strategies of the key players and the new entering market industries are studied in detail. Well explained SWOT analysis, revenue share and contact information are shared in this report analysis.

Ask for…

Financial Leasing Market 2017 Analysis – CDB Leasing, ICBC Financial Leasing C …

A financial lease is a method used by a business for acquisition of equipment with payment structured over time. To give proper definition, it can be expressed as an agreement wherein the lessor receives lease payments for the covering of ownership costs. Moreover, the lessor holds the responsibility of maintenance, taxes, and insurance.

In this report, RRI studies the present scenario (with the base year being 2017) and the growth prospects…

Financial Leasing Market Is Booming | KLC Financial, SMFL Leasing, GM Financial, …

HTF MI recently introduced Global Financial Leasing Market study with in-depth overview, describing about the Product / Industry Scope and elaborates market outlook and status to 2023. The market Study is segmented by key regions which is accelerating the marketization. At present, the market is developing its presence and some of the key players from the complete study are Sumitomo Mitsui Finance and Leasing, Maldives, HNA Capital, KUKE S.A., KLC…

Financial Analytics Market: Banking & financial sector expected to make most of …

The Financial Analytics Market deals with the development, manufacture and distribution of financial analytics tools for enterprises of all kinds and sizes. Financial data analytics can be described as a set of tools, techniques and processes used to find out answers for various business questions as well as to forecast future scenarios regarding finance and the economy.

The services provided by the Financial Analytics Market are used for analyzing the equity…