Press release

Fleet Electrification Consulting Business Plan 2025: Costs, Setup, and Profit Potential

Fleet Electrification Consulting Business Plan & Project Report OverviewIMARC Group's "Fleet Electrification Consulting Business Plan and Project Report 2025" offers a comprehensive framework for establishing a successful fleet electrification consulting business. The critical areas, including market trends, investment opportunities, revenue models, and financial forecasts, are discussed in this in-depth report and are therefore useful resources to entrepreneurs, consultants and investors. Whether evaluating the viability of a new venture or streamlining an existing one, the report gives an in-depth analysis of all the ingredients that make it successful, starting with business formation and profitability over time.

What is a Fleet Electrification Consulting Business?

A Fleet Electrification Consulting firm is a specialized professional service organization designed to deliver comprehensive transition strategies for organizations converting their vehicle fleets from internal combustion engines to electric vehicles. These consultancies emphasize total cost of ownership analysis, charging infrastructure planning, vehicle selection optimization, grid integration strategies, and sustainability reporting, catering to corporations, municipalities, logistics providers, and transportation companies seeking efficient electrification solutions.

They offer a variety of services including fleet assessment and benchmarking, EV readiness evaluations, charging infrastructure design, energy management solutions, incentive and grant identification, procurement advisory, implementation project management, driver training programs, maintenance transition planning, and ongoing performance monitoring for organizations committed to sustainable transportation goals.

The category encompasses strategic advisory firms, technical implementation consultancies, energy transition specialists, and comprehensive fleet transformation partners, each prioritizing data-driven analysis, technology-agnostic recommendations, stakeholder engagement, regulatory compliance guidance, utility coordination, pilot program design, change management support, and long-term optimization strategies.

To achieve these goals, Fleet Electrification Consulting firms integrate state-of-the-art fleet management analytics software, total cost of ownership modeling tools, charging infrastructure simulation platforms, energy consumption forecasting systems, route optimization algorithms, carbon footprint calculators, project management dashboards, and real-time performance monitoring technologies.

Depending on their positioning, these establishments may operate as specialized technical advisories, full-service electrification partners, energy management consultancies, or comprehensive sustainability transformation firms, delivering complete fleet electrification strategies tailored to diverse industry verticals, fleet sizes, operational requirements, and organizational sustainability commitments.

Request for a Sample Report: https://www.imarcgroup.com/fleet-electrification-consulting-business-plan-feasibility-report/requestsample

Fleet Electrification Consulting Business Market Trends and Growth Drivers

The trends and drivers of a Fleet Electrification Consulting business are shaped by the accelerating global transition toward decarbonization, increasingly stringent emissions regulations, and corporate sustainability commitments. These factors, combined with declining electric vehicle costs, expanding charging infrastructure availability, and advancing battery technologies, are fuelling demand for expert electrification guidance. Contributing to this shift is the expanding focus on ESG (Environmental, Social, and Governance) reporting requirements, government incentive programs, total cost of ownership advantages, technological maturation of commercial EVs, along with organizational preferences for data-driven transition planning, risk mitigation strategies, and seamless operational continuity within the evolving clean transportation ecosystem.

To meet these demands, operators are investing in advanced analytical modeling platforms, industry-specific knowledge development, strategic utility partnerships, charging infrastructure design capabilities, and expertise in evolving EV technologies and regulatory frameworks. These investments not only enhance client outcomes but also strengthen business positioning by aligning with broader trends in climate action and sustainable business practices.

Revenue diversification is another critical factor in building financial resilience. In addition to direct consulting fees, income streams may include retainer-based advisory services, implementation project management, charging infrastructure design and engineering, energy procurement consulting, grant writing and incentive optimization, training and change management programs, software licensing for proprietary tools, and ongoing performance optimization subscriptions.

Location and network development play a vital role in success. Consultancies positioned in regions with aggressive electrification mandates, high concentrations of commercial fleets, progressive utility programs, and access to EV ecosystem partners benefit from steady client pipeline and market credibility. At the same time, deep technical expertise, proven implementation track records, and adherence to industry best practices ensure service excellence and client trust.

However, the business also faces risk factors, such as rapidly evolving EV technologies that can affect recommendation relevance, intense competition from established management consulting firms and automotive OEM advisory services, dependence on government policy stability and incentive program continuity, and challenges related to grid capacity constraints and charging infrastructure deployment timelines.

A successful Fleet Electrification Consulting business model requires careful financial planning-including capital investment in analytical software and modeling tools, development of proprietary methodologies, and establishment of strategic industry partnerships. It also demands highly skilled professionals with expertise in transportation, energy systems, project management, and sustainability strategy, supported by effective marketing strategies to build brand authority, foster client relationships, and establish long-term partnerships with fleet operators, utilities, OEMs, and charging infrastructure providers. By delivering rigorous analysis, technology-neutral recommendations, and exceptional implementation support, these businesses can accelerate the clean transportation transition while helping clients achieve operational efficiency, cost savings, and sustainability objectives.

Report Coverage

The Fleet Electrification Consulting Business Plan and Project Report includes the following areas of focus:

• Business Model & Operations Plan

• Technical Feasibility

• Financial Feasibility

• Market Analysis

• Marketing & Sales Strategy

• Risk Assessment & Mitigation

• Licensing & Certification Requirements

The comprehensive nature of this report ensures that all aspects of the business are covered, from market trends and risk mitigation to regulatory requirements and client acquisition strategies.

Key Elements of Fleet Electrification Consulting Business Setup

Business Model & Operations Plan

A solid business model is crucial to a successful venture. The report covers:

• Service Overview: A breakdown of fleet assessment and analysis, EV readiness evaluations, charging infrastructure design, energy management consulting, procurement advisory, grant and incentive optimization, implementation project management, training and change management, maintenance planning, and performance monitoring services offered

• Service Workflow: How each client engagement, diagnostic assessment, strategy development, infrastructure planning, procurement support, implementation oversight, and performance optimization process is managed

• Revenue Model: An exploration of the mechanisms driving revenue across multiple service categories and delivery models

• SOPs & Service Standards: Guidelines for consistent analytical rigor, recommendation quality, project delivery excellence, and client satisfaction

This section ensures that all operational and client service aspects are clearly defined, making it easier to scale and maintain service quality.

Buy Report Now: https://www.imarcgroup.com/checkout?id=41351&method=1911

Technical Feasibility

Setting up a successful business requires proper consulting infrastructure planning. The report includes:

• Location Selection Criteria: Key factors to consider when establishing office locations and targeting priority client markets

• Space & Costs: Estimations for required office space, meeting facilities, technical workstations, and associated costs

• Equipment & Systems: Identifying essential analytical software, modeling tools, project management platforms, and data visualization technologies

• Office & Technical Setup: Guidelines for creating advanced consulting work environments and client collaboration spaces

• Utility Requirements & Costs: Understanding the technology infrastructure and utilities necessary to run consulting operations

• Human Resources & Wages: Estimating staffing needs, roles, and compensation for senior consultants, technical analysts, project managers, business development professionals, and support personnel

This section provides practical, actionable insights into the consulting infrastructure needed for setting up your business, ensuring service excellence and client satisfaction.

Financial Feasibility

The Fleet Electrification Consulting Business Plan and Project Report provides a detailed analysis of the financial landscape, including:

• Capital Investments & Operating Costs: Breakdown of initial and ongoing investments

• Revenue & Expenditure Projections: Projected income and cost estimates for the first five years

• Profit & Loss Analysis: A clear picture of expected financial outcomes

• Taxation & Depreciation: Understanding tax obligations and equipment depreciation

• ROI, NPV & Sensitivity Analysis: Comprehensive financial evaluations to assess profitability

This in-depth financial analysis supports effective decision-making and helps secure funding, making it an essential tool for evaluating the business's potential.

Market Insights & Strategy

Market Analysis

A deep dive into the fleet electrification consulting market, including:

• Industry Trends & Segmentation: Identifying emerging trends and key market segments across corporate fleets, municipal transportation, logistics operations, delivery services, and public transit systems

• Regional Demand & Cost Structure: Regional variations in electrification adoption and cost factors affecting consulting service demand

• Competitive Landscape: An analysis of the competitive environment including established management consulting firms, specialized EV advisories, automotive OEM consulting divisions, and energy service companies

Profiles of Key Players

The report provides detailed profiles of leading players in the industry, offering a valuable benchmark for new businesses. It highlights their strategies, service offerings, client portfolios, and market positioning, helping you identify strategic opportunities and areas for differentiation.

Capital & Operational Expenditure Breakdown

The report includes a comprehensive breakdown of both capital and operational costs, helping you plan for financial success. The detailed estimates for office development, technology systems, and operating costs ensure you're well-prepared for both initial investments and ongoing expenses.

• Capital Expenditure (CapEx): Focused on office space setup and design, analytical software and modeling platforms, computing infrastructure, presentation equipment, meeting facilities, and proprietary tool development

• Operational Expenditure (OpEx): Covers ongoing costs like consultant salaries, software subscriptions, professional development and training, marketing expenses, professional liability insurance, industry association memberships, and office maintenance

Financial projections ensure you're prepared for cost fluctuations, including adjustments for technology platform upgrades, talent acquisition costs, market expansion investments, and competitive pressures over time.

Profitability Projections

The report outlines a detailed profitability analysis over the first five years of operations, including projections for:

• Total revenue from consulting fees, project management services, training programs, and software solutions, expenditure breakdown, gross profit, and net profit

• Profit margins for each revenue stream and year of operation

• Revenue per client projections and market penetration growth estimates

These projections offer a clear picture of the expected financial performance and profitability of the business, allowing for better planning and informed decision-making.

Request For Customization: https://www.imarcgroup.com/request?type=report&id=41351&flag=E

Our expertise includes:

• Market Entry and Expansion Strategy

• Feasibility Studies and Business Planning

• Company Incorporation and Consulting Practice Setup Support

• Regulatory and Licensing Navigation

• Competitive Analysis and Benchmarking

• Industry Partnership Development

• Branding, Marketing, and Client Acquisition Strategy

About Us

IMARC Group is a leading global market research and management consulting firm. We specialize in helping organizations identify opportunities, mitigate risks, and create impactful business strategies.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: (+1-201971-6302)

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Fleet Electrification Consulting Business Plan 2025: Costs, Setup, and Profit Potential here

News-ID: 4266559 • Views: …

More Releases from IMARC Group

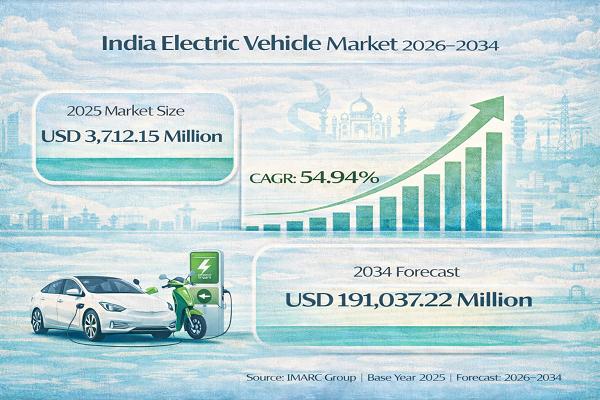

India Electric Vehicle Market Set to Reach USD 191,037.22 Million by 2034, Expan …

India Electric Vehicle Market : Report Introduction

According to IMARC Group's report titled "India Electric Vehicle Market Size, Share, Trends and Forecast by Vehicle Type, Price Category, Propulsion Type, and Region, 2026-2034" the report offers a comprehensive analysis of the industry, including market share, growth, trends, and regional insights.

Free Sample Download PDF (Exclusive Offer on Corporate Email) : https://www.imarcgroup.com/india-electric-vehicle-market/requestsample

India Electric Vehicle Market Overview

The India electric vehicle market size was valued at…

United States Revenue Cycle Management Market Size, Trends, Growth and Forecast …

IMARC Group has recently released a new research study titled "United States Revenue Cycle Management Market Size, Share, Trends and Forecast by Type, Component, Deployment, End User, and Region, 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Connect with a Research Analyst Now:

https://www.imarcgroup.com/united-states-revenue-cycle-management-market/requestsample

United States Revenue Cycle Management Market Summary:

The United States revenue cycle…

LED Chip Manufacturing Plant Cost Report 2026: Demand Analysis, CapEx/OpEx & ROI …

Setting up an LED chip manufacturing plant involves strategic planning, substantial capital investment, and comprehensive understanding of semiconductor fabrication technologies. These high-performance components power everything from general illumination and displays to automotive lighting and consumer electronics. Success requires careful site selection, advanced epitaxial growth processes, sophisticated cleanroom facilities, reliable raw material sourcing, and compliance with stringent quality and environmental regulations to ensure profitable and sustainable operations.

IMARC Group's report, "LED Chip…

Eyewear Manufacturing Plant DPR & Unit Setup - 2026: Machinery Cost, CapEx/OpEx, …

Setting up an eyewear manufacturing plant positions investors within a strategically important segment of the global optical and fashion accessories industry, driven by increasing demand for vision correction solutions, rising awareness of eye health, and growing fashion consciousness. As modern lifestyles advance, digital device usage expands, and the need for protective and corrective eyewear grows, eyewear continues to gain traction across prescription glasses, sunglasses, safety eyewear, and fashion accessories worldwide.…

More Releases for Fleet

Fleet Tracking and Logistics Market is thriving worldwide by 2027 | Top Key Play …

Fleet Tracking and Logistics Market research is an intelligence report with meticulous efforts undertaken to study the right and valuable information. The data which has been looked upon is done considering both, the existing top players and the upcoming competitors. Business strategies of the key players and the new entering market industries are studied in detail. Well explained SWOT analysis, revenue share and contact information are shared in this report…

Fleet Management Consulting Service Market will reach USD 39.94 Billion by 2032 …

The global fleet management size is expected to grow USD 39.94 Billion by 2032 from USD 21.6 Billion in 2021, at a Compound Annual Growth Rate (CAGR) of 10.5% during the forecast period.

The presence of various key players in the ecosystem has led to a competitive and diverse market. The market include a high growth rate for the adoption of cloud computing and analytics, declining hardware and IoT connectivity costs,…

Fleet Management Solution Market: Start managing fleet data, access and update i …

The report "Global Fleet Management Solution Market By Deployment Model (On-premise, and On-Demand Hybrid), By Solution (Asset Management, Information Management, Driver Management, Safety and Compliance Management, Risk Management, Operations Management, and other Solutions), By End User (Transportation, Energy, Construction, Manufacturing, and Other End Users), and Region - Global Forecast to 2029". Gradually adopting transportation by businesses to enhance their offerings this results in considerable rise over the past few years…

Fleet Management Market Insights | Key players: ARI Fleet Management, Azuga, Che …

According to recent research "Fleet Management Market by Solution (Operations Management, Vehicle Maintenance and Diagnostics, Performance Management, Fleet Analytics and Reporting), Service (Professional and Managed), Deployment Type, Fleet Type, and Region - Global Forecast to 2023", the global fleet management market size is expected to grow from USD 15.9 billion in 2018 to USD 31.5 billion by 2023, at a Compound Annual Growth Rate (CAGR) of 14.7% during the forecast…

Fleet software comm.fleet: Effective cost control for fleet managers

Relief for fleet managers: identify the cost drivers of the company and take appropriate actions with the fleet management software comm.fleet

The adoption of a multifunctional controlling system is an indispensable prerequisite for an effective and systematic management of all company fleet costs. Be it a question of planning enhancement and control, budgeting coordination or the execution and analysis of a target-performance comparison with the purpose of a perfect fleet administration,…

Fleet Specialisation-Cover 4 Fleet Insurance Investigate Future Fleet Trends

Victoria, London ( openpr ) June 10, 2011 - Economically driven by the need to immerse their resources in core activities, companies will turn to fleet outsourcing options. Even in the case of fleet contract hire, there are case studies which are dramatic in the current economic environment.

Take the case study of Fraikin , which was originally established in France in 1944 and is today the biggest commercial…