Press release

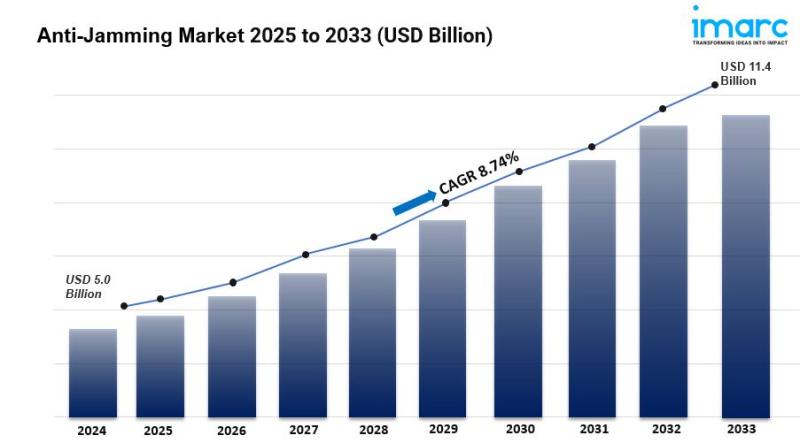

Anti-Jamming Market is Projected to Grow USD 11.4 Billion by 2033 | At CAGR 8.74%

Anti-Jamming Market Overview:The global anti-jamming market was valued at USD 4.83 Billion in 2024 and is projected to reach USD 11.10 Billion by 2033, exhibiting a CAGR of 12.61% during the 2025-2033 forecast period. Growing dependence on GPS and GNSS technologies, escalating electronic warfare threats, and heightened demand for secure navigation systems are driving this growth. The anti-jamming market size is expanding rapidly due to increasing reliance on satellite-based communication and navigation systems across military, aerospace, and commercial sectors. Anti-jamming technologies protect receivers from intentional or unintentional interference that disrupts GPS, GNSS, and other critical communication signals.

Rising geopolitical tensions, growing sophistication of jamming threats, and expanding applications in autonomous vehicles, unmanned aerial systems, and critical infrastructure are fueling global demand. Manufacturers are introducing advanced solutions featuring artificial intelligence, adaptive antenna arrays, and software-defined radio technologies to counter evolving electronic warfare tactics. Additionally, the expansion of defense budgets, regulatory mandates for secure navigation, and growing adoption of precision-guided systems are expected to further boost the global anti-jamming market size over the forecast period.

Sample Request Link: https://www.imarcgroup.com/anti-jamming-market/requestsample

Study Assumption Years

• Base Year: 2024

• Historical Year/Period: 2019-2024

• Forecast Year/Period: 2025-2033

Anti-Jamming Market Key Takeaways

• Current Market Size: USD 4.83 Billion (2024)

• CAGR: 12.61% (2025-2033)

• Forecast Period: 2025-2033

• The market is estimated to reach USD 11.10 Billion by 2033.

• North America dominates the market with over 34% share, driven by substantial defense spending and advanced electronic warfare capabilities.

• Military and government-grade receivers are the leading segment, while flight control applications show the fastest growth.

• Position, navigation, and timing (PNT) represents the largest application segment, with airborne platforms as the primary end-user.

• Market growth is supported by technological advancements, increasing cybersecurity concerns, and broader adoption across defense and commercial sectors.

Market Growth Factors

The anti-jamming market is being propelled by rising dependence on satellite-based navigation systems, escalating electronic warfare threats, and growing cybersecurity concerns. Defense forces worldwide are increasingly relying on GPS-guided systems for mission-critical operations including navigation, targeting, surveillance, and precision munitions guidance. The deliberate disruption of these signals through jamming poses severe operational risks, making anti-jamming technologies essential for military effectiveness. Industry reports indicate that global military spending reached approximately USD 2 trillion in 2023, with significant portions allocated to electronic warfare and countermeasure systems. The increasing sophistication of jamming equipment-capable of disrupting signals from multiple directions and frequencies-has created urgent demand for advanced anti-jamming solutions that can detect, identify, and neutralize interference in real-time.

Technological innovations are transforming anti-jamming capabilities through the integration of artificial intelligence, machine learning, and advanced digital signal processing. Modern anti-jamming systems employ adaptive antenna arrays that can dynamically adjust their reception patterns to null out jamming signals while maintaining connectivity with legitimate satellite signals. Software-defined radio (SDR) technologies provide flexible, programmable platforms that can adapt to evolving jamming environments by modifying frequency hopping patterns and signal modulation schemes. AI-driven algorithms enable autonomous threat detection and response mechanisms, significantly enhancing system resilience. Beamforming technologies allow antennas to focus reception toward specific satellites while rejecting interference from other directions. These technological advancements have made anti-jamming systems more effective, compact, and cost-efficient, expanding their applicability beyond military applications into commercial sectors.

The proliferation of autonomous systems and unmanned vehicles is creating substantial market opportunities. The Federal Aviation Administration projected that small unmanned aerial system units would reach between 1.47 million and 1.63 million by 2024, with commercial drone sales in the United States alone expected to reach 1.2 million units. These platforms rely heavily on continuous GPS signals for navigation, positioning, and control, making them highly vulnerable to jamming attacks. Similarly, the rapid growth of autonomous vehicles in the automotive sector is driving demand for anti-jamming solutions, as these vehicles depend on uninterrupted GPS connectivity for safe operation. Any signal disruption could have devastating consequences for autonomous mobility systems. The global installed base of GNSS devices is projected to reach 9.5 billion units by 2029, indicating the expanding scope and criticality of anti-jamming solutions across transportation, telecommunications, precision agriculture, and IoT applications.

Market Segmentation

• Receiver Type:

o Military and Government Grade: Dominates the market with approximately 71% share due to extensive defense applications; features advanced capabilities including multi-frequency operation, high jamming-to-signal ratios, and encrypted communications; used in fighter aircraft, missiles, naval vessels, ground vehicles, and command systems.

o Commercial Transportation Grade: Growing rapidly due to increasing adoption in commercial aviation, maritime shipping, and autonomous vehicles; incorporates lighter, more cost-effective solutions while maintaining robust interference immunity; projected to show significant growth during 2024-2032 period.

• Technique:

o Nulling Systems: Largest segment with approximately 45% market share; uses adaptive antenna arrays to create directional nulls toward jamming sources while maintaining satellite signal reception; highly effective for stationary and slow-moving platforms.

o Beam Steering Systems: Fastest growing segment with projected 12% CAGR; dynamically adjusts antenna reception patterns in real-time to track legitimate satellite signals and reject jamming; particularly effective for high-speed and maneuvering platforms; growing at 35% segment share.

o Civilian Systems: Accounting for approximately 20% share; includes frequency hopping, signal processing, and time-domain filtering techniques for commercial applications.

o Excision Techniques: Employs narrow-band filtering to remove jamming signals while preserving navigation signal integrity.

• Application:

o Position, Navigation, and Timing (PNT): Largest segment accounting for approximately 62% market share; critical for aircraft navigation, autonomous vehicle guidance, precision agriculture, surveying, and time synchronization in telecommunications networks.

o Flight Control: Fastest growing application driven by rising UAV and commercial aircraft deployments; essential for safe aircraft operation during approach, landing, and tactical maneuvers.

o Surveillance and Reconnaissance: Significant military application for intelligence gathering, border monitoring, and battlefield awareness; requires jam-proof positioning for sensor platforms and reconnaissance drones.

o Targeting: Critical for precision-guided munitions, artillery systems, and missile guidance; ensures accurate weapon delivery in contested electromagnetic environments.

o Casualty Evacuation: Medical and rescue operations requiring reliable navigation under hostile jamming conditions.

o Others: Includes command and control, communications relay, search and rescue, and specialized military applications.

• End User:

o Military: Dominant end-user segment at approximately 60% market share; includes all branches of armed forces requiring secure navigation and communication capabilities; driven by modernization programs and electronic warfare preparedness.

o Airborne Platforms: Largest platform segment including fighter jets, transport aircraft, helicopters, and UAVs; most platforms utilize GNSS and TACAN positioning systems requiring anti-jamming protection.

o Ground Vehicles: Tanks, armored personnel carriers, autonomous ground vehicles, and mobile command centers requiring jam-resistant navigation.

o Naval Platforms: Warships, submarines, and naval drones operating in contested maritime environments.

o Space Systems: Satellites and space-based navigation infrastructure requiring protection from ground-based jamming.

o Civilian Applications: Commercial aviation, autonomous vehicles, critical infrastructure, maritime shipping, and precision agriculture; fastest growing at approximately 15% CAGR.

• Distribution Channel:

o Direct Sales: Primary channel for military and government procurement through defense contractors and direct manufacturer relationships; includes long-term service contracts and system integration agreements.

o Defense Contractors: Major systems integrators incorporating anti-jamming equipment into larger defense platforms and turnkey solutions.

o Commercial Distributors: Growing channel for commercial-grade receivers serving aviation, automotive, and maritime sectors.

o Online Platforms: Emerging channel for smaller commercial systems and aftermarket solutions.

Regional Insights

North America currently dominates the market with 34.42% market share in 2023, driven by the highest defense spending globally, advanced electronic warfare capabilities, and early adoption of cutting-edge technologies. The United States leads regional growth through substantial Department of Defense investments in next-generation GPS receivers, including the Digital GPS Anti-Jam Receiver (DIGAR) program for F-16 fighter fleets and broader military modernization initiatives. The National Defense Authorization Act highlights ongoing federal commitment to protecting military assets from electronic threats. The region benefits from presence of major defense contractors, robust R&D infrastructure, and stringent requirements for secure navigation systems.

Asia Pacific represents the fastest-growing region during the forecast period, driven by rising defense budgets, territorial disputes, and indigenous R&D initiatives. China, India, and Japan are investing heavily in modernizing their military capabilities and developing domestic anti-jamming technologies to achieve self-sufficiency in critical defense systems. Japan approved a record defense budget of JPY 7.95 trillion (USD 55.9 billion) for 2024, representing a 16.5% increase with significant allocations to GPS-dependent systems. The region's growing pool of skilled engineers and expanding aerospace manufacturing capabilities are accelerating market development.

Europe holds substantial market share at approximately 31%, with strong defense industrial base and collaborative multinational programs. Germany, France, United Kingdom, and Italy lead regional adoption through NATO modernization initiatives and national defense programs. European Union Aviation Safety Agency partnerships with IATA to address GNSS spoofing and jamming demonstrate regional commitment to aviation safety.

Recent Developments & News

• October 2024: BAE Systems announced strategic partnership with a smart city project in Japan to deploy anti-jamming solutions for autonomous vehicle navigation, enhancing safety and reliability.

• February 2024: ADVA launched a centralized GNSS monitoring and assurance tool leveraging AI and machine learning for remote identification of problems and protection against GNSS vulnerabilities, including jamming and spoofing attacks.

• January 2024: Israel Aerospace Industries (IAI) signed a contract with Korea Aerospace Industries (KAI) to provide its ADA system-a GPS anti-jamming solution capable of suppressing interferences from multiple jammers from various directions-for Light Armed Helicopter 2nd Phase Production during Seoul ADEX 2023.

• January 2024: European Union Aviation Safety Agency (EASA) announced partnership with International Air Transport Association (IATA) to improve aviation safety by addressing and reducing risks linked to GNSS spoofing and jamming through enhanced data sharing, procedural guidance, and backup navigation systems development.

• October 2023: CS Group partnered with Thales to develop a cyber-secure, jam-resistant navigation system inspired by civil aviation technologies.

• July 2022: BAE Systems delivered anti-jam M-code GPS devices to Germany for UAVs and ground vehicles.

• July 2020: BAE Systems completed acquisition of Collins Aerospace Military Global Positioning System (GPS) business from Raytheon Technologies Corporation, bringing decades of experience and extensive installed product base to the company.

• July 2020: Raytheon UK awarded contract by UK Ministry of Defence to develop advanced GNSS anti-jamming technologies through Technology Demonstrator Programme featuring advanced multi-element anti-jam technology integrated with next-generation multi-GNSS receiver.

• April 2022: Boeing launched Protected Tactical Enterprise Service (PTES) providing jam-resistant satellite communication systems for defense applications; also developing Protected Tactical Waveform (PTW) space-based anti-jamming devices.

Key Players

• BAE Systems PLC

• Raytheon Technologies Corporation

• Lockheed Martin Corporation

• Collins Aerospace (Raytheon Technologies)

• Thales Group

• Cobham PLC (Eaton)

• NovAtel Inc. (Hexagon AB)

• L3Harris Technologies Inc.

• Israel Aerospace Industries Ltd.

• Rockwell Collins (Collins Aerospace)

• Mayflower Communications Company Inc.

• infiniDome Ltd.

• Furuno Electric Co., Ltd.

• Hexagon AB

• Boeing Defense, Space & Security

• Meteksan Defence Industry Inc.

• Tallysman Wireless Inc.

• VERIPOS

• Chemring Group PLC

• Schiebel Aircraft GmbH

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

Ask An Analyst: https://www.imarcgroup.com/request?type=report&id=2796&flag=C

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: sales@imarcgroup.com,

Tel No: (D) +91 120 433 0800,

United States: +1-201971-6302

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Anti-Jamming Market is Projected to Grow USD 11.4 Billion by 2033 | At CAGR 8.74% here

News-ID: 4266484 • Views: …

More Releases from IMARC Group

Waste-to-Energy Plant DPR & Unit Setup - 2026: Demand Analysis and Project Cost

Setting up a Waste-to-Energy Plant positions investors in one of the most stable and essential segments of the renewable energy and waste management value chain, backed by sustained global growth driven by rising municipal solid waste generation, sustainable waste management requirements, increasing demand for renewable energy sources, and the dual-benefit advantages of waste reduction with energy production. As urbanization accelerates, waste volumes escalate toward 3.40 billion tons globally by 2050,…

Vegetable Oil Processing Plant DPR & Unit Setup - 2026: Machinery Cost, CapEx/Op …

Setting up a vegetable oil processing plant positions investors in one of the most stable and essential segments of the food and agro-processing value chain, backed by sustained global growth driven by rising population, increasing consumption of edible oils, growth in packaged food demand, and expanding applications across food, personal care, and industrial sectors. As urbanization accelerates, consumer lifestyles shift toward convenience and packaged foods, and regulatory frameworks increasingly support…

Trinitrotoluene Production Plant DPR & Unit Setup 2026: Demand Analysis and Proj …

Setting up a trinitrotoluene production plant involves strategic planning, substantial capital investment, and a comprehensive understanding of production technologies. This critical explosive compound serves military and defense, mining and quarrying, construction and demolition, and industrial explosives manufacturing applications. Success requires careful site selection, efficient nitration processes, stringent safety protocols for handling hazardous materials, reliable raw material sourcing, and compliance with industrial safety regulations to ensure profitable and sustainable operations.

Market Overview…

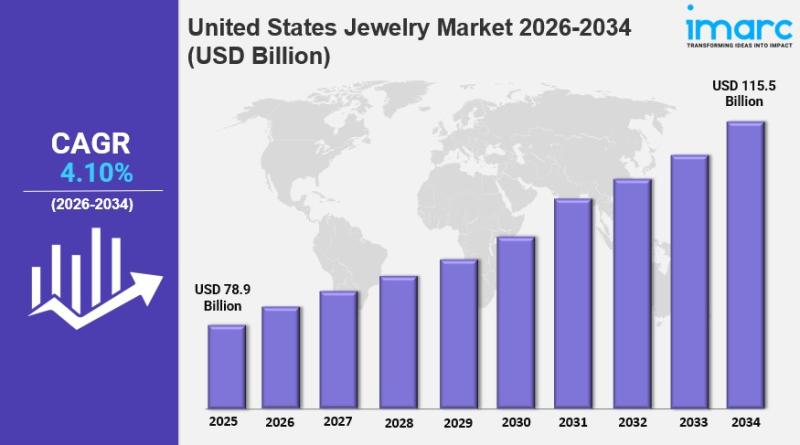

United States Jewelry Market Size, Share, Industry Overview, Growth and Forecast …

IMARC Group has recently released a new research study titled "United States Jewelry Market Report by Product (Necklace, Ring, Earrings, Bracelet, and Others), Material (Gold, Platinum, Diamond, and Others), and Region 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

United States Jewelry Market Overview

The United States jewelry market size reached USD 78.9 Billion in 2025.…

More Releases for GPS

Furthrive GPS Review: The Best GPS Collar of 2025

Losing a pet can be heartbreaking, and traditional fences do not always keep curious dogs or cats safe during walks, hikes or backyard play. Furthrive GPS changes that with a smart collar system that tracks location in real time and sets invisible boundaries to prevent escapes. This review breaks down how the device works, what pet owners gain from it, and whether it lives up to the promise of simple,…

GPS Market Potential Surge Evaluating GPS Market Growth Opportunities Ahead - 20 …

In recent years, the global GPS Market has witnessed a dynamic shift, influenced by changing consumer preferences, technological advancements, and a growing emphasis on sustainability. The Research report on GPS Market presents a complete judgment of the market through strategic insights on future trends, growth factors, supplier landscape, demand landscape, Y-o-Y growth rate, CAGR, pricing analysis. It also provides and a lot of business matrices including Porters Five Forces Analysis,…

AirBolt GPS Tracker Reviews USA: Is AirBolt GPS Tracker The World's Smartest GPS …

AirBolt GPS Tracker Reviews USA: Is AirBolt GPS Tracker The World's Smartest GPS Tracker? All You Need To Know About AirBolt GPS Tracker Before You Buy.

Looking for a game-changer in the realm of GPS trackers? Enter the AirBolt GPS, a revolutionary device that transcends the limitations of traditional Bluetooth trackers and bulky GPS units. Boasting four years of dedicated refinement, AirBolt presents a masterpiece of technology that redefines tracking…

Global GPS Equipment Market | Global GPS Equipment Industry | Global GPS Equipme …

GPS or Global Positioning System equipment is used to find the real-time location-based accurate information of any vehicle, or other types of assets. GPS detects the person or vehicle that uses the GPS to track its exact location. The location information is stored & transmitted to others, which are connected by the internet using radio, cellular, or satellite modem embedded in the unit. It comprises a GPS module for receiving…

Global GPS Equipment Market | Global GPS Equipment Industry | GPS Equipment Mark …

Global Positioning System or GPS equipment market comprises of sales of global positioning systems equipment & related services to determine the ground position of an object through GPS satellites. It is a satellite navigation system that transmits accurate signals that allow GPS equipment to decode or measure the desired location of the satellite. These equipments are smaller in size. With the advent of technologies, it has been possible to develop…

Global GPS Fleet Tracking System Market 2020 Industry Analysis by Manufacturers …

The market research report entitled Global GPS Fleet Tracking System Market 2020 by Company, Type and Application, Forecast to 2025 provides analysis on market conditions, trends, capability, key players, opportunities, and geographical analysis. The report proves to be an ultimate solution when it comes to a better understanding of the industry and leads the business growth. The report covers an overview of the segments and sub-segmentations including the product types,…