Press release

Singapore Retail Market Size, Share, Industry Outlook, Trends, Growth and Forecast Report 2025-2033

Singapore Retail Market 2025-2033According to IMARC Group's report titled "Singapore Retail Market Size, Share, Trends and Forecast by Product, Distribution Channel, and Region, 2025-2033", the report offers a comprehensive analysis of the industry, including market share, growth, trends, and regional insights.

How Big is the Singapore Retail Industry?

The Singapore retail market size reached USD 139.1 Billion in 2024 and is expected to reach USD 199.4 Billion by 2033, exhibiting a growth rate (CAGR) of 3.33% during 2025-2033.

Request for a free sample copy of this report: https://www.imarcgroup.com/singapore-retail-market/requestsample

Singapore Retail Market Trends:

Singapore's retail landscape is experiencing dynamic shifts driven by innovation, technology, and evolving consumer preferences. The rise of pop-up stores and experiential retail has transformed how brands connect with consumers. In September 2023, SHEIN opened a galaxy-inspired pop-up store at Bugis Junction, offering an immersive shopping experience with interactive elements that allowed buyers to engage directly with the brand. These temporary retail spaces enable brands to test new concepts and create excitement through limited-time promotions, catering to consumers seeking unique and exclusive experiences.

Technology integration has become central to retail operations across Singapore. In January 2024, 7-Eleven launched its first automated self-service store, "7-Eleven Shop & Go," at Esplanade MRT station. Using smart cameras and deep learning technology, shoppers can tap their credit cards to enter, select products, and complete automatic payments upon exit, significantly enhancing convenience and efficiency. This reflects the broader adoption of artificial intelligence, augmented reality, and data analytics that are revolutionizing customer engagement. AI-driven chatbots provide personalized support, while AR technology allows consumers to visualize products in real-time before making purchase decisions.

The luxury retail segment continues to thrive, particularly along Orchard Road, which attracts approximately 7 million visitors annually to its exclusive boutiques featuring Hermès and Dior stores. According to retail sales data from February 2024, the sector experienced remarkable growth with food and alcohol sales surging by 31.4% and watches and jewelry growing by 16.8%. This demonstrates the resilience of Singapore's high-end retail market, supported by strong economic fundamentals and high per capita income.

Online retail has gained significant momentum, with digital channels accounting for 12.1% of total retail sales in June 2024. Computer and telecommunications equipment, furniture and household equipment, and supermarkets and hypermarkets constituted 49.0%, 32.7%, and 12.5% of online retail sales respectively. The expansion of e-commerce is further accelerated by platforms like Shopee and the entry of TikTok Shop, which launched in 2021 and has intensified competition in Singapore's digital retail space. In August 2023, Singapore-based tech group Sea ramped up investments in Shopee to compete more effectively in this growing segment.

Physical retail expansion remains robust despite digital growth. March 2025 marked the grand opening of Punggol Coast Mall with over 120 retail, dining, and lifestyle establishments, directly connected to Punggol Coast MRT station within the Punggol Digital District. International brands are also expanding their presence-in July 2024, British footwear brand Hunter Boots launched its first physical store in Southeast Asia in Singapore, complemented by website launches in Singapore and Malaysia to enhance regional market reach. Additionally, Chinese lifestyle retailer KKV kicked off its Singapore expansion in May 2025 with its first store at Tiong Bahru Plaza, with plans to open 10 locations across the city-state by partnering with CapitaLand and Frasers Property.

Sustainability has emerged as a defining trend, with consumers increasingly prioritizing environmentally responsible shopping. Retailers are responding by adopting eco-friendly practices including sustainable sourcing, waste minimization, and recyclable packaging. The demand for second-hand, upcycled, and circular economy products is growing, particularly among younger consumers who balance sustainability with quality and affordability. Government initiatives supporting green retail schemes are reinforcing these market dynamics.

Purchase Full Market Analysis: https://www.imarcgroup.com/checkout/detail?id=23739&method=1220

Market Scope and Growth Factors

Singapore's retail market presents substantial growth potential, underpinned by several strategic advantages and emerging opportunities. The nation's strong and stable economy supports robust consumer spending, with final consumption expenditure exceeding USD 186 billion as of 2022, according to World Bank data. The Economic Development Board projects that annual disposable income will grow steadily through 2030, which is expected to further boost retail market demand.

The tourism sector serves as a powerful growth driver for Singapore's retail industry. As a premier shopping destination in Asia, Singapore attracts millions of international visitors annually who contribute significantly to retail revenues. The combination of luxury shopping experiences, duty-free options, and diverse retail formats makes Singapore particularly attractive to high-spending tourists, especially in prime areas like Orchard Road.

Government support plays a crucial role in sustaining retail sector growth. Through Budget 2024, the Singapore government introduced the Enterprise Support Package worth SGD 1.3 billion to help businesses manage rising operational costs. This package includes a 50% corporate income tax rebate capped at SGD 40,000 for companies, with unprofitable firms that employed at least one local employee in 2023 receiving a minimum cash payout of SGD 2,000. The Enterprise Financing Scheme has been permanently enhanced, with the maximum working capital loan quantum increased from SGD 300,000 to SGD 500,000, enabling small and medium-sized retailers to access better financing for business expansion.

Technology adoption is being actively encouraged through government initiatives like the Retail Industry Digital Plan by the Infocomm Media Development Authority, which helps retailers integrate digital tools, AI, and automation to enhance efficiency and customer experience. The Productivity Solutions Grant provides funding of up to 80% of qualifying project costs for businesses adopting technology solutions, benefiting various sectors including retail. The SME Go Digital Program specifically assists small retailers in integrating cloud-based systems, AI-driven analytics, and digital payments.

Regional expansion beyond Singapore's central business district presents significant opportunities. While metropolitan areas currently account for the majority of retail activity, emerging neighborhoods and newly developed districts like Punggol are attracting substantial investment in retail infrastructure. This geographic diversification is supported by improved connectivity through Singapore's extensive MRT network, making retail locations more accessible to residents across the island.

Cross-industry partnerships are accelerating market growth. Telecommunications operators offer affordable data packages specifically for mobile shopping, while hardware manufacturers launch competitively priced gaming and retail technology peripherals. Financial institutions have introduced enhanced payment solutions and point-of-sale systems that streamline transactions, offering fast and secure payment options that improve the overall shopping experience.

The integration of omnichannel retail strategies has become essential for success in Singapore's competitive market. Over 60% of retailers have implemented e-commerce and omnichannel approaches following the COVID-19 pandemic, allowing consumers to seamlessly transition between online browsing and in-store purchases. Click-and-collect services, flexible return policies, and mobile payment options have become standard offerings that meet consumer demands for convenience.

The food and beverage segment within retail continues to demonstrate strong performance, particularly in prime malls where F&B accounts for 50% of store openings. The proliferation of convenience stores, specialty food retailers, and international F&B chains reflects changing consumer preferences toward diverse dining options and ready-to-eat solutions. According to retail sales data, supermarkets and hypermarkets witnessed growth of 19.2% in February 2024, underscoring the importance of this category in Singapore's retail ecosystem.

Professional development and workforce enhancement are receiving increased attention through initiatives like the SkillsFuture Level Up Programme, which aims to attract and retain talent in the retail industry while elevating the sector's professional image. The Singapore Retailers Association has emphasized that addressing manpower shortages is critical for maintaining service levels and enabling domestic expansion, particularly as the industry continues to evolve and require more specialized skills.

Singapore Retail Industry Segmentation:

The report has segmented the market into the following categories:

Breakup by Product:

• Food and Beverages

• Personal and Household Care

• Apparel, Footwear and Accessories

• Furniture

• Toys and Hobby

• Electronic and Household Appliances

• Others

Breakup by Distribution Channel:

• Supermarkets and Hypermarkets

• Convenience Stores

• Specialty Stores

• Online Stores

• Others

Breakup by Region:

• North-East

• Central

• West

• East

• North

Competitor Landscape:

The report offers an in-depth examination of the competitive landscape. It includes a thorough competitive analysis encompassing market structure, key player positioning, leading strategies for success, a competitive dashboard, and a company evaluation quadrant.

Other key areas covered in the report:

• COVID-19 Impact on the Market

• Porter's Five Forces Analysis

• Strategic Recommendations

• Market Dynamics

• Historical, Current and Future Market Trends

• Market Drivers and Success Factors

• SWOT Analysis

• Value Chain Analysis

• Comprehensive Mapping of the Competitive Landscape

• Top Winning Strategies

• Recent Industry News

• Key Technological Trends & Development

Recent News and Developments

• March 2025: Punggol Coast Mall officially opened with over 120 retail, dining, and lifestyle establishments, directly connected to Punggol Coast MRT station within Singapore's first smart and sustainable business district-the Punggol Digital District.

• March 2025: Swiss running shoe brand On opened a flagship store at Jewel Changi Airport spanning approximately 864 square meters across two levels, featuring an innovative retail concept centered on performance innovation with curved surfaces, greenery-inspired textures, and the signature "Magic Wall" installation.

• May 2025: Chinese lifestyle retailer KKV launched its first Singapore store at Tiong Bahru Plaza, marking the beginning of an ambitious expansion plan to open 10 locations across Singapore in partnership with major property groups including CapitaLand and Frasers Property.

• May 2025: Singapore retail sales rose 1.4% year-on-year, demonstrating recovery momentum with growth driven by Computer & Telecommunications Equipment, Recreational Goods, and Cosmetics and Toiletries categories.

• July 2024: British footwear brand Hunter Boots announced the launch of its first physical store in Southeast Asia in Singapore, accompanied by website launches in Singapore and Malaysia to enhance regional market penetration.

• July 2024: Royal Holdings Co., Ltd. and Sojitz Corporation opened Royal Host's first directly operated international branch at Jewel Changi Airport, bringing Western-style cuisine to the global market through this strategic expansion.

• June 2024: Pasir Ris Mall opened along Pasir Ris Central with over 150 retail and F&B outlets, providing residents of Singapore's eastern region with enhanced shopping and dining options.

• January 2024: 7-Eleven opened its first automated self-service store, "7-Eleven Shop & Go," at Esplanade MRT station, utilizing smart cameras and deep learning technology to enable seamless cashierless shopping experiences.

• January 2024: Lotte Duty Free inaugurated its Changi Airport store with a lavish reopening event, signaling the launch of its 19 stores worldwide as part of its international sales expansion strategy, with CEO Kim Joo-nam emphasizing Changi Airport's importance in the company's global expansion plan.

Request For Customization: https://www.imarcgroup.com/request?type=report&id=23739&flag=E

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services.

IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Singapore Retail Market Size, Share, Industry Outlook, Trends, Growth and Forecast Report 2025-2033 here

News-ID: 4266021 • Views: …

More Releases from IMARC Group

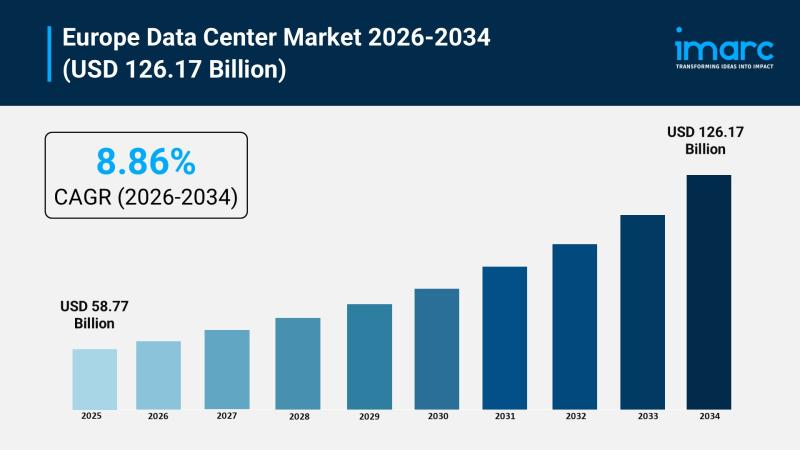

IMARC Group Forecasts 8.86% CAGR for Europe Data Center Market Amidst AI and Clo …

The Europe data center market is experiencing a critical phase of infrastructure evolution, having reached a valuation of USD 58.77 Billion in 2025. Propelled by the accelerating digitalization of the region's economy and sovereign cloud ambitions, the market is projected to reach USD 126.17 Billion by 2034. This growth trajectory represents a solid Compound Annual Growth Rate (CAGR) of 8.86% during the forecast period of 2026-2034.

Key Market Trends &…

Hot Sauce Manufacturing Plant DPR & Unit Setup - 2026: Demand Analysis and Proje …

Setting up a hot sauce manufacturing plant positions investors within one of the fastest-growing and flavor-driven segments of the global condiment industry, fueled by rising consumer appetite for spicy, bold, and ethnic flavors, increasing demand for clean-label and premium condiment products, and expanding utilization of hot sauce across food service, retail, and food processing applications. Made primarily from chili peppers, vinegar, salt, and complementary flavoring ingredients, hot sauce is recognized…

Glyoxylic Acid Prices Q4 2025: US Stable While Europe Remains High Price Trend

The Glyoxylic Acid Price Trend Analysis indicates dynamic shifts in global supply-demand balance, feedstock volatility, and regional trade flows. In 2026, Glyoxylic Acid Prices are reflecting fluctuations in raw material costs and downstream demand from pharmaceuticals, cosmetics, and agrochemicals. Market participants closely track the Glyoxylic Acid price index and forecast data to understand pricing momentum, risk exposure, and procurement strategies across key global regions.

Glyoxylic Acid Current Glyoxylic Acid Price Movements:

Recent…

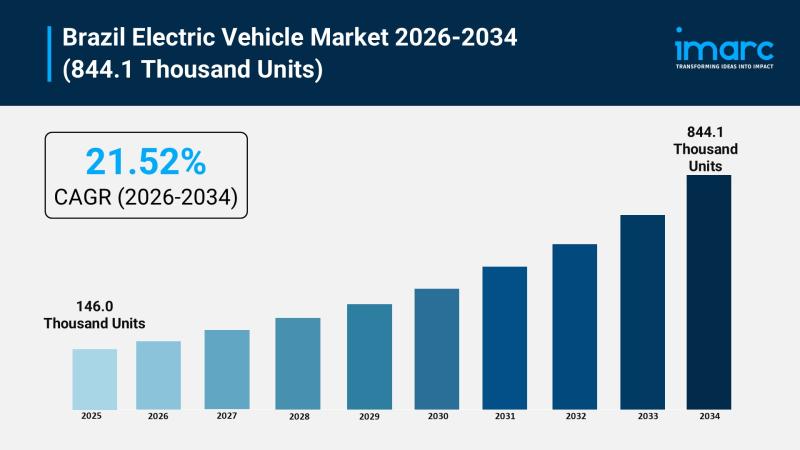

IMARC Group Forecasts 21.52% CAGR for Brazil EV Market as BYD and GWM Ramp Up Lo …

The Brazil electric vehicle (EV) market is currently witnessing an unprecedented surge, having reached a volume of 146.0 Thousand Units in 2025. Fueled by a combination of stringent environmental policies and a strategic shift toward domestic production by global automakers, the market is projected to reach 844.1 Thousand Units by 2034. This rapid expansion represents a robust Compound Annual Growth Rate (CAGR) of 21.52% during the forecast period of 2026-2034.

Key…

More Releases for Singapore

Singapore Tour Packages

TripNest Launches "Explore Singapore Your Way" - A Customized Singapore Tour Package for Every Traveler

Mysore, India - [Date] - TripNest, a leading travel and holiday planning company, proudly announces the launch of its new "Explore Singapore Your Way" tour package - an exclusive travel experience crafted for Indian travelers seeking the perfect balance of adventure, leisure, and luxury in the Lion City.

Designed with flexibility and personalization in mind, TripNest's Singapore…

Singapore Probiotic Food Supplement Market Statistical Forecast, Growth Insights …

Singapore Probiotic Food Supplement Market Research Report By DataM Intelligence: A comprehensive analysis of current and emerging trends provides clarity on the dynamics of the Singapore Probiotic Food Supplement market. The report employs Porter's Five Forces model to assess key factors such as the influence of suppliers and customers, risks posed by different entities, competitive intensity, and the potential of emerging entrepreneurs, offering valuable insights. Additionally, the report presents research…

Singapore Memories: The Pinnacle of Perfumery in Singapore

In the heart of Singapore lies an olfactory haven that has garnered acclaim and admiration from both locals and tourists alike. Singapore Memories, widely celebrated as the best perfume shop in Singapore, continues to captivate scent enthusiasts with its exquisite collection of fragrances that pay homage to the rich cultural heritage and diverse flora of the region.

Unparalleled Perfumery Craftsmanship

Singapore Memories stands out in the competitive landscape of the perfume industry…

Singapore Bunker Fuel Market: Fueling Maritime Commerce | Singapore 3.5% Growing

According to a new report published by Allied Market Research, The Singapore bunker fuel market size was valued at $17.6 billion in 2020, and is projected to reach $24.5 billion by 2030, growing at a CAGR of 3.5% from 2021 to 2030.

Singapore is one of the world's largest bunkering ports and is a significant hub for the supply and trading of bunker fuel. Bunker fuel is a type of fuel…

Payroll services Singapore: Automating Businesses In Singapore Becoming More Pop …

What is payroll

Payroll is the method used to pay employees' salaries. Making a list of the personnel who need to be paid comes first, and recording the expenses comes last. It's a complicated procedure that requires cooperation from numerous teams, including payroll, HR, and finance.

1. Save money on the best payroll processing available.

In order to give you the finest service possible, a payroll services firm is always updating…

Peoplewave selected for Startup Station Singapore by Facebook and IMDA Singapore

20 February 2019, Singapore – Peoplewave, Asia’s leading data-driven HR technology company, has been selected to participate in Startup Station Singapore 2019.

Startup Station Singapore is a partnership between Facebook and the Infocomm Media Development Authority (IMDA) Singapore. Kicking off in February 2019, this programme will empower data-driven startups to accelerate their businesses in new and cutting-edge ways, while continuing to keep peoples’ trust, transparency and control over their data at…