Press release

Third-Party Banking Software Market on Rise: Key Growth Drivers and Future Outlook (2025-2033)

The global Third-Party Banking Software Market was valued at USD 30.93 Billion in 2024 and is projected to reach USD 57.63 Billion by 2033. It is expected to grow at a CAGR of 6.80% during the forecast period of 2025-2033. Growth is primarily driven by increasing demand for secure, scalable banking solutions and the rising adoption of cloud-based technologies, coupled with regulatory compliance requirements across various financial sectors.Study Assumption Years

Base Year: 2024

Historical Year/Period: 2019-2024

Forecast Year/Period: 2025-2033

Third-Party Banking Software Market Key Takeaways

Current Market Size: USD 30.93 Billion in 2024

CAGR: 6.80% during 2025-2033

Forecast Period: 2025-2033

North America held the largest market share of 36.6% in 2024, driven by advanced technological infrastructure and high digital banking adoption.

Core banking software led the product segment with a 37.3% market share in 2024 due to demand for integrated and efficient banking solutions.

On-premises deployment dominated at 82.4% market share in 2024, favored for enhanced security and regulatory compliance.

Risk management application accounted for 41.6% market share in 2024, reflecting financial institutions' focus on mitigating complex risks.

Retail and trading banks were the leading end users with a 62.3% market share in 2024, driven by demand for specialized service delivery and operational efficiency.

Sample Request Link:

https://www.imarcgroup.com/third-party-banking-software-market/requestsample

Market Growth Factors

The third-party banking software market is witnessing robust growth due to the increasing use of cloud technology in the banking industry. Cloud solutions enable banks and financial institutions to reduce operational expenditures and enhance scalability. These platforms provide advanced technological features without hefty upfront infrastructure investments, improving agility, data security, and lowering maintenance costs. The seamless integration capability of cloud solutions with existing systems encourages customized offerings, expanding overall market demand.

Regulatory developments are another critical growth driver, particularly in regions like the United States where agencies such as the Consumer Financial Protection Bureau (CFPB) enforce data-sharing regulations. These regulations promote open banking by compelling banks to provide consumers with easier access to financial information. Consequently, financial institutions are adopting third-party software solutions that facilitate compliance and integrate smoothly with third-party platforms, enhancing competitiveness and service innovation.

The BFSI (Banking, Financial Services, and Insurance) sector's digital transformation significantly contributes to market expansion. Increasing digital transactions, as evidenced by 602 banks using UPI with 15.08 Billion digital transactions in 2024 in India, reflect rising digital platform adoption. Furthermore, the integration of big data analytics and automated accounting systems within banking software empowers institutions to make data-driven decisions, address cybercrime risks projected to cost USD 10.5 Trillion by 2025, and meet growing customer-centric banking demands, all fueling market growth.

Market Segmentation

Product:

Core Banking Software: Leads market with 37.3% share due to integrated, efficient banking demand and regulatory compliance needs.

Multi-Channel Banking Software

Business Intelligence Software

Others

Deployment Type:

On-premises: Dominates with 82.4% share as banks prioritize security, control over data, and regulatory compliance.

Cloud-based

Application:

Risk Management: Leads with 41.6% market share, driven by the need to mitigate credit, market, operational, and cyber risks.

Information Security

Business Intelligence

Others

End User:

Commercial Banks

Retail and Trading Banks: Lead with a 62.3% market share, fueled by demand for specialized, efficient service delivery and advanced digital solutions.

Region:

Asia Pacific

Europe

North America

Latin America

Middle East and Africa

Regional Insights

North America dominates the third-party banking software market with a 36.6% market share in 2024. This leadership is due to the region's sophisticated technological infrastructure, regulatory environment, and high adoption of digital banking platforms. Financial institutions in North America are increasingly investing in cloud-based, AI-driven solutions to enhance operational efficiency, security, and customer experience, positioning the region as a key innovation hub in the global market.

Recent Developments & News

April 2025: Backbase launched an AI-powered banking platform integrating real-time data insights and modular Agentic AI to automate tasks, unifying digital sales and customer service while emphasizing responsible AI deployment.

April 2025: Candescent expanded its Bangalore office with over 200 employees, focusing on next-generation user experience, customization, and fintech integration.

February 2025: Galoy introduced Lana, a platform enabling banks to offer bitcoin-backed loans using open-source software, customizable loan terms, and risk management to support crypto lending.

Key Players

Capgemini

Deltek

IBM

Infosys

Microsoft Corporation

NetSuite Inc.

Oracle Corporation

SAP SE

Tata Consultancy Services

Customization Note

https://www.imarcgroup.com/request?type=report&id=2121&flag=C

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

Contact Us

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: +1-201971-6302

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Third-Party Banking Software Market on Rise: Key Growth Drivers and Future Outlook (2025-2033) here

News-ID: 4265736 • Views: …

More Releases from IMARC Group

United States Air Freight Market Size, Share, Industry Trends, Growth and Foreca …

IMARC Group has recently released a new research study titled "United States Air Freight Market Size, Share, Trends and Forecast by Service, Destination, End User, and Region, 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

United States Air Freight Market Overview

The United States air freight market size was valued at USD 64.06 Billion in 2025.…

Mexico Medical Tourism Market 2026 : Industry Size to Reach USD 10.6 Billion by …

IMARC Group has recently released a new research study titled "Mexico Medical Tourism Market Size, Share, Trends and Forecast by Type, Treatment Type, and Region, 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Mexico Medical Tourism Market Overview

The Mexico medical tourism market size reached USD 2.1 Billion in 2025. Looking forward, the market is projected…

Saudi Arabia Pilates & Yoga Studios Market Size to Surpass USD 3.6 Billion by 20 …

Saudi Arabia Pilates & Yoga Studios Market Overview

Market Size in 2024: USD 1.6 Billion

Market Forecast in 2033: USD 3.6 Billion

Market Growth Rate 2025-2033: 8.20%

According to IMARC Group's latest research publication, "Saudi Arabia Pilates & Yoga Studios Market Size, Share, Trends and Forecast by Activity Type, Application, and Region, 2025-2033", the Saudi Arabia pilates & yoga studios market size reached USD 1.6 Billion in 2024. Looking forward, IMARC Group expects the…

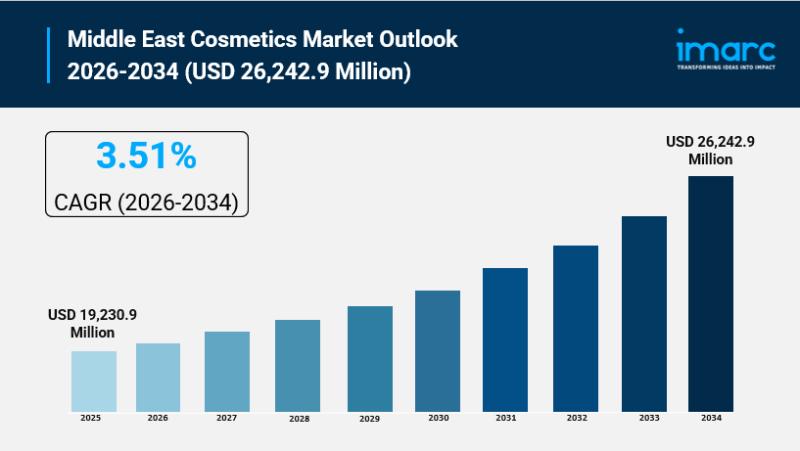

Middle East Cosmetics Market Size to Surpass USD 26,242.9 Million by 2034, at a …

Middle East Cosmetics Market Overview

Market Size in 2025: USD 19,230.9 Million

Market Size in 2034: USD 26,242.9 Million

Market Growth Rate 2026-2034: 3.51%

According to IMARC Group's latest research publication, "Middle East Cosmetics Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2026-2034", the Middle East cosmetics market size reached USD 19,230.9 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 26,242.9 Million by 2034, exhibiting a growth rate…

More Releases for Banking

Banking ERP Software Market: A Catalyst for Banking Excellence

The Banking ERP Software Market is at the forefront of a financial revolution, poised to redefine the way banking institutions operate in the digital age. As the industry grapples with evolving customer expectations, regulatory demands, and technological advancements, ERP software solutions have emerged as indispensable tools for financial institutions. These systems streamline operations, enhance data management, and empower banks to deliver more efficient and customer-centric services. In an era where…

Digital Banking Market Report, Worth, Size, Share, Trends, Segmented by Applicat …

Digital Banking Market Size:

In 2018, the global Digital Banking market size was 5.180 Billion USD and it is expected to reach 16.200 Billion US$ by the end of 2025, with a CAGR of 15.3% during 2019-2025.

Get Free Sample: https://reports.valuates.com/request/sample/QYRE-Auto-4N473/Global_Digital_Banking

Digital Banking Market Share:

• In 2017, North America's economy accounted for about 48.73% of the global Digital Banking market share, while Europe and Asia-Pacific accounted for about 30.22%, 16.54%, respectively.

• European countries such…

Online Banking Market by Banking Type - Retail Banking, Corporate Banking, and I …

The Online Banking Market size is expected to reach $29,976 million in 2023 from $7,305 million in 2016, growing at a CAGR of 22.6% from 2017 to 2023. Digital banking includes all kinds of online/internet transactions done for various purposes. It is the incorporation of new technologies, to deliver enhanced customer services.

Customer convenience, higher interest rates, and technologically advanced interface majorly drive the market. High security risk of customer’s data…

Explore Mobile Banking Market with Top Players like Barclays, BOC, SBI, HSBC Mob …

Mobile Banking allow various users to avail banking and financial services through any telecommunication devices. Different kind of services include both information and monetary transaction. Increase in the use of number of smart phones and mobile phones mobile Banking Market has gained its popularity. It is preferable and comfortable by the users than any other means of transaction.

Global Mobile Banking Market anticipated to grow at a CAGR of +35% over…

Mobile Banking Market Is Booming Worldwide | HSBC Mobile Banking, ICICI Bank Mob …

HTF MI recently introduced Global Mobile Banking Market study with in-depth overview, describing about the Product / Industry Scope and elaborates market outlook and status to 2023. The market Study is segmented by key regions which is accelerating the marketization. At present, the market is developing its presence and some of the key players from the complete study are HSBC Mobile Banking, ICICI Bank Mobile Banking, U.S. Bank, Santander Mobile…

Online Banking Market Report 2018: Segmentation by Banking Type (Retail Banking, …

Global Online Banking market research report provides company profile for ACI Worldwide (U.S.), Microsoft Corporation (U.S.), Fiserv, Inc. (U.S.), Tata Consultancy Services (India), Cor Financial Solutions Ltd. (UK), Oracle Corporation (U.S.) and Others.

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2018 to 2025 in terms of volume, revenue, YOY growth rate, and CAGR for…