Press release

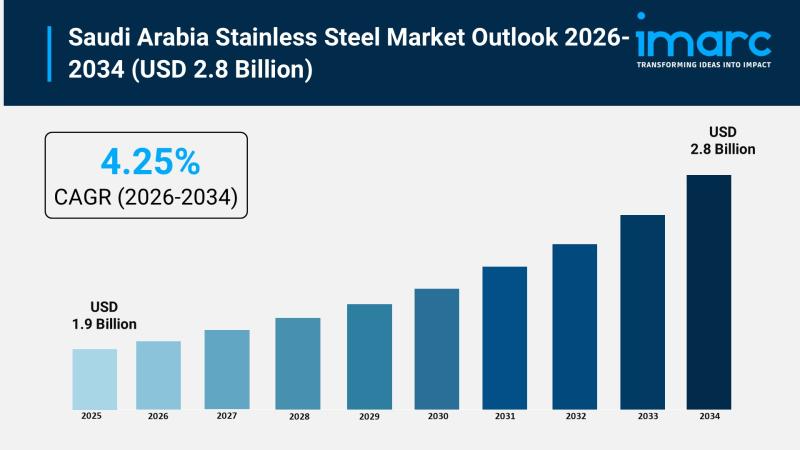

Saudi Arabia Stainless Steel Market Size to Surpass USD 2.8 Billion by 2034, at a CAGR of 4.25%

Saudi Arabia Stainless Steel Market OverviewMarket Size in 2025: USD 1.9 Billion

Market Size in 2034: USD 2.8 Billion

Market Growth Rate 2026-2034: 4.25%

According to IMARC Group's latest research publication, "Saudi Arabia Stainless Steel Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2026-2034", The Saudi Arabia stainless steel market size reached USD 1.9 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 2.8 Billion by 2034, exhibiting a growth rate (CAGR) of 4.25% during 2026-2034.

How AI is Reshaping the Future of Saudi Arabia Stainless Steel Market

● Smart Manufacturing and Production Optimization: Artificial intelligence is revolutionizing stainless steel manufacturing processes across Saudi Arabia by implementing predictive analytics, real-time quality monitoring, and automated process control systems that optimize production parameters including temperature, pressure, and alloy composition, reducing material waste, improving product consistency, and enhancing overall manufacturing efficiency in facilities producing flat and long stainless steel products for construction, automotive, and industrial applications throughout the Kingdom's expanding manufacturing sector aligned with Vision 2030 industrialization goals.

● Advanced Quality Control and Defect Detection: AI-powered computer vision systems integrated into Saudi stainless steel production lines are transforming quality assurance by automatically detecting surface defects, dimensional inconsistencies, and material imperfections with accuracy far exceeding human inspection capabilities, enabling manufacturers to identify and correct issues in real-time, minimize rejection rates, reduce rework costs, and ensure that stainless steel products meet stringent international standards required for critical applications in oil and gas infrastructure, petrochemical facilities, and high-rise construction projects across major Saudi cities including Riyadh, Jeddah, and Dammam.

● Predictive Maintenance and Equipment Optimization: Machine learning algorithms deployed across stainless steel manufacturing facilities in Saudi Arabia are analyzing equipment performance data, vibration patterns, temperature fluctuations, and operational parameters to predict potential machinery failures before they occur, enabling proactive maintenance scheduling that minimizes unplanned downtime, extends equipment lifespan, and ensures continuous production capacity to meet growing demand from the Kingdom's booming construction sector, expanding oil and gas industry, and developing manufacturing base supporting economic diversification initiatives.

● Supply Chain Intelligence and Demand Forecasting: AI-driven analytics platforms are enhancing supply chain management for Saudi Arabia's stainless steel distributors and manufacturers by analyzing historical sales data, construction project pipelines, industrial development trends, and macroeconomic indicators to forecast demand patterns accurately, optimize inventory levels, streamline logistics operations, and ensure timely product availability for major infrastructure projects including NEOM, Red Sea Development, and Qiddiya, while helping companies navigate raw material price fluctuations, import dynamics, and market volatility in the global stainless steel industry.

● Customized Product Development and Application Engineering: Artificial intelligence is enabling stainless steel manufacturers and suppliers in Saudi Arabia to develop customized alloy grades and product specifications tailored to specific industry requirements by analyzing application parameters, environmental conditions, corrosion resistance needs, and mechanical property requirements across diverse sectors including desalination plants addressing water scarcity, healthcare facilities requiring hygienic materials, food processing equipment demanding sanitary surfaces, and offshore oil platforms requiring superior corrosion resistance, accelerating product innovation and expanding market opportunities throughout the Kingdom's diversifying industrial landscape.

Grab a sample PDF of this report: https://www.imarcgroup.com/saudi-arabia-stainless-steel-market/requestsample

Saudi Arabia Stainless Steel Market Trends & Drivers:

Saudi Arabia's stainless steel market is experiencing robust growth driven by unprecedented construction and infrastructure development activities aligned with the Kingdom's Vision 2030 economic transformation agenda. The expanding population and rapid urbanization are fueling massive investments in residential and commercial building construction across major metropolitan areas, with stainless steel extensively utilized for structural elements, architectural facades, interior design features, elevator systems, handrails, and decorative applications due to its superior structural integrity, corrosion resistance, and modern aesthetic appeal. The government's ambitious mega-project portfolio including NEOM smart city, Red Sea Development luxury tourism destination, Qiddiya entertainment complex, and Diriyah Gate cultural hub represents multi-billion-dollar infrastructure initiatives requiring enormous quantities of stainless steel products for construction frameworks, pipeline systems, storage facilities, and architectural elements. The Kingdom's infrastructure development extends beyond iconic mega-projects to encompass transportation networks, healthcare facilities, educational institutions, hospitality developments, and residential housing programs designed to accommodate population growth and elevate living standards, creating sustained long-term demand for diverse stainless steel grades and product forms across the construction value chain.

The oil and gas sector remains a fundamental pillar supporting Saudi Arabia's stainless steel consumption, with the industry's inherent requirements for corrosion-resistant, high-temperature-tolerant materials driving consistent demand for specialized stainless steel products. Saudi Aramco's ongoing investments in expanding refining capacity, upgrading petrochemical facilities, developing new oil fields, and modernizing existing production infrastructure necessitate substantial quantities of stainless steel for pipelines transporting corrosive hydrocarbons, storage tanks holding refined products, pressure vessels in processing units, heat exchangers, valves, fittings, and offshore platform structures exposed to harsh marine environments. The Kingdom's strategic focus on downstream petrochemical development and value-added processing creates additional stainless steel demand for reactors, distillation columns, and process equipment requiring materials capable of withstanding aggressive chemical environments, elevated temperatures, and mechanical stresses. The development of domestic manufacturing capabilities represents another significant growth driver, with Vision 2030 initiatives promoting industrialization, import substitution, and export-oriented production across automotive components, consumer appliances, electronics, machinery, and precision instruments. The automotive sector is experiencing particular momentum with global manufacturers establishing production facilities in Saudi Arabia, driving demand for stainless steel in exhaust systems, structural components, trim elements, and fuel system parts.

The government's strategic emphasis on addressing water security challenges through desalination infrastructure expansion is creating specialized demand for high-grade corrosion-resistant stainless steel essential for seawater intake systems, reverse osmosis membranes, brine disposal pipelines, and desalination plant equipment. Saudi Arabia operates the world's largest desalination capacity and continues investing in new facilities to ensure reliable freshwater supply for its growing population and industrial requirements, with desalination projects representing sustained long-term opportunities for stainless steel suppliers. The healthcare infrastructure development supporting population growth and medical tourism ambitions drives demand for stainless steel in surgical instruments, medical devices, hospital equipment, pharmaceutical processing machinery, and cleanroom installations where hygiene, sterilization capability, and contamination resistance are paramount. Technological advancements in stainless steel manufacturing are enhancing product quality while improving cost-effectiveness, with development of new grades featuring enhanced properties, improved formability, superior weldability, and optimized performance characteristics expanding application possibilities across traditional and emerging industries. The growing emphasis on sustainability and circular economy principles aligns perfectly with stainless steel's inherent recyclability, long service life, low maintenance requirements, and environmental benefits, making it an increasingly preferred material choice for environmentally conscious developers, manufacturers, and industrial operators throughout the Kingdom. The market is further supported by continuous improvements in local distribution networks, technical service capabilities, fabrication infrastructure, and availability of diverse product forms including sheets, plates, coils, bars, pipes, tubes, and custom-fabricated components serving the Kingdom's diverse industrial, commercial, and residential requirements across its Northern and Central, Western, Eastern, and Southern regions.

Saudi Arabia Stainless Steel Industry Segmentation:

The report has segmented the market into the following categories:

Product Insights:

● Flat

● Long

Grade Insights:

● 200 Series

● 300 Series

● 400 Series

● Duplex Series

● Others

Application Insights:

● Automotive and Transportation

● Building and Construction

● Consumer Goods

● Mechanical Engineering and Heavy Industries

● Others

Breakup by Region:

● Northern and Central Region

● Western Region

● Eastern Region

● Southern Region

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Ask analyst of customized report: https://www.imarcgroup.com/request?type=report&id=20719&flag=E

Recent News and Developments in Saudi Arabia Stainless Steel Market

● February 2025: Major stainless steel manufacturers announced capacity expansion plans and technology upgrades in Saudi Arabia to support the Kingdom's growing infrastructure development requirements, with investments focusing on advanced production facilities capable of manufacturing high-grade stainless steel products meeting international quality standards for critical applications in construction, oil and gas, petrochemical, and industrial sectors, reflecting strong market confidence in the long-term growth trajectory driven by Vision 2030 mega-projects and economic diversification initiatives.

● March 2025: SeAH Gulf Special Steel progressed with its seamless stainless steel pipe manufacturing facility development in Saudi Arabia, with the advanced production plant designed to manufacture specialized pipe products for demanding applications in the Kingdom's expanding oil and gas infrastructure, petrochemical facilities, and industrial projects, demonstrating international manufacturers' recognition of Saudi Arabia's strategic importance as a regional hub for stainless steel consumption and distribution across the Middle East market.

● April 2025: The Saudi construction sector witnessed continued momentum with multiple infrastructure development agreements and mega-project advancements driving sustained demand for stainless steel products across residential, commercial, and industrial building applications, while the government's ongoing commitment to housing development programs, transportation infrastructure modernization, and smart city initiatives reinforced positive market outlook for stainless steel suppliers serving the Kingdom's dynamic construction industry and supporting the nation's ambitious urbanization and economic transformation objectives.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Saudi Arabia Stainless Steel Market Size to Surpass USD 2.8 Billion by 2034, at a CAGR of 4.25% here

News-ID: 4265586 • Views: …

More Releases from IMARC Group

Q4 2025 Chromium Prices Update: USA at USD 13,429/MT, China at USD 8,312/MT - Gl …

North America Chromium Prices Movement Q4 2025:

Chromium Prices in USA:

In Q4 2025, chromium prices in the United States averaged USD 13,429 per metric ton. Demand from stainless steel and specialty alloy industries remained robust. Stable domestic production and consistent import flows supported supply balance. Energy costs and industrial activity levels influenced pricing, while regional trade and logistical considerations contributed to moderate market fluctuations.

Get the Real-Time Prices Analysis: https://www.imarcgroup.com/chromium-pricing-report/requestsample

Note: The analysis…

Power Cable Manufacturing Plant DPR 2026: Investment Cost, Market Growth & ROI

Setting up a power cable manufacturing plant positions investors within one of the most infrastructure-critical and steadily expanding segments of the global electrical equipment industry, driven by rising electricity demand, rapid urbanization, and large-scale investments in transmission and distribution networks. Power cables are essential components in residential, commercial, industrial, and renewable energy projects, ensuring reliable and efficient electricity flow across grids and facilities.

As nations modernize aging infrastructure and expand…

Confectionery Manufacturing Plant DPR 2026: Investment Cost, Market Growth & ROI

Setting up a confectionery manufacturing plant positions investors within one of the most dynamic and consistently growing segments of the global food processing industry, supported by rising consumer demand for indulgent snacks, expanding urban populations, and increasing product innovation across chocolates, candies, gums, and baked sweets. Confectionery products benefit from strong brand loyalty, impulse purchasing behavior, and seasonal consumption patterns that sustain year-round sales.

As disposable incomes rise and retail…

PVC Blister Packaging Manufacturing Plant DPR 2026: CapEx/OpEx Analysis with Pro …

Setting up a PVC blister packaging manufacturing plant positions investors within one of the steadily expanding and functionality-driven segments of the global packaging industry, supported by rising demand from pharmaceuticals, consumer goods, electronics, and personal care sectors. PVC blister packs are widely preferred for their transparency, durability, tamper resistance, and ability to protect products from moisture and contamination. As retail markets grow and regulatory standards for product safety and labeling…

More Releases for Saudi

Saudi Wakala Offers Efficient and Reliable Saudi Visa Stamping Services

Saudi Wakala, a renowned agency specializing in Saudi visa stamping services, is proud to announce its commitment to providing swift and reliable visa processing for travelers to Saudi Arabia. Located in New Delhi, Saudi Wakala has established itself as a trusted partner for individuals and businesses requiring efficient visa stamping services.

Efficient Visa Processing

Understanding the complexities and time-sensitivity associated with visa stamping, Saudi Wakala offers a streamlined process managed by an…

saudi construction company,TOP saudi arabia construction companies list,civil co …

Abdul Ali Al-Ajmi Company

Advanced Support Company

Al Ashbelya Engineering

Al-Dour Engineering Contracting Est.

https://www.gdwatches.cn/

Free engineering construction consultation

Email:nolan@wholsale9.com

Alfanar

Arabian Tile Co. Ltd. (ARTIC)

Assad Said for Contracting Co Ltd

Automated Buildings Company

Bazy Trading and Contracting

Bin Dayel Contracting

Cercon

City Cement Company

Dar Al Majd

EG & G Middle East

East Consulting Engineering Center

El Seif Engineering Contracting Company

El Seif Engineering Contracting Company

Engineering Development Co for Contracting

FCC Company

https://www.gdwatches.cn/

Free engineering construction consultation

Email:nolan@wholsale9.com

Jones Engineering Group

Masar Consulting Engineer

Meinhardt Arabia

Mohammed M. Al Rashid Co. (MARCO)

Qureshi Telecom Contracting &…

Saudi Arabia Agriculture Market, Saudi Arabia Agriculture Industry, Saudi Arabia …

Saudi Arabia Agriculture is focussed on the spread of dates, dairy farm merchandise, eggs, fish, poultry, vegetables, and flowers to markets round the creation because it has attained its own potency within the production of such merchandise. The private sector additionally plays a role within the nation's agriculture, because the government offers long-term interest-free loans and inexpensive water, fuel, electricity, and duty-free imports of raw materials and machinery. Over the past…

Saudi Arabia Pharmaceutical Market | pharmaceutical companies in saudi arabia, p …

In order to study the various trends and patterns prevailing in the concerned market, Market Research Reports Search Engine (MRRSE) has included a new report titled “Saudi Arabia Pharmaceutical Market” to its wide online database. This research assessment offers a clear insight about the influential factors that are expected to transform the global market in the near future.

The report examines Saudi Arabia pharmaceutical market for the period 2016–2026. The primary…

Saudi Arabia Airport Privatization Sector Saudi Arabia Airport Sales Report 2022

For Report Sample Contact: neeraj@kuickresearch.com or +91-11-47067990

Report Table of Contents

Saudi Arabia Aviation Industry Overview

Privatization in Saudi Arabia

Saudi Arabia Civil Aviation Regulatory Authority

3.1 General Authority of Civil Aviation (GACA)

3.2 International Air Transport Association

Saudi…

Saudi Arabia Mutual Fund Sector Saudi Arabia Mutual Fund Sales Report 2022

For Report Sample Contact: neeraj@kuickresearch.com or +91-11-47067990

Report Table of Contents

1. Saudi Arabia Financial Sector Overview

2. Saudi Arabia Stock Market and Exchange Overview

3. Saudi Arabia Mutual Fund Market Overview

4. Saudi Arabia Mutual Fund Program and Managers

4.1 Fund Managers and Companies

4.2 Types of Mutual Funds

5. Saudi Arabia Mutual Fund Asset Allocation

5.1 Market Overview

5.2 Mutual Fund Market Indicators

…