Press release

Global Purpose-Driven Banking Industry Outlook 2025-2029: Market Set to Cross $111.7 Billion Milestone

"Use code ONLINE20 to get 20% off on global market reports and stay ahead of tariff changes, macro trends, and global economic shifts.How Large Will the Purpose-Driven Banking Market Size By 2025?

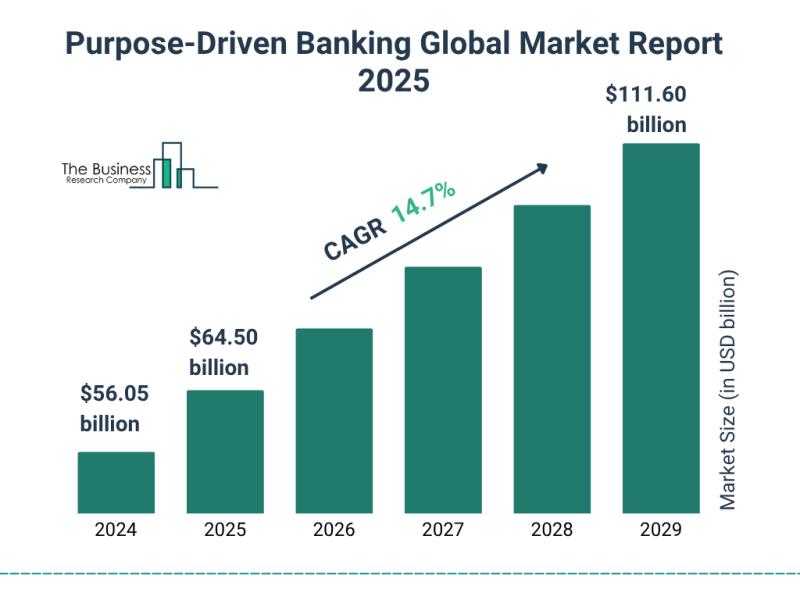

The sector dedicated to purpose-driven banking has experienced swift expansion recently, projected to increase its valuation from $56.05 billion in 2024 to $64.50 billion the following year, reflecting a compounded annual growth rate of 15.1%. This progression observed over the past period stems from several key factors, notably the escalating need for easily accessible banking functionalities, the wider uptake of digital platforms for banking via mobile and internet, governmental pushes toward broader financial access, consumers increasingly favoring tailored banking solutions, and the upward trend in the disposable income of the middle class.

How Big Is the Purpose-Driven Banking Market Size Expected to Grow by 2029?

The market centered around purpose-driven banking is projected to experience accelerated expansion in the forthcoming years, achieving a valuation of $111.60 billion by 2029, exhibiting a compound annual growth rate (CAGR) of 14.7%. This projected upswing throughout the forecast timeframe stems from several key factors: a heightened reliance on digital payment avenues and mobile wallet technologies, escalating banking needs within small and medium-sized enterprises (SMEs), the broader acceptance of open banking frameworks, a burgeoning requirement for environmentally conscious and sustainable financial offerings, alongside elevated customer demands for seamless, all-channel banking interactions. Significant developments anticipated during this period encompass breakthroughs in cloud-native retail banking platforms, enhancements in leveraging artificial intelligence (AI) to deliver tailored client services, the deeper embedding of AI and machine learning technologies across core banking functions, increased financial outlay toward fintech collaborations and alliances, and the continued evolution of open banking and open finance infrastructures.

View the full report here:

https://www.thebusinessresearchcompany.com/report/purpose-driven-banking-global-market-report

Which Key Market Drivers Powering Purpose-Driven Banking Market Expansion and Growth?

Forward momentum in the market focused on purpose-driven banking is anticipated, largely fueled by the escalating consumer preference for financial institutions that exhibit strong ethical commitment in their activities; this encompasses institutions demonstrating openness, social accountability, and dedication to moral principles throughout their business dealings. This surge in consumer desire for integrity within banking stems from society's rising expectations regarding corporate uprightness, especially within the financial sector, and purpose-driven finance caters directly to this by adopting explicit ethical guidelines, concentrating on sustainable investment approaches, and providing clear disclosures that resonate with client-held values; illustrating this trend, data from the Governance Institute of Australia, a professional body located in the UK, indicated that back in 2023, a notable 76 percent of adults considered ethical conduct in banking, finance, and insurance either important or extremely important, marking a two-point increase from the preceding year, thus confirming the expectation that greater consumer insistence on ethical financial services will act as an impetus for the expansion of purpose-driven banking.

Get your free sample here:

https://www.thebusinessresearchcompany.com/sample.aspx?id=29159&type=smp

Which Fast-Growing Trends Are Poised to Disrupt the Purpose-Driven Banking Market?

Leading financial institutions participating in the sector dedicated to purpose-driven banking are prioritizing cutting-edge developments, such as eco-friendly payment cards, aiming to deliver ecologically sound monetary offerings, deepen client interaction, and broaden their footprint within the expanding sphere of ethical finance. These environmentally conscious payment methods encompass debit, credit, or incentive cards fabricated from reclaimed resources, primarily intended to lessen plastic pollution without compromising standard operational capabilities. A prime illustration occurred in September 2025 when Bank Australia, a financial entity in Australia owned by its customers, rolled out a novel Visa debit card constituted entirely of recycled plastic, with a significant portion, 64 percent, gathered from seaside areas by Parley for the Oceans, an international ecological group. This particular card features several layers constructed from recycled polyethylene terephthalate (PET) and recycled polyethylene terephthalate glycol (rPETG), integrates tactile Braille markings to boost accessibility, and guarantees complete transparency regarding the origin of all constituent elements. Moreover than merely cutting down on plastic refuse, this card actively reinforces the bank's dedication to sustainability goals, such as achieving Benefit Corporation (B Corp) status and operating as a net-zero entity.

What Are the Emerging Segments in the Purpose-Driven Banking Market?

The purpose-driven bankingmarket covered in this report is segmented -

1) By Service Type: Retail Banking, Corporate Banking, Investment Banking, Wealth Management, Other Service Types

2) By Channel: Online Banking, Mobile Banking, Branch Banking, Other Channel Types

3) By Deployment Mode: On-Premises, Cloud-Based

4) By End-User: Individuals, Small And Medium Enterprises, Large Corporates, Non-Profit Organizations, Other End-User Types

Subsegments:

1) By Retail Banking: Savings Accounts, Current Accounts, Personal Loans, Mortgages, Credit Cards, Digital Banking Services, Microfinance Services

2) By Corporate Banking: Business Loans, Working Capital Financing, Cash Management Services, Trade Finance, Corporate Social Responsibility Financing, Sustainable Supply Chain Financing

3) By Investment Banking: Mergers And Acquisitions Advisory, Equity And Debt Underwriting, Sustainable Investment Advisory, Green Bond Issuance, Corporate Restructuring

4) By Wealth Management: Sustainable Investment Portfolios, Financial Planning, ESG-Focused Funds, Impact Investing, Retirement Planning, Philanthropic Advisory

5) By Other Service Types: Community Development Financing, Financial Inclusion Programs, Climate Financing, Educational Savings Programs, Social Impact Banking Initiatives

Tailor your insights and customize the full report here:

https://www.thebusinessresearchcompany.com/customise?id=29159&type=smp

Who Are the Global Leaders in the Purpose-Driven Banking Market?

Major companies operating in the purpose-driven banking market are Crédit Agricole S.A., DBS Bank Ltd., Svenska Handelsbanken AB (publ), Vancouver City Savings Credit Union, BancoSol S.A., Triodos Bank, Amalgamated Bank, Self-Help Credit Union, GLS Bank eG, Bank Australia Ltd., Sunrise Banks N.A., Oikocredit International, Beneficial State Bank, Ecology Building Society, RSF Social Finance, BlueOrchard Finance Ltd., Unity Trust Bank PLC, Charity Bank, Southern Bancorp Inc., EthikBank eG

Which are the Top Profitable Regional Markets for the Purpose-Driven Banking Industry?

Europe was the largest region in the purpose-driven banking market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the purpose-driven banking market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

Purchase the full report today:

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=29159

This Report Supports:

1.Business Leaders & Investors - To identify growth opportunities, assess risks, and guide strategic decisions.

2.Manufacturers & Suppliers - To understand market trends, customer demand, and competitive positioning.

3.Policy Makers & Regulators - To track industry developments and align regulatory frameworks.

4.Consultants & Analysts - To support market entry, expansion strategies, and client advisory work.

Connect with us on:

LinkedIn: https://in.linkedin.com/company/the-business-research-company,

Twitter: https://twitter.com/tbrc_info,

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ.

Contact Us

Saumya Sahey

Europe: +44 7882 955267,

Asia: +44 7882 955267 & +91 8897263534,

Americas: +1 310-496-7795

Email: saumyas@tbrc.info

Learn More About The Business Research Company

With over 15,000+ reports from 27 industries covering 60+ geographies, The Business Research Company has built a reputation for offering comprehensive, data-rich research and insights. Our flagship product, the Global Market Model delivers comprehensive and updated forecasts to support informed decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Global Purpose-Driven Banking Industry Outlook 2025-2029: Market Set to Cross $111.7 Billion Milestone here

News-ID: 4265212 • Views: …

More Releases from The Business research company

Leading Companies Fueling Growth and Innovation in the Sun Care Products Market

The sun care products market is on track for substantial expansion as consumer awareness about skin protection intensifies worldwide. With evolving preferences and technological advancements shaping product offerings, this sector is set to witness robust growth in the coming years. Let's explore the market's size projections, key players, emerging trends, and major segments driving its development through 2030.

Projected Size and Growth Trajectory of the Sun Care Products Market

The…

Future Perspectives: Key Trends Shaping the Styrene Butadiene Rubber (SBR) Based …

The styrene butadiene rubber (SBR) based adhesive market is on track for notable growth as we approach 2030. Driven by a variety of factors including expanding infrastructure projects and rising demand across multiple industries, this sector is poised for steady expansion. Let's explore the market's size projections, key players, emerging trends, and the main segments shaping its future.

Projected Growth and Market Size of Styrene Butadiene Rubber Based Adhesives

The…

Emerging Sub-Segments Transforming the Stearic Acid Market Landscape

The stearic acid market is poised for significant expansion in the coming years, driven by evolving demand across various industries. This report explores the projected market size, leading companies, key trends, and segment analysis shaping the future of this vital chemical.

Stearic Acid Market Size and Growth Outlook

The stearic acid market is set to grow robustly, reaching a valuation of $54.63 billion by 2030. This represents a compound annual…

Market Trend Insights: The Impact of Recent Innovations on the Specialty Pestici …

The specialty pesticides sector is on the verge of significant expansion as global agricultural practices continue to evolve. Driven by increasing demand for crop protection and sustainable farming techniques, this market is set to experience robust growth in the coming years. Let's explore the market's anticipated value, leading companies, emerging trends, and detailed segmentation to gain a comprehensive understanding of this dynamic industry.

Projected Market Size and Growth Expectations for Specialty…

More Releases for Bank

Mortgage-Backed Security Market 2022: Industry Manufacturers Forecasts- Construc …

The Mortgage-Backed Security research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Mortgage-Backed Security market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers formulate effective…

Doorstep Banking Services Market Challenges and Opportunities in Banking Service …

Doorstep banking is a facility provided so that user don't have to visit bank branches for routine banking activities like cash deposit, cash withdrawal, cheque deposit, or making a demand draft. The bank extends these facilities at user work place by appointing a service provider on your behalf.

This service was earlier available only to senior citizens but it is available to everyone with nominal fee charges, depending on the type…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank of …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance,…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank o …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance, regulatory, and other…