Press release

3D Secure Payment Authentication Market Forecast 2025-2032: Strong Growth Driven by Digital Payment Security

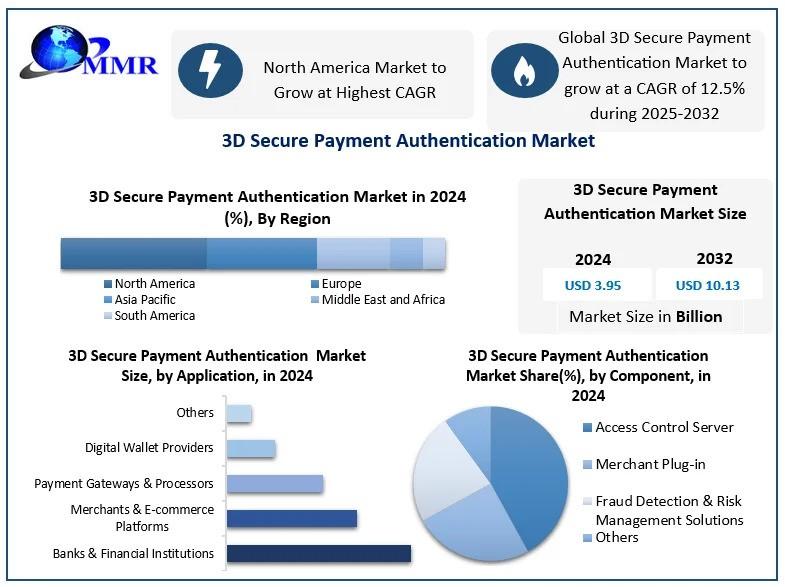

3D Secure Payment Authentication market Size was valued at USD 3.95 billion in 2024. The market is expected to reach USD 10.13 billion by 2032, exhibiting a compound annual growth rate (CAGR) of 12.5 % from 2025 to 2032.3D Secure Payment Authentication Market Overview:

The 3D Secure Payment Authentication Market is revolutionizing digital transactions by enhancing online payment security and reducing fraudulent activities. This protocol, developed by major card networks like Visa, Mastercard, and American Express, provides an additional verification step during online purchases, ensuring that the transaction is authorized by the legitimate cardholder. As global e-commerce continues to expand, 3D Secure (3DS) has become a critical component in safeguarding customer trust and minimizing cyber threats. Businesses are increasingly adopting 3DS 2.0, which offers a frictionless authentication experience with minimal transaction delays. It leverages advanced technologies such as biometrics, artificial intelligence, and risk-based authentication to improve both user experience and fraud prevention. With the growing shift toward digital payments, the 3D Secure Payment Authentication Market plays a vital role in maintaining the balance between convenience and security in today's rapidly evolving financial ecosystem.

Download a Free Sample Report Today: https://www.maximizemarketresearch.com/request-sample/281250/

3D Secure Payment Authentication Market Outlook and Future Trends:

The outlook for the 3D Secure Payment Authentication Market is highly promising, driven by rising online shopping activities, digital banking expansion, and the growing adoption of contactless payments. Future trends highlight the increasing deployment of 3DS 2.0 and the upcoming 3DS 2.3 protocol, which further enhances interoperability, mobile optimization, and real-time decision-making for smoother transactions. The integration of artificial intelligence and behavioral analytics is expected to enable more dynamic risk assessment, reducing false declines while ensuring robust protection against fraud. Moreover, regulatory frameworks such as the Payment Services Directive 2 (PSD2) in Europe are accelerating the adoption of strong customer authentication methods worldwide. As financial institutions and merchants seek to enhance user trust and compliance, 3D Secure technology will continue evolving to deliver seamless, secure, and personalized payment authentication experiences across multiple digital platforms and devices globally.

3D Secure Payment Authentication Market Dynamics:

The market dynamics of the 3D Secure Payment Authentication industry are influenced by several drivers, restraints, and emerging opportunities. Key drivers include the exponential growth in online transactions, increased fraud attempts, and regulatory emphasis on strong customer authentication. Financial institutions and merchants are actively adopting 3DS to mitigate chargebacks and protect brand reputation. However, challenges such as implementation complexity, user friction in legacy 3DS versions, and interoperability issues across platforms can hinder adoption rates. The introduction of 3DS 2.0 has addressed many of these concerns by offering improved data exchange between merchants and issuers for better risk assessment. Additionally, partnerships between payment gateways, fintech firms, and card networks are fostering innovation and enhancing transaction efficiency. As the digital payment landscape matures, the market is witnessing a shift toward real-time fraud detection, adaptive authentication, and mobile-first experiences that strengthen security without compromising convenience.

3D Secure Payment Authentication Market Key Recent Developments:

Recent developments in the 3D Secure Payment Authentication Market highlight rapid technological advancements and strategic collaborations among industry players. Major card networks have introduced upgrades like 3DS 2.3 to support emerging technologies such as digital wallets, IoT payments, and biometric authentication. Payment service providers are integrating machine learning algorithms to enable intelligent risk-based decision-making, ensuring smoother authentication for low-risk transactions. Additionally, fintech companies are collaborating with banks to implement APIs that enhance authentication transparency and interoperability. Governments and regulatory bodies are also tightening compliance frameworks to ensure consumer data protection and transaction integrity. The growing use of tokenization and encryption technologies further strengthens security in online transactions. With rising global awareness about cyber threats and the increasing preference for cashless payments, these advancements collectively position the 3D Secure Payment Authentication Market for sustainable growth and technological evolution over the coming decade.

To Gain More Insights into the Market Analysis, Browse Summary of the Research Report: https://www.maximizemarketresearch.com/request-sample/281250/

3D Secure Payment Authentication Market Segmentation:

by Component

Access Control Server

Merchant Plug-in

Fraud Detection & Risk Management Solutions

Others

by Application

Banks & Financial Institutions

Merchants & E-commerce Platforms

Payment Gateways & Processors

Digital Wallet Providers

Others

Some of the current players in the 3D Secure Payment Authentication Market are:

North America

1. Broadcom Inc. [United States]

2. Mastercard [New York]

3. Visa Inc. [United States]

4. EMVCo [United States]

5. American Express Company / American Express [New York]

6. RSA Security LLC [United States]

7. Entrust Corporation [United States]

8. SISA Information Security Inc. [United States]

9. Stripe [United States]

10. CyberSource [United States]

11. Braintree by PayPal Holdings, Inc. [United States]

12. Cardknox Development, Inc. [United States]

13. Discover Financial Services [United States]

14. Fiserv, Inc. [United States]

15. Shift4 Payments, LLC [United States]

16. Marqeta, Inc. [United States]

Europe

17. Thales Group [France]

18. DECTA Limited [London]

19. Netcetera [Switzerland]

20. Asseco Group [Poland]

21. Checkout.com Group [U.K.]

22. Ravelin Technology Ltd [U.K.]

23. Pay.com Group [U.K.]

24. SIA S.p.A [Italy]

Asia Pacific

25. AsiaPay Limited [Hong Kong]

26. RS Software [India]

South America

27. Modirum (Brazil)

28. Other Players

For additional reports on related topics, visit our website:

♦ Knowledge Process Outsourcing Market https://www.maximizemarketresearch.com/market-report/knowledge-process-outsourcing-market/187554/

♦ Global Industrial Vending Machine Market https://www.maximizemarketresearch.com/market-report/global-industrial-vending-machine-market/31293/

♦ Crypto Asset Management Market https://www.maximizemarketresearch.com/market-report/global-crypto-asset-management-market/27361/

♦ Femtocell Market https://www.maximizemarketresearch.com/market-report/global-femtocell-market/13100/

♦ Global Project Portfolio Management Market https://www.maximizemarketresearch.com/market-report/project-portfolio-management-market/79564/

Contact Maximize Market Research:

3rd Floor, Navale IT Park, Phase 2

Pune Banglore Highway, Narhe,

Pune, Maharashtra 411041, India

sales@maximizemarketresearch.com

Maximize Market Research is a multifaceted market research and consulting company with professionals from several industries. Some of the industries we cover include medical devices, pharmaceutical manufacturers, science and engineering, electronic components, industrial equipment, technology and communication, cars and automobiles, chemical products and substances, general merchandise, beverages, personal care, and automated systems. To mention a few, we provide market-verified industry estimations, technical trend analysis, crucial market research, strategic advice, competition analysis, production and demand analysis, and client impact studies.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release 3D Secure Payment Authentication Market Forecast 2025-2032: Strong Growth Driven by Digital Payment Security here

News-ID: 4265114 • Views: …

More Releases from MAXIMIZE MARKET RESEARCH PVT. LTD.

Ready-to-Drink Beverages Market Size to Reach USD 1,227.81 Billion by 2032

Ready-to-Drink Beverages Market is poised for substantial growth over the forecast period, driven by changing consumer lifestyles, rising disposable income, expanding urbanization, and increasing demand for convenient beverage solutions. According to recent industry analysis, the global Ready-to-Drink Beverages Market was valued at USD 766.69 Billion in 2024 and is projected to grow at a compound annual growth rate (CAGR) of 6.22% from 2025 to 2032, reaching nearly USD 1,227.81 Billion…

Second hand Product Market Set to Surpass USD 1451.34 Billion by 2032, Expanding …

Second hand Product Market was valued at USD 594.45 Billion in 2025 and is projected to grow at a robust CAGR of 13.6% from 2025 to 2032, reaching nearly USD 1451.34 Billion by 2032. The rapid expansion of resale ecosystems, increasing consumer preference for cost-effective purchasing, and rising sustainability awareness are significantly driving the growth of the Second hand Product Market globally.

Market Overview

The Second hand Product Market is undergoing a…

Tungsten Market to Reach USD 10.99 Billion by 2032, Driven by Expanding Aerospac …

The Global Tungsten Market is poised for significant expansion over the coming years, with the market size valued at USD 6.41 Billion in 2025 and projected to grow at a CAGR of 8% from 2025 to 2032, reaching nearly USD 10.99 Billion by 2032. Rising industrial demand, technological advancements in material science, and increasing applications in high-performance sectors are collectively driving this steady growth trajectory.

Tungsten, recognized for its exceptional hardness,…

System-on-Chip (SoC) Market to Reach USD 391.61 Billion by 2032, Driven by 5G, A …

The global System-on-Chip (SoC) Market is poised for significant growth over the forecast period, reflecting the rapid evolution of semiconductor technologies and increasing demand for high-performance, energy-efficient electronic devices. Valued at USD 228.06 Billion in 2025, the market is projected to grow at a CAGR of 8.03% from 2025 to 2032, reaching nearly USD 391.61 Billion by 2032.

♦ Request a Free Sample Copy or View Report Summary:https://www.maximizemarketresearch.com/request-sample/33954/

System-on-Chip (SoC) Market Overview

A…

More Releases for Pay

Mobile Payment Market to See Thriving Worldwide| Apple Pay • Google Pay • Sa …

Latest Report, titled Mobile Payment Market 2025-2032 Trends, Share, Size, Growth, Opportunity and Forecast 2025-2032, by Coherent Market Insights offers a comprehensive analysis of the industry, which comprises insights on the market analysis. As part of our Black Friday Limited-Time Discount, this premium research report is now available at up to 60% off, offering an exceptional opportunity for businesses, analysts, and stakeholders to access high-value insights at a significantly reduced…

Proximity Payment Market is Going to Boom | Major Giants Apple Pay, Google Pay, …

HTF MI just released the Global Proximity Payment Market Study, a comprehensive analysis of the market that spans more than 143+ pages and describes the product and industry scope as well as the market prognosis and status for 2025-2032. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.

𝐌𝐚𝐣𝐨𝐫 Giants in Proximity Payment Market are:

Apple Pay, Google Pay, Samsung…

Mobile Wallet (NFC, Digital Wallet) Market to Witness Stunning Growth | Apple Pa …

HTF MI recently introduced Global Mobile Wallet (NFC, Digital Wallet) Market study with 143+ pages in-depth overview, describing about the Product / Industry Scope and elaborates market outlook and status (2024-2032). The market Study is segmented by key regions which is accelerating the marketization. At present, the market is developing its presence. Some key players from the complete study are Apple Pay, Google Pay, Samsung Pay, PayPal, Alipay, WeChat Pay,…

Unified Payments Interface (UPI) Market Is Booming Worldwide | Google Pay, Amazo …

The latest study released on the Global Unified Payments Interface (UPI) Market by AMA Research evaluates market size, trend, and forecast to 2028. The Unified Payments Interface (UPI) market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about…

Unified Payments Interface (UPI) Market May See a Big Move | Major Giants Samsun …

The latest study released on the Global Unified Payments Interface (UPI) Market by AMA Research evaluates market size, trend, and forecast to 2027. The Unified Payments Interface (UPI) market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about…

Samsung Pay Market is Booming Worldwide with Samsung Pay, Apple Pay, Google Pay

HTF Market Intelligence released a new research report of 23 pages on title 'Samsung Pay - Competitor Profile' with detailed analysis, forecast and strategies. The study covers key regions that includes North America, LATAM, United States, GCC, Southeast Asia, Europe, APAC, United Kingdom, India or China etc and important players such as Samsung Pay, Apple Pay, Google Pay, Alipay, Tenpay, Samsung Electronics, Visa, Mastercard.

Request a sample report @ https://www.htfmarketreport.com/sample-report/3587660-samsung-pay-competitor-profile

Summary

Samsung…