Press release

Indonesia Car Rental Market Size, Share, Growth Insights, Trends Analysis & Report 2025-2033

According to the latest report by IMARC Group, titled "Indonesia Car Rental Market Report by Booking Type (Online, Offline), Rental Duration (Short-Term, Long-Term), Application Type (Tourism, Commuting), and Region 2024-2032," the report presents a thorough review featuring the Indonesia Car Rental Market growth, share, trends, and research of the industry.Market Size & Future Growth Potential:

The Indonesia car rental market size reached USD 3,090.47 Million in 2024 and expects the market to reach USD 10,081.84 Million by 2033, exhibiting a growth rate (CAGR) of 14% during 2025-2033.

Indonesia Car Rental Market Trends:

The Indonesia car rental market is experiencing remarkable transformation driven by the country's booming tourism industry and rapid digital adoption. Indonesia welcomed approximately 13.9 million international visitors in 2024, with the government targeting between 14.6 and 16 million foreign tourists for 2025. Bali alone recorded 6,333,360 foreign tourist arrivals in 2024, representing a substantial 20.10% increase from the previous year. This surge in tourism is directly fueling demand for flexible transportation options, particularly in popular destinations like Bali, Jakarta, and Yogyakarta.

The digital revolution is reshaping how Indonesians book car rentals. Online booking platforms now dominate the market, accounting for approximately 69.33% of revenue in 2024. Smartphone penetration and the rise of super-apps integrating trip planning, mapping, and digital wallets have made online reservations the preferred choice for both domestic and international travelers. Companies like TRAC have strengthened their digital presence, offering seamless online booking, payment processing, and order tracking without requiring physical visits to rental offices.

Corporate leasing and long-term rental services are gaining significant momentum as businesses increasingly view vehicle leasing as a cost-effective alternative to ownership. In 2023, Grab launched its innovative Sahabat Sejati car rental initiative, enabling drivers to rent vehicles with the opportunity to gain ownership after five years. This program addresses growing demand for long-term leasing while expanding access to ride-hailing opportunities across Indonesia. Meanwhile, in April 2023, Super Bank Indonesia partnered with PT Teknologi Pengangkutan Indonesia (TPI) to provide financing for over 1,000 additional vehicles for GrabCar drivers, demonstrating the expanding intersection between fintech and mobility services.

The shift toward sustainable mobility is accelerating throughout Indonesia's car rental sector. Following the Indonesian Ministry of Finance's removal of luxury tax on electric vehicles for 2024 and waiver of import tax until 2025, rental companies are rapidly expanding their EV fleets. Bluebird Group reached 300 electric vehicles by the end of 2024 and announced plans to double or triple this number by the end of 2025. The company's Goldenbird car rental division now offers electric vehicles from BYD, Denza, and Hyundai IONIQ. In a major development for the region, Grab committed to integrating over 1,000 BYD electric vehicles into its Indonesian fleet by end of 2024, complementing its existing fleet of more than 10,000 two- and four-wheeled electric vehicles.

Digital service platforms continue to reshape the competitive landscape. In February 2024, Sejasa introduced comprehensive car rental services with drivers, allowing customers to select vehicle types and rental durations with convenient online payment options. This reflects the broader industry trend toward AI-driven pricing, real-time vehicle tracking, and contactless payment solutions that enhance customer experience and operational efficiency.

Request Free Sample Report: https://www.imarcgroup.com/indonesia-car-rental-market/requestsample

Indonesia Car Rental Market Scope and Growth Factors:

The scope of Indonesia's car rental market is expanding rapidly as urbanization, infrastructure development, and changing mobility preferences reshape transportation patterns across the archipelago. The market benefits from Indonesia's position as one of Asia-Pacific's most visited international destinations, with domestic tourism recording over 1 billion trips in 2024, demonstrating strong recovery to pre-pandemic levels.

Government infrastructure investments are creating new opportunities for car rental services. Significant capital has been directed toward airport expansions in Komodo, Lombok, and other regional destinations as part of the "10 New Balis" initiative, increasing seat capacity and dispersing travel flows beyond Java. These infrastructure improvements are directly supporting growth in airport car rentals and intercity transport services. According to the World Travel & Tourism Council, the tourism sector is projected to contribute 4.6% to Indonesia's GDP in 2025.

Low vehicle ownership rates continue to drive car rental adoption. Indonesian Ministry of Industry data indicates that only approximately 99 out of every 1,000 individuals own a car, creating substantial demand for rental alternatives. This is particularly evident in urban centers where parking costs, vehicle maintenance expenses, and traffic congestion make ownership increasingly impractical. Jakarta, as the nation's largest metropolitan area, exemplifies this trend with room occupancy rates at classified hotels reaching 52.69%, significantly higher than many other Indonesian cities and indicating strong business travel demand.

The corporate mobility segment is experiencing robust growth as companies seek flexible fleet management solutions. Operating leases transfer maintenance, depreciation, and compliance burdens to service providers, offering predictable monthly costs without the capital investment of vehicle ownership. This model appeals particularly to multinational corporations, expatriates, and expanding businesses requiring scalable transportation solutions.

Indonesia's growing population of 277 million in 2023, up from 275 million in 2022 and 273 million in 2021 according to World Bank data, provides a substantial consumer base for rental services. Rising disposable incomes and strengthening infrastructure facilities, including improved internet connectivity, create favorable conditions for online car rental service providers to expand their reach across both urban and rural markets.

The regulatory environment is becoming increasingly supportive of market growth. Beyond EV tax incentives, the government has shown commitment to developing charging infrastructure, with national plans targeting 600,000 battery electric vehicles and 2.45 million electric two-wheelers by 2030, supported by 846 car charging stations and 1,401 battery-swap depots for motorcycles. Rental agencies introducing EVs gain access to preferential parking and bus-lane exemptions in Jakarta, providing competitive advantages.

Technological innovation continues to redefine service delivery. Fleet operators are deploying IoT devices for predictive maintenance and geofencing, reducing downtime by up to 15%. AI-driven yield management systems adjust rates hourly based on search traffic, seasonality, and competitor pricing, optimizing revenue across different demand scenarios. The availability of navigation apps like Google Maps and Waze has made self-drive rentals more accessible to international tourists who previously relied exclusively on chauffeur-driven services.

Indonesia Car Rental Market Report Highlights & Segmentation Analysis:

The market report offers a comprehensive analysis of the segments, highlighting those with the largest Indonesia Car Rental Market Share. It includes forecasts for the period 2025-2033 and historical data from 2019-2024 for the following segments.

Segmentation by Booking Type:

• Online

• Offline

Segmentation by Rental Duration:

• Short-Term

• Long-Term

Segmentation by Application Type:

• Tourism

• Commuting

Segmentation by Region:

• Java

• Sumatra

• Kalimantan

• Sulawesi

• Others

Get Instant Access to the Full Report Now: https://www.imarcgroup.com/checkout?id=14138&method=1200

Competitor Landscape:

The report offers an in-depth examination of the competitive landscape. It includes a thorough competitive analysis encompassing market structure, key player positioning, leading strategies for success, a competitive dashboard, and a company evaluation quadrant.

Recent News and Developments:

• January 2025: BYD announced an agreement to supply 50,000 vehicles to Grab's ride-hailing service across Southeast Asia, including Indonesia, Malaysia, Philippines, Singapore, Thailand, and Vietnam. The partnership includes models such as Denza D9, Atto 3 (Yuan Plus), Seal, and M6, with competitive preferential pricing and extended battery warranty services for Grab's fleet partners and cooperative drivers.

• December 2024: The Indonesian government announced plans to provide tax incentives to manufacturers including China's BYD and GAC Aion, and France's Citroën, aimed at strengthening electric vehicle production and sales in the country's growing EV market.

• November 2024: Bluebird Group's president director announced intentions to grow the company's EV fleet to 10% within the next three to five years, with public charging stations supporting expansion efforts. The company plans to increase its EV fleet from 300 units at end of 2024 to double or triple that amount by end of 2025.

• August 2024: Grab expanded its Indonesian fleet by integrating over 1,000 BYD electric vehicles, including the newly launched BYD M6 electric multipurpose van designed specifically for the Indonesian market. This addition complemented Grab's existing fleet of more than 10,000 two- and four-wheeled electric vehicles.

• April 2024: VinFast introduced battery rental services in Indonesia to address concerns about battery durability and health, providing customers with a convenient and worry-free electric vehicle ownership experience.

• April 2023: Super Bank Indonesia, supported by Grab, agreed to provide financing to PT Teknologi Pengangkutan Indonesia (TPI) for the purchase of over 1,000 additional cars for GrabCar drivers to rent, as part of a larger initiative to improve driver access to loans and financial services.

• February 2024: Sejasa introduced comprehensive car rental services with drivers, enabling customers to choose vehicle types and rental durations with online payment options, enhancing convenience for users seeking chauffeur-driven services.

• February 2024: Indonesia's Ministry of Finance announced the removal of luxury tax on electric vehicles for 2024 and waived import tax until 2025, significantly reducing EV prices and accelerating adoption in the rental market.

• 2023: Grab launched the Sahabat Sejati car rental initiative, supporting long-term leasing demand by enabling drivers to rent vehicles with the option to gain ownership after five years, expanding opportunities in the ride-hailing sector.

Contact Our Analysts for Brochure Requests, Customization, and Inquiries Before Purchase: https://www.imarcgroup.com/request?type=report&id=14138&flag=C

Key highlights of the Report:

• Historical Market Performance

• Future Market Projections

• Impact of COVID-19 on Market Dynamics

• Industry Competitive Analysis (Porter's Five Forces)

• Market Dynamics and Growth Drivers

• SWOT Analysis (Strengths, Weaknesses, Opportunities, Threats)

• Market Ecosystem and Value Creation Framework

• Competitive Positioning and Benchmarking Strategies

Major Advantages of the Report:

• This report provides market leaders and new entrants with accurate revenue estimates for the overall market and its key subsegments.

• Stakeholders can leverage this report to gain a deeper understanding of the competitive landscape, enabling them to strategically position their businesses and develop effective go-to-market strategies.

• The report provides stakeholders with valuable insights into the market dynamics, offering a comprehensive analysis of key drivers, restraints, challenges, and opportunities.

Why Choose IMARC Group:

• Extensive Industry Expertise

• Robust Research Methodology

• Insightful Data-Driven Analysis

• Precise Forecasting Capabilities

• Established Track Record of Success

• Reach with an Extensive Network

• Tailored Solutions to Meet Client Needs

• Commitment to Strong Client Relationships and Focus

• Timely Project Delivery

• Cost-Effective Service Options

Explore More Research Reports & Get Your Free Sample Now:

Indian Online Grocery Market Report: https://www.imarcgroup.com/indian-online-grocery-market/requestsample

India E-commerce Market Report: https://www.imarcgroup.com/india-e-commerce-market/requestsample

https://medium.com/@bhumika692003/india-mobile-gaming-market-size-2025-share-growth-insights-trends-industry-report-2033-da777b376dfb

Note: Should you require specific information not included in the current report, we are pleased to offer customization options to meet your needs.

Contact US

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: Sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

Americas: +1-201971-6302 | Africa and Europe: +44-702-409-7331

About Us

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC's information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company's expertise.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Indonesia Car Rental Market Size, Share, Growth Insights, Trends Analysis & Report 2025-2033 here

News-ID: 4263627 • Views: …

More Releases from IMARC Group

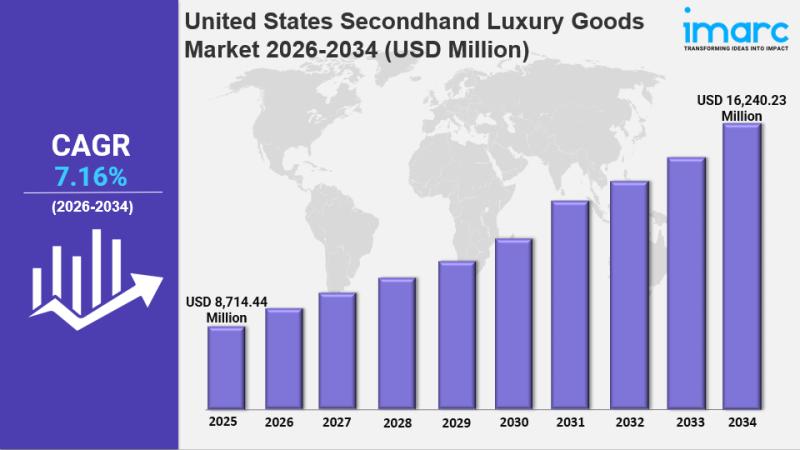

United States Secondhand Luxury Goods Market Size, Trends, Growth and Forecast 2 …

IMARC Group has recently released a new research study titled "United States Secondhand Luxury Goods Market Size, Share, Trends and Forecast by Product Type, Demography, Distribution Channel, and Region, 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

The United States secondhand luxury goods market was valued at USD 8,714.44 Million in 2025 and is…

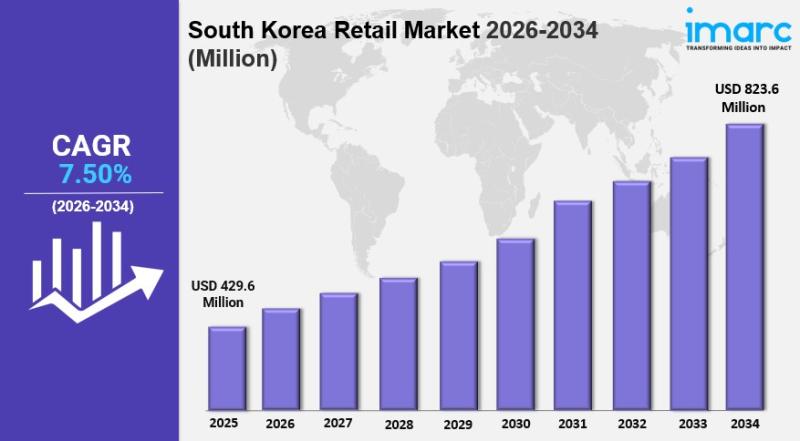

South Korea Retail Market Size Growth, Share Trends & Industry Demand 2026-2034

IMARC Group has recently released a new research study titled "South Korea Retail Market Report by Product Type (Food, Beverage, and Tobacco Products, Personal Care and Household, Apparel, Footwear, and Accessories, Furniture, Toys, and Hobby, Industrial and Automotive, Electronic and Household Appliances, Pharmaceuticals, Luxury Goods, and Others), Distribution Channel (Hypermarkets and Supermarkets, Convenience Stores, Department Stores, Specialty Stores, Online, and Others), and Region 2026-2034", offers a detailed analysis of the…

Wood Pellet Market Insights 2026-2034: Feedstock Evolution, Application Expansio …

The global Wood Pellet Market was valued at USD 14.8 Billion in 2025 and is expected to reach USD 23.3 Billion by 2034. The market is projected to grow at a CAGR of 5.20% during 2026-2034, driven by increasing demand for renewable energy, government incentives, advancements in pellet production technology, and environmental concerns promoting carbon neutrality.

STUDY ASSUMPTION YEARS

Base Year: 2025

Historical Year/Period: 2020-2024

Forecast Year/Period: 2026-2034

WOOD PELLET MARKET KEY TAKEAWAYS

Current Market Size:…

Agricultural Chelates Market Size, Share & Growth by Type, Crop, Application and …

The global agricultural chelates market reached a value of USD 750.8 million in 2024 and is projected to grow to USD 1,222.6 million by 2033. It is forecasted to expand at a CAGR of 5.57% during the period 2025-2033. Growth is driven by the demand for high-efficiency fertilizers, increasing awareness of sustainable farming practices, and technological advancements.

Study Assumption Years

Base Year: 2024

Historical Year/Period: 2019-2024

Forecast Year/Period: 2025-2033

Agricultural Chelates Market Key Takeaways

The…

More Releases for Indonesia

Indonesia Facility Management Market Size, Trends 2031 By Key Players- Sodexo, I …

Indonesia Facility Management Market Growth Factors

Market conditions reflect evolving infrastructure and service expectations. Urbanization accelerates demand as commercial buildings, transport hubs, and mixed use developments require integrated services. Regulatory compliance strengthens outsourcing through safety standards, sustainability mandates, and reporting requirements. Technology integration improves efficiency using sensors, analytics, and automated maintenance scheduling. Current challenges include skilled labor shortages, fragmented vendor ecosystems, and cost sensitivity among clients. Market scope for 2026 includes…

Indonesia Oil and Gas Market Size, Share Projections 2031 by Key Manufacturer- P …

USA, New Jersey: According to Verified Market Research analysis, the global Indonesia Oil and Gas Market size was valued at USD 281.50 Billion in 2024 and is projected to reach USD 499.94 Billion by 2032, growing at a CAGR of 7.66% during the forecast period 2026-2032.

What is the current outlook and growth potential of the Indonesia Oil and Gas Market?

The Indonesia Oil and Gas Market is showing signs of gradual…

Indonesia Amino Acid Fertilizer Market Anticipated for Positive Growth by 2031 | …

Indonesia Amino Acid Fertilizer Market Research Report By DataM Intelligence: A comprehensive analysis of current and emerging trends provides clarity on the dynamics of the Indonesia Amino Acid Fertilizer market. The report employs Porter's Five Forces model to assess key factors such as the influence of suppliers and customers, risks posed by different entities, competitive intensity, and the potential of emerging entrepreneurs, offering valuable insights. Additionally, the report presents research…

Overview of Indonesia MICE Market | SHIFTinc, Venuerific Indonesia, Werkudara Gr …

Astute Analytica, a leading provider of market research and analysis, released its highly anticipated Market Analysis Report on the Indonesia MICE Market. This comprehensive report aims to equip businesses with invaluable insights and data, enabling them to make informed decisions and stay one step ahead of the competition.

Access the Comprehensive PDF Market Research Analysis Report Here: https://www.astuteanalytica.com/request-sample/indonesia-mice-market

Indonesia MICE Market was valued at US$ 2,095.95 million in 2022 and is…

Clinical Laboratory Market in Indonesia, Clinical Laboratory Industry in Indones …

"Increase in healthcare expenditure from the Indonesian government has driven the growth of clinical laboratory market in Indonesia."

Increase in Healthcare Awareness: Largely driven by increase in healthcare spending by aging population (~$ 260 per person by 2050), rising income levels, rising awareness for preventive testing, advanced healthcare diagnostic tests offerings, and central government's healthcare measures.

Developments in Testing and Preference for Evidence based testing: There is also a rising number…

Baby Food Sector in Indonesia Market 2019 By PT Nestlé Indonesia, Danone, PT Ka …

"The Baby Food Sector in Indonesia, 2018", is an analytical report by GlobalData which provides extensive and highly detailed current and future market trends in the Indonesian market.

Dietary habits have inhibited sales of commercially prepared baby foods in Indonesia. With the exception of Jakarta, many Indonesians have a traditional diet, based on rice, fresh fruit, and vegetables, supplemented with meat, although, 80% of the population is Muslim, and do not…