Press release

India Over The Top (OTT) Market Share, Size, Industry Trends, Growth Rate & Forecast Report 2025-2033

According to the latest report by IMARC Group, titled "India Over The Top (OTT) Market Report by Component (Solution, Services), Platform Type (Smartphones, Smart TV's, Laptops, Desktops and Tablets, Gaming Consoles, Set-Top Boxes, and Others), Deployment Type (Cloud, On-Premise), Content Type (Voice over IP, Text and Images, Video, and Others), Revenue Model (Subscription, Procurement, Rental, and Others), Service Type (Consulting, Installation and Maintenance, Training and Support, Managed Services), Vertical (Media & Entertainment, Education & Training, Health & Fitness, IT & Telecom, E-Commerce, BFSI, Government, and Others), and Region 2025-2033," the report presents a thorough review featuring the India Over The Top (OTT) Market growth, share, trends, and research of the industry.Market Size & Future Growth Potential:

The India over the top (OTT) market size reached USD 4.5 Billion in 2024 and expects the market to reach USD 27.2 Billion by 2033, exhibiting a growth rate (CAGR) of 19.7% during 2025-2033.

Latest Market Trends:

The market is experiencing remarkable expansion driven by several transformative factors that are reshaping how Indians consume digital content. The surge in affordable high-speed internet connectivity, particularly with widespread 4G penetration reaching over 700 million active users and the rapid rollout of 5G services across major cities, has fundamentally changed content consumption patterns. This digital infrastructure boom has made streaming accessible even in tier-2 and tier-3 cities, opening massive untapped markets for OTT platforms.

Regional language content has emerged as a game-changing trend, with platforms aggressively investing in vernacular programming across Hindi, Tamil, Telugu, Kannada, Malayalam, Bengali, and other languages. This localization strategy has proven highly effective, as regional content consumption is projected to overtake Hindi and English streaming, enabling platforms to penetrate deeper into India's diverse linguistic markets and attract subscribers from smaller towns and rural areas where traditional cable TV once dominated.

The transformation of revenue models marks another significant shift in the industry landscape. Platforms are increasingly adopting hybrid approaches that combine subscription-based premium content with advertisement-supported free streaming (AVOD), making quality entertainment accessible to price-sensitive consumers. Following the success of platforms offering free IPL streaming and premium Hollywood content with advertisements, this freemium model has become the new standard, allowing platforms to maximize reach while maintaining multiple revenue streams through both subscriptions and advertising.

Strategic partnerships between OTT platforms and telecom operators have created powerful distribution channels, with bundled offerings making subscriptions more affordable and accessible. The integration of OTT services into mobile and broadband packages has significantly reduced acquisition costs while providing consumers with value-added entertainment options. Additionally, platforms are leveraging artificial intelligence for personalized content recommendations and investing heavily in original productions to differentiate themselves in an increasingly crowded marketplace.

Request Free Sample Report: https://www.imarcgroup.com/india-over-the-top-market/requestsample

Market Scope and Growth Factors:

The scope of the India OTT market is expanding dramatically as digital entertainment becomes mainstream across urban and rural demographics. The market is witnessing unprecedented growth fueled by the convergence of multiple factors including the smartphone revolution, with over 600 million smartphone users providing a massive addressable market for mobile-first content consumption. Smart TV penetration is accelerating rapidly, with consumers increasingly viewing streaming content on larger screens, enhancing the premium viewing experience and driving subscription upgrades.

The market is benefiting significantly from favorable government initiatives supporting digital infrastructure development. The Digital India program has facilitated improved internet connectivity nationwide, while the rollout of BharatNet is bringing broadband to rural areas, expanding the potential consumer base exponentially. The recent 5G spectrum auctions and aggressive network deployments by major telecom operators are further enhancing streaming quality and accessibility, enabling seamless delivery of high-definition and 4K content.

Content diversification is driving sustained growth, with platforms producing extensive libraries of original series, films, and documentaries tailored to Indian sensibilities. Sports content, particularly cricket with events like the Indian Premier League (IPL), continues to be a major subscriber acquisition tool, with exclusive broadcasting rights commanding premium valuations. The integration of live events, concerts, and interactive content formats is creating new engagement opportunities.

The evolving competitive dynamics, marked by major industry consolidations including the landmark merger of JioCinema and Disney+ Hotstar forming JioHotstar, are reshaping market structures. This consolidation brings together extensive content libraries, combining over 300,000 hours of programming and 120 television channels, creating an entertainment powerhouse with an estimated combined user base exceeding 500 million. These strategic mergers are enabling platforms to achieve operational efficiencies, negotiate better content deals, and offer more comprehensive entertainment packages to consumers.

Additionally, the growing adoption of connected devices including gaming consoles, set-top boxes, and IoT-enabled screens is expanding consumption touchpoints. The market is also witnessing increased investor confidence, with substantial capital flowing into content production, technology infrastructure, and platform innovations. As consumer habits continue evolving toward on-demand, personalized entertainment experiences, the India OTT market is positioned for sustained expansion and innovation throughout the forecast period.

Recent News and Developments:

• JioHotstar Merger (February 2025): Reliance Industries and The Walt Disney Company completed their landmark merger, combining JioCinema and Disney+ Hotstar into a unified platform named JioHotstar. The joint venture, valued at approximately USD 8.5 billion, positions JioHotstar as India's largest entertainment conglomerate, with Reliance holding 63.16% stake and Disney owning 36.84%. The platform launched with over 300,000 hours of content, featuring programming from Disney, NBCUniversal Peacock, Warner Bros. Discovery HBO, and Paramount, alongside exclusive sports broadcasting rights including IPL, English Premier League, ICC tournaments, and other major sporting events.

• 5G Network Expansion (2024-2025): India successfully completed its second 5G spectrum auction in June 2024, auctioning over 10.5 GHz capacity across eight frequency bands. Major telecom operators including Reliance Jio and Bharti Airtel have been rapidly deploying 5G networks across metropolitan cities and tier-2 towns, with Jio being the only provider offering standalone (SA) 5G architecture. This enhanced network infrastructure is enabling seamless streaming of high-definition and 4K content, significantly improving user experience on OTT platforms.

• Regulatory Framework Evolution (2024): The Indian government has been actively working on comprehensive regulatory frameworks for OTT platforms. The Information Technology (Intermediary Guidelines and Digital Media Ethics Code) Rules, 2021 continue to govern content standards, while discussions around the Broadcasting Services Regulation Bill 2023 aim to create unified regulations for all digital broadcasting services. The Ministry of Information and Broadcasting has intensified compliance monitoring, banning several platforms in 2024 and July 2025 for content violations, signaling stricter content governance.

• Revenue Growth Milestone (FY 2024-25): India's OTT market achieved record-breaking revenues of INR 37,940 crore in FY 2024-25 from combined advertising and subscription income. YouTube emerged as the market leader, capturing 37.7% market share with INR 14,300 crore in revenue, followed by major players including Netflix (INR 2,900 crore), Disney+ Hotstar (INR 2,750 crore before merger), and Amazon MX Player (INR 1,200 crore after merging Amazon miniTV with MX Player, reaching over 250 million unique users).

• Subscriber Growth Acceleration (2024): Major platforms reported substantial subscriber increases. JioCinema achieved rapid growth, surpassing 16 million paid subscribers by October 2024 with aggressive pricing starting at INR 29, positioning itself as the fastest-growing subscription platform. Zee5 reached 48 million paid subscribers with projected revenue growth, while Disney+ Hotstar expanded its paid user base to 35.9 million by Q4 2024 despite pricing pressures. Industry projections indicate the total OTT user base in India will reach 600 million by 2025, driven by increased internet penetration and affordable subscription models.

• Content Investment and Partnerships (2024-2025): OTT platforms significantly ramped up investments in regional language content and original productions. Netflix announced major content acquisition deals, including iconic Indian television shows like CID and Crime Patrol from Sony Pictures Networks India. Platforms collectively launched over 40-50 new original series annually, with emphasis on multilingual content across Hindi, Tamil, Telugu, Bengali, Kannada, and other regional languages. Strategic partnerships with telecom operators, production houses, and international studios have expanded content diversity, making premium entertainment accessible across different price points and demographic segments.

Comprehensive Market Report Highlights & Segmentation Analysis:

The market report offers a comprehensive analysis of the segments, highlighting those with the largest India Over The Top (OTT) Market Share. It includes forecasts for the period 2025-2033 and historical data from 2019-2024 for the following segments.

Segmentation by Component:

• Solution

• Services

Segmentation by Platform Type:

• Smartphones

• Smart TV's

• Laptops, Desktops and Tablets

• Gaming Consoles

• Set-Top Boxes

• Others

Segmentation by Deployment Type:

• Cloud

• On-Premise

Segmentation by Content Type:

• Voice over IP

• Text and Images

• Video

• Others

Segmentation by Revenue Model:

• Subscription

• Procurement

• Rental

• Others

Segmentation by Service Type:

• Consulting

• Installation and Maintenance

• Training and Support

• Managed Services

Segmentation by Vertical:

• Media & Entertainment

• Education & Training

• Health & Fitness

• IT & Telecom

• E-Commerce

• BFSI

• Government

• Others

Segmentation by Region:

• North India

• West and Central India

• South India

• East India

Competitor Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Contact Our Analysts for Brochure Requests, Customization, and Inquiries Before Purchase: https://www.imarcgroup.com/request?type=report&id=5859&flag=C

Key highlights of the Report:

• Historical Market Performance

• Future Market Projections

• Impact of COVID-19 on Market Dynamics

• Industry Competitive Analysis (Porter's Five Forces)

• Market Dynamics and Growth Drivers

• SWOT Analysis (Strengths, Weaknesses, Opportunities, Threats)

• Market Ecosystem and Value Creation Framework

• Competitive Positioning and Benchmarking Strategies

Major Advantages of the Report:

• This report provides market leaders and new entrants with accurate revenue estimates for the overall market and its key subsegments.

• Stakeholders can leverage this report to gain a deeper understanding of the competitive landscape, enabling them to strategically position their businesses and develop effective go-to-market strategies.

• The report provides stakeholders with valuable insights into the market dynamics, offering a comprehensive analysis of key drivers, restraints, challenges, and opportunities.

Why Choose IMARC Group:

• Extensive Industry Expertise

• Robust Research Methodology

• Insightful Data-Driven Analysis

• Precise Forecasting Capabilities

• Established Track Record of Success

• Reach with an Extensive Network

• Tailored Solutions to Meet Client Needs

• Commitment to Strong Client Relationships and Focus

• Timely Project Delivery

• Cost-Effective Service Options

Explore More Research Reports & Get Your Free Sample Now:

India Protein Bars Market Report: https://www.imarcgroup.com/india-protein-bars-market/requestsample

https://markettinsights.mystrikingly.com/blog/indian-textile-market-share-size-growth-trends-analysis-industry-outlook/

https://talkmarkets.com/member/marketintelligence/blog/services/india-defense-industry-size-share-growth-rate-trends-analysis--market-report-2025-2033?post=535261

Note: Should you require specific information not included in the current report, we are pleased to offer customization options to meet your needs.

Contact US

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: Sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

Americas: +1-201971-6302 | Africa and Europe: +44-702-409-7331

About Us

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC's information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company's expertise.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release India Over The Top (OTT) Market Share, Size, Industry Trends, Growth Rate & Forecast Report 2025-2033 here

News-ID: 4263425 • Views: …

More Releases from IMARC Group

India Women Apparel Market Outlook 2026-2034: Fashion Trends, Industry Share & O …

According to IMARC Group's report titled "India Women Apparel Market Size, Share, Trends and Forecast by Product Type, Season, Distribution Channel, and Region, 2026-2034" the report offers a comprehensive analysis of the industry, including market share, growth, trends, and regional insights.

India Women Apparel Market Outlook

The India women apparel market size was valued at USD 95.83 Billion in 2025 and is projected to reach USD 121.87 Billion by 2034, growing at…

India Women Apparel Market Outlook 2026-2034: Fashion Trends, Industry Share & O …

According to IMARC Group's report titled "India Women Apparel Market Size, Share, Trends and Forecast by Product Type, Season, Distribution Channel, and Region, 2026-2034" the report offers a comprehensive analysis of the industry, including market share, growth, trends, and regional insights.

India Women Apparel Market Outlook

The India women apparel market size was valued at USD 95.83 Billion in 2025 and is projected to reach USD 121.87 Billion by 2034, growing at…

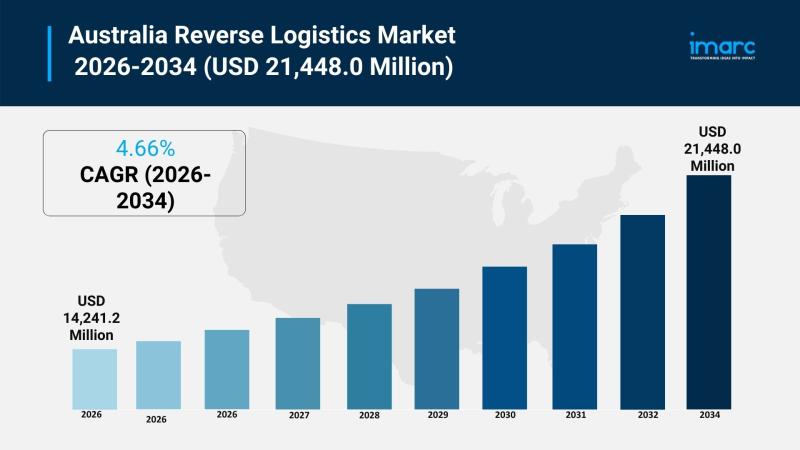

Australia Reverse Logistics Market Projected to Reach USD 21,448.0 Million by 20 …

Market Overview

The Australia reverse logistics market size reached USD 14,241.2 Million in 2025 and is projected to reach USD 21,448.0 Million by 2034, growing at a CAGR of 4.66% during 2026-2034. This expansion is driven by the rise in e-commerce platforms, environmental sustainability efforts, and the integration of advanced technologies in logistics operations. The market encompasses return types, services, end users, and regional segments across Australia. For more details, visit…

Global Hummus Market Report 2026-2034: Growth, Trends, Packaging, Channels & Reg …

The global hummus market size reached USD 4.7 Billion in 2025 and is anticipated to reach USD 9.1 Billion by 2034, reflecting a CAGR of 7.50% during the forecast period 2026-2034. This growth is driven by increasing lifestyle diseases, rising health-conscious consumers, and escalating demand for plant-based proteins. The popularity of hummus as a substitute for traditional condiments further supports market expansion.

Study Assumption Years

Base Year: 2025

Historical Period: 2020-2025

Forecast Period:…

More Releases for India

India Smart Air Purifier Market Set to Witness Significant Growth by 2035 | Phil …

India smart air purifier market was valued at $125.8 million in 2024 and is projected to reach $298.7 million by 2035, growing at a CAGR of 8.3% during the forecast period (2025-2035).

India Smart Air Purifier Market Overview

The Indian smart air purifier market is experiencing significant growth, driven by increasing concerns over air pollution and its impact on health. Consumers are increasingly adopting smart air purifiers equipped with advanced features…

Ayurvedic Service Market is Flourishing Like Never Before | Patanjali Ayurved Li …

RnM newly added a research report on the Ayurvedic Service market, which represents a study for the period from 2020 to 2026.

The research study provides a near look at the market scenario and dynamics impacting its growth. This report highlights the crucial developments along with other events happening in the market which are marking on the growth and opening doors for future growth in the coming years. Additionally, the…

Pasta Market Report 2018 Companies included Bambino (India), Nestle (USA), Field …

We have recently published this report and it is available for immediate purchase. For inquiry Email us on: jasonsmith@marketreportscompany.com

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2018 to 2025 in terms of volume, revenue, YOY growth rate, and CAGR for the year 2018 to 2025, etc. The report also provides detailed segmentation on the…

Interior Designers India, Designers and Architects India, Interior Design Consul …

Synergy Corporate Interiors Pvt. Ltd. are offer Designers and Architects India Our architects, designers are working an national and international client base. The final design output is then integrated with the various technical and engineering aspects and taken into production. The expression is also individualistic, based on the communication of the correct corporate identity. Our designers, engineers and architects perform any plan successfully combine handy knowledge with creative ideas into…

Domain Registration India, Web Hosting India, VPS Hosting India , SSL Certificat …

All the Domain Registration services are at affordable price and assure you for the 100% quality.

India Internet offers cheap domain name registration for many domain extensions available. We are a full-service web site solutions provider. We offer a full range of web services including domain registration India, Web Hosting India, Web design, SEO marketing and etc.

We offer different standard and different Windows .NET low-cost, full-featured, all-inclusive web hosting and domain…

Domain Registration India, Web Hosting India, Payment Gateway India

Indiainternet.in is a Quality Web Hosting Company India, provide all web related support and Web hosting services like linux web hosting, windows web hosting, web hosting packages, domain registration in india, Corporate email solution, business email hosting, payment gateway integration, SSL with supports like free php, cgi, asp, free msaccess, free cdonts, free webmail, web based control panel, unlimited ftp access, unlimited data transfer.

During the domain registration process, you will…