Press release

Turkey Foreign Exchange Market to Hit USD 24.68 Billion by 2033 with a Robust CAGR of 8.23%

Market OverviewThe Turkey foreign exchange market size reached USD 11.19 Billion in 2024. It is projected to grow to USD 24.68 Billion by 2033, exhibiting a compound annual growth rate (CAGR) of 8.23% during the forecast period 2025-2033. Supported by steady inflows from tourism, non-tourism services, and rapidly growing e-commerce exports, these sectors generate recurring hard currency income, strengthen central bank reserves, and enhance market liquidity.

Sample Request Link: https://www.imarcgroup.com/turkey-foreign-exchange-market/requestsample

Study Assumption Years

Base Year: 2024

Historical Years: 2019-2024

Forecast Period: 2025-2033

Turkey Foreign Exchange Market Key Takeaways

Current Market Size: USD 11.19 Billion (2024)

CAGR: 8.23%

Forecast Period: 2025-2033

Turkey is the fourth most visited destination globally, attracting 56.7 million international tourists in 2024, significantly contributing to foreign currency inflows.

Robust tourism and services sectors create a services surplus that supports balance of payments and central bank reserves.

Growth in e-commerce exports, with the market size reaching USD 235.1 Billion in 2024 and projected to reach USD 1,774.5 Billion by 2033, drives foreign exchange market expansion.

Digital payment platforms facilitate international trade participation for SMEs, broadening foreign currency sources.

The market segmentation covers counterparties (reporting dealers, other financial institutions, and non-financial customers) and types (currency swaps, outright forward and FX swaps, FX options).

Request Customization: https://www.imarcgroup.com/request?type=report&id=42068&flag=E

Market Growth Factors

The Turkey foreign exchange market is significantly bolstered by strong tourism revenues and a services surplus. In 2024, Turkey ranked as the fourth most visited destination worldwide, attracting 56.7 million international tourists, according to the United Nations World Tourism Organization's May 2025 World Tourism Barometer. These visitors contribute substantial foreign spending, which escalates demand for the Turkish lira, particularly during peak travel seasons. This influx helps maintain the services surplus, supports the balance of payments, and alleviates pressure on foreign currency reserves. The steady inflows strengthen central bank buffers and give monetary authorities enhanced flexibility in managing exchange rate fluctuations.

Beyond tourism, other service sectors such as logistics, construction, and information technology generate recurring foreign currency inflows by securing international contracts, increasing foreign exchange market stability. Government initiatives positioning Turkey as a regional service hub expand market access across emerging and developed economies. Combined, these sectors provide a dependable foundation for foreign exchange market liquidity throughout the year, minimizing reliance on volatile capital flows.

The rapid rise of e-commerce exports is another critical growth driver. Turkey's e-commerce market was valued at USD 235.1 Billion in 2024, and IMARC Group forecasts growth to USD 1,774.5 Billion by 2033, at a CAGR of 25.18% between 2025 and 2033. This expansion enables new exporters, particularly SMEs, to reach global markets through digital platforms where transactions are conducted mainly in euros, dollars, or sterling. The proliferation of secure digital payment gateways and fintech applications streamlines currency conversion and repatriation processes, increasing transparency and speeding transactions. This fosters greater participation beyond large corporations, diversifying Turkey's sources of foreign currency and reinforcing market liquidity while reducing dependence on informal exchange channels.

Market Segmentation

Counterparty Insights:

Reporting Dealers: Entities involved in official foreign exchange transactions.

Other Financial Institutions: Banks and non-bank financial entities participating in FX trading.

Non-financial Customers: Corporate and individual clients engaging in foreign exchange activities.

Type Insights:

Currency Swap: Agreements to exchange currencies between counterparties for a specified period.

Outright Forward and FX Swaps: Contracts for future exchange of currencies at predetermined rates.

FX Options: Contracts providing the right but not obligation to exchange currency at a set rate.

Regional Insights

The Turkey foreign exchange market includes key regions such as Marmara, Central Anatolia, Mediterranean, Aegean, Southeastern Anatolia, Black Sea, and Eastern Anatolia. The report does not specify the dominant region or provide detailed regional market shares or CAGRs. Thus, specific regional dominance and statistics are not provided in the source.

Recent Developments & News

In May 2025, Turkey increased the FX conversion support rate from 2% to 3% for businesses converting foreign currency into Turkish lira, effective May 1 to July 31, 2025. Eligible companies must commit not to repurchase foreign exchange beyond what they sold, with penalties and a one-year ban from Central Bank loans for violators. In March 2025, the Turkish Central Bank initiated Turkish lira-settled foreign exchange forward selling transactions aimed at stabilizing the FX market, preventing currency volatility, ensuring steady liquidity, and boosting market confidence.

Key Players

Competitive Landscape

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Customization Note

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: sales@imarcgroup.com,

Tel No: (D) +91 120 433 0800,

United States: +1-201971-6302

About Us

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Turkey Foreign Exchange Market to Hit USD 24.68 Billion by 2033 with a Robust CAGR of 8.23% here

News-ID: 4263373 • Views: …

More Releases from IMARC Group

India Women Apparel Market Outlook 2026-2034: Fashion Trends, Industry Share & O …

According to IMARC Group's report titled "India Women Apparel Market Size, Share, Trends and Forecast by Product Type, Season, Distribution Channel, and Region, 2026-2034" the report offers a comprehensive analysis of the industry, including market share, growth, trends, and regional insights.

India Women Apparel Market Outlook

The India women apparel market size was valued at USD 95.83 Billion in 2025 and is projected to reach USD 121.87 Billion by 2034, growing at…

India Women Apparel Market Outlook 2026-2034: Fashion Trends, Industry Share & O …

According to IMARC Group's report titled "India Women Apparel Market Size, Share, Trends and Forecast by Product Type, Season, Distribution Channel, and Region, 2026-2034" the report offers a comprehensive analysis of the industry, including market share, growth, trends, and regional insights.

India Women Apparel Market Outlook

The India women apparel market size was valued at USD 95.83 Billion in 2025 and is projected to reach USD 121.87 Billion by 2034, growing at…

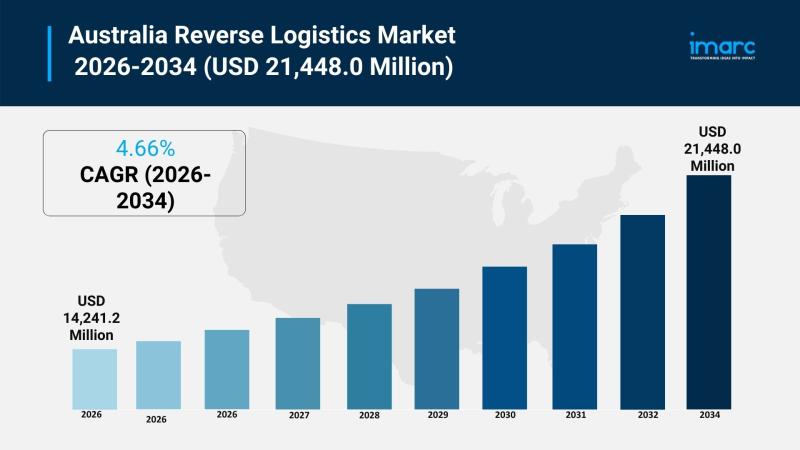

Australia Reverse Logistics Market Projected to Reach USD 21,448.0 Million by 20 …

Market Overview

The Australia reverse logistics market size reached USD 14,241.2 Million in 2025 and is projected to reach USD 21,448.0 Million by 2034, growing at a CAGR of 4.66% during 2026-2034. This expansion is driven by the rise in e-commerce platforms, environmental sustainability efforts, and the integration of advanced technologies in logistics operations. The market encompasses return types, services, end users, and regional segments across Australia. For more details, visit…

Global Hummus Market Report 2026-2034: Growth, Trends, Packaging, Channels & Reg …

The global hummus market size reached USD 4.7 Billion in 2025 and is anticipated to reach USD 9.1 Billion by 2034, reflecting a CAGR of 7.50% during the forecast period 2026-2034. This growth is driven by increasing lifestyle diseases, rising health-conscious consumers, and escalating demand for plant-based proteins. The popularity of hummus as a substitute for traditional condiments further supports market expansion.

Study Assumption Years

Base Year: 2025

Historical Period: 2020-2025

Forecast Period:…

More Releases for Turkey

Hair Transplant in Turkey - Why Turkey is the Top Destination

Hair Transplant in Turkey have surged in popularity as a highly effective solution for combating hair loss. With numerous advancements in technology and a growing number of international options, individuals are increasingly seeking detailed information about the procedure, its costs, expected results, and the best locations for treatment. This comprehensive guide delves deep into everything you need to know about hair transplants, including cost considerations, what to expect before and…

Government Fitness Services Initiatives Turkey | Turkey Active Knowledge Partner …

August 2021 | Turkey News

The shift of the millennial generation to healthier lifestyle has brought the importance of physical exercise to the fore driving the demand for fitness centers over the last decade.

Customer Mindset or Fitness: Majority of the population in Turkey, irrespective of age groups participate actively in regular physical activities such as walking, cycling & gymming in public parks, fitness centers or at home. Around 80.0% of the…

Turkey Power Sector Analysis

The power sector in Turkey is a highly evolved and efficient sector, being supported by an extremely favorable and facilitative government policy and regulatory regime. The power sector is divided into three sub-sectors in Turkey, namely the generation, transmission and distribution sectors.

The power generation sector in Turkey is fully competent to meet the domestic demand. Furthermore, the country is also capable of supplying electricity to neighboring nations in Europe and…

Agrochemicals Market in Turkey

ReportsWorldwide has announced the addition of a new report title Turkey: Agrochemicals: Market Intelligence (2016-2021) to its growing collection of premium market research reports.

The report “Turkey: Agrochemicals: Market Intelligence (2016-2021)” provides market intelligence on the different market segments, based on type, active ingredient, formulation, crop, and pest. Market size and forecast (2016-2021) has been provided in terms of both, value (000 USD) and volume (000 KG) in the report. A…

Cigarettes in Turkey, 2016

ReportsWorldwide has announced the addition of a new report title Cigarettes in Turkey, 2016 to its growing collection of premium market research reports.

"Cigarettes in Turkey, 2016" is an analytical report by GlobalData that provides extensive and highly detailed current and future market trends in the Turkish market. The report offers Market size and structure of the overall and per capita consumption based upon a unique combination of industry research, fieldwork,…

SOCAR TURKEY and STAR Refinery once again supporting the CEE & Turkey Refining a …

22nd August 2016 – The World Refining Association and SOCAR Turkey today announced that top management team from SOCAR Turkey and STAR Refinery will be present at the 19th Annual CEE and Turkey Refining and Petrochemicals Conference, taking place in Izmir, Turkey from the 19th – 21st of September 2016.

The event will host 40 decision makers from major operators in the region such as Tüpras, Petkim, Rompetrol, OMV Petrom,…