Press release

U.S. Individual Health Insurance Market Driven by Digital Enrollment Trends - Persistence Market Research

The U.S. individual health insurance market represents a crucial segment of the nation's broader healthcare ecosystem. This market caters to individuals who purchase health insurance independently, rather than through employer-sponsored plans, and plays a pivotal role in ensuring healthcare access for self-employed, gig economy workers, retirees, and those without group coverage. In 2024, the market was valued at approximately US$ 1.8 billion and is projected to reach US$ 2.7 billion by 2031, expanding at a compound annual growth rate (CAGR) of 5.9% during the forecast period.The expansion of this market is being driven by several key factors, including rising healthcare costs, shifting employment dynamics, and a growing prevalence of chronic diseases. Additionally, increased consumer awareness regarding the importance of healthcare coverage and ongoing regulatory reforms continue to support market growth. As individuals become more health-conscious and seek flexible coverage options, insurers are innovating product offerings to cater to diverse demographic needs and budget constraints.

Get a Sample Copy of Research Report (Use Corporate Mail id for Quick Response): https://www.persistencemarketresearch.com/samples/34794

From a segmentation perspective, the public segment, led primarily by Medicare and Medicaid, dominates the U.S. individual health insurance landscape. These programs, managed by the federal government, set the standard for coverage quality, affordability, and accessibility, influencing private sector strategies. Meanwhile, the senior demographic-comprising individuals aged 65 and older-represents the largest share of the market, holding over 88% in 2022. This dominance is attributed to the aging baby boomer generation and the increasing need for comprehensive care among older adults.

Regionally, the South region stands out as the market leader, with Florida and Texas accounting for more than 40% of the regional share combined. The region's dominance stems from its large and diverse population, higher adoption of individual health plans, and a strong concentration of senior residents. The West region, led by California, Washington, and Arizona, is projected to be the fastest-growing, with a 9.9% CAGR through 2031, driven by growing awareness and the availability of innovative coverage models.

Key Highlights from the Report

• Rising healthcare costs and employment shifts drive sustained demand for individual coverage.

• Ongoing debates surrounding healthcare reform and universal coverage shape market dynamics.

• Increasing prevalence of chronic diseases boosts individual insurance uptake.

• Public segment expected to grow significantly, led by Medicare and Medicaid programs.

• Seniors segment dominates the market, holding over 88% of total share.

• The South region remains the market leader, with strong adoption in Florida and Texas.

Market Segmentation

The U.S. individual health insurance market can be segmented based on type, demographics, and region, each offering unique insights into consumer preferences and market performance.

By Type:

The market is broadly divided into public and private insurance segments. The public segment-primarily driven by government-sponsored programs such as Medicare and Medicaid-accounts for a substantial portion of total market revenue. Medicare provides health insurance for individuals aged 65 and older, as well as those with specific disabilities, while Medicaid offers coverage to low-income individuals and families. The role of these programs extends beyond enrollment numbers; they influence policy standards, reimbursement rates, and coverage benchmarks that shape private insurers' strategies.

The private insurance segment, though smaller, remains dynamic, characterized by competitive product innovation, telehealth integration, and value-based care initiatives. Private insurers offer flexible plans tailored to individuals and families seeking customized coverage. The introduction of silver-level plans and marketplace expansions by insurers like UnitedHealthcare and Aetna have helped make private plans more accessible and affordable.

By Demographics:

Among the demographic segments, seniors dominate the market, accounting for 88% of the total share as of 2022. This dominance is primarily attributed to the expanding elderly population and their elevated healthcare utilization rates. Older adults often require comprehensive coverage for chronic diseases, prescription drugs, and long-term care-services frequently included in Medicare Advantage and Medigap plans. In contrast, adults under 65 and minors represent smaller market shares but are becoming increasingly important as more individuals seek independent coverage due to freelance and gig economy work.

By Region:

The market demonstrates strong regional variations across the Northeast, Midwest, South, and West. The South region leads the nation in market size, supported by robust adoption rates in populous states like Florida and Texas. Meanwhile, the West is witnessing the fastest growth, fueled by a tech-savvy population and a strong push toward digital health insurance platforms. States like California are at the forefront of market innovation, emphasizing accessibility, affordability, and telehealth integration.

Read Detailed Analysis: https://www.persistencemarketresearch.com/market-research/us-individual-health-insurance-market.asp

Regional Insights

Regional trends across the U.S. highlight significant variations in adoption patterns, insurer participation, and policy environments.

The South continues to dominate the market, capturing the largest regional share due to demographic diversity, higher uninsured rates historically transitioning into coverage, and supportive state-level initiatives promoting enrollment in individual plans. Florida and Texas, in particular, account for a combined 41.1% share, reflecting widespread uptake of both public and private insurance options.

The West region follows closely, showing remarkable potential for growth. With an estimated CAGR of 9.9%, it is emerging as a hub of innovation and digital transformation in healthcare coverage. California leads this surge with its proactive policy framework, thriving startup ecosystem, and emphasis on consumer-friendly insurance marketplaces.

The Northeast region, encompassing states like New York and Massachusetts, remains a mature market characterized by high insurance penetration rates and well-established regulatory frameworks. In contrast, the Midwest exhibits moderate growth driven by rising awareness and affordability initiatives targeting low- and middle-income households.

Market Drivers

The U.S. individual health insurance market is being propelled by several interconnected drivers. One of the most significant is the rising cost of healthcare, which continues to push individuals toward seeking insurance coverage to mitigate out-of-pocket expenses. Coupled with changing employment patterns, including the rise of freelance work, entrepreneurship, and the gig economy, more Americans are now in need of independent health insurance solutions.

Regulatory shifts at both the federal and state levels further shape market dynamics. The evolution of the Affordable Care Act (ACA) has improved access, increased subsidies, and expanded Medicaid coverage in several states, fostering a more inclusive insurance environment. Additionally, policy measures such as risk adjustment, reinsurance, and risk corridor programs have helped stabilize premiums and promote insurer participation.

Another major growth driver is the increasing prevalence of chronic diseases such as diabetes, cardiovascular disorders, and cancer. With chronic illness rates rising across the country, individuals are seeking comprehensive insurance options that cover preventive care, prescription drugs, and long-term treatment. The growing awareness around personal health management and wellness programs has also contributed to the increased uptake of individual plans.

Market Restraints

Despite strong growth, the U.S. individual health insurance market faces persistent challenges. Affordability remains one of the most critical restraints, affecting both consumers and insurers. Premiums and out-of-pocket costs continue to rise due to escalating healthcare expenses, high deductibles, and administrative costs. Many consumers-especially middle-income earners-struggle to balance coverage quality with affordability, leading some to opt for minimal or no coverage.

Another major challenge is market instability and regulatory uncertainty. Frequent policy shifts, administrative changes, and fluctuating subsidy structures often create unpredictability for insurers. This uncertainty can discourage participation and limit competition in certain regions, especially rural areas. Furthermore, adverse selection-where high-risk individuals are more likely to enroll than low-risk ones-can destabilize risk pools and drive up premiums.

Operational inefficiencies and a lack of standardized reimbursement frameworks also hinder market stability. Although federal programs such as reinsurance and risk adjustment aim to mitigate volatility, inconsistent implementation across states can limit their effectiveness.

Market Opportunities

The future presents numerous opportunities for growth and innovation in the U.S. individual health insurance market. A key area of opportunity lies in personalization and consumer engagement. Insurers are increasingly leveraging data analytics and AI to design customized plans based on individual health profiles and preferences. This includes flexible deductibles, tailored benefits for chronic disease management, and incentives for preventive care participation.

Digital transformation also presents substantial potential. The expansion of telehealth, online policy management portals, and mobile health apps has transformed the consumer experience. Insurers can use these tools to enhance accessibility, transparency, and customer satisfaction, ultimately improving retention rates.

There are also significant opportunities to expand access and affordability for underinsured and uninsured populations. By developing cost-effective products and advocating for stronger ACA subsidies, insurers can reach broader demographics. Partnerships with state and federal programs, as well as community organizations, can also facilitate broader coverage adoption. Additionally, integrating blockchain and automation in claims processing could reduce administrative overhead and allow for more competitive pricing.

Request for Customization of the Research Report: https://www.persistencemarketresearch.com/request-customization/34794

Company Insights

The U.S. individual health insurance market is characterized by the presence of several key players, each striving to enhance service accessibility, pricing flexibility, and digital engagement.

• Elevance Health (formerly Anthem, Inc.)

• Cigna

• Health Care Service Corporation

• Providence Health Plan

• Point32Health

• Highmark

• UnitedHealth Group Incorporated

• Kaiser Foundation Health Plan, Inc.

• Independence Holding Company (IHC Group)

These companies have adopted strategies such as mergers, acquisitions, and partnerships with healthcare providers and technology firms to strengthen their market positions. They are also investing heavily in telehealth solutions, AI-driven analytics, and consumer education programs to improve healthcare accessibility and affordability.

U.S. Individual Health Insurance Market Research Segmentation

By Type

Public

Private

By Demographics

Minors

Adults

Seniors

By Region

Northeast

Midwest

South

West

Recent Developments:

In 2023, UnitedHealthcare and Aetna launched competitively priced silver-level plans aimed at attracting cost-sensitive consumers, marking a strategic effort to expand their presence in the individual market.

Several major insurers expanded their digital platforms to include virtual consultations and preventive care monitoring, reflecting the growing emphasis on technology integration in healthcare delivery.

Conclusion

The U.S. individual health insurance market is undergoing a transformative phase driven by demographic shifts, regulatory reforms, and evolving consumer expectations. With an anticipated CAGR of 5.9% between 2024 and 2031, the market is poised for sustained growth. The public segment-led by Medicare and Medicaid-continues to anchor market performance, while private insurers innovate to meet growing demand for flexibility, digital accessibility, and affordability.

Challenges such as premium affordability and regulatory uncertainty persist, but technological innovation and policy evolution offer promising solutions. As healthcare continues to move toward personalized, value-based, and digitally integrated models, insurers that embrace data-driven strategies and consumer engagement will be best positioned to thrive. Ultimately, the U.S. individual health insurance market stands at the intersection of opportunity and reform, reflecting a future where health coverage becomes more inclusive, adaptive, and responsive to the needs of every individual.

Read More Related Reports:

Microbiome Therapeutic Market https://www.persistencemarketresearch.com/market-research/microbiome-therapeutic-market.asp

On-Site Laboratory Service Market https://www.persistencemarketresearch.com/market-research/on-site-laboratory-service-market.asp

Crohn's Disease Treatment Market https://www.persistencemarketresearch.com/market-research/crohns-disease-treatment-market.asp

Alopecia Treatment Market https://www.persistencemarketresearch.com/market-research/alopecia-treatment-market.asp

Contact Us:

Persistence Market Research

Second Floor, 150 Fleet Street, London, EC4A 2DQ, United Kingdom

USA Phone: +1 646-878-6329

UK Phone: +44 203-837-5656

Email: sales@persistencemarketresearch.com

Web: https://www.persistencemarketresearch.com

About Persistence Market Research:

At Persistence Market Research, we specialize in creating research studies that serve as strategic tools for driving business growth. Established as a proprietary firm in 2012, we have evolved into a registered company in England and Wales in 2023 under the name Persistence Research & Consultancy Services Ltd. With a solid foundation, we have completed over 3600 custom and syndicate market research projects, and delivered more than 2700 projects for other leading market research companies' clients.

Our approach combines traditional market research methods with modern tools to offer comprehensive research solutions. With a decade of experience, we pride ourselves on deriving actionable insights from data to help businesses stay ahead of the competition. Our client base spans multinational corporations, leading consulting firms, investment funds, and government departments. A significant portion of our sales comes from repeat clients, a testament to the value and trust we've built over the years.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release U.S. Individual Health Insurance Market Driven by Digital Enrollment Trends - Persistence Market Research here

News-ID: 4263043 • Views: …

More Releases from Persistence Market Research

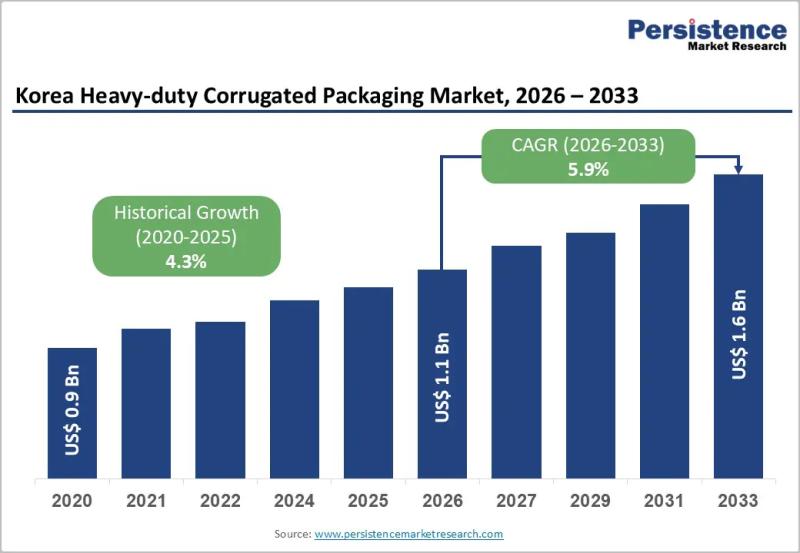

Korea Heavy-duty Corrugated Packaging Market to Reach US$1.6 Billion by 2033 - P …

The Korea heavy-duty corrugated packaging market plays a critical role in supporting industrial logistics, bulk transportation, and export-driven manufacturing. Heavy-duty corrugated packaging is widely used for shipping machinery, automotive components, electronics, chemicals, and large industrial goods that require superior strength and structural integrity. Unlike conventional corrugated boxes, heavy-duty variants are engineered with multi-wall boards, reinforced liners, and customized structural designs to withstand high load capacity, stacking pressure, and long-distance transportation.…

Textile Flooring Market Set for Steady Growth as Demand for Sustainable and Styl …

The global textile flooring market is entering a phase of stable expansion, supported by rising construction activity, increasing consumer focus on interior aesthetics, and growing demand for eco-friendly flooring solutions. According to industry estimates, the global textile flooring market size is likely to be valued at US$11.1 billion in 2026 and is projected to reach US$16.5 billion by 2033, expanding at a CAGR of 5.8% between 2026 and 2033. This…

Power System Simulator Market Size to Reach US$ 2.6 Billion by 2033 - Persistenc …

The power system simulator market is gaining strategic importance as global energy systems transition toward digitalization, decentralization, and decarbonization. Power system simulators are advanced software and hardware platforms used by utilities, grid operators, engineering firms, and research institutions to model, analyze, and optimize electrical power networks. These simulators enable real time grid analysis, contingency planning, load flow studies, fault analysis, stability assessment, and operator training. As electricity networks become more…

Yoga and Meditation Products Market Set for Robust Growth, Projected to Reach US …

The global wellness industry is undergoing a major transformation as consumers increasingly prioritize mental health, mindfulness, and preventive self-care. Within this evolving landscape, the yoga and meditation products market has emerged as a fast-growing segment, encompassing everything from yoga mats and apparel to meditation cushions, smart devices, and digital-enabled accessories. According to industry estimates, the global yoga meditation products market is projected to be valued at US$ 8.3 billion in…

More Releases for Health

Health Coach Market Positioned for Accelerated Growth with Iora Health, Virta He …

Global health coach market is estimated to be valued at USD 18.83 Bn in 2025 and is expected to reach USD 30.65 Bn by 2032, exhibiting a compound annual growth rate (CAGR) of 7.2% from 2025 to 2032.

Latest Report on the Health Coach Market 2025-2032, focuses on a comprehensive analysis of the current and future prospects of the Health Coach Market industry. An in-depth analysis of historical trends, future trends,…

Digital Therapeutics Market Research 2025 Leading Key Players - Proteus Digital …

An exclusive Digital Therapeutics Market research report created through broad primary research (inputs from industry experts, companies, and stakeholders) and secondary research, the report aims to present the analysis of Global Digital Therapeutics Market by Type, By Application, By Region - North America, Europe, South America, Asia-Pacific, Middle East and Africa. The report intends to provide cutting-edge market intelligence and help decision makers take sound investment evaluation. Besides, the report…

Digital Therapeutics Market Outlook 2025 : Proteus Digital Health, Omada Health, …

ReportsWeb.com has announced the addition of the “Global Digital Therapeutics Market Size, Status and Forecast 2025” The report focuses on major leading players with information such as company profiles, product picture and specification.

This report studies the global Digital Therapeutics market, analyzes and researches the Digital Therapeutics development status and forecast in United States, EU, Japan, China, India and Southeast Asia.

This report focuses on the top players in global market,…

Digital Therapeutics Market Outlook to 2025 - Propeller Health, CANARY HEALTH, N …

The global digital therapeutics market is segmented on the basis of application, distribution channel, and geography. The application segment includes, respiratory diseases, central nervous system disease, smoking cessation, medication adherence, cardiovascular diseases, musculoskeletal diseases, and other applications. Based on distribution channel, the digital therapeutics market is segmented as, B2B and B2C.

Digital therapeutics, a subset of digital health, is a health discipline and treatment option that utilizes a digital and…

Digital Therapeutics Market Analysis 2018 | Growth by Top Companies: Proteus Dig …

Global Digital Therapeutics Market to 2025

This report "Digital Therapeutics Market Analysis to 2025" provides an in-depth insight of medical device industry covering all important parameters including development trends, challenges, opportunities, key manufacturers and competitive analysis.

Digital therapeutics, a subset of digital health, is a health discipline and treatment option that utilizes a digital and often online health technologies to treat a medical or psychological condition. The treatment relies on behavioral and…

Digital Therapeutics Market Global Outlook to 2025 - Proteus Digital Health, Wel …

“Digital Therapeutics Market" covers a detailed research on the industry with financial analysis of the major players. The report provides key information and detailed study relating to the industry along with the Economic Impact and Regulatory and Market Support. The report examines the industry synopsis, strategic investments, Industry Surveys, Economic Impact, etc.

The market of digital therapeutics market is anticipated to grow with a significant rate in the coming years, owing…