Press release

Digital Lending Platform Market Size to Reach USD 39.8 Billion by 2033 | Growing at a CAGR of 11.85%

The global market share is expanding significantly due to the growing user preferences for hassle-free loan processes.

The global digital lending platform market size was valued at USD 13.0 Billion in 2024 and is projected to reach USD 39.8 Billion by 2033, growing at a CAGR of 11.85% from 2025 to 2033. The market growth is supported by the increasing use of sophisticated technology to customize loan products and improve the lending process.

Study Assumption Years

• Base Year: Not provided in source

• Historical Year/Period: Not provided in source

• Forecast Year/Period: Not provided in source

Global Digital Lending Platform Market Key Takeaways

• Current Market Size: USD 13.0 Billion in 2024

• CAGR: 11.85%

• Forecast Period: 2025 to 2033

• The landscape is fueled by demand for personalization, with platforms providing simple applications and customizable loan offerings.

• Regulatory agencies are providing customer protections for promoting innovation, which drives adoption of these platforms.

• Artificial intelligence, machine learning, and blockchain potentially assess risk better and reduce costs.

• Alternative lending channels exist and are becoming increasingly widely deployed globally.

• The growth of smartphones, along with digital accessibility, enables online loan applications.

Request Free Sample Report: https://www.imarcgroup.com/digital-lending-platform-market-statistics/requestsample

Market Growth Factors

Furthermore, the digital lending space is expected to be driven by increasing demand for personalization, with the adoption of advanced technology to provide easy application, simple user interface and personalized loan products catering to borrowers' requirements. For example, PhonePe's secured digital lending platform, launched in May 2024, offers six types of loans (gold, personal, home, education, business and auto) to 535 million registered users of the platform.

Regulatory bodies are constantly engaged in protecting consumers, managing risk and stability of the system, and promoting innovation. An example is Salesforce which, due to the regulatory climate, rolled out a digital lending platform for Indian PSUs. Data privacy regulations have contributed as well to the increasing popularity of platforms such as Temenos and Finastra.

Artificial intelligence, machine learning, and blockchain technologies can help bring efficiencies to the market. They are also potentially capable of improving risk assessment, decision making, and lowering sales or origination costs. A good example is Tavant's LO.ai for digital lending, a generative AI solution that launched in October 2024, which is part of the trend toward sales automation and increased borrower confidence. The channels for alternative lending have become more accessible than customary banks and lending institutions, becoming a global phenomenon.

Market Segmentation

Type:

• Loan Origination: Represents the largest segmentation due to rising demand for new application creation, processing, and approval.

• Decision Automation

• Collections and Recovery

• Risk and Compliance Management

• Others

Component:

• Solutions: Largest segment pivotal in modernizing lending by improving accuracy and operational efficiency.

• Services

Deployment Model:

• On-Premises: Largest segment allowing organizations control over system performance, maintenance, and uptime for consistent platform access.

• Cloud-Based

Industry Vertical:

• Banks: Largest segment driven by banks' need to streamline and enhance traditional lending processes.

• Insurance Companies

• Credit Unions

• Savings and Loan Associations

• Peer-to-Peer Lending

• Others

Regional Insights

North America dominates the digital lending platform market because consumers instantly demand easy loans and disburse paperless loans when consumers use peer-to-peer lending platforms in the region. The peer-to-peer lending market in the United States should grow at a CAGR of 14% between 2024 to 2032. This has allowed for diverse investment portfolios and has given North America the largest market share.

Recent Developments & News

• In May 2024, PhonePe launched its secure digital lending platform within its app, offering six types of loans to 535 million users.

• In June 2024, Salesforce announced the launch of its digital lending platform for India, aimed at public sector enterprises and government departments.

• In March 2024, Epic River launched a digital lending platform for credit unions, connecting them to healthcare providers.

• Tavant Technologies launched LO.ai in October 2024 as an AI-powered component of its digital lending platform that leverages generative AI and straight-through processing to reduce origination costs.

• In June 2023, technology provider Black Knight, Inc. released Validate, a mobile loan approval and valuation application.

Key Players

• Black Knight Inc.

• Finastra

• FIS

• Fiserv Inc.

• Intellect Design Arena Ltd

• Intercontinental Exchange Inc.

• Nucleus Software Exports Ltd.

• Pegasystems Inc.

• Roostify Inc.

• Tavant Technologies

• Wipro Limited

Customization Note

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as part of the customization.

Ask Our Expert & Browse Full Report with TOC & List of Figures: https://www.imarcgroup.com/request?type=report&id=4195&flag=E

Contact US:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services.

IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Digital Lending Platform Market Size to Reach USD 39.8 Billion by 2033 | Growing at a CAGR of 11.85% here

News-ID: 4261369 • Views: …

More Releases from IMARC Group

Smart Lighting Systems Manufacturing Plant DPR 2026: Investment, Machinery Cost …

Setting up a smart lighting systems manufacturing plant positions investors in one of the most rapidly expanding segments of the global energy-efficient technology supply chain. The smart lighting systems market is growing rapidly, driven by the increasing demand for energy-efficient solutions and the growing adoption of smart homes and buildings. The rise in awareness of energy conservation, the need to reduce electricity consumption, and the growing trend toward automation in…

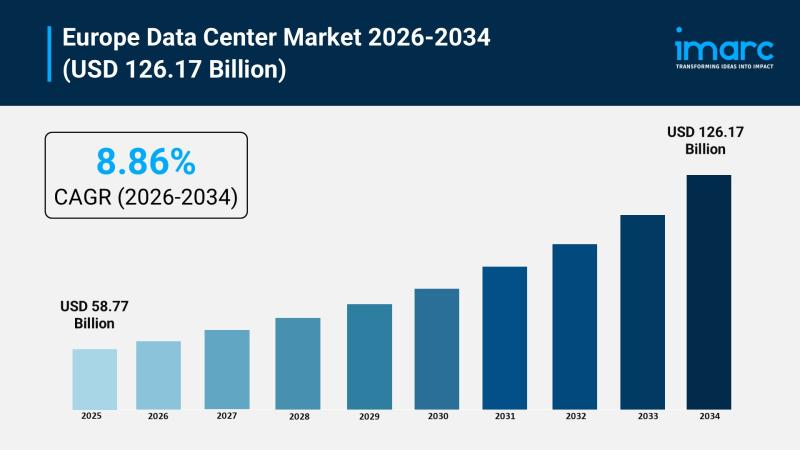

IMARC Group Forecasts 8.86% CAGR for Europe Data Center Market Amidst AI and Clo …

The Europe data center market is experiencing a critical phase of infrastructure evolution, having reached a valuation of USD 58.77 Billion in 2025. Propelled by the accelerating digitalization of the region's economy and sovereign cloud ambitions, the market is projected to reach USD 126.17 Billion by 2034. This growth trajectory represents a solid Compound Annual Growth Rate (CAGR) of 8.86% during the forecast period of 2026-2034.

Key Market Trends &…

Hot Sauce Manufacturing Plant DPR & Unit Setup - 2026: Demand Analysis and Proje …

Setting up a hot sauce manufacturing plant positions investors within one of the fastest-growing and flavor-driven segments of the global condiment industry, fueled by rising consumer appetite for spicy, bold, and ethnic flavors, increasing demand for clean-label and premium condiment products, and expanding utilization of hot sauce across food service, retail, and food processing applications. Made primarily from chili peppers, vinegar, salt, and complementary flavoring ingredients, hot sauce is recognized…

Glyoxylic Acid Prices Q4 2025: US Stable While Europe Remains High Price Trend

The Glyoxylic Acid Price Trend Analysis indicates dynamic shifts in global supply-demand balance, feedstock volatility, and regional trade flows. In 2026, Glyoxylic Acid Prices are reflecting fluctuations in raw material costs and downstream demand from pharmaceuticals, cosmetics, and agrochemicals. Market participants closely track the Glyoxylic Acid price index and forecast data to understand pricing momentum, risk exposure, and procurement strategies across key global regions.

Glyoxylic Acid Current Glyoxylic Acid Price Movements:

Recent…

More Releases for USD

Bone Cement Market Outlook USD 1,871.10M-USD 3,512.31M

How Is the Bone Cement Market Supporting the Rise of Modern Orthopedic Surgery?

The Bone Cement Market plays a critical role in modern orthopedic and spinal procedures, acting as a foundational material for joint replacement, fracture fixation, and vertebral stabilization. Bone cement is widely used to anchor implants, restore bone structure, and improve patient mobility-making it an essential component of musculoskeletal care.

In 2025, the global bone cement market was valued at…

Autologous Cell Therapy Market Outlook USD 9.31B-USD 54.83B

How Is the Autologous Cell Therapy Market Redefining the Future of Precision Medicine?

The Autologous Cell Therapy Market is rapidly emerging as one of the most transformative areas in modern healthcare, offering highly personalized treatment options for complex and chronic diseases. By using a patient's own cells to repair, replace, or regenerate damaged tissues, autologous cell therapy minimizes immune rejection risks while maximizing therapeutic effectiveness.

In 2025, the global autologous cell therapy…

PACS Market USD 5.59B in 2025, USD 9.73B by 2035

Picture Archiving and Communication System (PACS) Market Expands as Digital Imaging Transforms Global Healthcare

Introduction: PACS at the Core of Modern Medical Imaging

The healthcare industry is undergoing a rapid digital transformation, with medical imaging playing a critical role in diagnosis, treatment planning, and patient monitoring. At the heart of this transformation lies the Picture Archiving and Communication System (PACS)-a technology that enables the storage, retrieval, management, and sharing of medical images…

Global HEOR Market USD 1.70B-USD 6.03B

Health Economics and Outcomes Research (HEOR) Market Accelerates as Value-Based Healthcare Redefines Global Decision-Making

Introduction: The Growing Importance of HEOR in Modern Healthcare

The global healthcare industry is undergoing a profound transformation, shifting from volume-driven care models to value-based healthcare systems that prioritize patient outcomes, cost efficiency, and real-world effectiveness. At the center of this transformation lies Health Economics and Outcomes Research (HEOR)-a discipline that evaluates the economic value, clinical outcomes, and…

Foam Tape Market Outlook 2035: Industry Growth from USD USD 4.89 Billion (2025) …

The Foam Tape Market plays a vital role in modern industrial and manufacturing ecosystems. Foam tapes are pressure-sensitive adhesive products manufactured using materials such as polyurethane, polyethylene, PVC, and acrylic foam. These tapes are widely used for bonding, sealing, insulation, cushioning, vibration damping, and noise reduction across multiple industries. Their ability to replace traditional mechanical fasteners like screws, bolts, and rivets has positioned foam tapes as a preferred solution in…

Chlorella Market Reach USD 465.85 Million USD by 2030

Market Growth Fueled by Increased Adoption of Plant-Based Proteins and Health Supplements

Global Chlorella Market size was valued at USD 303.75 Mn. in 2023 and the total Chlorella revenue is expected to grow by 6.3 % from 2024 to 2030, reaching nearly USD 465.85 Mn. . The growth of the market is majorly due to increase in the consumer awareness about health, the inclination towards plant-based food such as chlorella and…