Press release

Income Capital Management Reports Solid Results for October 2025

Income Capital Management has released its results for October 2025, confirming the resilience of its investment strategies in a market still searching for direction after a volatile summer.October was characterized by relative calm across the main financial markets, with fewer shocks compared to previous months. In this environment, investors have continued to focus on quality assets and well-structured, diversified strategies.

"Our management approach - built on prudence, flexibility, and diversification - once again demonstrated its value," said the Paolo Volpicelli, CEO at Income Capital Management.

"By avoiding excessive exposure and maintaining a disciplined approach, our portfolios have continued to deliver positive and sustainable results."

Performance Highlights - October 2025

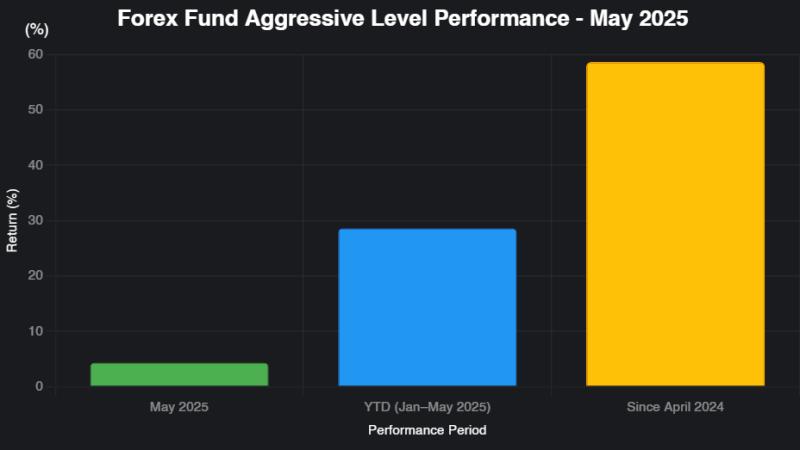

Forex Fund (Aggressive Level): +2.55% in October | +30.71% YTD | +60.76% since April 2024

The prudent strategy adopted in August continues to deliver consistent results, limiting exposure in fragile market phases.

Real Estate Fund: +0.55% in October | +6.99% YTD | +13.19% since April 2024

The real estate sector showed signs of consolidation, supported by strong demand for quality housing and investment assets.

Physical Gold: Total holdings 12.85 kg | Market value €1,432,775 (€111.50/g)

Gold maintained its role as a defensive asset amid rising institutional and private demand.

Global Growth Fund (Launched September 2025): +1.89% since inception

Positive results driven by selective exposure to innovative companies and high-potential sectors.

High Yield Fund (Launched September 2025): +3.16% since inception

Strong performance supported by selective investment in high-yield corporate bonds and REIT ETFs.

Looking Ahead For November, Income Capital Management highlights the importance of "concreteness" - focusing on portfolio rationalization, sustainable returns, and the careful selection of quality instruments.

Full performance reports are available in the private client area under the Results section.

INCOME CAPITAL MANAGEMENT s.r.o.

Rybná 716/24, Staré Město

110 00 Praha 1

(Czech Republic)

About Income Capital Management Income Capital Management s.r.o. is an independent asset management company specializing in alternative investments and diversified fund strategies. The firm's philosophy centers on prudence, flexibility, and long-term value creation for its clients.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Income Capital Management Reports Solid Results for October 2025 here

News-ID: 4260943 • Views: …

More Releases from INCOME CAPITAL MANAGEMENT

Income Capital Management Yearly Results 2025

Income Capital Management Reports Strong 2025 Performance in a Year of Divergent Global Markets

Prague, Czech Republic- Income Capital Management closed 2025 with solid results across its diversified investment strategies, successfully navigating a year marked by sharp divergences between asset classes. The firm enters 2026 with a disciplined, multi-asset approach focused on delivering consistent value to its investors.

Market Environment

Global markets in 2025 were characterized by pronounced dispersion. Gold emerged as the…

Income Capital Management closes September with positive results despite market …

INCOME CAPITAL MANAGEMENT s.r.o. has released its September 2025 Monthly Report, confirming another month of positive performance across all managed instruments, despite one of the most volatile periods in recent months.

Challenging markets, solid results

September brought intense volatility, geopolitical tensions, and a relentless rise in gold prices.

In this environment, Income Capital Management's strategies demonstrated resilience and consistency, remaining aligned with each fund's defined risk profile.

"With discipline, diversification, and a rigorous risk-based…

INCOME CAPITAL MANAGEMENT's Forex Fund Soars with +58.63% Return Since April 202 …

Prague, Czech Republic - June 05, 2025

In May 2025, the Aggressive Level achieved a return of +4.30%. The Year-To-Date (YTD) performance from January to May 2025 stands at +28.58%, while the fund has delivered an impressive +58.63% return since April 2024. These results reflect INCOME CAPITAL MANAGEMENT's disciplined investment process, active management, and deep expertise in navigating volatile currency markets.

In addition to the Aggressive Level, the Forex Fund offers three…

Income Capital Management Announces Strategic Partnership with Bitcashier to Ena …

Prague, April 10, 2025 - Income Capital Management is pleased to announce a strategic partnership with Bitcashier, a fully regulated European platform for crypto payments and settlement services.

This collaboration allows clients to deposit and withdraw funds using cryptocurrencies such as Bitcoin, Ethereum, and stablecoins, which are securely converted into fiat currency and allocated to managed investment portfolios. The entire process is compliant, insured, and completed within 24-48 hours-without clients needing…

More Releases for October

Dogecoin Price Prediction In October

Dogecoin Price Prediction is on the radar this October as investors monitor whether the meme cryptocurrency can sustain its bullish formation in light of broader market volatilities. With rising interest in utility-driven assets and renewed optimism around strong community tokens, Dogecoin remains one of the top cryptocurrencies to consider right now.

While Dogecoin was conceived as a meme coin, it has grown into a legitimate market force with strong liquidity, a…

October Headlining Shows In Vegas

Upcoming Headlining Shows In Las Vegas

OCTOBER 2024

now - 10/27

Sistahs! The Hocus Pocus Parody

now - 10/19

Earth, Wind and Fire

now - 10/19

Eagles

now - 10/26

Carrie Underwood: REFLECTION

now - 10/19

Barry Manilow: The Hits Come Home

10/18

When We Were Young Sideshow:

The Used and Taking Back Sunday

10/18

Tommy James & The Shondells

10/18 - 10/19

Toni Braxton and Cedric The Entertainer

10/18 - 10/19

Brad Paisley

10/18 - 10/26

Lenny Kravitz

10/19

Porter Robinson

10/19

Parker McCollum

10/19 - 10/20

When We Were Young Festival

10/19 - 10/20

Nick Swardson

10/20

Jeff Dunham: Still…

The Second Line Film Festival enters its 2nd year October 14 – October 18

New Orleans, La ( October 15, 2020) The Second Line Film Festival is an exciting virtual event produced by Gloried Media, LLC, the producers of the South Carolina Cultural Film Festival and the Charlotte Black Film Festival. After participating in the New Orleans cultural scene and serving as a producer for the Real Caregivers of New Orleans Mr. Nichols president of Glorified Media, LLC. fell in love with the people…

ProviNET Solutions exhibits at Leading Age Dallas on October 27 – October 30

A Leading Provider of Healthcare IT Solutions Participates in Leading Age Dallas Annual Meeting and Expo

Tinley Park, IL (September, 2013) ProviNET Solutions is a full-service IT company that offers a comprehensive spectrum of technology products and services for senior living facilities throughout the United States. Born from a long-term care provider, ProviNET is familiar with the strict demands and urgent needs of the industry. ProviNET focuses on ways to…

October Trade Show Triathlon

A high-intensity program of three events for rational motion and TM4 in Germany.

Cologne, October 9, 2012

October is marathon month for rational motion and partner enterprise TM4. With three events following close on one another, the two companies are on tour for electric powertrains and vehicle integration throughout the month. The grand finale will be a joint booth at the eCarTec in Munich. Though the three events differ greatly, they all…

Florida: October is "Guardianship Month"

Florida Governor Charlie Crist has declared October as “Guardianship Month.”

NASGA would point Governor Crist’s attention to the fact that the original intent of guardianship/conservatorship law - “guard,” “protect” and “conserve” - is no longer being complied with in a frightening and growing number of cases involving court-appointed fiduciaries. Wards' estates, instead of being conserved, are being plundered in the guise of fiduciary fee billings for "services," either not…