Press release

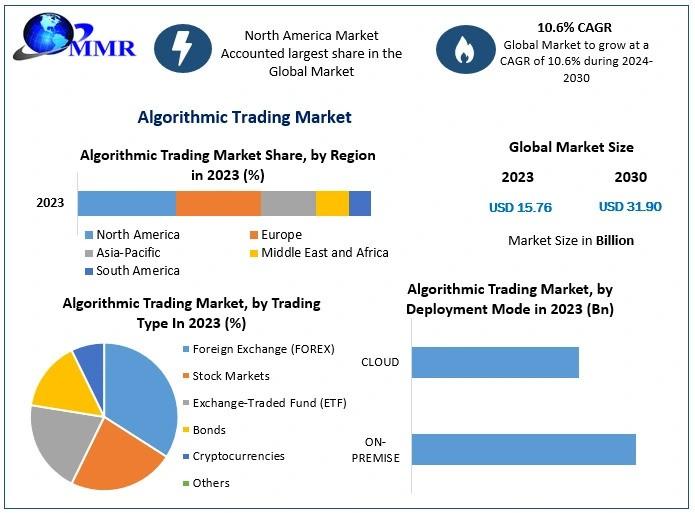

Algorithmic Trading Market Growth Outlook | From USD 15.76 Billion in 2023 to USD 31.90 Billion by 2030

Algorithmic Trading Market size was valued at USD 15.76 Bn. in 2023 and the total Algorithmic Trading revenue is expected to grow by 10.6 % from 2024 to 2030, reaching nearly USD 31.90 Bn.Algorithmic Trading Market Overview:

Algorithmic trading, often referred to as algo-trading, involves utilizing sophisticated computer programs to automatically execute financial orders based on pre-programmed instructions and complex mathematical models. This revolutionary methodology leverages machine speed and computational precision far beyond human capacity, enabling high-frequency and low-latency transactions across global financial venues. Its application is ubiquitous, dominating trading volumes in major markets including equities, foreign exchange, derivatives, and commodities. The primary benefits of algo-trading lie in its ability to significantly enhance market efficiency, ensure systematic execution of large orders, and entirely mitigate the psychological biases and operational errors inherent in human decision-making. This technological backbone has become indispensable for institutional investors, hedge funds, and proprietary trading firms seeking optimal pricing and minimal market impact.

Download a Free Sample Report Today: https://www.maximizemarketresearch.com/request-sample/29843/

Algorithmic Trading Market Outlook and Future Trends:

The future of the Algorithmic Trading Market is being decisively shaped by the convergence of advanced computing and sophisticated data science. A crucial trend is the ascendancy of specialized AI-driven strategies, leveraging deep learning and reinforcement learning to build adaptive models that can autonomously adjust to fluid market regimes. Predictive analytics, enhanced by machine learning algorithms, is moving beyond simple technical indicators to incorporate nuanced data, such as natural language processing of news sentiment. Furthermore, the increasing adoption of highly scalable, cloud-based trading platforms is democratizing access to high-performance computing, lowering the barrier to entry for smaller firms. The integration of distributed ledger technology, or blockchain, promises to introduce new levels of transparency and efficiency in trade execution and settlement, revolutionizing automated portfolio management.

Algorithmic Trading Market Dynamics:

The market's momentum is propelled by several strong drivers, chief among them being the perpetual institutional demand for superior order execution speed and precision, which directly minimizes slippage and transaction costs. The ongoing expansion and modernization of global electronic trading infrastructure, including low-latency network connections and advanced data feeds, continually supports higher trading volumes. Complementary regulatory advancements that standardize algorithmic practices also foster market integrity and stability, encouraging broader adoption. However, key challenges include sophisticated data security concerns, system complexities, and the risk of unexpected algorithmic crashes leading to flash events. The primary opportunity lies in the profound digital transformation underway in financial institutions, creating a massive addressable market for custom, AI-powered solutions that integrate trading and risk management.

Algorithmic Trading Market Key Recent Developments:

Recent developments highlight a pronounced focus on infusing intelligent capabilities into automated systems and fortifying market infrastructure. A significant advancement is the commercial introduction of robust, AI-powered trading systems that utilize proprietary machine learning models to identify ephemeral arbitrage opportunities and optimize multi-asset strategies in real-time. We are also observing frequent strategic partnerships between established financial institutions and specialized fintech firms, focused on co-developing custom low-latency execution algorithms and cloud-native risk analytics tools. Regulatory bodies worldwide are actively responding to these innovations by initiating pilot programs and frameworks to enhance transparency and mandate testing requirements for sophisticated automated trading platforms, aiming to ensure systemic stability in an increasingly automated environment.

To Gain More Insights into the Market Analysis, Browse Summary of the Research Report: https://www.maximizemarketresearch.com/request-sample/29843/

Algorithmic Trading Market Segmentation:

by Component

Solutions

Platforms

Software Tools

Services

Professional Services

Managed Services

by Trading Type

Foreign Exchange (FOREX)

Stock Markets

Exchange-Traded Fund (ETF)

Bonds

Cryptocurrencies

Others

by Deployment Mode

ON-PREMISE

CLOUD

by Enterprise Size

SME's

Large Enterprises

Some of the current players in the Algorithmic Trading Market are:

1. Algo Trader GmbH (Switzerland)

2. Trading Technologies (USA)

3. Info Reach (USA)

4. Tethys Technology (USA)

5. Lime Brokerage LLC (USA)

6. Flex Trade Systems (USA)

7. Tower Research Capital (USA)

8. Virtu Financial (USA)

9. Hudson River Trading (USA)

10. Citadel (USA)

11. Technologies International (USA)

12. Argo Software Engineering (USA)

13. Automated Trading Soft-Tech (India)

14. Kuberre Systems (USA)

15. Meta Quotes Software Corp. (Cyprus)

16. Software AG (Germany)

17. Thomson Reuters Corporation (Canada)

18. uTrade (India)

19. Vela Trading Systems LLC (USA)

For additional reports on related topics, visit our website:

♦ Knowledge Process Outsourcing Market https://www.maximizemarketresearch.com/market-report/knowledge-process-outsourcing-market/187554/

♦ Global Industrial Vending Machine Market https://www.maximizemarketresearch.com/market-report/global-industrial-vending-machine-market/31293/

♦ Crypto Asset Management Market https://www.maximizemarketresearch.com/market-report/global-crypto-asset-management-market/27361/

♦ Femtocell Market https://www.maximizemarketresearch.com/market-report/global-femtocell-market/13100/

♦ Global Project Portfolio Management Market https://www.maximizemarketresearch.com/market-report/project-portfolio-management-market/79564/

MAXIMIZE MARKET RESEARCH PVT. LTD.

⮝ 3rd Floor, Navale IT park Phase 2,

Pune Banglore Highway, Narhe

Pune, Maharashtra 411041, India.

✆ +91 9607365656

🖂 sales@maximizemarketresearch.com

Maximize Market Research is a multifaceted market research and consulting company with professionals from several indusring, electronic components, industrial equipment, technologtries. Some of the industries we cover include medical devices, pharmaceutical manufacturers, science and engineey and communication, cars and automobiles, chemical products and substances, general merchandise, beverages, personal care, and automated systems. To mention a few, we provide market-verified industry estimations, technical trend analysis, crucial market research, strategic advice, competition analysis, production and demand analysis, and client impact studies.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Algorithmic Trading Market Growth Outlook | From USD 15.76 Billion in 2023 to USD 31.90 Billion by 2030 here

News-ID: 4260880 • Views: …

More Releases from MAXIMIZE MARKET RESEARCH PVT. LTD.

Morocco Cosmetics Market Poised for Robust Growth, Projected to Reach USD 3.59 B …

Global Morocco Cosmetics Market Overview

The Global Morocco Cosmetics Market is witnessing significant expansion, driven by rising consumer awareness regarding personal grooming, skincare, and wellness. Valued at USD 1.82 billion in 2024, the market is projected to grow at a strong compound annual growth rate (CAGR) of 7.92% from 2024 to 2032, reaching nearly USD 3.59 billion by the end of the forecast period. This steady growth reflects increasing demand for…

Virtual Fitting Room Market to Reach US$ 19.32 Billion by 2030, Driven by Rapid …

The Global Virtual Fitting Room Market is witnessing remarkable growth, fueled by the rapid digital transformation of the fashion and retail industry. Valued at US$ 5.20 billion in 2023, the market is projected to expand at a robust compound annual growth rate (CAGR) of 20.6% from 2024 to 2030, reaching nearly US$ 19.32 billion by 2030. This strong growth trajectory reflects increasing investments in immersive technologies, rising e-commerce penetration, and…

Car Care Products Market to Reach USD 18.02 Billion by 2032, Growing at a CAGR o …

The global car care products market is witnessing steady expansion, driven by rising vehicle ownership, increasing consumer awareness about vehicle maintenance, and rapid technological innovations. According to recent industry analysis, the market was valued at USD 13.96 billion in 2024 and is projected to reach USD 18.02 billion by 2032, registering a compound annual growth rate (CAGR) of 4.2% during the forecast period. This growth reflects the increasing importance of…

Car Care Products Market to Reach USD 18.02 Billion by 2032, Growing at a CAGR o …

The global car care products market is witnessing steady expansion, driven by rising vehicle ownership, increasing consumer awareness about vehicle maintenance, and rapid technological innovations. According to recent industry analysis, the market was valued at USD 13.96 billion in 2024 and is projected to reach USD 18.02 billion by 2032, registering a compound annual growth rate (CAGR) of 4.2% during the forecast period. This growth reflects the increasing importance of…

More Releases for Trading

Algorithmic Trading Market Showing Impressive Growth : Hudson River Trading, Jum …

The competitive landscape which incorporates the Algorithmic Trading Market ranking of the major players, along with new service/product launches, partnerships, business expansions and acquisitions in the past five years of companies profiled are also highlighted in the Algorithmic Trading Market report. Extensive company profiles comprising of company overview, company insights, product benchmarking and SWOT analysis for the major Algorithmic Trading Market players.

Top 10 key companies…

Increasing Awareness about Algorithmic Trading Market In Coming Years By Virtu F …

Global Algorithmic Trading Industry 2019 Research report provides information regarding market size, share, trends, growth, cost structure, capacity, revenue and forecast 2025. This report also includes the overall and comprehensive study of the Algorithmic Trading market with all its aspects influencing the growth of the market. This report is exhaustive quantitative analyses of the Algorithmic Trading industry and provides data for making Strategies to increase the market growth and effectiveness.

Algorithmic…

Algorithmic Trading Market 2024 SWOT Analysis by Key Players like Virtu Financia …

Algorithmic trading is a method of executing a large order (too large to fill all at once) using automated pre-programmed trading instructions accounting for variables such as time, price, and volume to send small slices of the order (child orders) out to the market over time. Algorithmic Trading are mainly used in investment banks, pension funds, mutual funds, hedge funds, etc.

Key trend which will predominantly effect the market in coming…

Automated Trading Market By Top Key Players- Citadel, KCG, Optiver, DRW Trading, …

The report "Automated Trading Market - Global Industry Analysis, Size, Share, Growth, Trends and Forecast 2016 - 2024", has been prepared based on an in-depth market analysis with inputs from industry experts.

An automated trading system, also referred to as mechanical trading system or algorithmic trading system, enables vendors to set up specific rules for money management, trade entries, and trade exits. Automated trading systems are generally programmed in a way…

Search4Research Announced Algorithmic Trading Market Forecast to 2024 - Virtu Fi …

Algorithmic trading is a method of executing a large order (too large to fill all at once) using automated pre-programmed trading instructions accounting for variables such as time, price, and volume to send small slices of the order (child orders) out to the market over time.

Algorithmic Trading Market provides a detail overview of latest technologies and in-depth analysis that reflect top vendor’s portfolios and technology; examines the strategic planning, challenges…

Algorithmic Trading Market 2019 | Flow Traders, Jump Trading, Spot Trading, DRW …

Global Algorithmic Trading market is also presented to the readers as a holistic snapshot of the competitive landscape within the given forecast period. The report also educates about the market strategies that are being adopted by your competitors and leading organizations. The report also focuses on all the recent industry trends. It presents a comparative detailed analysis of the all regional and player segments, offering readers a better knowledge of…