Press release

Establishing Regulatory Momentum: PrairieVault Exchange Secures U.S. MSB Registration to Bolster Global Expansion Strategy

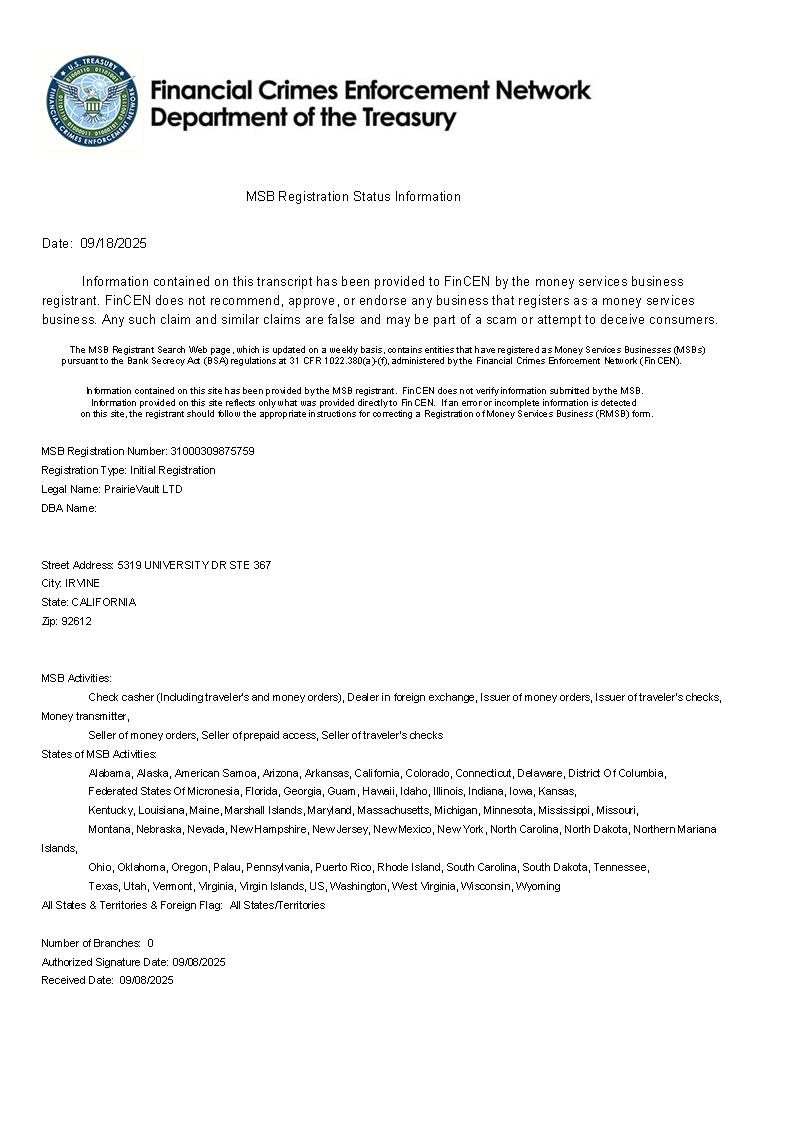

PrairieVault Exchange, a digital infrastructure platform engineered for performance, governance, and transparency, has officially confirmed its registration as a Money Services Business (MSB) with the Financial Crimes Enforcement Network (FinCEN), a division of the U.S. Department of the Treasury. This milestone affirms PrairieVault's commitment to regulatory integrity and paves the way for broader institutional engagement in key jurisdictions worldwide.A Critical Milestone for U.S. Regulatory Alignment

The MSB registration enables PrairieVault Exchange to operate legally within the United States as a provider of money transmission and digital asset services. Under FinCEN rules, this designation requires strict compliance with Anti-Money Laundering (AML) standards, Counter-Terrorist Financing (CFT) protocols, Know Your Customer (KYC) procedures, and verifiable record-keeping obligations.

With this regulatory foundation in place, PrairieVault Exchange reinforces its positioning as a secure, compliant, and institution-ready platform for digital asset infrastructure.

Oliver Mercer, Managing Director at PrairieVault Exchange, stated:

"This registration with FinCEN represents more than a license-it represents credibility, transparency, and a long-term vision for responsible innovation. PrairieVault is building for scale, and compliance is the architecture we build upon."

Users can confirm PrairieVault's MSB registration by visiting the FinCEN MSB Registration Search platform and entering "PrairieVault" in the name field.

Strengthening the Foundation for International Growth

With U.S. registration secured, PrairieVault Exchange now accelerates its global compliance strategy, including preparations for registration under the European Union's Markets in Crypto-Assets (MiCA) framework, Hong Kong's VASP licensing scheme, and regional approvals in the Middle East and Southeast Asia.

The MSB milestone allows PrairieVault to formalize institutional onboarding pathways, offer expanded fiat integrations, and deepen partnerships with banks, custodians, and regulatory authorities worldwide.

Oliver Mercer added:

"Global finance is rapidly converging with real-time digital infrastructure. At PrairieVault, our responsibility is to ensure that innovation moves in lockstep with accountability. This is how we earn trust-and keep it."

Regulatory Confidence Meets Engineering Precision

PrairieVault Exchange is built to meet the rigorous standards of modern institutional trading. Alongside its compliance achievements, the platform continues to enhance its technology stack with embedded risk controls, permissioned access systems, audit-ready architecture, and jurisdiction-aware disclosure engines.

New features scheduled for release include transaction-level audit logs, enterprise-grade KYC onboarding flows, and user-configurable transparency settings for corporate accounts.

Oliver Mercer concluded:

"Our mission is to deliver infrastructure that meets the standards of tomorrow. Compliance isn't just a requirement-it's a competitive edge. PrairieVault stands ready to serve global users who demand clarity, security, and excellence."

DISCLAIMER:

The information in this press release is provided for general informational purposes only and should not be construed as legal, tax, investment, or regulatory advice.

globe pr wire

PrairieVault Exchange is a next-generation infrastructure platform designed to support institutional-grade trading, modular compliance, and secure financial connectivity. Built with a focus on intelligent risk management and scalable systems, PrairieVault serves professional traders, corporate operators, and fintech developers seeking compliant access to evolving digital markets.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Establishing Regulatory Momentum: PrairieVault Exchange Secures U.S. MSB Registration to Bolster Global Expansion Strategy here

News-ID: 4260151 • Views: …

More Releases from Globe PR Wire

Dramatic Play and Imagination: Building Foundational Skills with Elizabeth Frale …

One of the most potent and natural modes of learning during the early childhood period is dramatic play, in which a child adopts role-playing and imagines situations. This form of play is not a waste; it is a multifaceted mental exercise that develops the social-emotional, language, and executive functions needed to prepare a child to be ready to start kindergarten. Elizabeth Fraley Kinder Ready philosophy holds this experiential form of…

Celebrating Eid in Educational Ways: Blending Tradition with Readiness via Eliza …

Eid festivities provide an interesting and rich backdrop for incorporating academic activities to foster holistic kindergarten preparation. By highlighting the main ideas of the holiday, such as the importance of thankfulness, generosity, community and happiness, the families can create their own experiences that will help a child grow socially-emotionally, cognitively, and practically in the sphere of their life. This premeditated practice is consistent with the Elizabeth Fraley Kinder Ready(https://www.kinderready.com/) philosophy,…

Top Crypto Gainers Today: DOGEBALL Crypto Presale 2026 Hits $100K While XRP ($1. …

The cryptocurrency market is entering a phase of heightened uncertainty this February 2026, characterized by a "risk-off" sentiment following new U.S. tariff announcements. Major assets are testing critical psychological floors as the Fear & Greed Index plunges into "Extreme Fear" territory at a reading of 12. While legacy tokens like XRP, Cardano (ADA), and Dogecoin (DOGE) struggle with consolidation and bearish pressure, savvy investors are pivoting toward high-utility opportunities to…

Safest Crypto Presale to Invest In: Why DOGEBALL is OutZcash pacing BTC ($68K), …

The 2026 cryptocurrency landscape has shifted from speculative "hype" cycles to a market defined by technical execution and tangible utility. As we move through the first quarter of the year, savvy investors are looking past traditional assets to find high-growth opportunities that offer a secure entry point. While the "Big Three"-Bitcoin, Ethereum, and Zcash-provide the necessary stability for a balanced portfolio, the real search is for the safest crypto presale…

More Releases for PrairieVault

PrairieVault Exchange Enhances Platform Infrastructure to Support Secure and Sca …

PrairieVault Exchange announced a series of platform and operational enhancements aimed at strengthening system reliability, improving user experience, and supporting the platform's continued expansion across international markets. The updates reflect the company's focus on building a secure, transparent, and scalable trading environment aligned with the needs of both individual and institutional participants.

The latest developments are part of PrairieVault Exchange's broader strategy to invest in long-term infrastructure, operational discipline, and user-centered…

Prairie Vault Exchange Reviews & News: Investors Can Trace Their Lost Funds (Upd …

InvestorWarnings.com has issued a new update on the Prairie Vault Exchange case.

Trace Your Lost Funds Here:

https://www.investorwarnings.com/warnings/get-expert-assistance-on-your-case/

Regulatory Warnings Against Prairie Vault Exchange

Regulatory discussion surrounding PrairieVault Exchange has largely focused on caution rather than on any single, explicit prohibition from a major financial authority. As of early 2026, there is no widely published warning or enforcement action from top-tier regulators such as the U.S.

Securities and Exchange Commission or the…

PrairieVault Exchange Deploys Behavioral Risk Intelligence for Real-Time Threat …

PrairieVault Exchange introduces a behavioral analytics-based risk model to detect anomalies, prevent fraud, and enhance platform security through adaptive trust scoring and automated safeguards.

PrairieVault Exchange announces the integration of a Behavioral Risk Intelligence (BRI) model into its platform infrastructure, marking a major enhancement in real-time risk surveillance, account monitoring, and fraud prevention. The model applies behavioral analytics to trading activity, device usage, and session patterns to detect deviations from expected…

PrairieVault Exchange Adds Lite Trading Option for Accessibility

PrairieVault Exchange introduces a new Lite Trading Mode designed to improve accessibility and reduce complexity for users seeking a more intuitive trading experience. The new mode is built to serve mobile-first users, beginners, and time-sensitive traders who prefer speed, simplicity, and essential functionality over advanced technical tools.

Lite Trading Mode removes interface friction by focusing on core actions such as market viewing, instant order placement, and portfolio summaries-without the clutter of…